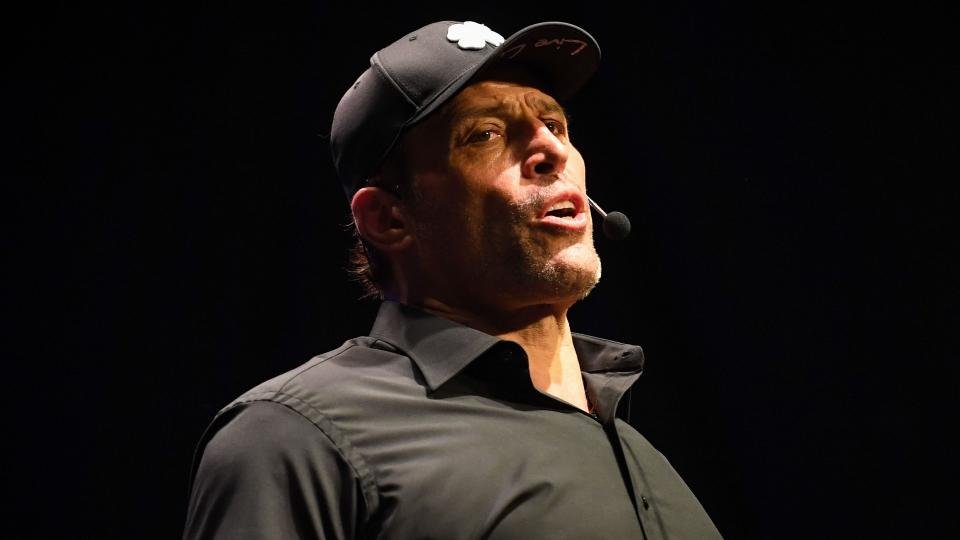

Financial influencer Tony Robbins spoke in a recent NewsNation interview about how the average Joe now has access to investment opportunities that were available only to rich investors and hedge funds in the past.

Try This: Tony Robbins: 5 Retirement Planning Tips He Swears By

Trending Now: 5 Unusual Ways To Make Extra Money (That Actually Work)

So what are these new investment opportunities, and how can you use them to build wealth?

Alternative Investments

Robbins said he was so excited about the access regular Americans have to alternative investments like private equity.

Alternative investments have traditionally been the domain of wealthy individuals and institutional investors like hedge funds. These investments differ from conventional options such as stocks, bonds and savings accounts because they often involve assets that aren’t traded on standard exchanges or are regulated differently.

However, recent changes in the financial landscape are democratizing access to these previously exclusive investment opportunities. Online platforms and apps have made investing in and managing alternative assets easy. For example, platforms like Fundrise and Masterworks allow investors to buy fractional real estate or artwork shares, without raising enough capital to buy the whole thing.

Check Out: 6 Reasons the Poor Stay Poor and Middle Class Doesn’t Become Wealthy

Changes in U.S. legislation, like the JOBS Act, have also lowered the barrier to entry into some types of investments. Crowdfunding for equity, for example, now allows non-accredited investors to purchase shares in startups and small businesses.

These changes are making it possible for everyday investors to add alternative assets to their portfolios, which can provide new sources of revenue and diversification. Here are five alternative investments that you may want to take advantage of.

1. Private Equity

Private equity involves investing in privately owned companies not listed on a public stock exchange. These investments are typically made in mature companies through buyouts or newer companies showing potential for substantial growth. Private equity firms aim to improve the financial health of these companies and make money from the increased profits or sell them to another buyer for a higher price.

How Regular People Can Invest

Previously, private equity was accessible only to institutional investors or wealthy individuals. However, some mutual funds and exchange-traded funds now offer exposure to private equity investments. Additionally, online platforms like Yieldstreet allow accredited and sometimes non-accredited investors to participate in private equity with lower minimum investments.

Risks Involved

Private equity investments are illiquid, often requiring capital to be locked up for years. There’s a significant risk of losing all of your capital if you invest in a single company and it fails. Moreover, these investments require high amounts of initial capital and may be subject to management and performance fees that can erode your returns.

2. Real Estate Debt

Real estate debt involves investing in loans secured by real estate. This could be through mortgages or direct loans to property owners and developers. Investors earn money from the interest paid on these loans, making them a fixed-income investment that can offer stability.

How Regular People Can Invest

Investors can access real estate debt investments through real estate investment trusts specializing in mortgage securities, peer-to-peer lending platforms or publicly available debt funds that invest in real estate-backed loans.

Risks Involved

While it’s less risky than equity investments in real estate, real estate debt still involves the risk of default, which can occur if the borrower fails to meet their financial obligations. Additionally, changes in interest rates or prepayment by the borrower can affect the value of real estate debt investments.

3. Venture Capital

Venture capital is a form of private equity focused on investing in startup companies with high growth potential. Investors provide capital to startups in exchange for equity, participating in the financial upside if the company grows and either goes public or is later sold to a larger company.

How Regular People Can Invest

Access to venture capital has become easier for regular investors through online platforms like AngelList and crowdfunding websites.

Risks Involved

Venture capital is highly risky because many startups fail, resulting in a total loss of capital. The market is also highly competitive, and the illiquid nature of the investment means your money may be tied up for a long time without any guarantee of a return.

4. Structured Products

Structured products are complex financial instruments derived from other assets, like stocks, bonds, indices or commodities. These products often promise higher returns based on certain market conditions but can vary widely in terms of their risk and return profiles.

How Regular People Can Invest

Some structured products are available through banks and financial institutions as notes or bonds. Investors should thoroughly understand the product’s workings and underlying assets before investing.

Risks Involved

Structured products are complex and may be opaque, which can make it difficult for investors to fully understand the risks. They’re also sensitive to changes in the underlying assets and can result in the loss of principal if the investment does not perform as expected.

5. Art and Collectibles

Investing in art and collectibles involves purchasing items expected to appreciate in value over time. This category can include fine art, vintage cars, rare wines, antiques and more.

How Regular People Can Invest

Platforms like Masterworks allow investors to buy fractional shares of artwork, making it more accessible to individuals who can’t afford to buy expensive pieces outright. There are funds and online marketplaces for fractional investing in different types of collectibles as well — Public, for example, allows users to invest in valuable comics, shoes and trading cards, among others.

You can also purchase collectibles and art and hold them yourself, though you ensure you store them in the right conditions to avoid damage. Enlisting professionals helps ensure you don’t lose your investment.

Risks Involved

The market for art and collectibles can be volatile and subjective. Prices are influenced by changing trends and the economic environment. Additionally, such investments may require additional expenses for insurance, storage and maintenance and there can be significant costs associated with buying and selling them.

Next Steps

Each of these alternative investment options offers unique opportunities and challenges, and they can all serve as valuable components of a diversified investment portfolio. However, make sure to conduct thorough research and consult with a financial advisor beforehand to ensure these investments and the risks that come with them align with your overall financial goals.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Tony Robbins: 5 Ways the Average Joe Can Build Wealth