Recent surveys have uncovered a fascinating trend in the United States: the outcome of presidential elections significantly influences American investments in precious metals, such as gold and silver. With an observed increase following Democrat wins and a decrease with Republican victories, this pattern highlights a burgeoning distrust towards governmental stability and a shift towards tangible assets for financial security. Between 2016 and 2020, the net retail gold investment in the USA was approximately 48 tons, which dramatically rose to an average of 112 tons from 2021 to 2023. Similarly, silver investments have seen a doubling in the same period.

Understanding the Surge in Precious Metals Investment

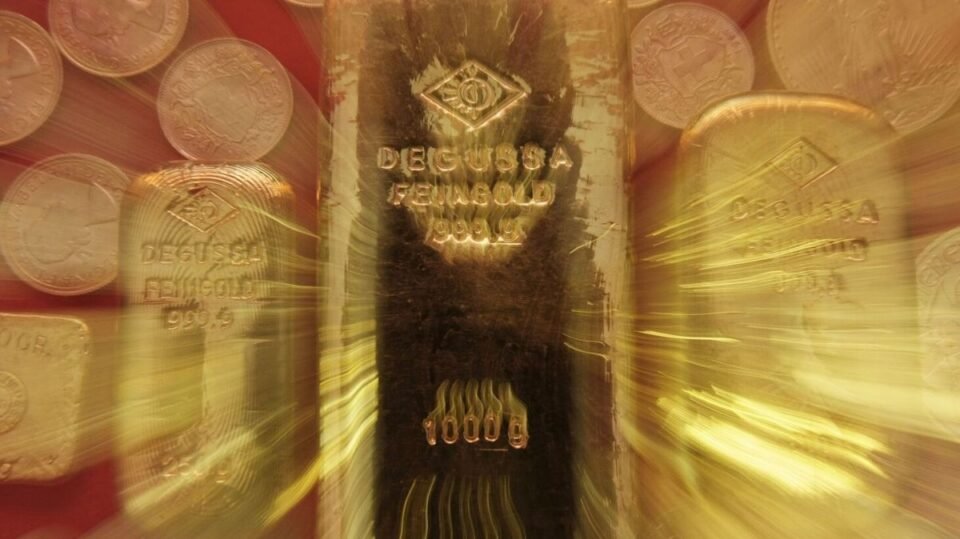

The surge in precious metals investment is multifaceted. Factors such as fluctuating metal prices, inflation rates, and recent legislative changes in several states play crucial roles. These legislative adjustments, aimed at abolishing precious metal taxation, have made gold and silver even more attractive as investment options. Moreover, the economic uncertainty and the desire for asset protection against potential inflation have prompted investors to lean more towards physical precious metal investments.

Spotlight on Gold and Silver Mining Stocks

Beyond the traditional physical holdings of gold and silver, stocks of companies involved in gold and silver mining, such as GoldMining and U.S. GoldMining, present themselves as viable investment avenues. These companies, holding valuable properties and projects, offer a different dimension to precious metal investing. However, it’s crucial for investors to be aware of the inherent risks associated with securities trading, emphasizing the importance of caution and due diligence in such financial endeavors.

The Role of Investor Sentiment and Future Outlook

The link between presidential election outcomes and precious metal investments underscores the critical role of investor sentiment in financial markets. This trend also reflects a deeper, growing concern over governmental trust and economic stability, pushing more Americans towards tangible assets like gold and silver as safe havens. With Robert Kiyosaki advocating for the direct ownership of physical assets as a hedge against inflation and uncertainty, it’s evident that this mindset is gaining traction among the wealthy and cautious investors alike. As factors like inflation and legislative changes continue to influence the market, the attractiveness of precious metals as a means of asset protection is likely to remain strong.