13h00 ▪

3

min of reading ▪ by

Bitcoin whales, those large crypto-currency investors, seem never to get enough. With daily purchases nearing a billion dollars, they risk leaving only crumbs for individual investors. As the price of bitcoin reaches new heights, the whale accumulation frenzy may well disrupt the crypto market.

Frenzied Accumulation of Bitcoin Whales

Long-term bitcoin holders, or fans of HODLing, have added 70,000 BTC to their portfolios over the past month. This massive accumulation phenomenon, driven by whales, reflects renewed confidence in bitcoin, notes CoinGape.

These crypto giants buy a billion dollars worth of BTC daily, fueling unprecedented demand. This buying frenzy not only inflates balances but also exerts upward pressure on prices, propelling bitcoin to record highs.

With bitcoin prices currently exceeding 71,000 dollars, the trend seems set to continue.

Major Investors Double Down

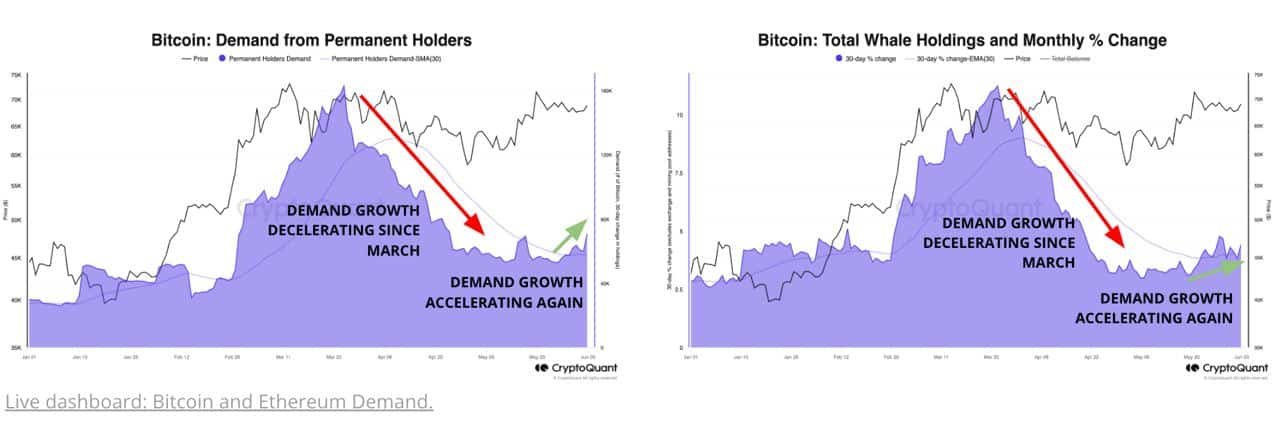

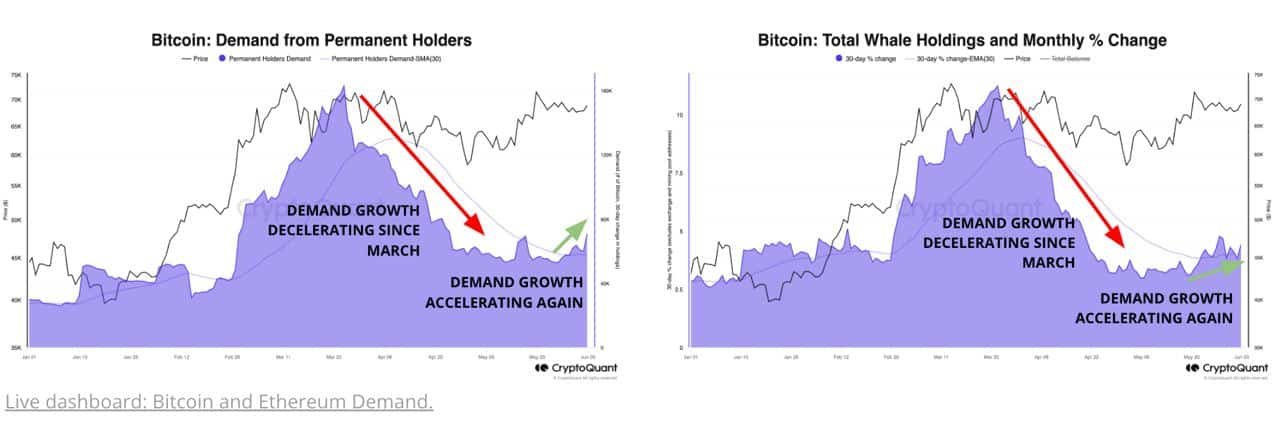

The cryptocurrency market is in a frenzy, driven by substantial daily inflows from new major investors. CryptoQuant reported a significant improvement in demand, a sign of sustained price recovery.

The growth in balances of long-term holders and major investors is accelerating, showing increased confidence in bitcoin’s future performance.

Spot ETFs, notably those from BlackRock and Grayscale, are also participating in this dynamic. The increase in bitcoin purchases by these funds has further strengthened demand, contributing to the stability and potential upside of the crypto market.

BTC Stability and Upside Potential

The CryptoQuant report highlights that massive sales by traders have decreased, creating valuable stability for the market. With the unrealized profit ratio back to 0%, this indicates a balance point where selling pressure is reduced.

The whales continue to display a voracious appetite for buying, reaching record levels over the past two months. Continuous capital inflows into spot Bitcoin ETFs have also played a crucial role. On June 6, the net total inflow of U.S. spot ETFs on bitcoin amounted to 218 million dollars, highlighting the persistent and growing interest in the cryptocurrency.

All in all, the insatiable appetite of bitcoin whales is shaping and energizing the market, leaving little room for small investors.

Maximize your Cointribune experience with our ‘Read to Earn’ program! Earn points for each article you read and gain access to exclusive rewards. Sign up now and start accruing benefits.

Click here to join ‘Read to Earn’ and turn your passion for crypto into rewards!

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.