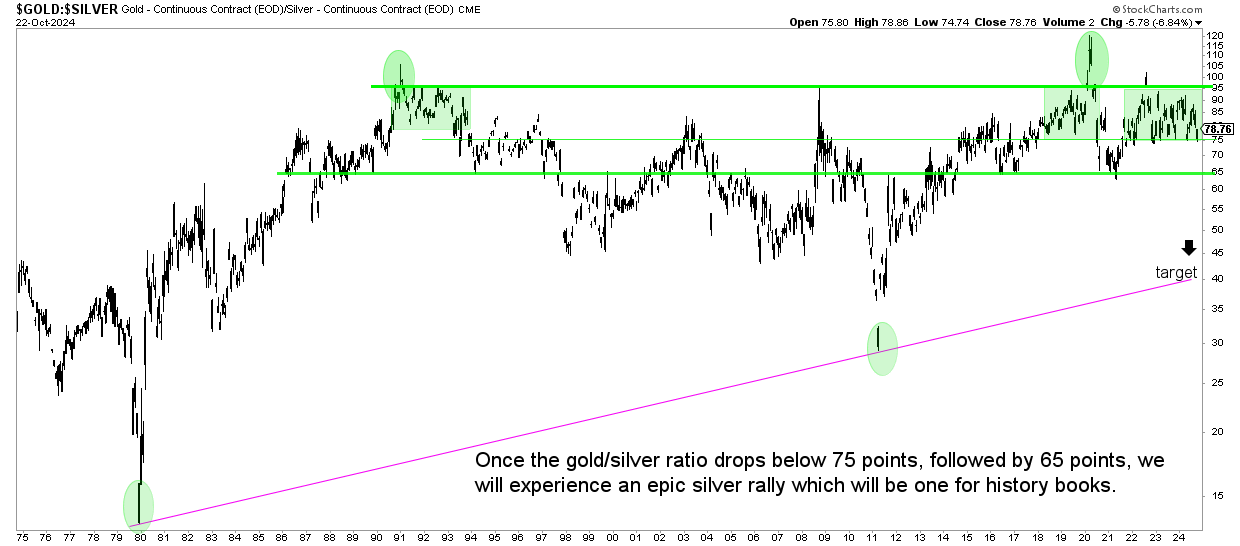

The 75-point level in the gold to silver ratio is one of the most important levels, historically. It is being tested now. What’s next?

In this article, we look at the possibility of a quick silver run to $50 without using a specific silver chart.

Gold to silver ratio – the importance of 75 points

As explained in great detail in Gold-to-Silver Ratio Historical Chart:

- This ratio has spent most of its time (50 years of data) in the area 65 to 95 points.

- The few times in which silver touched the area around 95 points marked epic silver price under-valuations.

- The few times in which silver fell below 65 points coincided with silver price spikes.

- The 75 point level is a critical level, typically coinciding with an acceleration point in spot silver.

The last point, above, is important, when checked against the gold to silver ratio chart shown below.

The chart is self-explanatory: a tiny move higher in the price of silver, and the probability for an epic rally in spot silver rises exponentially.

Below is the secular gold to silver price chart.

Note – The huge drops in this ratio, in 1980 and 2011, coinciding with $50 in spot silver. With silver pretty close to $50 now, we might be looking at $100 silver when the rising trendline connecting 1980 with 2011 is hit in the future.

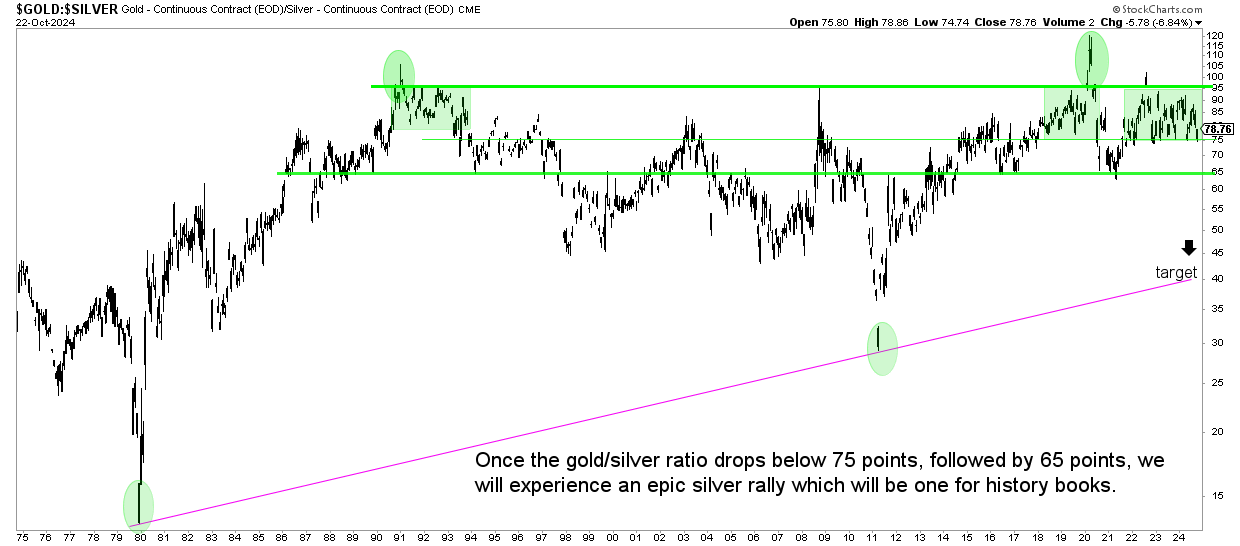

Gold to silver ratio – another chart

While we have been vocal about the extraordinarily bullish silver opportunity, specifically the 50-year silver chart, we only focus on the gold to silver ratio in this article.

One of the few posts on X on this topic comes from Willem M.:

The gold-silver ratio signals the start of a significant rally in precious metals-related equities, just like 2010, 2016, and 2020. It’s one of our favorite indicators .. pic.twitter.com/NSLg8VR1lo

— Willem Middelkoop (@wmiddelkoop) October 22, 2024

He rightfully pointed out, yesterday, that this ratio chart is testing an epic level.

We couldn’t agree more, our analysis shown above is consistent with his finding.

What we would add to his chart is that silver requires a tiny push higher though for the probability to exponentially rise that we have a 2010, 2016 or 2020 style silver rally.

Gold to silver ratio – what’s next?

As explained in this short but to-the-point article, silver needs to push a little higher.

For instance, a breakdown below 75 points in the gold to silver ratio might happen when:

- Spot silver moves to 37 USD/oz, a rise of 7%.

- Spot gold remains flat around 2720 USD/oz.

In this scenario, the ratio falls to 74 points which would coincide with the start of an epic breakdown.

The expected outcome would be for silver to start a quick run, presumably to 42 and/or even 49 USD/oz.

While we are not projecting this will happen in the short term, we cannot exclude it once the gold to silver ratio breaks down as 75 points gives up.

Receive weekly guidance per our premium silver alerts >>