This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

Are you ready for the single most important earnings report of 2024?

Interestingly, this company won the award for the single most important earnings report of 2024 (and every quarter in 2023) when it reported three months ago!

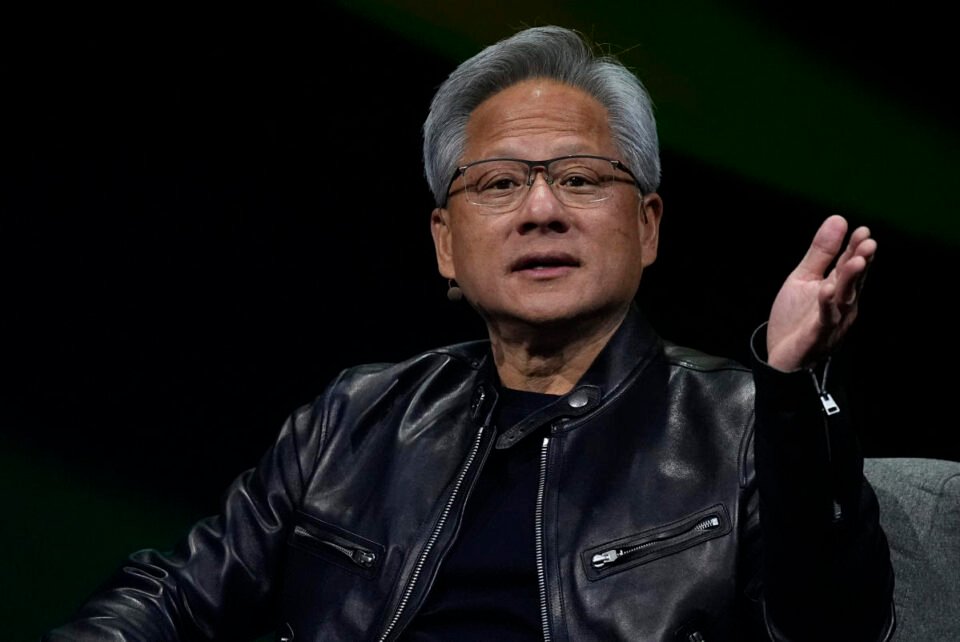

I am talking about Nvidia (NVDA). Earnings are out on Aug. 28 after the close of trading, and it could mean big things for the AI trade as Morning Brief co-host Seana Smith points out.

Every day, I get to the office by 4:20 a.m. and turn on some software we use to track which stories and ticker pages are garnering the most interest from Yahoo Finance readers. Every single day, one of the most actively viewed pages on our platform is for Nvidia.

The world could be on the cusp of an alien attack, and I fancy people will still be hitting refresh on the Nvidia ticker page. Investors have become absolutely obsessed with a company they had never even heard of two years ago.

I can’t blame them.

Nvidia’s stock is up 170% in the past year. Nvidia’s stock is up 3,000% in the past five years.

These are insane gains, the type that lure in the less-experienced investor hoping to retire early.

And Nvidia’s story is surprisingly easy to grasp despite the company’s incredibly complicated business. Nvidia makes the best artificial intelligence chips in a world being upheaved by AI. Simple. No one is even close to Nvidia in terms of AI chip performance and forward-looking demand.

I do want to caution that the setup on Nvidia going into the quarterly report is a little different this go around. While the Street is staying super bullish on Nvidia heading into the print, they are a touch cautious amid reported shipment delays for Nvidia’s powerful new AI chip Blackwell.

There is good reason for the bullishness based on a host of recent signals from earnings reports:

-

Taiwan Semiconductor (TSM) just cited strong AI demand when it reported.

-

AMD (AMD) recently lifted its sales for data center chips for the third time in a year.

-

Super Micro Computer (SMCI) cited strong demand for its liquid cooling solutions.

-

Nvidia chip customer Meta (META) just raised its capital expenditures guidance for 2024 and 2025 by billions.

“We expect Nvidia to report beat/raise results, in which upside will be driven by strong demand for Hopper GPUs. Given the Blackwell delay, we believe Nvidia will prioritize the ramp of B200 for hyperscalers and has effectively canceled B100, which will be replaced with a lower cost/performance GPU (B200A) targeted at enterprise customers,” Keybanc analyst John Vinh said in a client note.

For Nvidia’s report to be embraced, I think investors need to see at least two things:

If this happens, it could shake off a few bears and set the table for what EMJ Capital founder and tech investor Eric Jackson told me on the Opening Bid podcast.

“I’m saying [Nvidia’s value] could double again between now and the end of the year,” Jackson said.

This embedded content is not available in your region.

To put that in perspective, Jackson thinks Nvidia’s market cap could hit $6 trillion by year-end from $3.2 trillion or so currently.

Jackson reasons the company stands to get there by delivering a very, very strong earnings report this week or in November (or both) that shows off continuing demand for H100 and H200 chips while teeing up the potential of its new AI-focused Blackwell chips.

Rest up. It’s going to be a busy week ahead.

Three times each week, I field insight-filled conversations with the biggest names in business and markets on my Opening Bid podcast. Find more episodes on our video hub. Watch on your preferred streaming service. Or listen and subscribe on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

Brian Sozzi is Yahoo Finance’s Executive Editor. Follow Sozzi on X @BrianSozzi and on LinkedIn. Tips on deals, mergers, activist situations, or anything else? Email brian.sozzi@yahoofinance.com.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance