Paul Singer, the billionaire founder and president of Elliott Management, one of the world’s most formidable activist funds, recently made waves with major investments in Southwest Airlines, Texas Instruments, and SoftBank (SFTBF) Group, among others. With target companies having a combined market cap of $400 billion, Paul Singer’s strategic bets will surely send ripples through the market this summer.

Southwest Airlines

On Monday (June 10), Elliott Management revealed a $1.9 billion stake in Southwest Airlines, giving the hedge fund ownership of around 11 percent of the air carrier. Singer is likely considering pushing for leadership and broader strategic changes at Southwest through the large stake, putting CEO Bob Jordan and executive chairman Gary Kelly in the spotlight.

“The executive chairman and CEO, who have spent a cumulative 74 years at Southwest, have presided over a period of stunning underperformance at the company. Further, they have demonstrated that they are not up to the task of modernizing Southwest,” Elliott Management said in a presentation sent to Southwest on Monday. Southwest Airlines, the third largest U.S. airline by passengers carried, has lost half of its market value in the last five years. However, at a market capitalization of $16.6 billion, it is more than twice the size of the largest U.S. airline by passengers carried, American Airlines.

Texas Instruments

Earlier this month, Elliott Management announced a $2.5 billion investment in the Dallas-based semiconductor manufacturer, criticizing the company’s free cash flow (per share) decreasing 75 percent since 2022 after an impressive 17 percent annual gain from 2006 to 2019. Quoting Texas Instruments’ chairman and former CEO Rich Templeton, Elliott pointed out that “the best measure to judge a company’s performance over time is growth of free cash flow per share” in a letter to the company. Elliott noted that while Texas Instruments is an industry leader in semiconductors, bringing in the most revenue of any company in the analog/mixed-signal semiconductor market in 2022, its stock has underperformed key competitors.

The main disconnect between the chipmaker’s impressive revenue and slumping stock price is the company’s expensive re-investment strategy since 2022 in a bid to expand production capacity. Leadership spent a third of the company’s revenue on capital expenditures without clear evidence that the investment will pay off in long-term revenue. Elliott argues this approach is “far in excess.” The activist fund hopes to leverage its freshly injected capital to steer the company back to prioritizing long-term free cash flow per share.

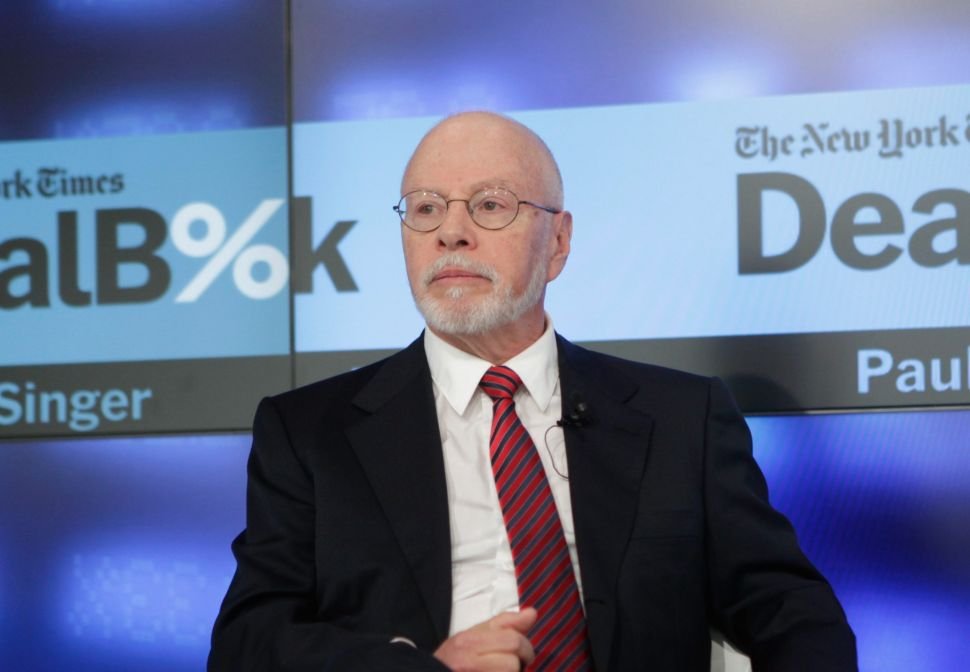

The “vulture capitalist”

Singer, 79, founded the hedge fund Elliott Associates in 1977 with $1.3 million raised from friends and family. His early investment strategy focused on buying highly distressed debt and going after companies and even governments. This strategy has earned him the reputation of the “vulture capitalist.” Since then, the firm has expanded into various investing strategies, including commodity trading, portfolio management and activist investing, under the name Elliott Management. Today, the firm manages around $65.5 billion. One of the oldest hedge funds of its kind, Elliott has only ever lost money in two of its 47 years in business and has produced an 11 percent annualized return.