During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

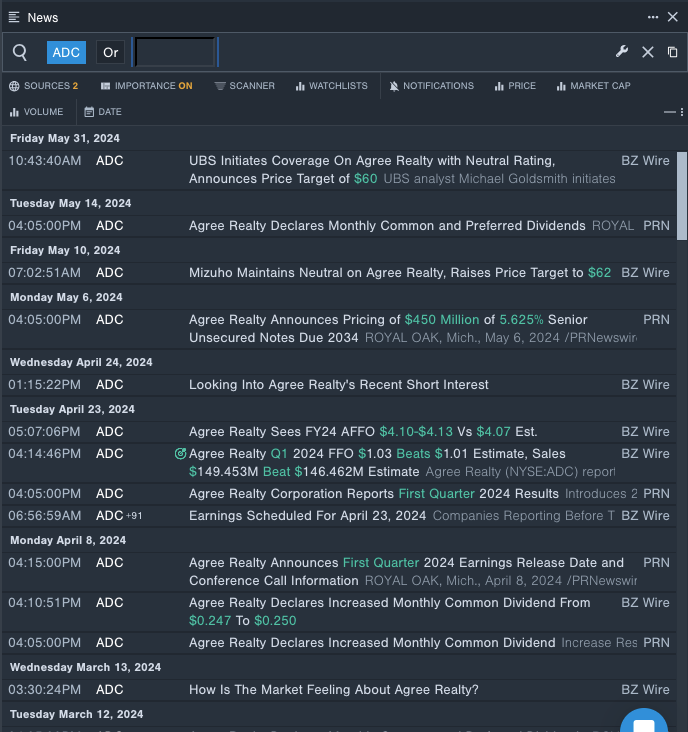

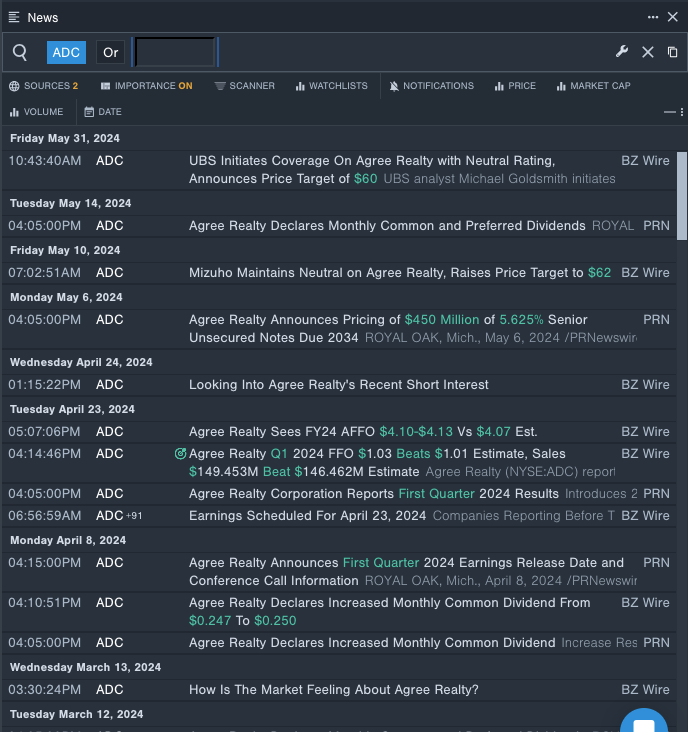

Agree Realty Corporation (NYSE:ADC)

- Dividend Yield: 4.94%

- Truist Securities analyst Ki Bin Kim maintained a Buy rating and cut the price target from $70 to $68 on Feb. 27. This analyst has an accuracy rate of 61%.

- Wells Fargo analyst Connor Siversky maintained an Overweight rating and slashed the price target from $66 to $62 on Feb. 20. This analyst has an accuracy rate of 60%.

- Recent News: On May 6, Agree Realty announced pricing of $450 million of 5.625% senior unsecured notes due 2034.

- Benzinga Pro’s real-time newsfeed alerted to latest Agree Realty news

CubeSmart (NYSE:CUBE)

- Dividend Yield: 4.82%

- Raymond James analyst Jonathan Hughes reiterated an Outperform rating with a price target of $48 on March 28. This analyst has an accuracy rate of 67%.

- Jefferies analyst Jonathan Petersen upgraded the stock from Hold to Buy and boosted the price target from $38 to $53 on Jan. 2. This analyst has an accuracy rate of 61%.

- Recent News: On May 22, CubeSmart declared a quarterly dividend of 51 cents per common share for the period ending June 30, 2024.

- Benzinga Pro’s charting tool helped identify the trend in CubeSmart’s stock.

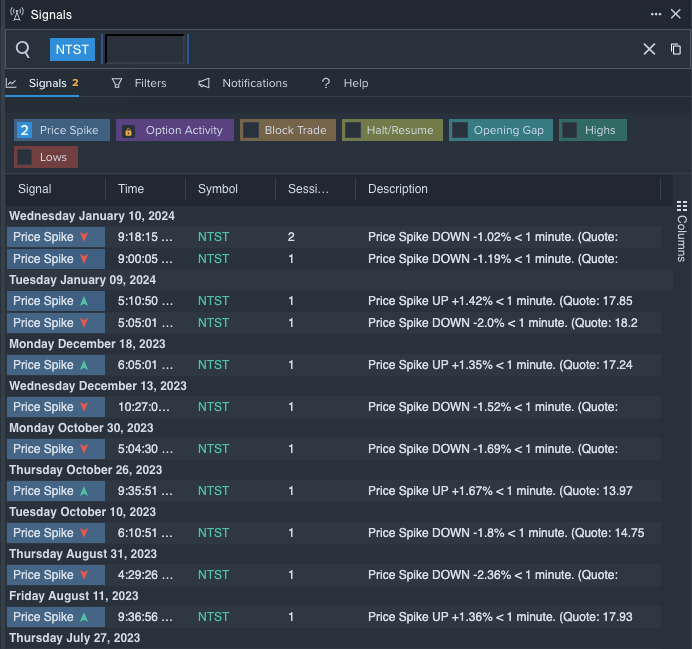

NETSTREIT Corp. (NYSE:NTST)

- Dividend Yield: 4.73%

- Truist Securities analyst Ki Bin Kim maintained a Buy rating and cut the price target from $22 to $18 on Nov. 27, 2023. This analyst has an accuracy rate of 61%.

- Stifel analyst Simon Yarmikmaintained a Buy rating and slashed the price target from $20 to $17.75 on Oct. 26, 2023. This analyst has an accuracy rate of 60%.

- Recent News: On April 29, Netstreit posted better-than-expected quarterly results.

- Benzinga Pro’s signals feature notified of a potential breakout in NTST’s shares.

Read More: How to Find Dividend Stocks: Scan, Analyze, and Capture with Benzinga Pro