July 02, 2024 9:29 AM EDT | Source: Silver Elephant Mining Corp.

Vancouver, British Columbia–(Newsfile Corp. – July 2, 2024) – Silver Elephant Mining Corp. (TSX: ELEF) (OTC Pink: SILEF) (FSE: 1P2) (“Silver Elephant” or the “Company“) is pleased to report gallium and indium assay results from the selected drill core at its flagship Pulacayo-Paca silver-lead-zinc project (“Pulacayo-Paca Project”) in Potosi department, Bolivia.

The results show extensive occurrences of gallium and indium in the assayed samples over a strike-length of approximately 750 meters that appear to be correlated to zinc. The Company is highly encouraged by the gallium and indium results and will continue to evaluate this potential. These elements could add significant value to any final concentrate produced from mining and processing activities.

A total of 199 core samples from 12 diamond drill holes were collected from the Pulacayo-Paca project and submitted to ALS Laboratory in Bolivia to assay for gallium and indium. The samples were selected because of their proximity to drill holes PUD 028, PUD 029, PUD 030 and PUD 031, whose samples were assayed by the previous operator for gallium and indium. Results from those drill holes included 99 meters of 27.8 g/t gallium and 9.7 g/t indium. (refer to Company News Release dated May 21, 2024).

The drill holes reported in the following tables were previously assayed for silver, lead and zinc only. It should be noted that only selected intervals were assayed for gallium and indium in this initial discovery test.

| HOLE ID | FROM m | TO m | WIDTH m | Ag g/t | Pb % | Zn % | Ga g/t | In g/t |

| PUD156 | 247.3 | 248 | 0.7 | 934 | 5.67 | 6.16 | 4.56 | 266.00 |

| 11PUD231 | 30 | 31 | 1 | 1 | 0.53 | 0.01 | 7.58 | 12.25 |

| 11PUD231 | 42 | 43 | 1 | 1 | 0.65 | 0.02 | 10.05 | 14.55 |

| 11PUD231 | 48 | 49 | 1 | 2 | 1.56 | 0.02 | 34.80 | 42.40 |

| 11PUD231 | 101 | 102 | 1 | 108 | 1.91 | 8.71 | 5.56 | 38.40 |

| 11PUD231 | 111 | 112 | 1 | 345 | 5.83 | 10.85 | 8.83 | 74.80 |

| 11PUD231 | 119 | 120 | 1 | 145 | 2.20 | 1.23 | 10.20 | 29.00 |

| PUD069 | 254 | 255 | 1 | 40 | 1.10 | 5.44 | 4.61 | 11.15 |

| PUD069 | 278 | 279 | 1 | 44 | 0.17 | 6.65 | 2.42 | 20.30 |

| PUD069 | 290 | 291 | 1 | 98 | 0.91 | 1.20 | 2.57 | 17.75 |

| PUD069 | 296 | 297 | 1 | 620 | 0.44 | 8.79 | 3.04 | 16.40 |

| PUD069 | 310 | 311 | 1 | 169 | 0.24 | 7.73 | 7.08 | 219.00 |

| 11PUD220 | 84 | 85 | 1 | 74 | 2.67 | 2.95 | 2.61 | 14.50 |

| PUD046 | 227 | 228 | 1 | 54 | 1.02 | 4.35 | 3.90 | 10.30 |

| PUD046 | 233 | 234 | 1 | 93 | 1.62 | 3.82 | 7.29 | 21.60 |

| PUD046 | 261 | 262 | 1 | 106 | 1.47 | 1.81 | 1.84 | 20.80 |

| PUD046 | 267 | 268 | 1 | 314 | 1.71 | 2.44 | 2.53 | 20.00 |

| PUD046 | 273 | 274 | 1 | 62 | 0.96 | 4.91 | 4.61 | 37.50 |

| PUD046 | 279 | 280 | 1 | 56 | 0.51 | 5.48 | 5.45 | 32.70 |

| PUD046 | 285 | 286 | 1 | 199 | 1.99 | 6.70 | 3.77 | 29.50 |

| PUD046 | 291 | 292 | 1 | 786 | 10.95 | 3.59 | 5.74 | 51.00 |

| PUD046 | 296 | 297 | 1 | >100 | 0.83 | >10000 | 2.05 | 12.40 |

| PUD098 | 63 | 64.15 | 1.15 | 77 | 1.74 | 3.89 | 2.93 | 12.60 |

| PUD098 | 154 | 155 | 1 | 44 | 0.71 | 5.84 | 5.18 | 43.40 |

| PUD098 | 159 | 160 | 1 | 1.29 | 0.15 | 0.66 | 4.64 | 14.00 |

| PUD098 | 184 | 185 | 1 | 41 | 0.94 | 5.43 | 2.52 | 12.90 |

| PUD098 | 190 | 191 | 1 | 650 | 10.90 | 12.95 | 6.84 | 83.90 |

| PUD187 | 316 | 317 | 1 | 15 | 0.06 | 1.63 | 3.27 | 13.25 |

| PUD267 | 33.5 | 35 | 1.5 | 40 | 1.22 | 1.21 | 3.78 | 15.90 |

In the next table, the Company presents the silver, lead, and zinc assay results (previously reported by Apogee Minerals Ltd. and Silver Elephant) of the same drill holes which gallium and indium analysis were performed in 2024. The historic drill results show wide intersections of mineralization.

| HOLE ID | FROM m | TO m | WIDTH m | TRUE WIDTH m | Ag g/t | Pb % | Zn % |

| PUD 156 | 241 | 278 | 37 | 22.78 | 74.65 | 0.33 | 0.82 |

| including… | 246.6 | 253 | 6.4 | 3.94 | 217.49 | 0.99 | 1.36 |

| 11PUD 231 | 21 | 23 | 2 | 0.94 | 199.5 | 9.35 | 0.06 |

| 11PUD 231 | 40 | 47 | 7 | 3.29 | 92 | 2.53 | 0.07 |

| including… | 45 | 46 | 1 | 0.47 | 407 | 6.72 | 0.07 |

| 101 | 106 | 5 | 2.35 | 54.4 | 1.07 | 3.32 | |

| 109 | 114 | 5 | 2.35 | 96.4 | 1.77 | 4.7 | |

| 117 | 120 | 3 | 1.41 | 79 | 1.37 | 4.45 | |

| PUD 069 | 276 | 306 | 30 | 22.98 | 413.9 | 3.59 | 1.2 |

| 11PUD 220 | 35.2 | 56 | 20.8 | 9.76 | 79.3 | 0.9 | 0.62 |

| 65 | 68 | 3 | 1.41 | 44.7 | 0.75 | 0.6 | |

| 80 | 89 | 9 | 4.22 | 119.7 | 2.6 | 2.64 | |

| PUD 040 | 237 | 241 | 4 | 2.29 | 7.25 | 1.1 | 3.49 |

| PUD 046 | 225 | 309 | 84 | 70.44 | 106.29 | 0.86 | 2.26 |

| including… | 284 | 303 | 19 | 15.93 | 258.47 | 1.8 | 2.85 |

| PUD 187 | 315 | 317 | 2 | 1.53 | 13.5 | 0.08 | 1.74 |

| 324 | 326 | 2 | 1.53 | 7 | 0.01 | 1.14 | |

| PUD 267 | 31.5 | 67 | 35.5 | 25.10 | 54.3 | 4.31 | 0.92 |

| including… | 48 | 58 | 10 | 7.07 | 146.7 | 9.79 | 1.97 |

| PUD 267 | 117 | 123 | 6 | 4.24 | 47.8 | 1.11 | 0.25 |

| including… | 121 | 122 | 1 | 0.71 | 238 | 3.61 | 0.86 |

| 127.5 | 131 | 3.5 | 2.47 | 1.3 | 1.45 | 0.25 | |

| 139.5 | 142 | 2.5 | 1.77 | 2.4 | 1.68 | 0.2 | |

| PUD 271 | 123 | 126 | 3 | 2.12 | 1 | 0.005 | 0.012 |

| PUD 098 | 178 | 215 | 37 | 29.93 | 48.8 | 1.06 | 2.9 |

| Including… | 189 | 193 | 14 | 11.33 | 304.4 | 5.15 | 10.69 |

| PND 108 | 15 | 65 | 50 | 48.30 | 135 | 1.42 | 0.4 |

| including… | 33 | 57 | 24 | 23.18 | 200 | 2.12 | 0.6 |

| and… | 33 | 43 | 10 | 9.66 | 257 | 1.49 | 0.41 |

| 94 | 96 | 2 | 1.93 | 160 | 0.52 | 0.94 | |

| PND 110 | 9 | 182 | 173 | 122.33 | 95 | 1.4 | 1.63 |

| incl… | 9 | 98 | 89 | 62.93 | 279 | 1.17 | 1.28 |

| and… | 9 | 28 | 19 | 13.43 | 718 | 0.74 | 0.05 |

| and… | 9 | 12 | 3 | 2.12 | 145 | 0.9 | 0.07 |

| and… | 16 | 28 | 12 | 8.49 | 1085 | 0.71 | 0.04 |

| and… | 44 | 180 | 138 | 97.58 | 87 | 2.01 | 1.59 |

| and… | 44 | 46.5 | 2.5 | 1.77 | 111 | 1.09 | 0.61 |

| and… | 44 | 98 | 54 | 38.18 | 98 | 1.52 | 2.03 |

| and… | 52 | 54 | 2 | 1.41 | 115 | 1.33 | 1.61 |

| and… | 60 | 82 | 22 | 15.56 | 328 | 1.43 | 1.98 |

| and… | 61 | 65 | 4 | 2.83 | 1248 | 2.88 | 1.93 |

| and… | 86 | 94 | 8 | 5.66 | 270 | 2.74 | 2.83 |

| and… | 97 | 98 | 1 | 0.71 | 155 | 3.03 | 3.26 |

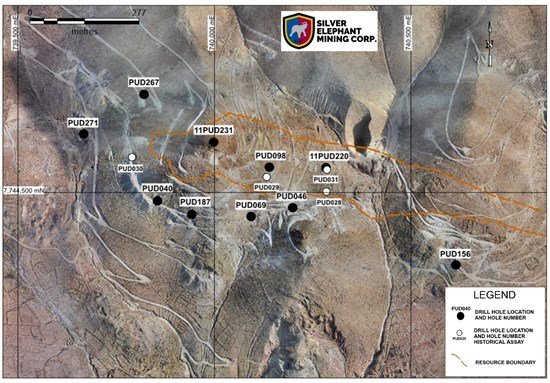

The locations of the latest sampled Pulacayo drill holes are shown on the map below, which also displays the 43-101 resource envelope of Pulacayo:

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9008/215225_74d0d41a0404480b_002full.jpg

The Pulacayo-Paca project has a total indicated resource of 106.7 million ounces of silver, 1.4 billion pounds of zinc and 690 million pounds of lead (48Mt @ 69g/t Ag, 1.3% Zn, 0.7% Pb) published in the Technical Report dated October 13, 2020 and tabulated below.

| Pulacayo-Paca Project Resource Estimate Oct 13, 2020* | |||||

| Deposit | Category | k Tonnes | Ag M oz | Zn M lbs | Pb M lbs |

| Pulacayo | Indicated | 26,350 | 70.2 | 903.7 | 386 |

| Inferred | 1,670 | 7.2 | 71.8 | 18.4 | |

| Paca | Indicated | 21,690 | 37 | 485.8 | 304.2 |

| Inferred | 3,395 | 6 | 51.1 | 43.7 | |

| Total | Indicated | 48,040 | 106.7 | 1,384.70 | 690.2 |

| Inferred | 5,065 | 13.1 | 122.8 | 61.9 | |

*Combined Indicated Mineral Resources includes Pulacayo pit-constrained and out-of-pit plus only Paca pit-constrained resources. Oxide resources use a 50 g/t Ag cutoff. Sulfide resources use a 100 g/t Ag Eq cutoff. Ag Eq = Silver Equivalent (Recovered) = (Ag g/t*89.2%)+((Pb%*(US$0.95/lb. Pb/14.583 Troy oz./lb./US$17 per Troy oz. Ag)*(10,000*91.9%))+((Zn%*(US$1.16/lb. Zn/14.583 Troy oz./lb./US$17 per Troy oz. Ag)*(10,000*82.9%)). Sulphide zone metal recoveries of 89.2% for Ag, 91.9% for Pb, and 82.9% for Zn were used in the Silver Equivalent (Recovered) equation and reflect metallurgical testing results disclosed previously for the Pulacayo Deposit. Matthew Harrington P. Geo., Michael Cullen, P. Geo. and Osvaldo Arce, P. Geo are the independent Qualified Persons for the mineral resource estimate (“N.I. 43-101 Mineral Resource Estimate Technical Report for the Pulacayo Project Effectve Date October 13, 2020”). They have verified all data and the QA/QC methodology. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The full gallium and indium assay results are shown in the table below.

| HOLE ID | FROM m | TO m | WIDTH m | Ag g/t | Pb % | Zn % | Ga g/t | In g/t |

| PUD156 | 234 | 235 | 1 | 0.5 | 0.117 | 0.56 | 0.77 | 0.759 |

| PUD156 | 240 | 241 | 1 | 8 | 0.004 | 0.188 | 1.32 | 6.74 |

| PUD156 | 247.3 | 248 | 0.7 | 934 | 5.67 | 6.16 | 4.56 | 266 |

| PUD156 | 253 | 254 | 1 | 26 | 0.297 | 0.769 | 1.1 | 6.67 |

| PUD156 | 259 | 260 | 1 | 10 | 0.38 | 1.05 | 1.7 | 2.41 |

| PUD156 | 264 | 265 | 1 | 497 | 1.015 | 0.441 | 0.99 | 6.47 |

| PUD156 | 270 | 271 | 1 | 4 | 0.079 | 0.292 | 0.94 | 0.51 |

| PUD156 | 276 | 277 | 1 | 3 | 0.154 | 0.702 | 0.86 | 3.76 |

| PUD156 | 282 | 283 | 1 | 1 | 0.041 | 0.088 | 0.86 | 0.031 |

| PUD156 | 288 | 289 | 1 | 3 | 0.121 | 0.405 | 0.83 | 0.096 |

| 11PUD231 | 12 | 13 | 1 | 0.5 | 0.0005 | 0.001 | 5.22 | 0.027 |

| 11PUD231 | 18 | 19 | 1 | 1 | 0.001 | 0.001 | 3.79 | 0.054 |

| 11PUD231 | 24 | 25 | 1 | 3 | 1.07 | 0.01 | 5.92 | 4.29 |

| 11PUD231 | 30 | 31 | 1 | 1 | 0.53 | 0.01 | 7.58 | 12.25 |

| 11PUD231 | 36 | 37 | 1 | 5 | 0.65 | 0.23 | 1.94 | 0.797 |

| 11PUD231 | 42 | 43 | 1 | 1 | 0.65 | 0.02 | 10.05 | 14.55 |

| 11PUD231 | 48 | 49 | 1 | 2 | 1.56 | 0.02 | 34.8 | 42.4 |

| 11PUD231 | 54 | 55 | 1 | 7 | 0.29 | 0.001 | 5.07 | 2.37 |

| 11PUD231 | 60 | 61 | 1 | 2 | 0.01 | 0.02 | 3.27 | 0.102 |

| 11PUD231 | 66 | 67 | 1 | 1 | 0.001 | 0.02 | 3.18 | 0.056 |

| 11PUD231 | 72 | 72.9 | 0.9 | 4 | 0.16 | 0.75 | 2.24 | 0.207 |

| 11PUD231 | 79 | 80 | 1 | 0.5 | 0.01 | 0.02 | 4.47 | 1.885 |

| 11PUD231 | 85 | 86 | 1 | 0.5 | 0.03 | 0.1 | 3.18 | 0.14 |

| 11PUD231 | 91 | 92 | 1 | 5 | 0.35 | 0.77 | 3.59 | 2.75 |

| 11PUD231 | 97 | 98 | 1 | 0.5 | 0.02 | 0.13 | 1.58 | 0.14 |

| 11PUD231 | 101 | 102 | 1 | 108 | 1.91 | 8.71 | 5.56 | 38.4 |

| 11PUD231 | 107 | 108 | 1 | 10 | 0.24 | 0.57 | 2.96 | 1.275 |

| 11PUD231 | 111 | 112 | 1 | 345 | 5.83 | 10.85 | 8.83 | 74.8 |

| 11PUD231 | 119 | 120 | 1 | 145 | 2.2 | 1.23 | 10.2 | 29 |

| 11PUD231 | 126 | 127 | 1 | 1 | 0.001 | 0.03 | 2.04 | 0.277 |

| PUD069 | 92 | 93 | 1 | 0.5 | 0.02 | 0.09 | 1.84 | 0.041 |

| PUD069 | 98 | 99 | 1 | 1 | 0.005 | 0.02 | 2.27 | 0.031 |

| PUD069 | 104 | 105 | 1 | 1 | 0.06 | 0.34 | 1.88 | 0.108 |

| PUD069 | 110 | 111 | 1 | 1 | 0.04 | 0.17 | 2.5 | 0.047 |

| PUD069 | 116 | 117 | 1 | 0.5 | 0.005 | 0.01 | 3.1 | 0.039 |

| PUD069 | 122 | 123 | 1 | 0.5 | 0.02 | 0.08 | 3.11 | 0.081 |

| PUD069 | 128 | 129 | 1 | 18 | 0.53 | 5.13 | 4.12 | 4.58 |

| PUD069 | 134 | 136 | 2 | 0.5 | 0.01 | 0.02 | 2.76 | 0.047 |

| PUD069 | 146 | 148 | 2 | 1 | 0.08 | 0.57 | 2.1 | 0.454 |

| PUD069 | 158 | 160 | 2 | 0.5 | 0.01 | 0.07 | 1.96 | 0.05 |

| PUD069 | 170 | 172 | 2 | 1 | 0.005 | 0.03 | 3.38 | 0.049 |

| PUD069 | 182 | 184 | 2 | 0.5 | 0.01 | 0.12 | 1.89 | 0.05 |

| PUD069 | 194 | 196 | 2 | 2 | 0.06 | 0.21 | 2.47 | 0.21 |

| PUD069 | 206 | 208 | 2 | 0.5 | 0.02 | 0.09 | 3.17 | 0.061 |

| PUD069 | 218 | 220 | 2 | 1 | 0.02 | 0.07 | 1.86 | 0.035 |

| PUD069 | 230 | 232 | 2 | 1 | 0.04 | 0.19 | 2.04 | 0.054 |

| PUD069 | 242 | 243 | 1 | 0.5 | 0.03 | 0.16 | 1.47 | 0.044 |

| PUD069 | 248 | 249 | 1 | 0.5 | 0.01 | 0.05 | 1.46 | 0.022 |

| PUD069 | 254 | 255 | 1 | 40 | 1.1 | 5.44 | 4.61 | 11.15 |

| PUD069 | 260 | 261 | 1 | 1 | 0.1 | 0.5 | 1.97 | 0.927 |

| PUD069 | 268 | 269 | 1 | 2 | 0.14 | 0.38 | 1.74 | 0.473 |

| PUD069 | 274 | 275 | 1 | 10 | 0.29 | 1.65 | 2.74 | 5.53 |

| PUD069 | 278 | 279 | 1 | 44 | 0.17 | 6.65 | 2.42 | 20.3 |

| PUD069 | 290 | 291 | 1 | 98 | 0.91 | 1.2 | 2.57 | 17.75 |

| PUD069 | 296 | 297 | 1 | 620 | 0.44 | 8.79 | 3.04 | 16.4 |

| PUD069 | 304 | 305 | 1 | 590 | 0.62 | 0.57 | 1.35 | 3.74 |

| PUD069 | 310 | 311 | 1 | 169 | 0.24 | 7.73 | 7.08 | 219 |

| PUD069 | 316 | 317 | 1 | 7 | 0.27 | 0.84 | 1.53 | 0.247 |

| PUD069 | 322 | 323 | 1 | 5 | 0.24 | 1.14 | 1.54 | 0.207 |

| PUD069 | 328 | 329 | 1 | 1 | 0.03 | 0.17 | 1.33 | 0.055 |

| PUD069 | 334 | 335 | 1 | 0.5 | 0.005 | 0.03 | 1.37 | 0.046 |

| PUD069 | 340 | 341 | 1 | 1 | 0.01 | 0.04 | 1 | 0.046 |

| PUD069 | 346 | 347 | 1 | 1 | 0.01 | 0.05 | 1.1 | 0.048 |

| 11PUD220 | 20 | 21 | 1 | 0.5 | 0.0005 | 0.085 | 5.98 | 0.102 |

| 11PUD220 | 25 | 26 | 1 | 1 | 0.062 | 0.059 | 3.72 | 0.4 |

| 11PUD220 | 31 | 32 | 1 | 1 | 0.051 | 0.037 | 3.79 | 0.048 |

| 11PUD220 | 61 | 62 | 1 | 8 | 0.605 | 0.433 | 2.12 | 2.17 |

| 11PUD220 | 67 | 68 | 1 | 91 | 0.783 | 0.523 | 3.25 | 5.35 |

| 11PUD220 | 73 | 74 | 1 | 8 | 0.455 | 0.988 | 1.42 | 1.615 |

| 11PUD220 | 79 | 80 | 1 | 8 | 0.233 | 0.938 | 1.9 | 0.787 |

| 11PUD220 | 84 | 85 | 1 | 74 | 2.67 | 2.95 | 2.61 | 14.5 |

| 11PUD220 | 89 | 90 | 1 | 5 | 0.341 | 0.212 | 1.94 | 0.656 |

| 11PUD220 | 95 | 96 | 1 | 1 | 0.001 | 0.009 | 1.66 | 0.057 |

| 11PUD220 | 101 | 102 | 1 | 0.5 | 0.001 | 0.013 | 3.65 | 0.055 |

| 11PUD220 | 107 | 108 | 1 | 0.5 | 0.037 | 0.125 | 1.68 | 0.078 |

| PUD040 | 4 | 6 | 2 | 0.5 | 0.07 | 0.01 | 3.07 | 0.388 |

| PUD040 | 16 | 17 | 1 | 2 | 0.11 | 0.02 | 2.67 | 1.14 |

| PUD040 | 22 | 23 | 1 | 0.5 | 0.02 | 0.06 | 3.08 | 0.035 |

| PUD040 | 28 | 29 | 1 | 5 | 0.49 | 0.03 | 2.78 | 0.805 |

| PUD040 | 34 | 35 | 1 | 3 | 0.25 | 0.02 | 2.23 | 0.278 |

| PUD040 | 40 | 41 | 1 | 0.5 | 0.03 | 0.11 | 4.86 | 0.031 |

| PUD040 | 46 | 47 | 1 | 1 | 0.11 | 0.48 | 2.71 | 0.05 |

| PUD040 | 52 | 53 | 1 | 0.5 | 0.005 | 0.25 | 5.35 | 0.045 |

| PUD040 | 58 | 59 | 1 | 0.5 | 0.005 | 0.71 | 8.2 | 0.051 |

| PUD040 | 64 | 65 | 1 | 1 | 0.005 | 1.28 | 5.68 | 0.058 |

| PUD040 | 70 | 72 | 2 | 0.5 | 0.005 | 0.36 | 2.88 | 0.023 |

| PUD040 | 82 | 84 | 2 | 0.5 | 0.005 | 0.17 | 2.38 | 0.019 |

| PUD040 | 94 | 96 | 2 | 1 | 0.005 | 0.52 | 2.16 | 0.021 |

| PUD040 | 106 | 108 | 2 | 1 | 0.005 | 0.29 | 2.67 | 0.022 |

| PUD040 | 118 | 120 | 2 | 1 | 0.005 | 0.1 | 2.02 | 0.022 |

| PUD040 | 130 | 132 | 2 | 0.5 | 0.005 | 0.01 | 2.16 | 0.022 |

| PUD040 | 142 | 144 | 2 | 0.5 | 0.005 | 0.005 | 1.42 | 0.019 |

| PUD040 | 154 | 156 | 2 | 0.5 | 0.005 | 0.24 | 1.41 | 0.02 |

| PUD040 | 166 | 168 | 2 | 0.5 | 0.005 | 0.01 | 1.4 | 0.016 |

| PUD040 | 176 | 177 | 1 | 1 | 0.005 | 0.01 | 1.26 | 0.015 |

| PUD040 | 182 | 183 | 1 | 0.5 | 0.005 | 0.01 | 0.56 | 0.01 |

| PUD040 | 191 | 193 | 2 | 1 | 0.005 | 0.07 | 1 | 0.012 |

| PUD040 | 203 | 204 | 1 | 0.5 | 0.005 | 0.1 | 1.02 | 0.022 |

| PUD040 | 209 | 210 | 1 | 0.5 | 0.01 | 0.21 | 2.32 | 0.082 |

| PUD040 | 215 | 216 | 1 | 1 | 0.005 | 0.06 | 2.84 | 0.097 |

| PUD040 | 221 | 222 | 1 | 0.5 | 0.005 | 0.04 | 3.08 | 0.054 |

| PUD040 | 227 | 228 | 1 | 0.5 | 0.06 | 0.19 | 2.44 | 0.071 |

| PUD040 | 233 | 234 | 1 | 0.5 | 0.005 | 0.03 | 2.5 | 0.042 |

| PUD040 | 239 | 240 | 1 | 13 | 2.01 | 6.27 | 1.45 | 0.036 |

| PUD040 | 245 | 246 | 1 | 0.5 | 0.005 | 0.05 | 2.55 | 0.044 |

| PUD040 | 251 | 252 | 1 | 0.5 | 0.03 | 0.1 | 2.23 | 0.033 |

| PUD040 | 257 | 258 | 1 | 0.5 | 0.03 | 0.07 | 2.29 | 0.036 |

| PUD046 | 153 | 154 | 1 | 4 | 0.21 | 1.23 | 2.05 | 0.496 |

| PUD046 | 164 | 166 | 2 | 2 | 0.09 | 0.46 | 1.84 | 0.528 |

| PUD046 | 176 | 178 | 2 | 2 | 0.06 | 0.35 | 2.49 | 0.445 |

| PUD046 | 188 | 190 | 2 | 5 | 0.27 | 0.85 | 2.15 | 1.585 |

| PUD046 | 200 | 202 | 2 | 2 | 0.09 | 0.39 | 1.49 | 0.417 |

| PUD046 | 212 | 214 | 2 | 1 | 0.01 | 0.05 | 1.55 | 0.05 |

| PUD046 | 221 | 222 | 1 | 4 | 0.06 | 0.34 | 1.33 | 1.51 |

| PUD046 | 227 | 228 | 1 | 54 | 1.02 | 4.35 | 3.9 | 10.3 |

| PUD046 | 233 | 234 | 1 | 93 | 1.62 | 3.82 | 7.29 | 21.6 |

| PUD046 | 239 | 240 | 1 | 8 | 0.33 | 1.9 | 2.26 | 6.56 |

| PUD046 | 245 | 246 | 1 | 474 | 1.13 | 1.68 | 2.66 | 1.48 |

| PUD046 | 251 | 252 | 1 | 9 | 0.13 | 0.51 | 2.61 | 8.44 |

| PUD046 | 261 | 262 | 1 | 106 | 1.47 | 1.81 | 1.84 | 20.8 |

| PUD046 | 267 | 268 | 1 | 314 | 1.71 | 2.44 | 2.53 | 20 |

| PUD046 | 273 | 274 | 1 | 62 | 0.96 | 4.91 | 4.61 | 37.5 |

| PUD046 | 279 | 280 | 1 | 56 | 0.51 | 5.48 | 5.45 | 32.7 |

| PUD046 | 285 | 286 | 1 | 199 | 1.99 | 6.7 | 3.77 | 29.5 |

| PUD046 | 291 | 292 | 1 | 786 | 10.95 | 3.59 | 5.74 | 51 |

| PUD046 | 296 | 297 | 1 | 2.05 | 12.4 | |||

| PUD046 | 303 | 304 | 1 | 6 | 0.19 | 0.63 | 1.77 | 0.122 |

| PUD046 | 309 | 310 | 1 | 0.5 | 0.03 | 0.1 | 1.2 | 0.051 |

| PUD046 | 315 | 316 | 1 | 4 | 0.11 | 0.4 | 1.04 | 0.839 |

| PUD046 | 321 | 322 | 1 | 3 | 0.08 | 0.31 | 1.2 | 0.042 |

| PUD046 | 332 | 334 | 2 | 1 | 0.01 | 0.09 | 1.82 | 0.037 |

| PUD046 | 346 | 348 | 2 | 16 | 0.62 | 1.84 | 2.14 | 2.39 |

| PUD098 | 21 | 22 | 1 | 13 | 0.69 | 1.26 | 2.81 | 2.62 |

| PUD098 | 27 | 28 | 1 | 1 | 0.01 | 0.02 | 2.52 | 0.086 |

| PUD098 | 35 | 36 | 2.91 | 0.255 | ||||

| PUD098 | 39 | 40 | 1 | 8 | 0.24 | 1.44 | 2.81 | 2.53 |

| PUD098 | 45 | 46 | 1 | 12 | 0.36 | 1.77 | 3.17 | 4.24 |

| PUD098 | 51 | 52 | 1 | 12 | 0.27 | 1.04 | 2.36 | 4.01 |

| PUD098 | 57 | 58 | 1 | 3 | 0.1 | 0.24 | 2.22 | 0.922 |

| PUD098 | 63 | 64.15 | 1.15 | 77 | 1.74 | 3.89 | 2.93 | 12.6 |

| PUD098 | 110 | 111 | 1 | 1 | 0.005 | 0.04 | 0.64 | 0.051 |

| PUD098 | 116 | 117 | 1 | 2 | 0.07 | 0.32 | 1.54 | 0.064 |

| PUD098 | 122 | 123 | 1 | 2 | 0.16 | 0.69 | 2.3 | 0.4 |

| PUD098 | 128 | 129 | 1 | 5 | 0.13 | 0.7 | 1.53 | 1.775 |

| PUD098 | 134 | 135 | 1 | 8 | 0.15 | 1.08 | 1.92 | 2.4 |

| PUD098 | 140 | 141 | 1 | 6 | 0.18 | 0.9 | 2.35 | 7.4 |

| PUD098 | 148 | 149 | 1 | 22 | 0.48 | 1.16 | 2.5 | 7.06 |

| PUD098 | 154 | 155 | 1 | 44 | 0.71 | 5.84 | 5.18 | 43.4 |

| PUD098 | 159 | 160 | 4.64 | 14 | ||||

| PUD098 | 166 | 167 | 1 | 5 | 0.14 | 0.42 | 1.68 | 0.117 |

| PUD098 | 172 | 173 | 1 | 0.5 | 0.01 | 0.04 | 1.86 | 0.056 |

| PUD098 | 178 | 179 | 1 | 15 | 0.22 | 1.28 | 1.7 | 0.452 |

| PUD098 | 184 | 185 | 1 | 41 | 0.94 | 5.43 | 2.52 | 12.9 |

| PUD098 | 190 | 191 | 1 | 650 | 10.9 | 12.95 | 6.84 | 83.9 |

| PUD098 | 195 | 196 | 1 | 6 | 0.2 | 0.64 | 1.6 | 0.105 |

| PUD098 | 201 | 202 | 1 | 7 | 0.24 | 0.91 | 2.16 | 0.07 |

| PUD098 | 207 | 208 | 1 | 2 | 0.17 | 0.77 | 1.82 | 0.066 |

| PUD098 | 212 | 213 | 1 | 1 | 0.12 | 0.32 | 2.12 | 0.07 |

| PUD098 | 217 | 218 | 1 | 1 | 0.005 | 0.03 | 1.5 | 0.034 |

| PUD187 | 298 | 299 | 1 | 0.5 | 0.004 | 0.121 | 2.1 | 0.023 |

| PUD187 | 304 | 305 | 1 | 1 | 0.056 | 0.195 | 1.82 | 0.025 |

| PUD187 | 310 | 311 | 1 | 1 | 0.028 | 0.102 | 1.38 | 0.026 |

| PUD187 | 316 | 317 | 1 | 15 | 0.062 | 1.63 | 3.27 | 13.25 |

| PUD187 | 322 | 323 | 1 | 2 | 0.012 | 0.25 | 1.62 | 0.746 |

| PUD187 | 331.35 | 332.18 | 0.83 | 9 | 0.078 | 0.498 | 1.46 | 0.831 |

| PUD187 | 337 | 338 | 1 | 3 | 0.021 | 0.07 | 1.45 | 0.072 |

| PUD187 | 343 | 344 | 1 | 0.5 | 0.087 | 0.259 | 1.14 | 0.027 |

| PUD267 | 15 | 16 | 2 | 3 | 0.135 | 0.005 | 2.21 | 0.193 |

| PUD267 | 24 | 26 | 2 | 4 | 0.231 | 0.9 | 2.05 | 1.235 |

| PUD267 | 33.5 | 35 | 1.5 | 40 | 1.22 | 1.205 | 3.78 | 15.9 |

| PUD267 | 40.5 | 41.5 | 1 | 39 | 0.627 | 2.84 | 3.08 | 3.9 |

| PUD267 | 67 | 69 | 2 | 0.001 | 0.032 | 0.137 | 2.61 | 0.135 |

| PUD267 | 79 | 81 | 2 | 0.001 | 0.003 | 0.023 | 2.16 | 0.058 |

| PUD267 | 87 | 89 | 2 | 0.001 | 0.006 | 0.032 | 1.87 | 0.065 |

| PUD267 | 97 | 99 | 2 | 0.001 | 0.006 | 0.034 | 1.44 | 0.095 |

| PUD267 | 107 | 109 | 2 | 0.001 | 0.013 | 0.081 | 1.74 | 0.044 |

| PUD267 | 119 | 120 | 1 | 1 | 0.141 | 0.799 | 1.96 | 0.073 |

| PUD267 | 126 | 127.5 | 1.5 | 0.001 | 0.046 | 0.386 | 1.7 | 0.051 |

| PUD267 | 135 | 137 | 2 | 0.001 | 0.003 | 0.093 | 4.23 | 0.037 |

| PUD267 | 142 | 144 | 2 | 3 | 0.052 | 0.228 | 2.99 | 0.125 |

| PUD267 | 153 | 155 | 2 | 0.001 | 0.005 | 0.185 | 4.33 | 0.051 |

| PUD267 | 161 | 162 | 1 | 0.001 | 0.003 | 0.008 | 1.97 | 0.019 |

| PUD267 | 172 | 174 | 2 | 2 | 0.002 | 0.007 | 0.86 | 0.017 |

| PUD271 | 7 | 8 | 1 | 0.001 | 0.013 | 0.01 | 4.62 | 0.136 |

| PUD271 | 13 | 14 | 1 | 0.001 | 0.052 | 0.008 | 6.44 | 0.172 |

| PUD271 | 19 | 20 | 1 | 0.001 | 0.013 | 0.005 | 2.89 | 0.161 |

| PUD271 | 25 | 26 | 1 | 0.001 | 0.009 | 0.032 | 1.69 | 0.06 |

| PUD271 | 35 | 37 | 2 | 0.001 | 0.004 | 0.032 | 1.34 | 0.034 |

| PUD271 | 44 | 46 | 2 | 0.001 | 0.005 | 0.025 | 1.38 | 0.038 |

| PUD271 | 53 | 54 | 1 | 0.001 | 0.003 | 0.022 | 1.64 | 0.033 |

| PUD271 | 59 | 61 | 2 | 0.001 | 0.002 | 0.01 | 1.5 | 0.03 |

| PUD271 | 69 | 71 | 2 | 0.001 | 0.003 | 0.165 | 1.55 | 0.035 |

| PUD271 | 80 | 82 | 2 | 0.001 | 0.002 | 0.007 | 1.17 | 0.026 |

| PUD271 | 92 | 94 | 2 | 1 | 0.003 | 0.007 | 1.31 | 0.034 |

| PUD271 | 104 | 106 | 2 | 0.001 | 0.002 | 0.005 | 1.06 | 0.019 |

| PUD271 | 116 | 118 | 2 | 0.001 | 0.005 | 0.016 | 2.59 | 0.041 |

| PUD271 | 126 | 127 | 1 | 0.001 | 0.004 | 0.018 | 1.66 | 0.028 |

| PUD271 | 136 | 138 | 2 | 0.001 | 0.003 | 0.011 | 1.87 | 0.044 |

| PUD271 | 146 | 148 | 2 | 0.001 | 0.003 | 0.008 | 1.61 | 0.038 |

| PND108 | 61 | 62 | 1 | 83 | 0.93 | 0.47 | 1.47 | 0.022 |

| PND110 | 64 | 65 | 1 | 693 | 3.44 | 2.35 | 1.58 | 0.59 |

QA/QC

An industry standard Quality Assurance/Quality Control program was used during the various drill campaigns. All core and other samples were split with half being bagged, labelled and shipped directly to the laboratory. The other 50% split is retained in a secure facility. Both standards and blanks were inserted at regular intervals within each sample batch prior to shipment to the laboratory. These comprised 3-5% (depending on the phase of the drill campaign) of analyzed material. For further details, the reader is referred to the N.I. 43-101 cited above.

Qualified Person

The technical contents of this news release have been prepared under the supervision of Bill Pincus, who is an independent consultant of the Company. Mr. Pincus is a qualified person as defined by the guidelines of NI 43-101.

About Silver Elephant Mining Corp.

Silver Elephant is a silver mining company, with its flagship Pulacayo-Paca silver project in production since October 2023 in Bolivia.

Further information on Silver Elephant can be found at www.silverelef.com.

SILVER ELEPHANT MINING CORP.

ON BEHALF OF THE BOARD

“John Lee”

Executive Chairman

For more information about Silver Elephant, please contact Investor Relations:

+1.604.569.3661 ext. 101

info@silverelef.com

www.silverelef.com

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes,” “may,” “plans,” “will,” “anticipates,” “intends,” “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Such forward-looking information, which reflects management’s expectations regarding Silver Elephant’s future growth, results of operations, performance, business prospects and opportunities, is based on certain factors and assumptions and involves known and unknown risks and uncertainties which may cause the actual results, performance, or achievements to be materially different from future results, performance, or achievements expressed or implied by such forward-looking information.

Forward-looking information involves significant risks and uncertainties, should not be read as a guarantee of future performance, events or results, and may not be indicative of whether such events or results will actually be achieved. A number of risks and other factors could cause actual results to differ materially from expected results discussed in the forward-looking information, including but not limited to: changes in operating plans; ability to secure sufficient financing to advance the Company’s project; conditions impacting the Company’s ability to mine at the project, such as unfavourable weather conditions, development of a mine plan, maintaining existing permits and receiving any new permits required for the project, and other conditions impacting mining generally; maintaining cordial business relations with strategic partners and contractual counter-parties; meeting regulatory requirements and changes thereto; risks inherent to mineral resource estimation, including uncertainty as to whether mineral resources will be further developed into mineral reserves; political risk in the jurisdictions where the Company’s projects are located; commodity price variation; and general market, industry and economic conditions. Additional risk factors are set out in the Company’s latest annual and interim management discussion and analysis and annual information form (AIF), available on SEDAR+ at www.sedarplus.ca.

Forward-looking information is based on reasonable assumptions by management as of the date of this news release, and there can be no assurance that actual results will be consistent with any forward-looking information included herein. Readers are cautioned that all forward- looking statements in this news release are made as of the date of this news release. The Company undertakes no obligation to update or revise any forward-looking information in this news release to reflect circumstances or events that occur after the date of this news release, except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/215225