Getting more money is what investing is all about.

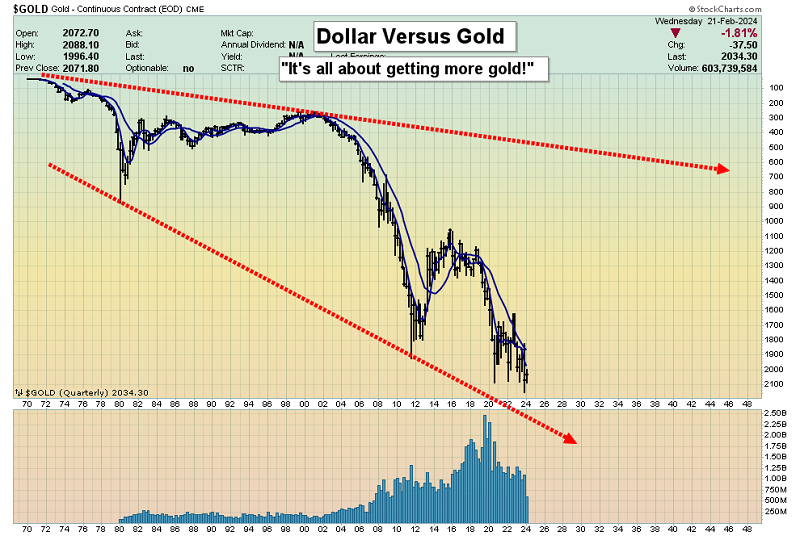

The US fiat money versus gold money chart. is the money of kings (and gold bugs.). It’s the greatest money, and all investors should want more.

On this weekly line chart, gold is consolidating what appears to be a major breakout from a broadening formation.

The top of the formation is the key $2000 price zone, making this breakout a very significant event.

In addition to the wars in Gaza and Ukraine, all gold bug eyes should be on the Feb 29 PCE report, which is the Fed’s favourite inflation report.

The recent CPI report was negative for both gold and the stock market, but the PPI that followed was positive for gold and negative for stocks.

The PCE will likely determine whether institutional money managers view a fresh inflationary surge as a reason for the Fed to call off its rate cuts… or a reason to sell the stock market and buy some gold.

This daily futures chart shows the superb resilience of gold on dips to $2000.

Note the Stochastics oscillator (14,7,7 series) at the bottom of the chart. More upside action looks imminent.

The spectacular BDRY “shipflation” chart. Investors who followed my lead and bought into the lows are up 100% on those buys.

I’ve urged them to put some of the winning proceeds into gold on the next $100/oz dip in the price. Eventually, even the biggest fiat profits all melt away against gold.

Amateur investors tend to try to outperform all the asset benchmarks. With the stock market, they try to outperform the Dow. With crypto, they try to outperform bitcoin. With precious metals, they try to outperform gold, and that’s the most difficult task of all.

There’s no need to outperform gold, but there is a need for investors to get as much of it as they can.

The “foodflation” (with no K1 tax filing required) PDBA chart. By the time the soaring soft commodities like orange juice and cocoa take a breather, the grains could start getting their time in the higher price sun.

The bottom line: A new long-term inflation (and stagflation) cycle began as US interest rates bottomed.

This insidious cycle will intensify as de-dollarization, US war mongering, tariff taxes, and global government debt worship all become much bigger themes than they already are right now.

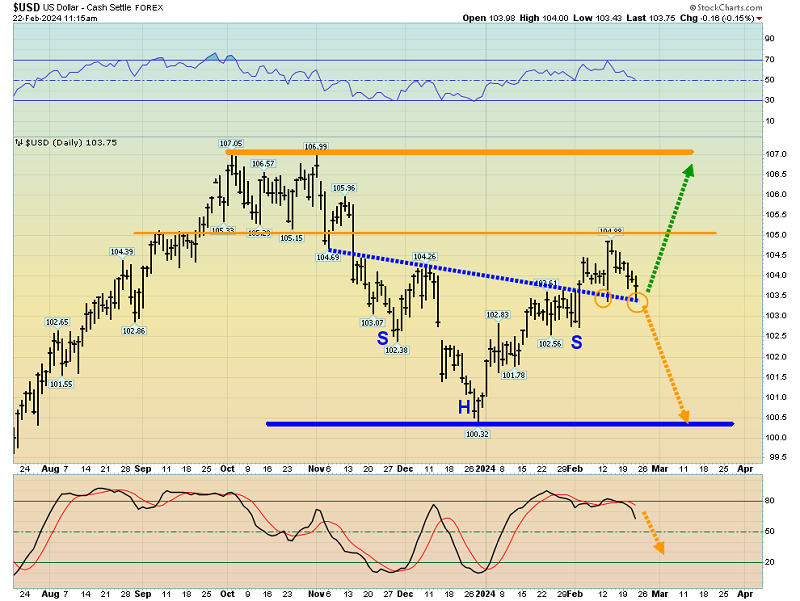

The daily chart. There is an inverse H&S pattern in play. A move to the 107 highs is possible and it could push gold back down a bit, towards $2000 in the futures market ($1973 cash).

Having said that, note the “double touching” of the neckline. The H&S pattern itself isn’t great. A collapse in the dollar is as likely as a last gasp rally.

In the big picture, usury and government are worshipped in empires that are at their zenith. Empires of the past (India, China, Turkey, Ethiopia, etc) were similar to America today. The citizens there no longer pray to their tin can usury, fiat, and government gods. They don’t care if fiat rates rise. When it comes to money, all they care about is getting a lot more gold.

As the American empire fades (and both China and India rise), the “holy grail” of US fiat usury as a negative driver for gold will not only reverse but become an outrageously bullish driver for the price. The good news is while higher rates are still a negative driver for gold right now, the Fed is likely to become more dovish so they appear relatively neutral going into the US election.

The miners? Western gold bugs are as obsessed with gold and silver miners as Eastern bugs are obsessed with jewellery, and that’s good. For myself, I’m obsessed with anything and everything related to gold, and that’s also good.