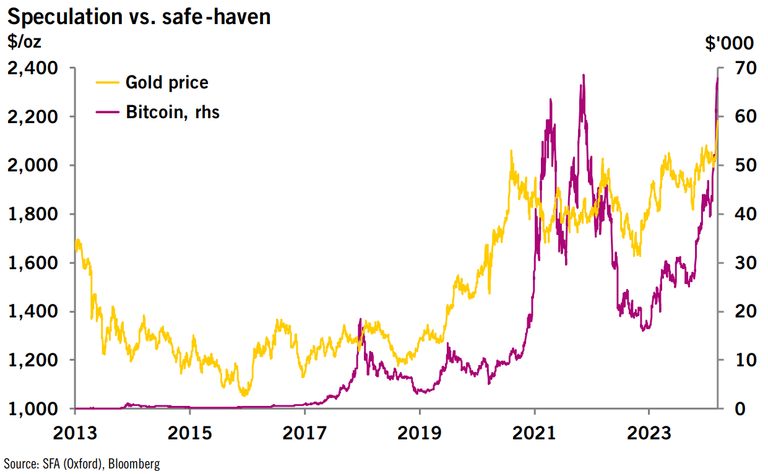

(Kitco News) – The outperformance of both stocks and cryptocurrencies and the absence of gold’s traditional tailwinds makes the yellow metal’s current rally more difficult to explain, according to precious metals analysts at Heraeus.

“Record highs in both defensive (gold) and speculative (stocks/crypto) assets imply the gold price rally is not simply the result of a rise in ‘risk-off’ sentiment,” the analysts wrote in their latest report. “Gold pushing to new all-time highs in dollar and euro terms last week appears at first glance to have been part of a wider ‘buy-everything’ phase in financial markets. However, shifting expectations for US interest rate cuts to occur later are not supportive of a higher gold price.”

They said that notwithstanding the difficulty in identifying the drivers behind the recent rally, “clearly gold has been able to find willing buyers.”

The analysts pointed out that gold’s rally lacks the typical drivers of a weaker U.S. dollar, lower interest rates, and ETF inflows. “US bond yields fell to below 4.6% following US February PCE core inflation data coming in line with expectations and a weaker than expected US manufacturing PMI, which may have been a moderate tailwind for the rally,” they said. “Inflation is receding in the US, weakening the ‘inflation hedge’ argument for gold allocations, and the dollar is yet to offer much bullish support for gold, given the US dollar index is up >2% year-to-date.”

Heraeus said that if these factors do come together later in the year, they could push gold prices even higher. “While the gold price has been rising since the middle of February, ETF investors have yet to back the rally,” they noted. “Bullion-backed ETFs have seen steadily reducing holdings of gold for more than year. However, the longer that gold trades at current levels, the more likely it is that trend-chasing investors will begin buying which may be an important positive stimulus.”

They said the most obvious and impactful catalyst for a further bull-run for gold is the start of the Fed’s cutting cycle. “Last week, Jerome Powell’s comment that rate cuts are ‘likely’ this year indicate the Fed is open to cuts, but keen not to rush,” they said. “Nevertheless, the market expects three or more interest rate cuts this year, which should be gold price supportive.”

Heraeus said that strong physical demand is what’s underpinning high gold prices. “Physical gold demand is expected to remain relatively robust in China and India this year, and net positive demand from central banks appears to be extending into this year, with central banks adding 39 tonnes of gold in January,” they said. “Now in overbought territory, gold could see a correction and momentum could be arrested if US CPI comes in hotter than expected tomorrow. Despite any short-term volatility, the ingredients for longer-term gold price strength should be in place for later in 2024.”

The analysts also noted the strong start to sovereign gold purchases so far in 2024, which “suggests that these institutions, particularly those in emerging markets, will continue to accumulate gold at a similar rate to that in the last two years.”

“Central banks have been skewed towards net purchases for more than 15 years,” they said. “Since 2010, emerging market economies have accumulated 4,937 tonnes of gold, while developed economies have accumulated just 452 tonnes.”

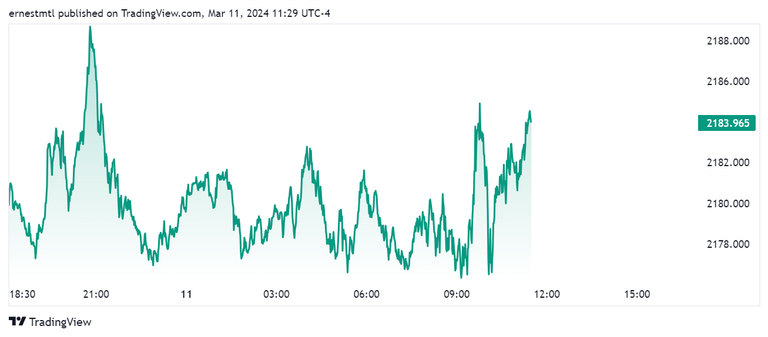

They added that gold’s record highs in a number of currencies last week were “supported by what was considered by the markets to be a ‘dovish’ tone from Jerome Powell in his testimony to Congress, and downward revisions to US January payroll numbers on Friday.”

Spot gold rose to just below $2,190 per ounce early in the Asian trading session on Monday, and last traded at $2,183.42, up 0.23% at the time of writing.

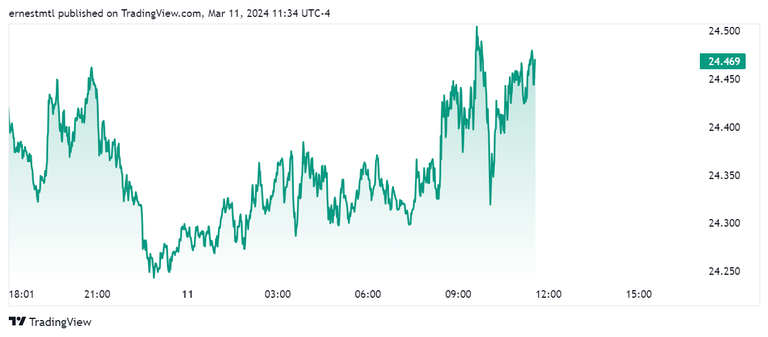

Turning to silver, the analysts noted that while the gray metal also rallied last week, it continued to underperform gold. “By the end of the week, silver had broken above, and was holding above, $24/oz – a year-to-date high,” they said. “Nonetheless, with gold making new highs, sub-$25/oz for silver looks cheap versus its sister metal gold, at a gold:silver ratio of 89.6.”

Spot silver last traded at $24.469 per ounce at the time of writing, up 0.62% on the session.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.