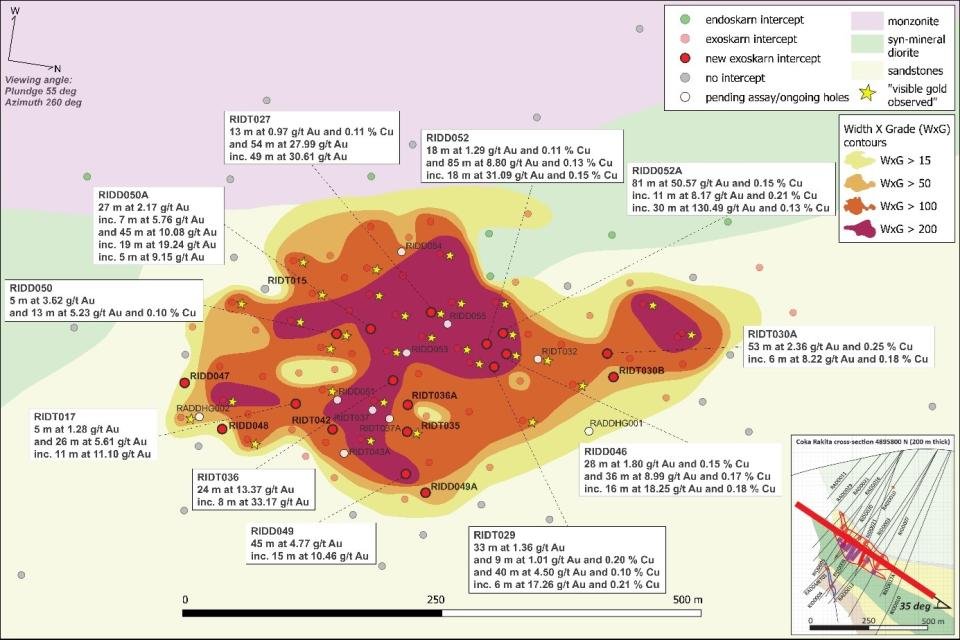

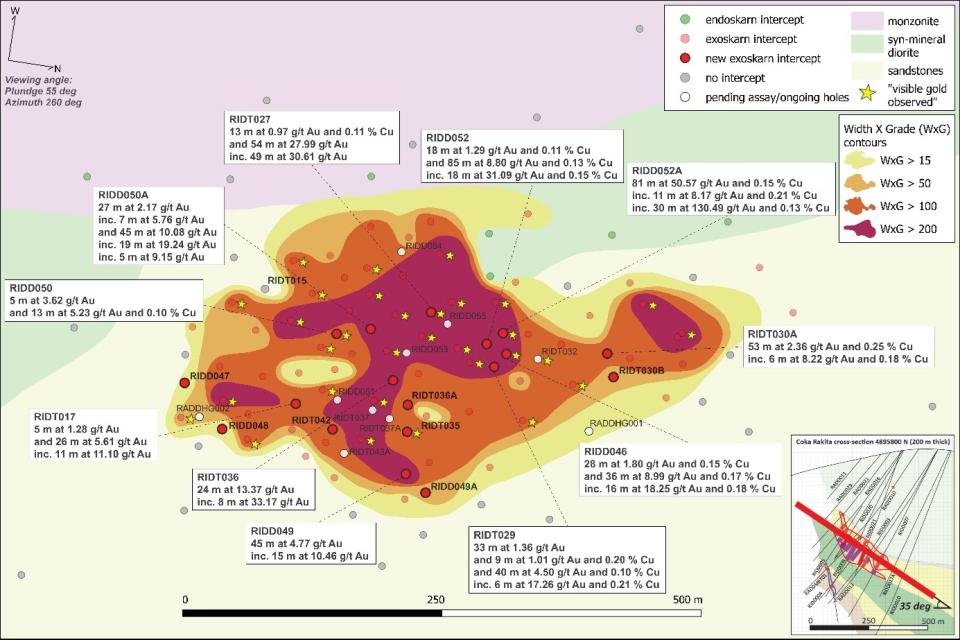

Figure 1

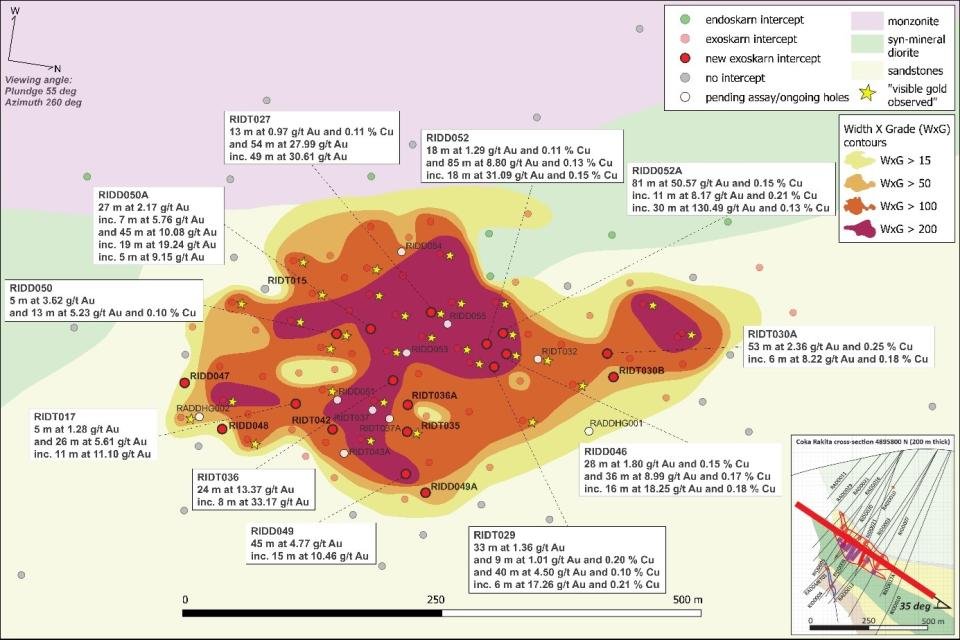

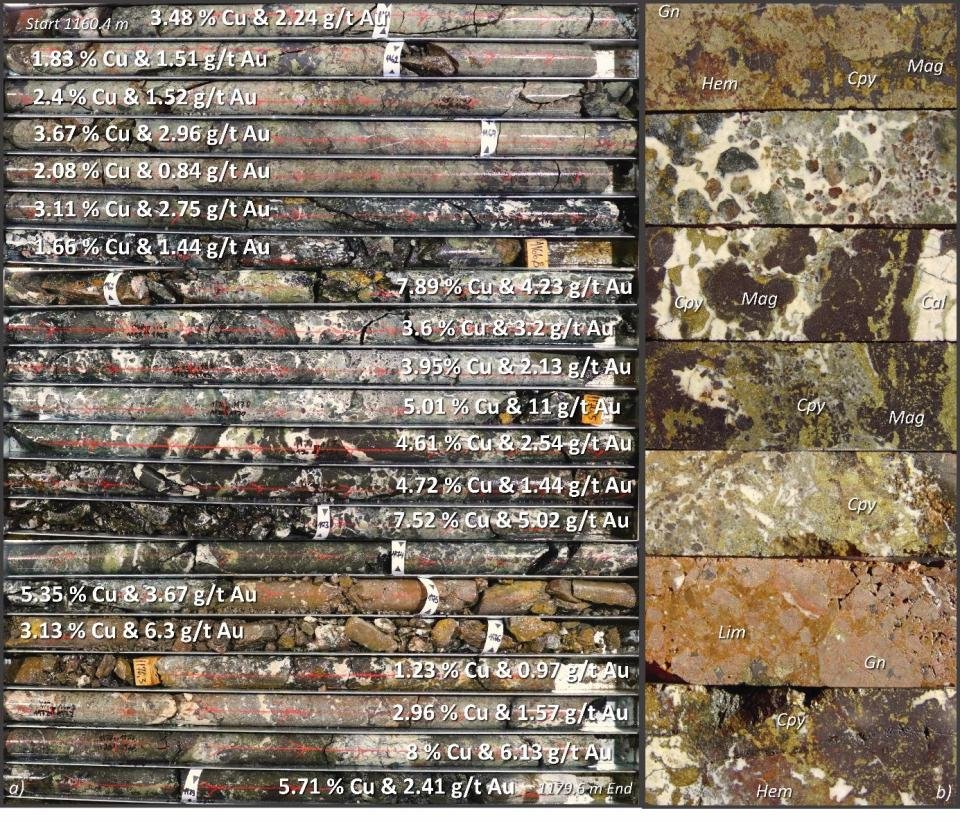

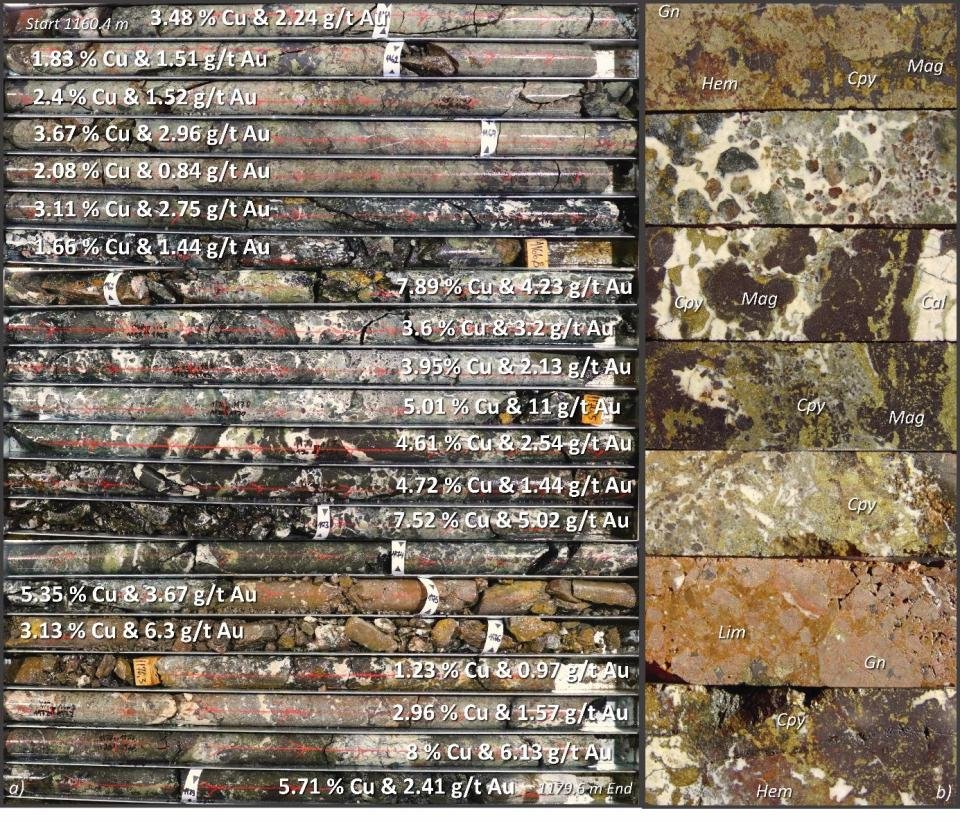

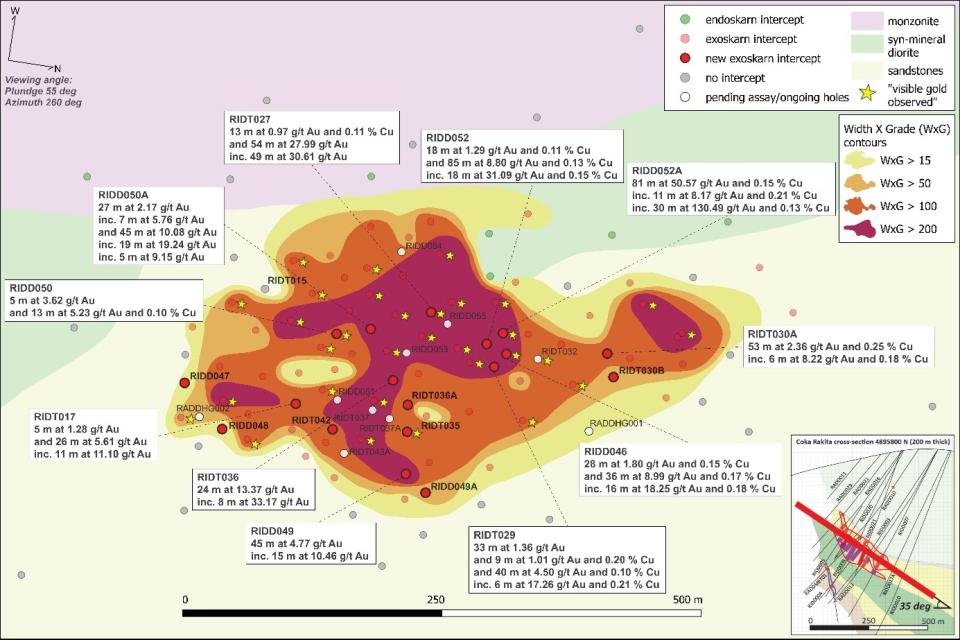

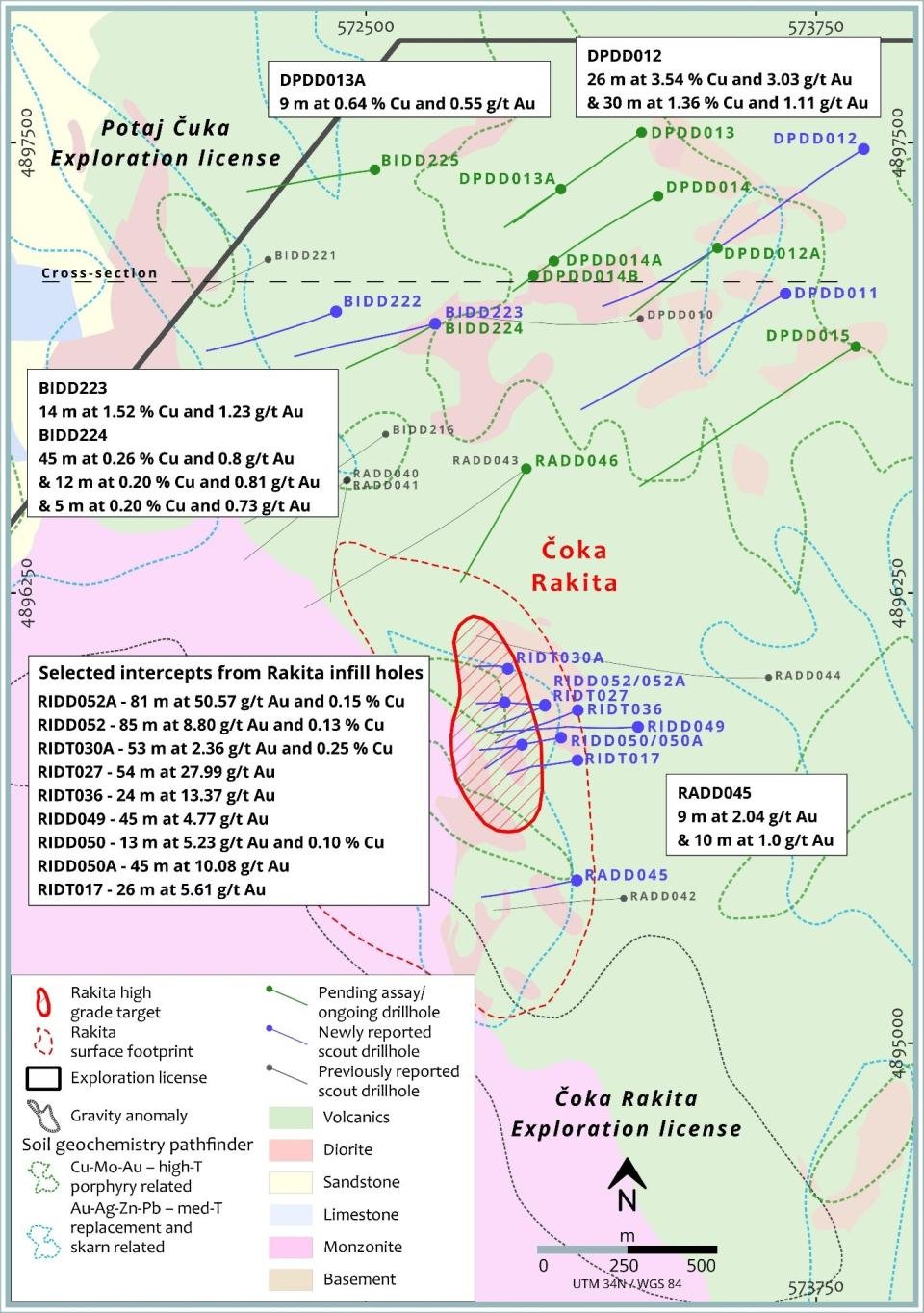

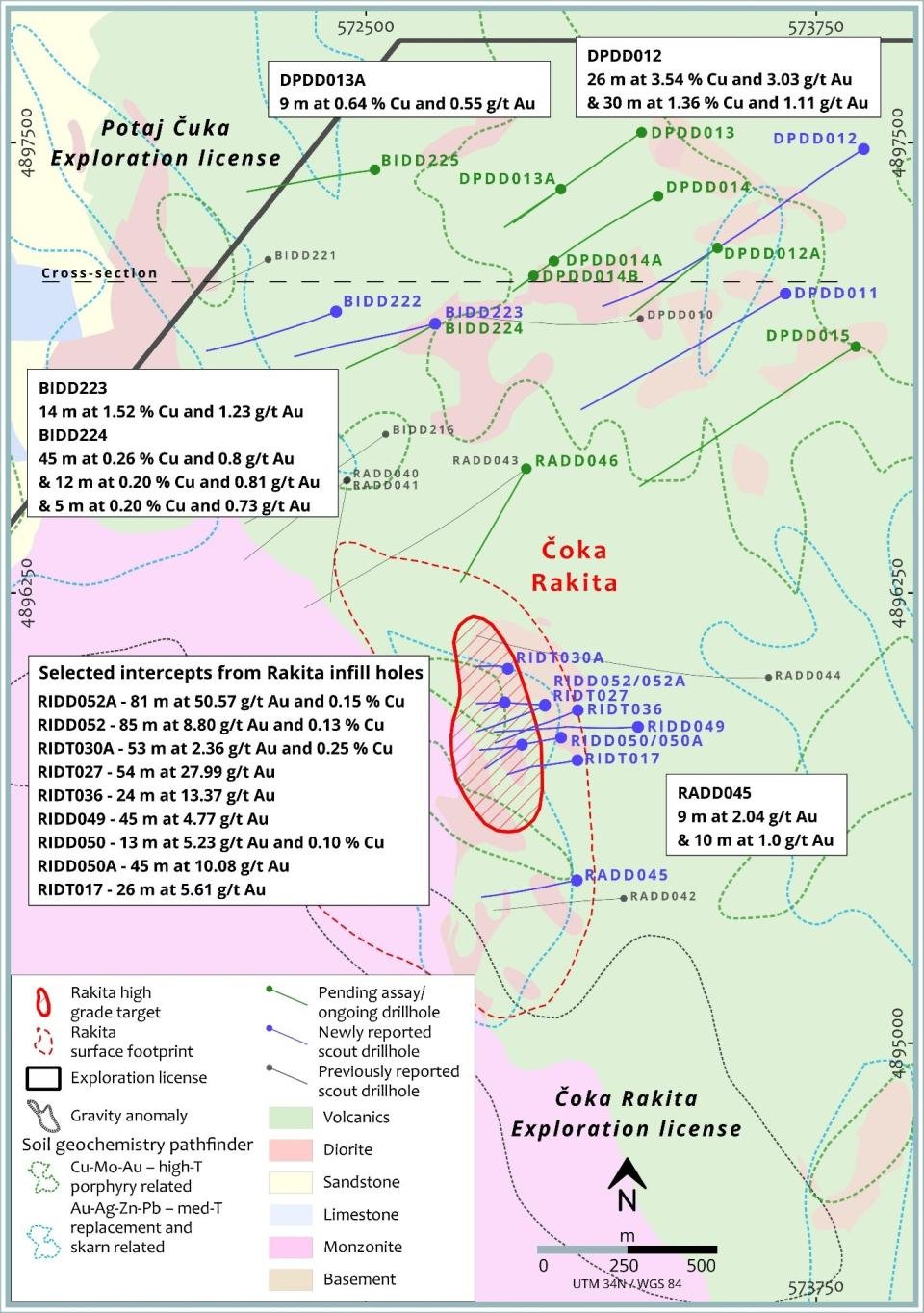

Figure 2

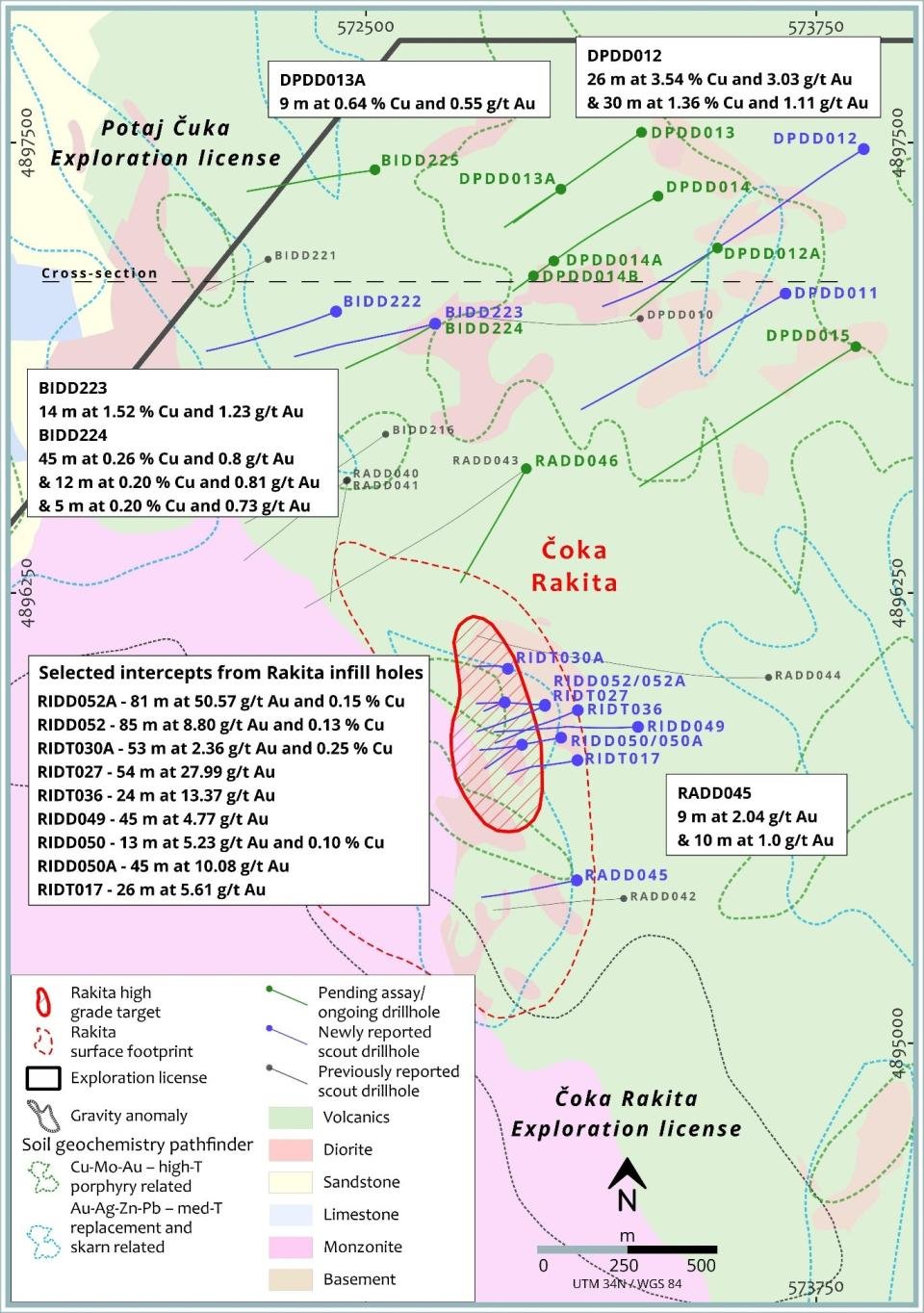

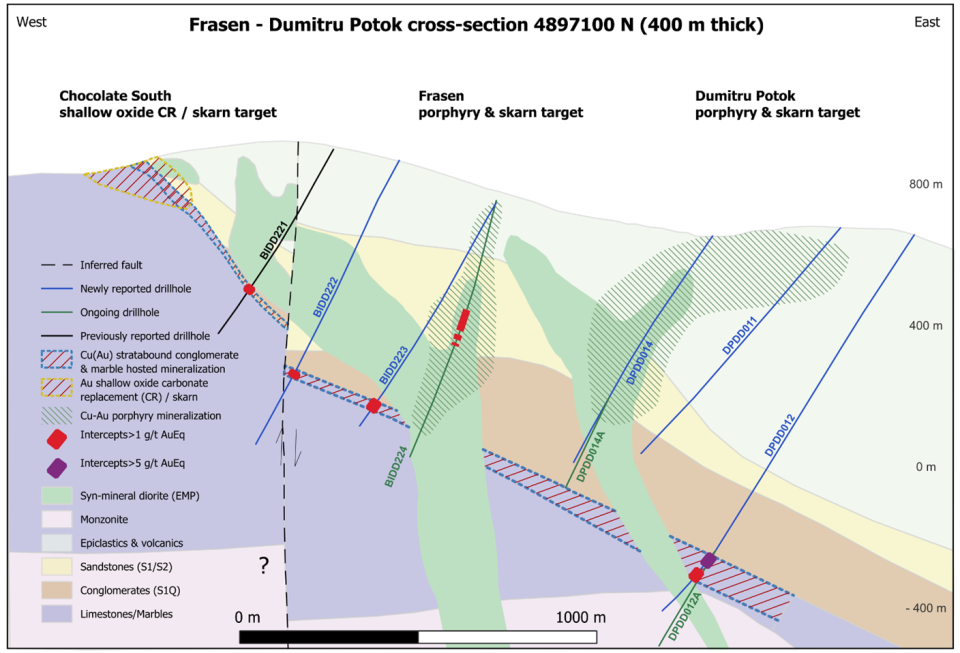

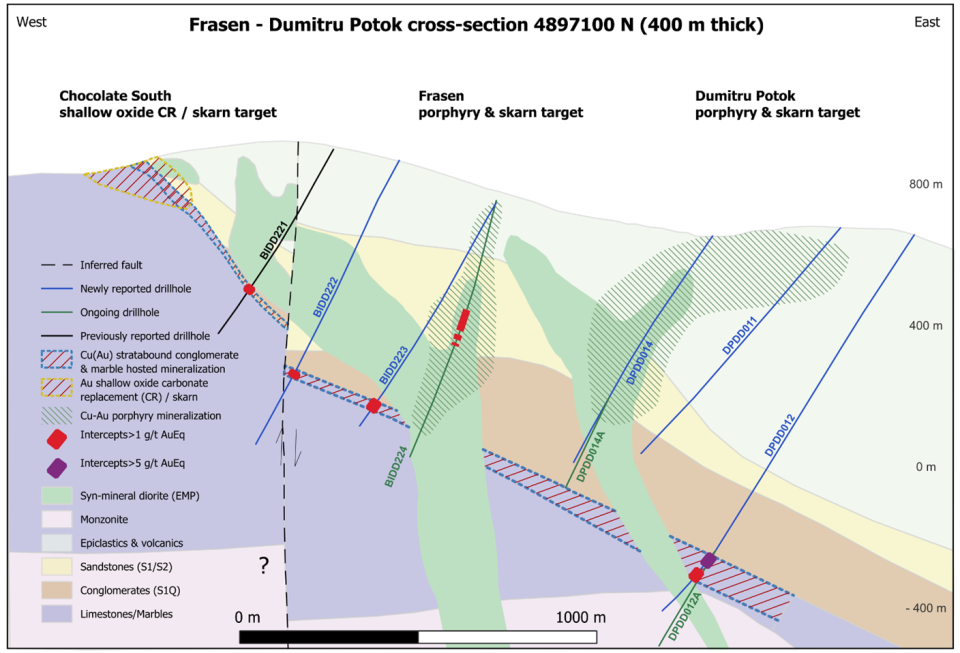

Figure 3

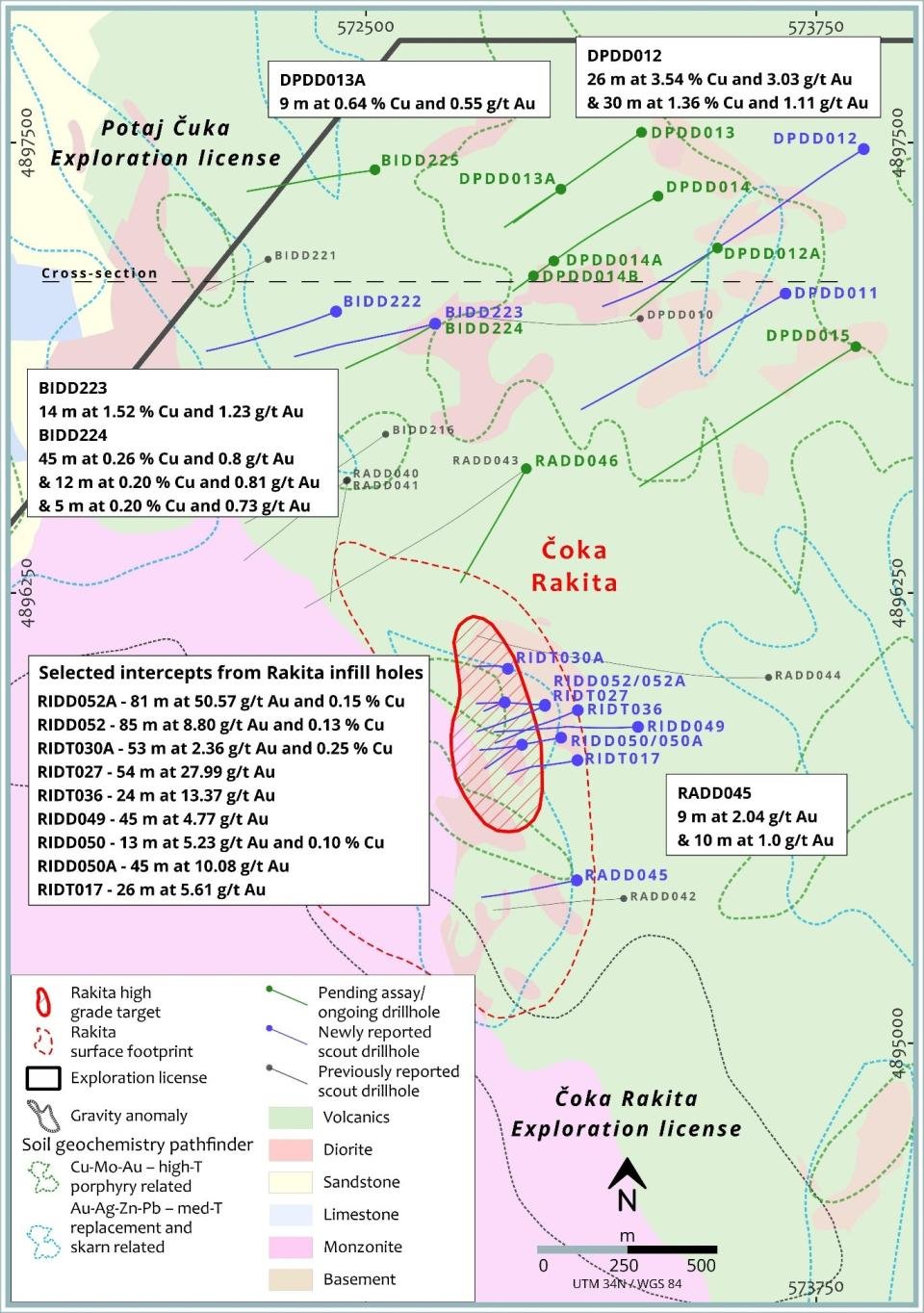

Figure 4

Infill drill results include 81 metres at 50.57 g/t Au and 0.15% Cu

Scout drill results include 26 metres at 3.54% Cu and 3.03 g/t Au

TORONTO, Feb. 26, 2024 (GLOBE NEWSWIRE) — Dundee Precious Metals Inc. (TSX: DPM) (“DPM” or “the Company”) today reported new assay results from its ongoing infill drilling program at Čoka Rakita in eastern Serbia, where DPM recently announced an Inferred mineral resource estimate of 1.8 million ounces of gold.1 The Company also reported results from the scout drilling program at the Dumitru Potok and Frasen prospects, which are located on the Čoka Rakita licence and are approximately 1.0 to 1.5 kilometres north of the Čoka Rakita deposit.

Highlights

(Refer to Tables 1 and 2 for full results)

-

Strong high-grade intercepts from infill drilling at Čoka Rakita, that continue to confirm and extend the high-grade core, including:

-

RIDD052A – 81 metres at 50.57 g/t Au and 0.15% Cu from 122 metres2

-

RIDD052 – 85 metres at 8.80 g/t Au and 0.13% Cu from 411 metres

-

RIDD50A – 45 metres at 10.08 g/t Au from 219 metres

-

RIDD049 – 45 metres at 4.77 g/t Au from 604 metres

-

RIDT030A – 53 metres at 2.36 g/t Au and 0.25% Cu from 162 metres

-

RIDT029 – 40 metres at 4.50 g/t Au and 0.1% Cu from 450 metres

-

RIDT027 – 54 metres at 27.99 g/t Au from 427 metres

-

RIDT017 – 26 metres at 5.61 g/t Au from 504 metres

-

-

New results from scout drilling on Čoka Rakita exploration licence: Confirms camp-wide upside potential for high grade, manto-like skarn gold-copper mineralization, as well as additional potential for sandstone hosted skarn mineralization and porphyry type mineralization. Recently returned intercepts include:

-

DPDD012 – 26 metres at 3.54% Cu and 3.03 g/t Au from 1,155 metres

30 metres at 1.36% Cu and 1.11 g/t Au from 1,214 metres -

DPDD013A – 9 metres at 0.64% Cu and 0.55 g/t Au from 84 metres

-

BIDD222 – 8 metres at 2.36% Cu and 1.26 g/t Au from 706 metres

-

BIDD223 – 14 metres at 1.52 % Cu and 1.23 g/t Au from 657 metres

-

BIDD224 – 45 metres at 0.26% Cu and 0.80 g/t Au from 327 metres

-

-

Next steps: DPM is on track to complete a preliminary economic assessment (“PEA”) for Čoka Rakita in the second quarter of 2024 and continues to advance activities aimed at accelerating the project, including geotechnical and hydrogeological drilling, the next phase of the metallurgical testwork program, the evaluation of locations for potential site infrastructure, and stakeholder engagement activities. The Company is also aggressively pursuing additional potential skarn targets through its scout drilling campaigns within the Čoka Rakita licence, on the new Potaj Čuka and Pešter Jug licences, and on the Umka licence. In 2024, DPM has budgeted between $20 million and $22 million for exploration activities in Serbia.

“We are excited to announce these strong results from our ongoing drilling program, which continue to demonstrate the significant exploration potential of Čoka Rakita and the surrounding licences beyond the current Čoka Rakita deposit,” said David Rae, President and Chief Executive Officer of Dundee Precious Metals.

“We are on track to complete the preliminary economic assessment in the second quarter of 2024, and we are planning continued aggressive exploration at Čoka Rakita and on the surrounding licences to generate new discoveries.”

_________________________

1 For further details, refer to the technical report “Maiden Mineral Resource Estimate – Čoka Rakita Gold Project, Serbia,” dated January 24, 2024, available on the Company’s website at www.dundeeprecious.com and on SEDAR+ at www.sedarplus.ca.

2 Including 1 metre at 3,025 g/t Au from 173 to 174 metres.

Čoka Rakita Infill Drilling Program Results

The infill drilling program at Čoka Rakita continues, with an additional 9,200 metres drilled comprising of 19 completed drill holes and a further seven ongoing drill holes, since the Company’s previous update on November 15, 2023.

Results from the infill drilling program continues to deliver high-grade intercepts, including the project’s best intercept reported to date from drill hole RIDD052A. This intercept returned a wide interval of high-grade gold mineralization, with visible gold observed over an approximate 20 metre section of the hole related to strong skarn altered sandstone with intermittent brecciated intervals. Fire assay results returned an 81-metre interval grading at 50.57 g/t Au and 0.15% Cu from 122 metres, including a single 1-metre interval of 3,025 g/t Au from 173m to 174m.

In addition to confirming the grade-tenor of the mineralization, infill drilling continues to demonstrate a coherent concentration of high-grade mineralization within the core of the deposit (see Figure 1).

Results from the 19 new infill drill holes are disclosed in the following table.

Table 1: New drill intercepts from the Čoka Rakita infill drilling

|

HOLEID |

EAST |

NORTH |

RL |

AZ |

DIP |

FROM |

TO |

LENGTH |

AuEq |

Au |

Cu |

|

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(%) |

||||||

|

RIDD046 |

572911 |

4895983 |

910 |

239 |

-81 |

391 |

419 |

28 |

2.00 |

1.80 |

0.15 |

|

and |

|

|

|

|

|

431 |

467 |

36 |

9.22 |

8.99 |

0.17 |

|

Including |

|

|

|

|

|

445 |

461 |

16 |

18.50 |

18.25 |

0.18 |

|

RIDD047 |

573136 |

4895669 |

943 |

265 |

-65 |

498 |

504 |

6 |

2.99 |

2.99 |

– |

|

and |

|

|

|

|

|

567 |

572 |

5 |

1.05 |

1.05 |

– |

|

RIDD048 |

573219 |

4895694 |

938 |

268 |

-63 |

595 |

610 |

15 |

1.28 |

1.28 |

– |

|

RIDD049* |

573255 |

4895878 |

927 |

267 |

-61 |

604 |

649 |

45 |

4.77 |

4.77 |

– |

|

Including |

|

|

|

|

|

633 |

648 |

15 |

10.46 |

10.46 |

– |

|

RIDD049A* |

573048 |

4895878 |

562 |

273 |

-63 |

198 |

245 |

47 |

1.74 |

1.74 |

– |

|

RIDD050* |

573042 |

4895848 |

919 |

260 |

-64 |

423 |

428 |

5 |

3.62 |

3.62 |

– |

|

and |

|

|

|

|

|

489 |

502 |

13 |

5.37 |

5.23 |

0.10 |

|

RIDD050A* |

572933 |

4895829 |

693 |

258 |

-64 |

183 |

210 |

27 |

2.17 |

2.17 |

– |

|

including |

|

|

|

|

|

194 |

201 |

7 |

5.76 |

5.76 |

– |

|

and |

|

|

|

|

|

219 |

264 |

45 |

10.08 |

10.08 |

– |

|

including |

|

|

|

|

|

226 |

245 |

19 |

19.24 |

19.24 |

– |

|

including |

|

|

|

|

|

249 |

254 |

5 |

9.15 |

9.15 |

– |

|

RIDD051 |

573095 |

4895789 |

931 |

265 |

-73 |

in progress |

|||||

|

RIDD052* |

572997 |

4895940 |

915 |

271 |

-67 |

376 |

394 |

18 |

1.44 |

1.29 |

0.11 |

|

and |

|

|

|

|

|

411 |

496 |

85 |

8.97 |

8.80 |

0.13 |

|

including |

|

|

|

|

|

474 |

492 |

18 |

31.29 |

31.09 |

0.15 |

|

RIDD052A* |

572885 |

4895946 |

649 |

271 |

-69 |

122 |

203 |

81 |

50.77 |

50.57 |

0.15 |

|

including |

|

|

|

|

|

133 |

144 |

11 |

8.45 |

8.17 |

0.21 |

|

including |

|

|

|

|

|

162 |

192 |

30 |

130.67 |

130.49 |

0.13 |

|

RIDD053 |

573040 |

4895848 |

919 |

270 |

-66 |

in progress |

|||||

|

RIDD054 |

572954 |

4895843 |

901 |

266 |

-66 |

in progress |

|||||

|

RIDD055 |

572999 |

4895938 |

915 |

257 |

-65 |

in progress |

|||||

|

RIDT015 |

573019 |

4895684 |

928 |

280 |

-66 |

no significant intervals |

|||||

|

RIDT017 |

573087 |

4895786 |

931 |

258 |

-69 |

221 |

226 |

5 |

1.28 |

1.28 |

– |

|

and |

|

|

|

|

|

504 |

530 |

26 |

5.61 |

5.61 |

– |

|

including |

|

|

|

|

|

516 |

527 |

11 |

11.10 |

11.10 |

– |

|

RIDT027 |

572997 |

4895937 |

915 |

247 |

-65 |

403 |

416 |

13 |

1.11 |

0.97 |

0.11 |

|

and |

|

|

|

|

|

427 |

481 |

54 |

27.99 |

27.99 |

– |

|

including |

|

|

|

|

|

432 |

481 |

49 |

30.61 |

30.61 |

– |

|

RIDT029 |

572995 |

4895943 |

915 |

268 |

-69 |

375 |

408 |

33 |

1.36 |

1.36 |

– |

|

and |

|

|

|

|

|

423 |

432 |

9 |

1.27 |

1.01 |

0.20 |

|

and |

|

|

|

|

|

450 |

490 |

40 |

4.63 |

4.50 |

0.10 |

|

including |

|

|

|

|

|

478 |

484 |

6 |

17.54 |

17.26 |

0.21 |

|

RIDT030A* |

572894 |

4896040 |

647 |

293 |

-70 |

162 |

215 |

53 |

2.70 |

2.36 |

0.25 |

|

including |

|

|

|

|

|

202 |

208 |

6 |

8.46 |

8.22 |

0.18 |

|

RIDT030B* |

572884 |

4896044 |

619 |

291 |

-69 |

106 |

116 |

10 |

1.28 |

0.70 |

0.43 |

|

|

|

|

|

|

|

125 |

176 |

51 |

1.02 |

0.77 |

0.18 |

|

RIDT030C |

572896 |

4896038 |

653 |

295 |

-69 |

aborted for technical reasons |

|||||

|

RIDT032 |

572991 |

4896003 |

916 |

266 |

-68 |

in progress |

|||||

|

RIDT035 |

573089 |

4895922 |

920 |

248 |

-72 |

439 |

479 |

40 |

1.70 |

1.45 |

0.18 |

|

and |

|

|

|

|

|

487 |

523 |

36 |

3.23 |

3.23 |

– |

|

including |

|

|

|

|

|

493 |

498 |

5 |

10.41 |

10.41 |

– |

|

and |

|

|

|

|

|

536 |

543 |

7 |

1.02 |

1.02 |

– |

|

RIDT036 |

573088 |

4895924 |

920 |

248 |

-66 |

503 |

527 |

24 |

13.37 |

13.37 |

– |

|

including |

|

|

|

|

|

507 |

515 |

8 |

33.17 |

33.17 |

– |

|

RIDT036A* |

572963 |

4895878 |

610 |

253 |

-66 |

156 |

196 |

40 |

2.51 |

2.38 |

0.10 |

|

RIDT037 |

573086 |

4895926 |

920 |

250 |

-70 |

completed – awaiting results |

|||||

|

RIDT037A |

572987 |

4895883 |

643 |

245 |

-69 |

in progress |

|||||

|

RIDT039 |

573251 |

4895877 |

927 |

264 |

-61 |

aborted for technical reasons |

|||||

|

RIDT042 |

573193 |

4895769 |

939 |

264 |

-62 |

521 |

526 |

5 |

1.21 |

1.21 |

– |

|

and |

|

|

|

|

|

534 |

539 |

5 |

1.53 |

1.53 |

– |

|

and |

|

|

|

|

|

569 |

580 |

11 |

7.14 |

7.14 |

– |

|

including |

|

|

|

|

|

569 |

577 |

8 |

9.49 |

9.49 |

– |

|

and |

|

|

|

|

|

590 |

601 |

11 |

1.51 |

1.51 |

– |

|

RIDT043 |

573202 |

4895768 |

940 |

275 |

-65 |

aborted for technical reasons |

|||||

|

RIDT043A |

573150 |

4895774 |

833 |

280 |

-64 |

in progress |

|||||

|

RADDHG001* |

572900 |

4896039 |

912 |

270 |

-85 |

398 |

407 |

9 |

1.18 |

0.54 |

0.48 |

|

RADDHG002 |

573144 |

4895669 |

943 |

268 |

-69 |

completed / awaiting results |

|||||

* Holes have been assayed using a 50 g Fire Assay method, Screen Fire Assays (SFA) results pending.

1) Coordinates are in UTM Zone 34 North WGS84 datum.

2) Intervals are reported at a cut-off grade of 1 g/t AuEq using 5 metres minimum length and 5 metres maximum internal dilution. Higher grade ‘Including’ intervals are reported at a cut-off grade of 5 g/t AuEq using 5 metres minimum length and 3 metres maximum internal dilution.

3) The AuEq calculation is based on the following formula: Au g/t + 1.35 x Cu %, based on a gold price of $1,400/oz. and a copper price of $2.75/lb.; and assumes metallurgical recoveries of 90% for gold and 90% for copper within the equivalency calculation. These assumptions are based on preliminary metallurgical testwork results and expected behaviour of copper and gold during flotation. Copper below 0.1% has not been reported and is not included in the equivalency calculation.

4) No upper cuts have been applied.

5) Based on the current understanding of the geometry of the mineralized body, true widths are considered to be 90% or more of the reported downhole interval.

6) “DT” within the hole naming nomenclature (e.g. RIDT005) indicates that the hole is a diamond tail of a reverse circulation pre-collar drillhole.

7) Daughter holes identified with “A” (e.g. RIDT030A) are navigational holes with collar coordinates and depth indicating the exit point from the parent hole.

8) “HG” within the hole naming nomenclature (e.g. RADDHG001) indicates that the hole is a hydrogeological monitoring hole.

Čoka Rakita Scout Drilling

The Company is continuing its aggressive scout drilling program on the Čoka Rakita exploration licence, drilling over 7,800 metres since the previous update on November 15, 2023, with seven drill holes completed and six drill holes in progress. The objective of this phase of drilling is to test for the continuation of skarn hosted gold mineralization within sandstones as well as conglomerate and marble hosted copper-gold mineralization based on the presence of favourable stratigraphy and fertile intrusives. The current drill plan builds upon previous intercepts of these mineralization types, found to the north of Čoka Rakita. Examples include the previously disclosed drill hole RADD044, which included 42 metres at 0.72% Cu and 0.5 g/t Au hosted within skarn altered marbles, and drillhole BIDD221, which reported 5 metres at 1.45% Cu and 0.64 g/t Au on manto-like skarn mineralization.

So far, the scout holes drilled north of Čoka Rakita have confirmed the conceptual targeting model and consistently show the presence of skarn alteration and mineralization within more reactive lithological units. Mineralization is interpreted as a manto-like skarn, developed at the limit of conglomerates / sandstone and marbles, in close proximity of fertile diorite porphyries that often display potassic alteration and exhibiting weak to moderate copper-gold mineralization.

At the Dumitru Potok prospect, located approximately 1.5 kilometres northeast of Čoka Rakita, several long holes were drilled to test for the extension of a higher grade manto target at depth. Drill hole DPDD012, collared on the eastern flank of the Dumitru Potok prospect, reported two, deep (~ 900 metres below surface), but consistent intercepts of high-grade copper-gold manto-like skarn mineralization including 26 metres at 3.54% Cu and 3.03 g/t Au from 1,155 metres downhole and 30 metres at 1.36% Cu and 1.11 g/t Au from 1,214 metres (see Figure 4). These intercepts are located along the conglomerate – marble contact, as well as on the upper contact of monzonites and associated diorites. A follow-up daughter hole (DPDD012A) is underway to test the continuation of this target.

Drill holes DPDD013 and DPDD014 both returned strongly silicified sandstones and conglomerates, with intermittent sulphides, as well as diorite dikes with weakly to moderate developed potassic alteration. Due to technical difficulties, both drill holes were terminated short of the deeper marble contact. Daughter holes, wedged off of the original holes, are currently underway to reach this target zone. Drillhole DPDD013A reported a promising intercept of 9 metres at 0.55 g/t Au and 0.64% copper, developed within strongly skarn altered sandstones. This hole, as well as DPDD014B, are currently ongoing and approaching the marble conglomerate contact, with increasing sulphides and more abundant skarn altered marble clasts observed by DPM geologists.

At the Frasen prospect, located approximately one kilometre north-west of Čoka Rakita, drill holes BIDD222 and BIDD223, collared east of the aforementioned BIDD221, intercepted well developed manto-like skarn mineralization. Drillhole BIDD224, which is currently ongoing, intercepted a mineralized porphyry diorite with strong potassic alteration and locally well developed stockwork, that returned a partial (upper section of the hole) intercept of 45 metres at 0.8 g/t Au and 0.26% Cu. This intrusion is believed to be the causative intrusion for the manto style skarn mineralization. At the time of this news release, the hole is still within strongly potassic altered diorites with porphyry style mineralization and has not yet reached the expected manto target. However, the increasing presence of skarn altered marbles and conglomerate xenoliths within the diorite suggest that the contact zone is nearby.

Scout drilling on the southern flank of the Čoka Rakita deposit returned a promising intercept from drill hole RADD045, which returned 9 metres at 2.04 g/t Au and 10 metres at 1.0 g/t Au, developed on the upper epiclastic cover sequence that possesses irregular levels of skarn alteration related with sub-vertical structures. Based on the observed relationship between epiclastic hosted mineralization and underlying sandstone hosted skarn mineralization at the Čoka Rakita deposit, these results would suggest that higher grade sandstone hosted skarn mineralization may be present at depth. Additional drilling will follow-up on these results, as well as to test the larger footprint of coincident surface geochemical anomaly and to test the target skarn stratigraphy, which is still open to south and southeast from Čoka Rakita.

For details of the Čoka Rakita scout drilling program, refer to Table 2 and Figures 2 and 3.

Table 2: New drill intercepts from the scout drilling campaign on the Čoka Rakita exploration licence

|

HOLEID |

EAST |

NORTH |

RL |

AZ |

DIP |

FROM |

TO |

LENGTH |

AuEq |

Au |

Cu |

|

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(%) |

||||||

|

DPDD011 |

573665 |

4897081 |

698 |

240 |

-46 |

completed – no significant intervals |

|||||

|

DPDD012 |

573882 |

4897482 |

691 |

238 |

-50 |

1155 |

1181 |

26 |

7.80 |

3.03 |

3.54 |

|

and |

|

|

|

|

|

1214 |

1244 |

30 |

2.94 |

1.11 |

1.36 |

|

DPDD012A |

573476 |

4897208 |

48 |

238 |

-53 |

in progress |

|||||

|

DPDD013 |

573265 |

4897529 |

669 |

235 |

-50 |

completed – awaiting results |

|||||

|

DPDD013A |

573040 |

4897370 |

337 |

235 |

-52 |

84 |

93 |

9 |

1.42 |

0.55 |

0.64 |

|

DPDD014 |

573311 |

4897351 |

687 |

242 |

-51 |

completed – awaiting results |

|||||

|

DPDD014A |

573022 |

4897172 |

239 |

235 |

-56 |

aborted for technical reasons |

|||||

|

DPDD014B |

572965 |

4897130 |

124 |

232 |

-58 |

in progress |

|||||

|

DPDD015 |

573860 |

4896934 |

649 |

240 |

-49 |

completed – awaiting results |

|||||

|

BIDD222 |

572417 |

4897031 |

891 |

249 |

-60 |

706 |

714 |

8 |

4.44 |

1.26 |

2.36 |

|

BIDD223 |

572692 |

4896998 |

775 |

256 |

-59 |

657 |

671 |

14 |

3.28 |

1.23 |

1.52 |

|

BIDD224 |

572691 |

4896996 |

775 |

239 |

-73 |

327 |

372 |

45 |

1.15 |

0.80 |

0.26 |

|

and |

|

|

|

|

|

394 |

406 |

12 |

1.08 |

0.81 |

0.20 |

|

and |

|

|

|

|

|

411 |

416 |

5 |

1.01 |

0.73 |

0.20 |

|

BIDD225 |

572527 |

4897425 |

816 |

260 |

-70 |

in progress |

|||||

|

RADD045 |

573085 |

4895452 |

909 |

259 |

-64 |

132 |

141 |

9 |

2.04 |

2.04 |

– |

|

and |

|

|

|

|

|

162 |

172 |

10 |

1.00 |

1.00 |

– |

|

RADD046 |

572945 |

4896595 |

791 |

210 |

-67 |

in progress |

|||||

1) Coordinates are in UTM Zone 34 North WGS84 datum.

2) Intervals are reported at a cut-off grade of 1 g/t AuEq using 5 metres minimum length and 5 metres maximum internal dilution.

3) The AuEq calculation is based on the following formula: Au g/t + 1.35 x Cu %, based on a gold price of $1,400/oz. and a copper price of $2.75/lb.; and assumes metallurgical recoveries of 90% for gold and 90% for copper within the equivalency calculation. These assumptions are based on preliminary metallurgical results and expected similar behaviour of copper and gold during flotation. Copper below 0.1% has not been reported and is not included in the equivalency calculation.

4) No upper cuts have been applied.

5) Based on the limited understanding of the geometry of the mineralized body, true widths are considered to be 90% or more of the reported downhole interval, assuming strata-bound control on the mineralization.

6) Daughter holes identified with “A” (e.g., DPDD013A) are navigational holes with collar coordinates and depth indicating the exit point from the parent hole.

Preliminary economic assessment

DPM is on track to complete a PEA for Čoka Rakita in the second quarter of 2024. The Company is continuing to advance activities aimed at accelerating the project, including geotechnical and hydrogeological drilling, the next phase of the metallurgical test-work program, evaluation of locations for potential site infrastructure, and stakeholder engagement activities. In 2024, the Company has budgeted approximately $10 and $13 million for the PEA.

Significant exploration program planned for 2024

In 2024, the Company’s exploration program in Serbia includes 35,000 metres of infill and geotechnical drilling as well as approximatively 55,000 metres of scout drilling.

As part of its ongoing scout drilling program on the Čoka Rakita licence, DPM plans to test favourable stratigraphy for carbonate replacement and skarn mineralization on the Potaj Čuka and the Pešter Jug exploration licences, as well as re-commencing drilling on the Umka licence.

Furthermore, the Company aims to extend the magneto-telluric (MT) survey in an area to the north of Čoka Rakita, up to the Korkan East prospect. This approach has proven to be an effective targeting tool for outlining sulphide bearing mineralization at the Frasen and Dumitru Potok prospects.

The Company has budgeted between $20 million and $22 million for exploration activities in Serbia in 2024.

Figure 1. Tilted slice along high-grade skarn mineralization highlighting new intercepts from the ongoing infill drilling program at Čoka Rakita.

Figure 2. Updated camp scale map highlighting new results from the scout drilling program and selected intercepts from the Čoka Rakita infill program.

Figure 3. Cross section looking north at the Frasen and Dumitru Potok targets, located approximately 1 km north of the Čoka Rakita deposit, displaying scout drilling, the conceptual geology model and interpretation of target mineralization styles.

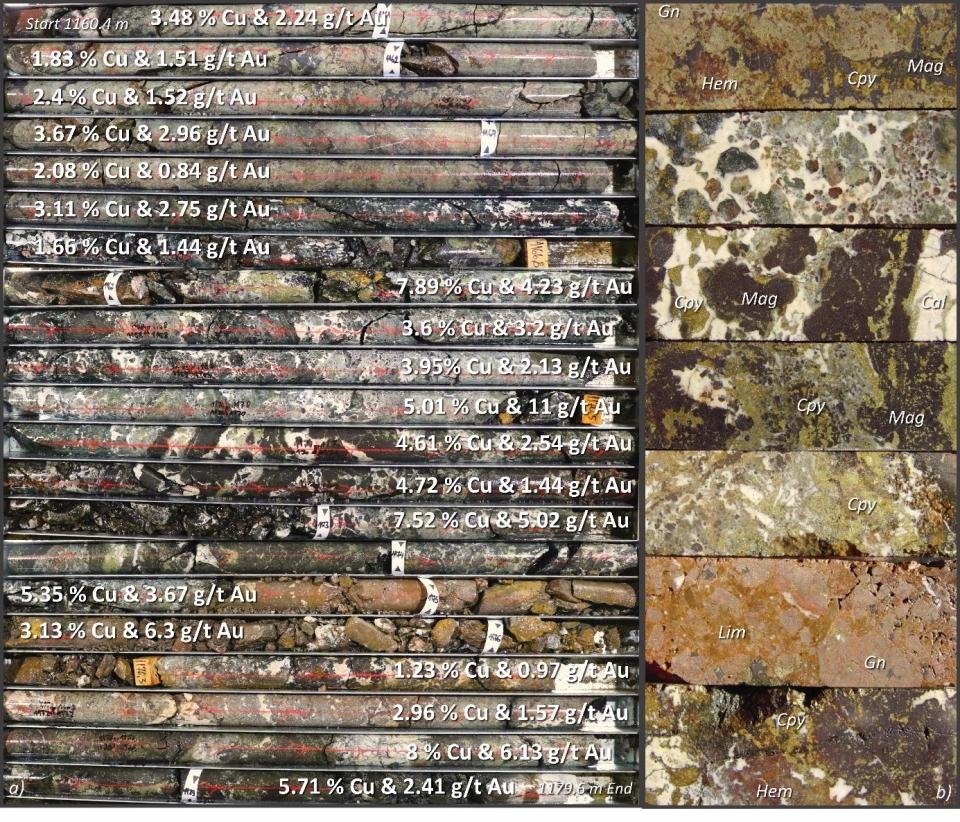

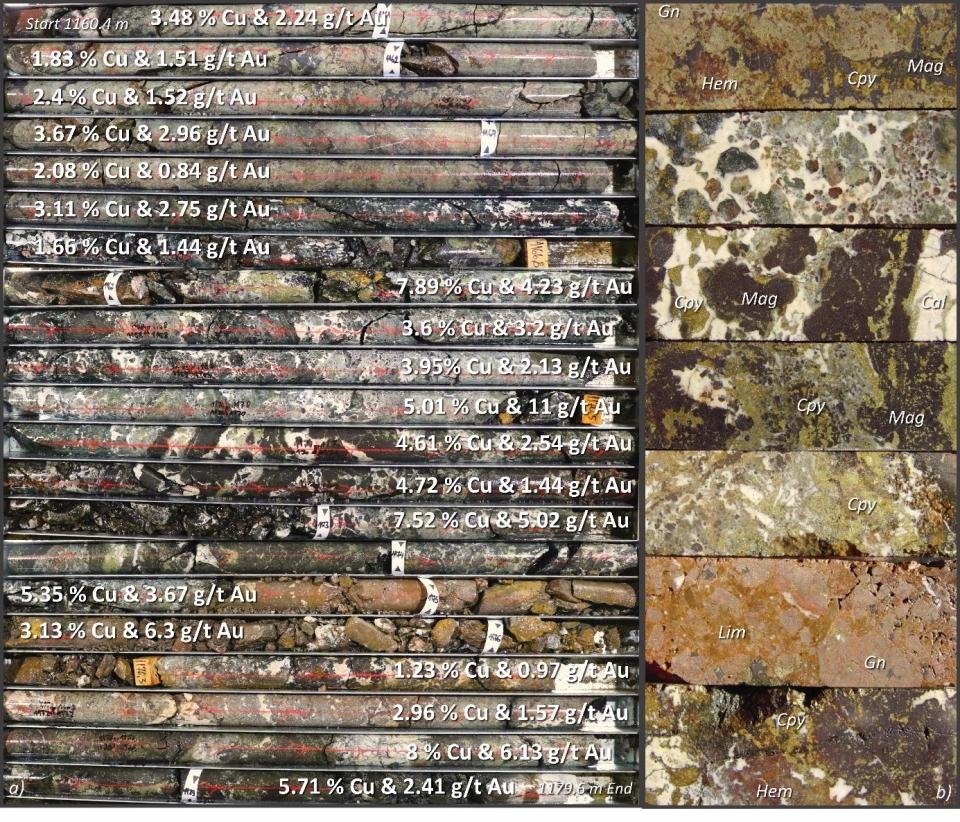

Figure 4. Images showing the core photos of copper-gold manto skarn mineralization from hole DPDD012, within the interval reporting 26 metres at 3.54% Cu and 3.03 g/t Au from 1155 metres downhole.

a) Full NQ size core boxes from DPDD012 starting at 1160.4 metres downhole and ending at 1179.6 metres downhole, displaying copper and gold assay values for each metre.

b) Macro images of half-core from the same intervals displaying textural variability, from garnet dominated skarn with magnetite-chalcopyrite cement on upper right, semi-massive magnetite-chalcopyrite-carbonate hydrothermal replacement in center right and brecciated skarn with late limonite-hematite-carbonate cement with on lower right. (Abbreviations: Cpy – chalcopyrite, Mag – magnetite, Hem – hematite, Lim – limonite, Cal – calcite, Gn – garnet)

Sampling, Analysis and QAQC of Exploration Drill Core Samples

Given the presence of coarse gold at Čoka Rakita, a rigorous sampling and QAQC procedure has been selected which includes the use of laboratory screen metallic assaying.

Most exploration diamond drill holes are collared with PQ size, continued with HQ, and are sometimes finished with NQ. Triple tube core barrels and short runs are used whenever possible to improve recovery. All drill core is cut lengthwise into two halves using a diamond saw: one half is sampled for assaying and the other half is retained in core trays. The common length for sample intervals within mineralized zones is one metre. Weights of drill core samples range from three to eight kilograms (“kg”), depending on the size of core, rock type, and recovery. A numbered tag is placed into each sample bag, and the samples are grouped into batches for laboratory submission.

Drill core samples are shipped to the Company’s own exploration laboratory in Bor, Serbia, which is independently managed by SGS. SGS methods and procedures are accredited at SGS hub labs and independent internal lab QAQC check samples are sent to an SGS accredited laboratory. The Bor lab also participate in SGS monthly round robins, and other international Round Robins. Quality control samples, comprising certified reference materials, blanks, and field duplicates, are inserted into each batch of samples and locations for crushed duplicates and pulp replicates are specified. All drill core and quality control samples are tabulated on sample submission forms that specify sample preparation procedures and codes for analytical methods. For internal quality control, the laboratory includes its own quality control samples comprising certified reference materials, blanks and pulp duplicates. All QAQC monitoring data are reviewed, verified and signed off by an independent QAQC geologist. Chain of custody records are maintained from sample shipments to the laboratory until analyses are completed and remaining sample materials are returned to the Company. The chain of custody is transferred from the Company to SGS at the laboratory door.

At the SGS Bor laboratory, the submitted drill core samples are dried at 105°C for a minimum of 12 hours, and then jaw crushed to approximately 80% passing four millimetres. Sample preparation duplicates are created by riffle splitting crushed samples on a 1-in-20 basis. Larger samples are riffle split prior to pulverizing, whereas smaller samples are pulverized entirely. Pulverization specifications are 90% passing 75 microns. Gold analyses are done using a conventional 50-gram fire assay and AAS finish. Multi-element analyses for 49 elements, including Ag, Cu, Mo, As, Bi, Pb, Sb, and Zn, are done using a four-acid digestion and an ICP-MS finish. Samples returning over 10 ppm for Ag and 1% for Cu, Pb or Zn are re-analyzed using high grade methods with AAS finish. Sulphur is analyzed using an Eltra Analyzer equipped with an induction furnace.

All fire assays performed at SGS Bor with results exceeding 1 g/t gold grade from the Čoka Rakita deposit are re-assayed by means of a specifically designed gold screen fire assay program at the ALS Global laboratory located in Romania. For re-analyses, 1 kg of 2 mm sized coarse reject material is split, pulverized and screened at 106 microns to separate the sample into a coarse fraction (>106 µm) and a fine fraction (<106 µm). After screening, two 50-gram aliquots of the fine fraction are analyzed using the traditional fire assay method and AAS finish. The entire coarse fraction is assayed to determine the contribution of the coarse gold using fire assay and gravimetric finish. A “total” gold calculation for the 1 kg sample is based on the weighted average of the coarse and fine fractions.

Ross Overall, Corporate Director Technical Services of the Company, who is a Qualified Person as defined under NI 43-101, and Paul Ivascanu, General Manager, Exploration of the Company, have reviewed, and approved the scientific and technical content of this news release. Mr. Overall has verified the accuracy of the information presented in this disclosure.

About Dundee Precious Metals

Dundee Precious Metals Inc. is a Canadian-based international gold mining company with operations and projects located in Bulgaria, Namibia, Serbia and Ecuador. The Company’s purpose is to unlock resources and generate value to thrive and grow together. This overall purpose is supported by a foundation of core values, which guides how the Company conducts its business and informs a set of complementary strategic pillars and objectives related to ESG, innovation, optimizing our existing portfolio, and growth. The Company’s resources are allocated in-line with its strategy to ensure that DPM delivers value for all of its stakeholders. DPM’s shares are traded on the Toronto Stock Exchange (symbol: DPM).

For further information please contact:

Cautionary Note Regarding Forward Looking Statements

This news release contains “forward looking statements” or “forward looking information” (collectively, “Forward Looking Statements”) that involve a number of risks and uncertainties. Forward Looking Statements are statements that are not historical facts and are generally, but not always, identified by the use of forward looking terminology such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “outlook”, “intends”, “anticipates”, “believes”, or variations of such words and phrases or that state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms or similar expressions. The Forward Looking Statements in this news release relate to, among other things: future exploration potential at Čoka Rakita; additional potential of sandstone hosted mineralization; timing of the preliminary economic assessment for Čoka Rakita and other matters discussed under “Next Steps”; the geology and metallurgy at Čoka Rakita; the price of commodities; metallurgical recoveries; the future estimation of Mineral Resources and the realization of such mineral estimates; and success of exploration activities. Forward Looking Statements are based on certain key assumptions and the opinions and estimates of management and the Qualified Persons, as of the date such statements are made, and they involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any other future results, performance or achievements expressed or implied by the Forward Looking Statements. In addition to factors already discussed in this news release, such factors include, among others, fluctuations in foreign exchange rates; risks arising from the current inflationary environment and the impact on operating costs and other financial metrics, including risks of recession; continuation or escalation of the conflict in Ukraine or elsewhere in the world; risks relating to the Company’s business generally and the impact of global pandemics, including COVID-19, resulting in changes to the Company’s supply chain, product shortages, delivery and shipping issues; possible variations in ore grade and recovery rates; inherent uncertainties in respect of conclusions of economic evaluations, economic studies and mine plans; changes in project parameters, including schedule and budget, as plans continue to be refined; uncertainties with respect to actual results of current exploration activities; uncertainties and risks inherent to developing and commissioning new mines into production, which may be subject to unforeseen delays; uncertainties inherent with conducting business in foreign jurisdictions where corruption, civil unrest, political instability and uncertainties with the rule of law may impact the Company’s activities; limitations on insurance coverage; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities; actual results of current and planned reclamation activities; opposition by social and non-governmental organizations to mining projects and smelting operations; unanticipated title disputes; claims or litigation; failure to achieve certain cost savings or the potential benefits of any upgrades and/or expansion; increased costs and physical risks, including extreme weather events and resource shortages, related to climate change; cyber-attacks and other cybersecurity risks; as well as those risk factors discussed or referred to in any other documents (including without limitation the Company’s most recent Annual Information Form) filed from time to time with the securities regulatory authorities in all provinces and territories of Canada and available on SEDAR+ at www.sedarplus.ca. The reader has been cautioned that the foregoing list is not exhaustive of all factors which may have been used. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward Looking Statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that Forward Looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company’s Forward Looking Statements reflect current expectations regarding future events and speak only as of the date hereof. Unless required by securities laws, the Company undertakes no obligation to update Forward Looking Statements if circumstances or management’s estimates or opinions should change. Accordingly, readers are cautioned not to place undue reliance on Forward Looking Statements.

Figures accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/b6543f77-2c6c-43ca-a54f-3edd38bc5184

https://www.globenewswire.com/NewsRoom/AttachmentNg/a6c976c1-cf34-4afa-a055-a647cd3fc786

https://www.globenewswire.com/NewsRoom/AttachmentNg/21df42ea-0b98-416f-8271-50482657afcc

https://www.globenewswire.com/NewsRoom/AttachmentNg/4da026ca-68a8-4734-a974-01a46e4ac67e