So the Wall Street Journal had a great piece summarizing the “liquidity crunch” in private equity. Liquidity (cash from exits — M&A and IPO) is down so much, many are being forced to take out loans to generate cash.

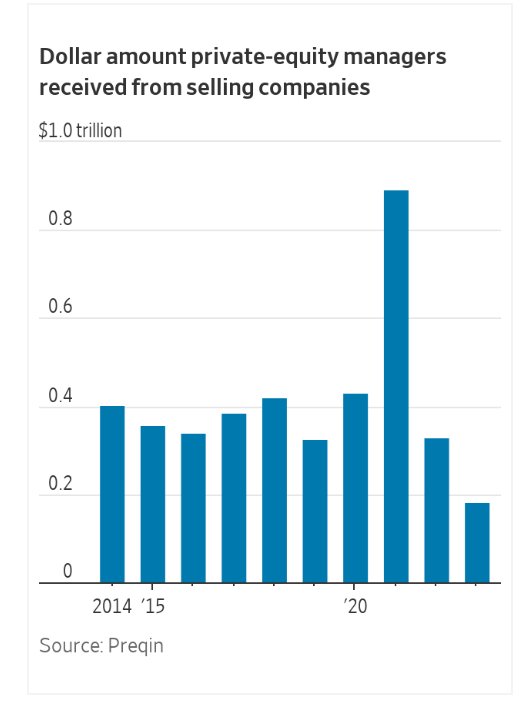

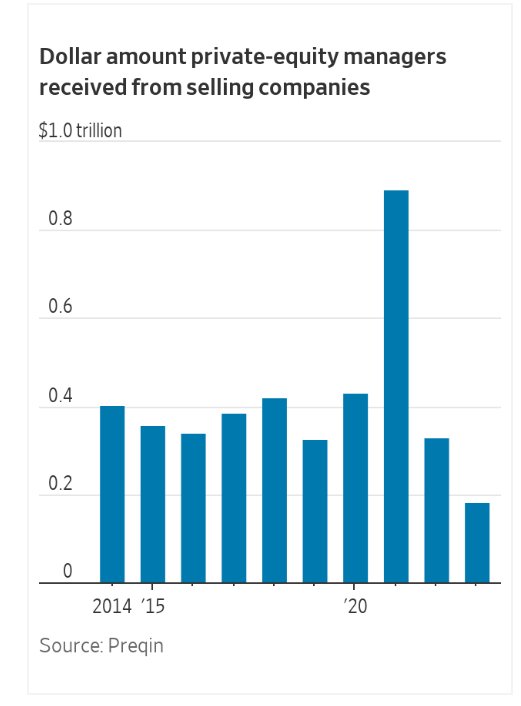

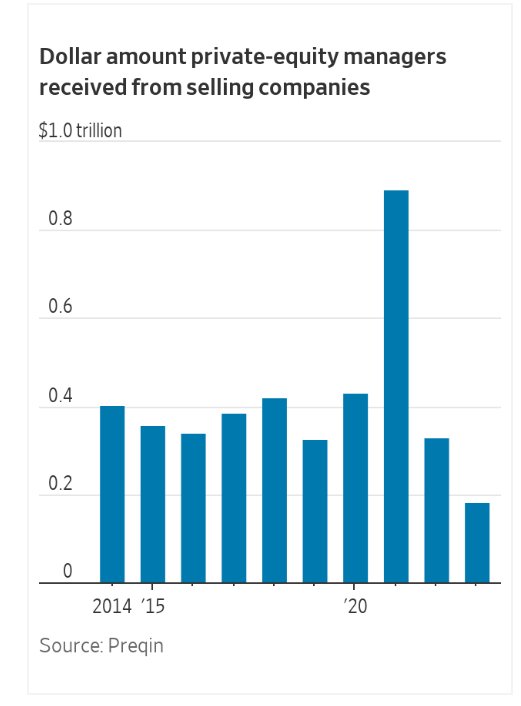

As you can see below, liquidity last year was down 50% from the historical average of the past 10 years, and way, way down from the crazy 2021 peak:

Now to some extent, this is to be expects. Private Equity overall and Venture Capital in particular had an insane amount of “exits” for high dollar amounts in 2021. An IPO a week, and seemingly, a billion+ exit every week as well. From Slack selling for $27 Billion to Salesloft for $2.5 Billion and so, so many more.

It just makes sense there would be a hangover after that era. And indeed there is.

But while Venture Capital and Private Equity are overall built to be patient, and wait 10+ yeas for returns from any given investment — in exchange for higher returns — they aren’t build to be all that patient in the aggregate.

PE and VC expect a steady stream of returns each year to, at a minimum, recycle back into new VC and PE funds.

Right now, that’s at a decade+ low. And it’s looking like 2024 is much of the team.

Perhaps a string of IPOs in 2025 will unleash liquidity, from Databricks to Canva to Plaid and more. But even there, with a lot of big M&A for now being blocked (see, e.g., Adobe and Figma), it’s just plain harder.

In the end, a liquidity cycle is what creates the endless treat of venture capital to invest in startups. Right now, it’s down -50%. It will bounce back. But Founders should at least understand the stresses at the input levels for funding. When liquidity is at a decade+ low for private investments.

And a bit more here: