With over 3 trillion won (US$2.17 billion) of foreign capital flowing into the domestic commercial real estate market last year, the so-called “inbound investments” have returned to the levels before COVID-19. However, with a decrease in domestic companies’ investments in overseas real estate, or outbound investments, the figure fell below the size of inbound investments for the first time.

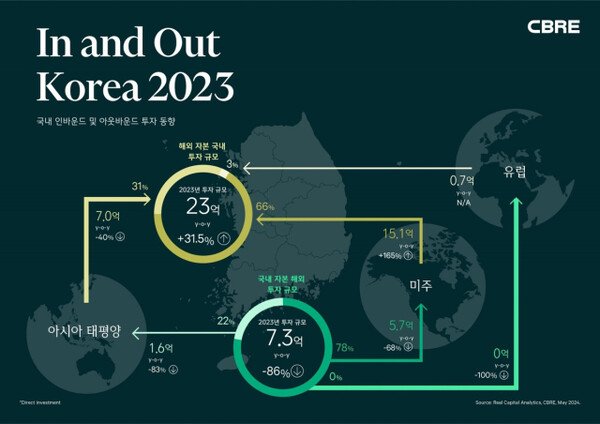

According to the “2023 Trends in Domestic Inbound and Outbound Investments” report published by CBRE Korea, a global real estate services company, on June 2, foreign capital invested a total of US$2.3 billion in the domestic market last year. This is a similar level with the five-year average from 2015 to 2019 before COVID-19. During the COVID-19 period from 2020 to 2022, the annual average stood at around US$1.9 billion.

Last year, investment in the domestic logistics asset market reached a record high of US$1.6 billion, driving the recovery of inbound investments. By country, the United States accounted for 43 percent of the total investment, taking the top spot, followed by Singapore with 28 percent. The investment amount from Singapore was at a similar level to that of 2022, but capital inflows from the U.S. sources increased by approximately 74 percent compared to the previous year, marking the highest level in the past six years.

Following the U.S. and Singapore, Canada secured the third position. This is analyzed to be influenced by Canadian investment firm Brookfield’s acquisition of a large logistics center in Incheon. Capital from the Americas, including the U.S. and Canada, accounted for 66 percent of total inbound investments, with over three-quarters of this invested in the domestic logistics asset market.

Investments in the logistics asset market increased. However, the size of foreign capital’s investments in domestic office properties decreased by 47 percent compared to the previous year.

The limited price adjustments in the domestic office market, coupled with the expansion of risks in office markets in the Americas and Europe, led to the formulation of strategies to downsize office portfolios. Consequently, a cautious approach has been maintained regarding investments in office assets. Unlike the concentration of investments in logistics assets by U.S. and Canadian capital, Asian capital diversified its investments across various sectors such as office, logistics, and hotels. Singapore-based Keppel Investment Management acquired both the Bank of Korea Sogong Annex and the Citibank Seoul Center in Jongno, while other Singaporean companies like Mapletree and CapitaLand purchased multiple logistics assets.

Meanwhile, the size of overseas investments by domestic investors, also known as outbound investments, reached US$700 million last year, marking an 86 percent decrease compared to the previous year and hitting the lowest level on record. Consequently, inbound investments surpassed outbound investments for the first time last year. Looking at the destinations of domestic companies’ investments, the U.S. topped the list, followed by India and Japan. Nearly half of all outbound investments were directed towards the office market, with all acquisition activities concentrated in the U.S. Hyundai Motor Group acquired the newly built office building “Fifteen Laight” in New York for US$260 million, while Daemyung Sono Group’s Sono International purchased the “33 Seaport Hotel” in New York for US$60 million.