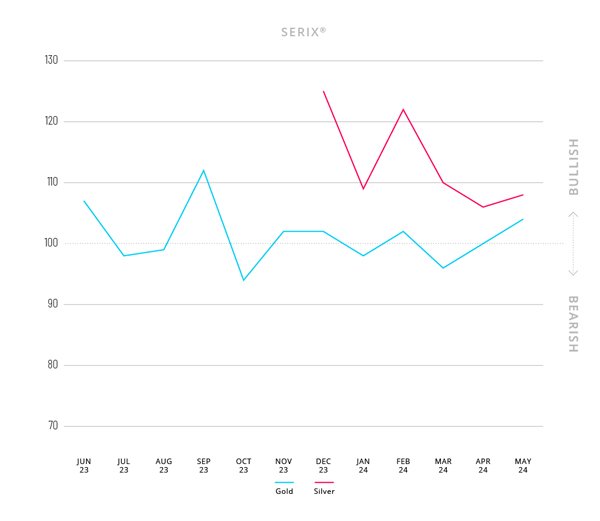

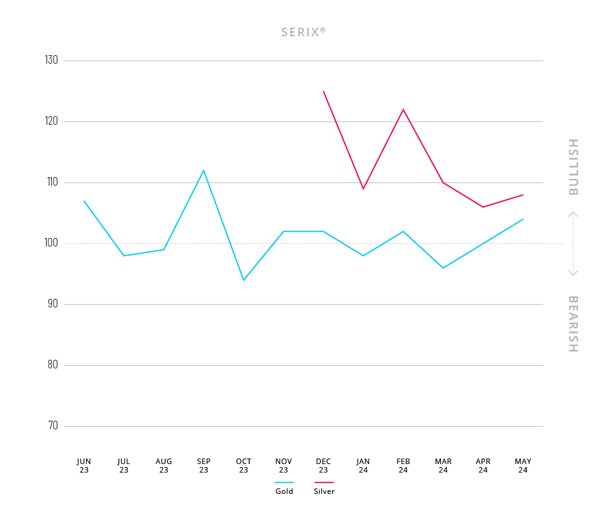

- Spectrum’s European retail investor sentiment indicator shows bullish behaviour on gold and silver

- Sentiment suggests retail investors saw a buying opportunity as gold prices dipped in May

- Retail investor sentiment has remained bullish on silver since its introduction on Spectrum in December 2023

Spectrum Markets (“Spectrum”), the pan-European trading venue designed for retail investors, has published its SERIX sentiment data for European retail investors for May, revealing bullish trading behaviour for both available precious metal underlyings, gold and silver.

Gold prices fluctuated in May, peaking at $2,449 per ounce by 20th May before dropping to $2,325 towards the end of the month[1]. This dip created a buying opportunity for investors and was likely a key driver of the bullish SERIX sentiment of 104.

Silver also reached a record high of $32.391 per ounce by the end of May[2]. However, retail investors remained bullish, with the SERIX for silver closing at 108 points for the month. Since Spectrum introduced products with silver as an underlying asset to trade in December 2023 in response to investor demand, sentiment towards the precious metal has been consistently bullish, starting with a peak SERIX value of 125 points.

The SERIX value indicates retail investor sentiment, with a number above 100 marking bullish sentiment, and a number below 100 indicating bearish sentiment. (See below for more information on the methodology).

Market opinion

“Despite the SERIX sentiment on gold indicating tactical buying behaviour from retail investors, the SERIX on silver tells a different story, aligning with its high market price,” says Michael Hall, Head of Distribution at Spectrum Markets.

“While the performance of gold is strongly connected with currencies and interest rates, the SERIX sentiment indicator suggests European retail investors track the silver market based on rising demand patterns. This increasing demand is driven in part by the search for alternative energy solutions, as silver is essential in photovoltaic panels, which convert sunlight into electricity,” adds Michael Hall.

Spectrum’s May data

In May 2024, order book turnover on Spectrum was €246.7 million, with 36% of trades taking place outside of traditional hours (i.e., between 17:30 and 9:00 CET).

70.5% of the order book turnover was on indices, 16.8% on commodities, 5.4% on equities, 3.6% on currency pairs, and 3.7% on cryptocurrencies, with the top three traded underlying markets being DAX 40 (25.1%), NASDAQ 100 (24.9%), and DOW 30 (9%).

Looking at the SERIX data for the top three underlying markets, the DAX 40 sentiment decreased from 101 to a bearish 98. Similarly, the NASDAQ 100 dropped from 101 to 99 and the DOW 30 fell from 103 to 99 this month.

|

Calculating SERIX data The Spectrum European Retail Investor Index (SERIX), uses the trading venue’s pan-European trading data to shed light on investor sentiment towards current development in financial markets.

The index is calculated on a monthly basis by analysing retail investor trades placed and subtracting the proportion of bearish trades from the proportion of bullish trades, to give a single figure (rebased at 100) that indicates the strength and direction of sentiment: SERIX = (% bullish trades – % bearish trades) + 100 Trades where long instruments are bought and trades where short instruments are sold are both considered bullish trades, while trades where long instruments are sold and trades where short instruments are bought are considered bearish trades. Trades that are matched by retail clients are disregarded. (For a detailed methodology and examples, please visit this link).

|