7h40

3

min read

Bitcoin, once soaring in March, now refuses to regain its upward momentum. Several factors influence this stagnation, notably the decrease in interest from American investors. The recent surge of bitcoin to $64,000 raises doubts about its sustainability, especially in the absence of significant support from the American market, particularly from the Coinbase platform, although Asian capital flows are fueling this rise.

The Challenges of the American Stock Exchange

As the Bitcoin price continues its rapid climb, the lack of enthusiasm from the American Stock Exchange, and especially from Coinbase, is intriguing. Indeed, the “Coinbase Premium” index, which measures the price difference between Coinbase and other platforms, has fallen into negative territory. A clear sign that American buyers are no longer quite in the dance, casting doubt on the strength of this rise.

- Bitcoin Price at $64,000, without American support;

- Open Interest down by 0.83% to $33.25 billion;

- Open Interest volume plummeting by 31.04% to $45.49 billion.

Without the active participation of US investors, some analysts, such as BQYoutube, believe that this rally might be a false dawn. The American market, usually a pillar in the rise of crypto-assets, seems to have deserted the area, making the situation more fragile.

Bitcoin and Retail: A Glimmer of Hope

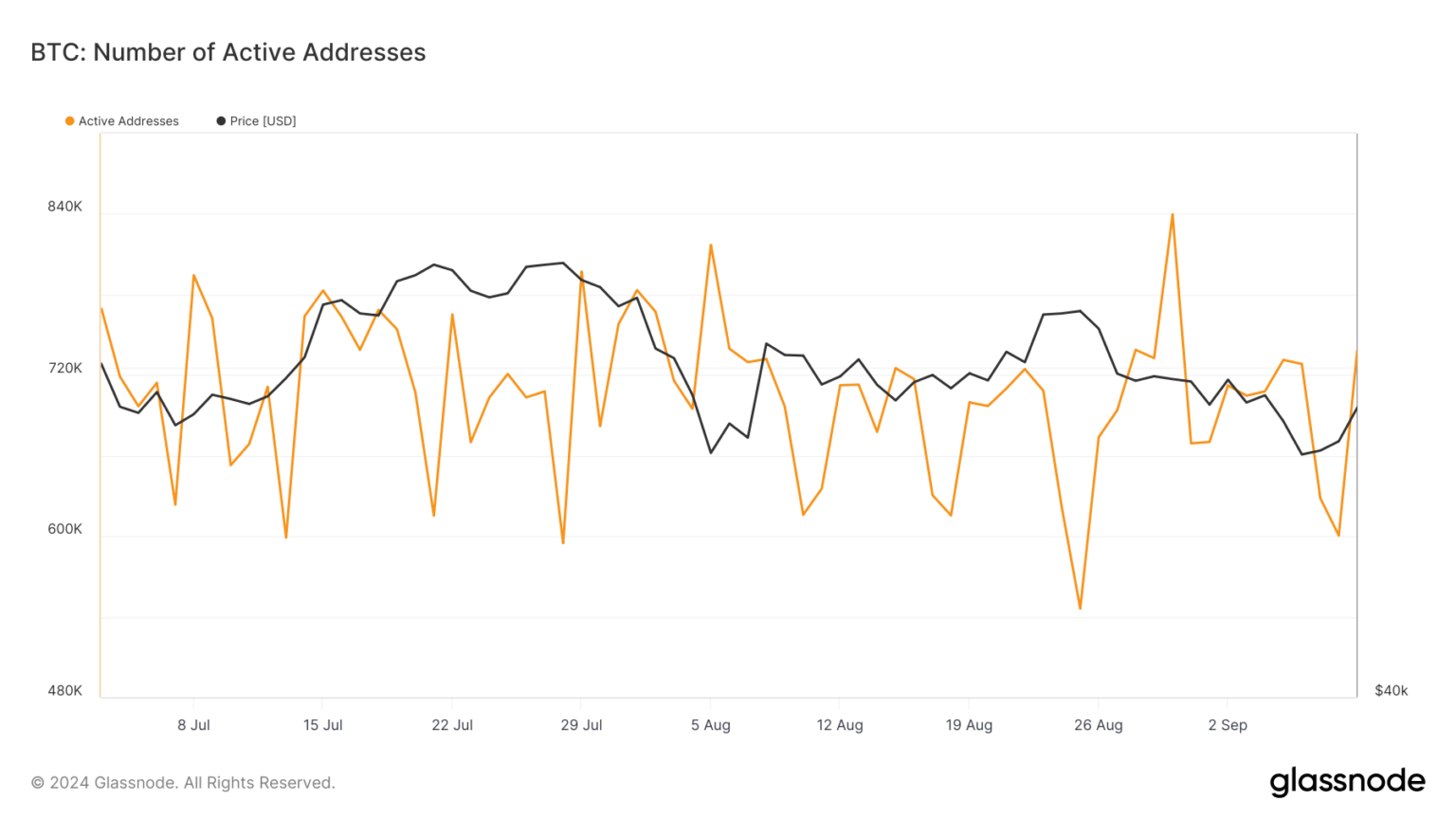

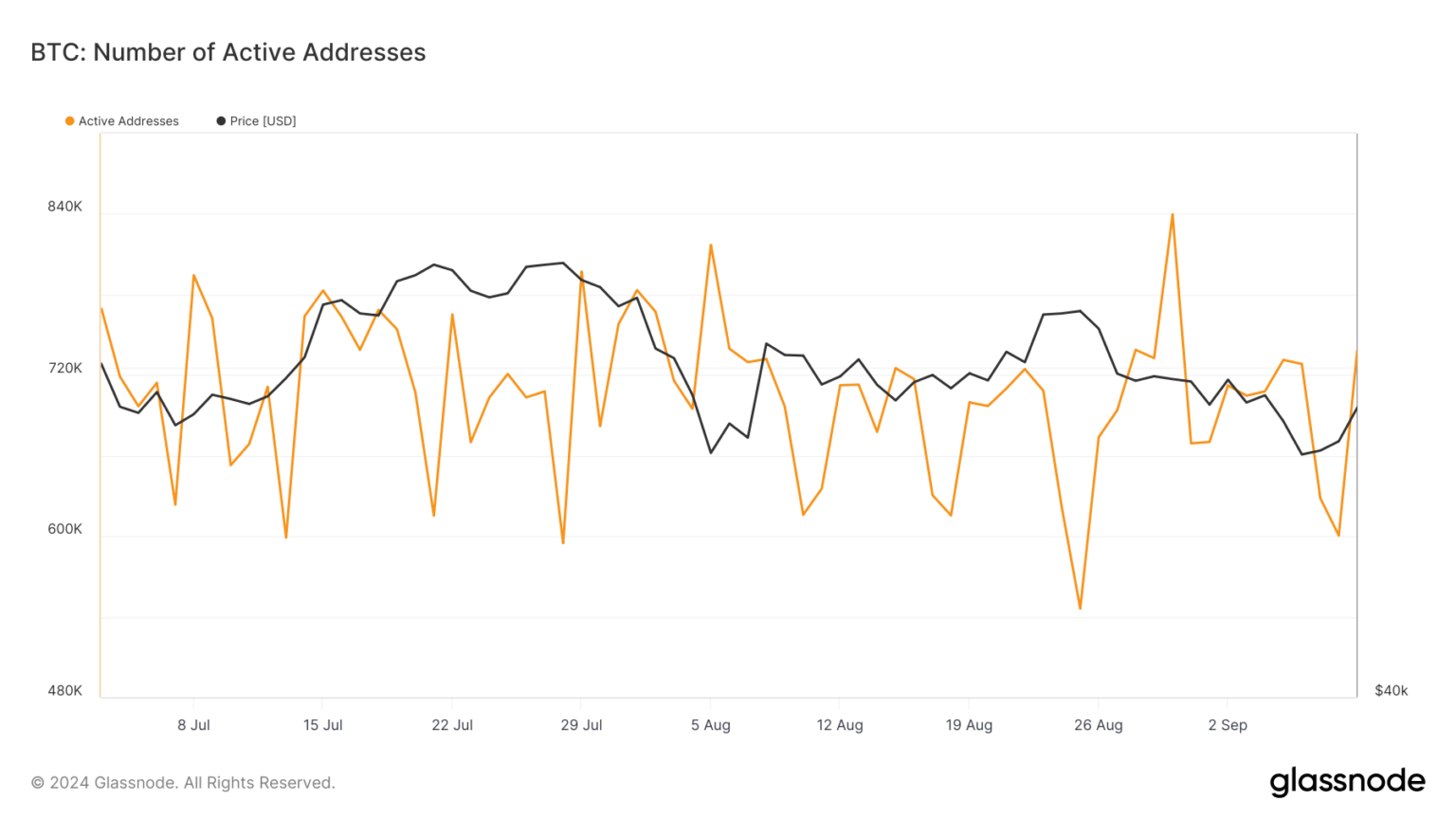

But not everything is bleak for bitcoin. Active addresses, often an indicator of interest from retail investors, show a slight recovery. After hitting a low of 600,000 at the end of September, they have recently climbed back above 700,000.

This could signal a revival of interest from small investors, despite the caution of major players in the market.

This pick-up in activity among retail investors could breathe new life into the market, even if large American investors remain absent. However, the decline in Open Interest and trading volumes reminds us that the path is still riddled with obstacles for bitcoin, especially without a global support, including that of Wall Street.

Fortunately, even with a cautious American market, optimism around Bitcoin persists, notably with the prediction from Standard Chartered: a bitcoin at $100,000 before the American elections would be a pleasant surprise.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.