Fri, 23 Aug 2024 | BUSINESS SALE

Sewtec, a 170-strong automation business with a facility in Wakefield and a satellite office in Taunton, has been sold to US-headquartered group Automated Industrial Robotics (AIR) by private equity firm Endless.

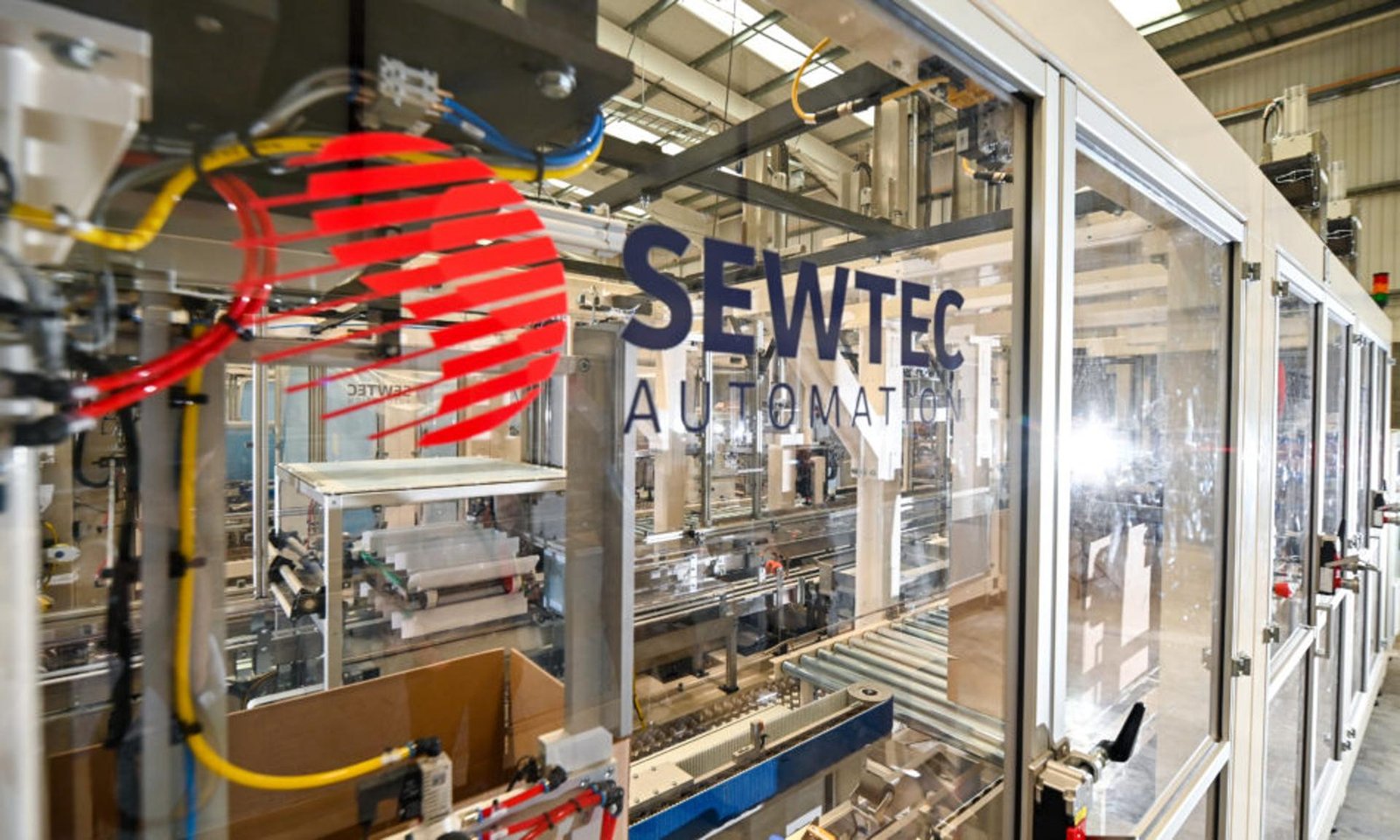

Endless supported a 2017 management buyout (MBO) at Sewtec which took the firm out of founder ownership, with Mark Cook joining as Managing Director. In 2020, the business relocated its operations to a 75,000 sq ft design and manufacturing facility in Wakefield before subsequently opening its Taunton satellite office.

The company’s workforce now numbers over 170 staff, more than double the figure at the time of the MBO. It serves a wide range of brands across sectors including medical devices, food and beverage, pharmaceutical, personal care, e-commerce and pet care.

Following the sale, Endless Investment Partner Andy Ross said: “We knew it was a special business from the start and our role was to provide guidance and support to the management team to help them take their unique capabilities to new customers and markets. The site move was a big positive step forward to allow the team to grow the business responsibly and sustainably.”

The acquisition means that AIR now has more than 400 staff, with an automation hub footprint of around 275,000 sq ft across the US, UK and Ireland. Sewtec joins other AIR portfolio assets Totally Automated Systems (TA Systems) and Modular Automation (Modular).

As part of the deal, Sewtec co-Managing Director Mark Cook has been appointed Chief Operating Officer of AIR. Cook commented: “I believe AIR is the right partner for Sewtec as we look to grow our business with existing and new customers.”

“We look forward to leveraging the skills and know-how across AIR to further our ability to invent innovative solutions that help our customers solve complex operational challenges.”

The UK remains the top destination in Europe for inbound and domestic M&A investment