This has raised questions about the effectiveness of the new charge.

The latest statistics from Revenue outline the yield from the tax, which applied to fewer than 3,500 properties in 2024.

The small amount raised means that it probably cost more for Revenue to collect it than it yielded last year, experts said.

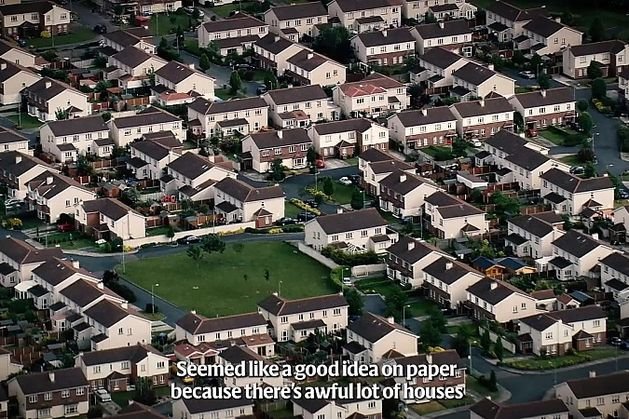

The vacant homes tax was introduced last year, and now applies on November 1 each year to properties that can be lived in, and have been stayed in for fewer than 30 days in the previous 12 months.

Its aim is to make more homes available to buyers or renters, but it now seems the charge is costing more to administer than it is taking in.

The vacant homes tax was charged at a rate of three times the base Local Property Tax (LPT) last year.

This means a house valued at €300,000 attracted a vacant home tax of €945 if unoccupied.

Business development director with leading tax advisory firm Taxback.com Marian Ryan said: “As we had suspected the vacant homes tax (VHT) yield is much lower than would have been hoped and certainly doesn’t seem to be effective with just €2m in VHT collected to date.”

She said with the current rate being charged at three times the annual LPT rate (increased to five times in Budget 2024), the average yield from a vacant home is around €600.

Ms Ryan said a VHT bill of €600, or even €1,000, at the increased rate certainly wouldn’t act as a deterrent to leaving a property vacant and it doesn’t appear that the VHT would achieve what it set out to do.

“A yield of just €2m would, in my mind, not be sufficient to cover the internal administrative costs of the Revenue Commissioners,” she said.

“It appears to be ineffective and tokenistic. It made a good soundbite on Budget day but the impact is negligible.

“It has neither helped government coffers nor acted as a deterrent to leaving homes vacant.”

Before it was introduced it had been thought the tax would apply to around 60,000 properties. But the many exemptions to the self-assessed tax means it only applied to 3,468 homes last year.

Labour leader Ivana Bacik has claimed the small number of homes subject to the tax bears “no relation to reality”.

“The figures are extraordinary, we’re seeing just 3,000 properties subject to the vacant homes tax,” she said. “This is a tiny proportion of the number that was predicted to be eligible. We had understood certainly that at least 50,000 homes might be eligible and that’s from the Local Property Tax figures.”

Revenue said in a statistical bulletin that the Vacant Homes Tax applies to properties which are residential properties for the purposes of Local Property Tax (LPT) and have been used as a dwelling for under 30 days in a chargeable period.

It does not apply if the property is derelict or uninhabitable, was sold in the chargeable period, is subject to a qualifying tenancy, or is exempt from LPT for 2023.

“In addition, several exemptions to VHT can be claimed as part of the VHT return,” Revenue said.

Last year, the rate of the tax was set at three times the Local Property Tax, but in the last Budget Finance Minister Michael McGrath increased the rate to five times the property tax.

Moving to a rate of five times the LPT means a property valued at €300,000 will have a vacant homes tax of €1,575, plus €315.

This is a total of €1,890.

Revenue said it has created a register of vacant homes and this will be continually updated as necessary.

It said owners declared 5,856 homes vacant last year. But 2,388 of these were exempt from the tax.