Hedge funds are wagering one of their biggest bets against the Japanese yen in years, pushing Japanese authorities’ tolerance of the currency’s slide towards new 34-year depths to the limit.

Although Tokyo has cranked up the warnings recently that “rapid” moves in the exchange rate are “undesirable”, there are reasons to believe there may be less appetite to carry out large-scale yen-buying intervention than there was in 2022.

Speculative market positioning, however, is one variable that could push Tokyo to act. And speculators have the bit between their teeth.

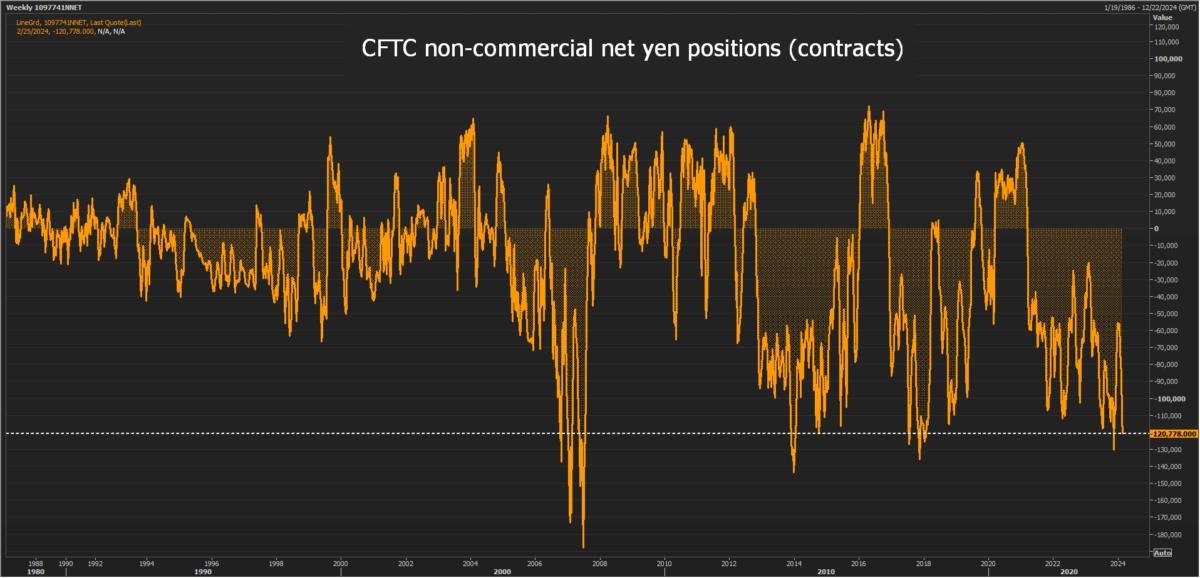

The latest Commodity Futures Trading Commission data show that funds increased their net short yen position to more than 120,000 contracts in the week ending Feb. 20 from just over 111,000 the week before.

That’s a $10 billion, leveraged bet on the yen weakening.

A short position is essentially a wager an asset’s price will fall, and a long position is a bet it will rise. Hedge funds often take directional bets on currencies, hoping to get on the right side of long-term trends.

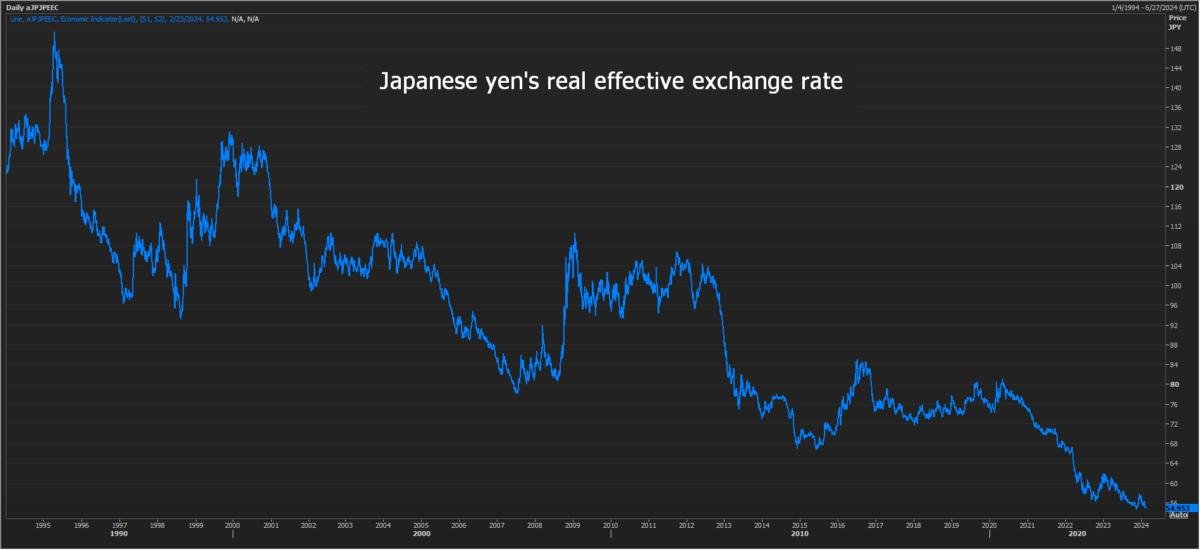

And the yen has weakened substantially. It has shed 6% of its value against the dollar so far this year, falling below 150.00 per dollar to within sight of its post-1990 lows around 152.00 per dollar.

The yen is the worst-performing major currency this year as funds and others have traded on the huge U.S.-Japan interest rate and bond yield gap and bet that it will persist. Either the Bank of Japan will be slow to ‘normalize’ policy or the Federal Reserve won’t cut rates as much as many people expect.

Or both.

However the policy mix plays out, it has been a winning trade for hedge funds so far. The latest CFTC net short yen position is the biggest since November and the second largest in six years, and there have only been three periods since yen futures contracts were launched in the late 1980s where funds have been more bearish on the yen.

Perhaps more importantly, it is larger now than September and October 2022, when Japan intervened in the FX market buying yen for the first time since 1998, spending a record $60 billion in total to stem the bleeding.

Hedge funds have doubled their net short position since the start of the year, probably a major driver of the yen’s renewed slump towards fresh 34-year lows.

The yen is flirting with historic lows against other major currencies, and on a trade-weighted basis is also on the brink of printing fresh multi-decade lows.

Japan has just registered a technical recession and interest rates are still negative, while rates across most of the rest of the developed world are their highest in decades. Maybe the yen’s weakness is justified?

Regardless of the ‘fundamentals’, authorities in Tokyo are unlikely to want speculators to continue the rapid expansion of their short yen position.

(The opinions expressed here are those of the author, a columnist for Reuters.)