Oct 10 (Reuters) – Gold prices extended gains on Thursday after traders added to bets that the Federal Reserve will deliver an interest-rate cut next month following the latest U.S. economic data.

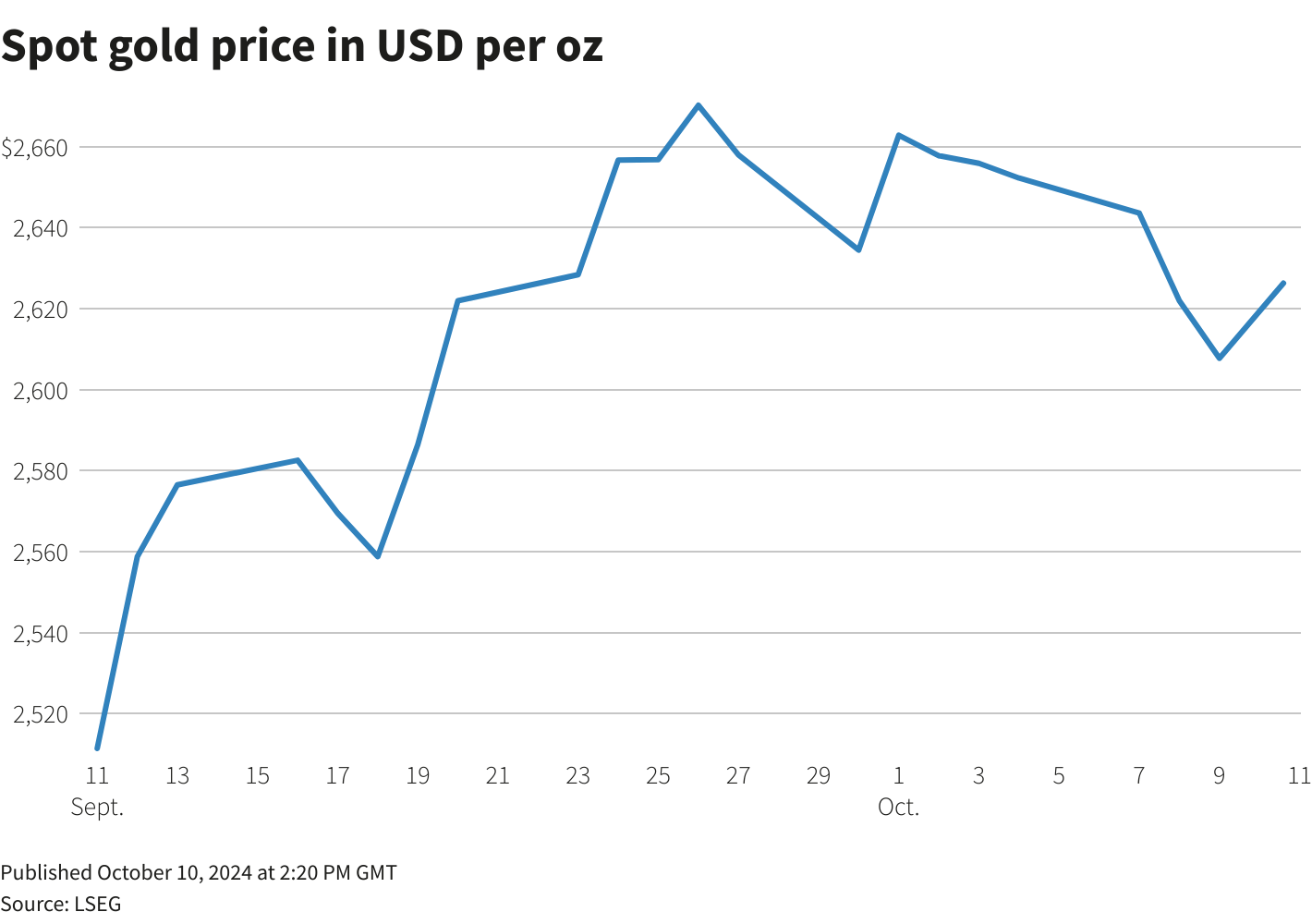

Spot gold was up 0.6% at $2,623.58 per ounce as of 1:59 p.m. ET (1759 GMT), on track to snap a six-session losing streak. U.S. gold futures settled 0.5% higher to $2,639.30.

The CPI report didn’t bring much of a surprise and the jobs numbers show a trend of weakening, which puts the notion that the Fed is on track to cut rates, helping gold, said Alex Ebkarian, chief operating officer at Allegiance Gold.

“Last few days, saw cooling in gold’s rally, so it is in a good position to go back up,” Ebkarian added.

Markets now see an 80% likelihood of a 25-basis-point cut from the Fed next month versus 76% before the data, according to the CME FedWatch tool.

Zero-yield bullion is a preferred investment amid lower interest rates.

Investors’ focus will shift to U.S. Producer Price Index data on Friday for additional insights on rate cuts.

Heightened geopolitical events and strong demand led by central banks are the other positive catalysts for gold, Ebkarian added.

Spot silver rose 1.7% to $31.02 per ounce.

“Easing monetary policy and an undersupplied market will likely attract investor interest, with silver remaining an inexpensive alternative to gold,” ANZ said in a note.

Platinum added 2.4% to $967.17, and palladium was up 3% to $1,070.50.

Sign up here.

Reporting by Anushree Mukherjee in Bengaluru; Editing by Tasim Zahid and Vijay Kishore

Our Standards: The Thomson Reuters Trust Principles.