- Bitcoin has seen a slight decline, pausing the revisiting of its ATH.

- The market is now in greed as many anticipate BTC hitting its ATH again.

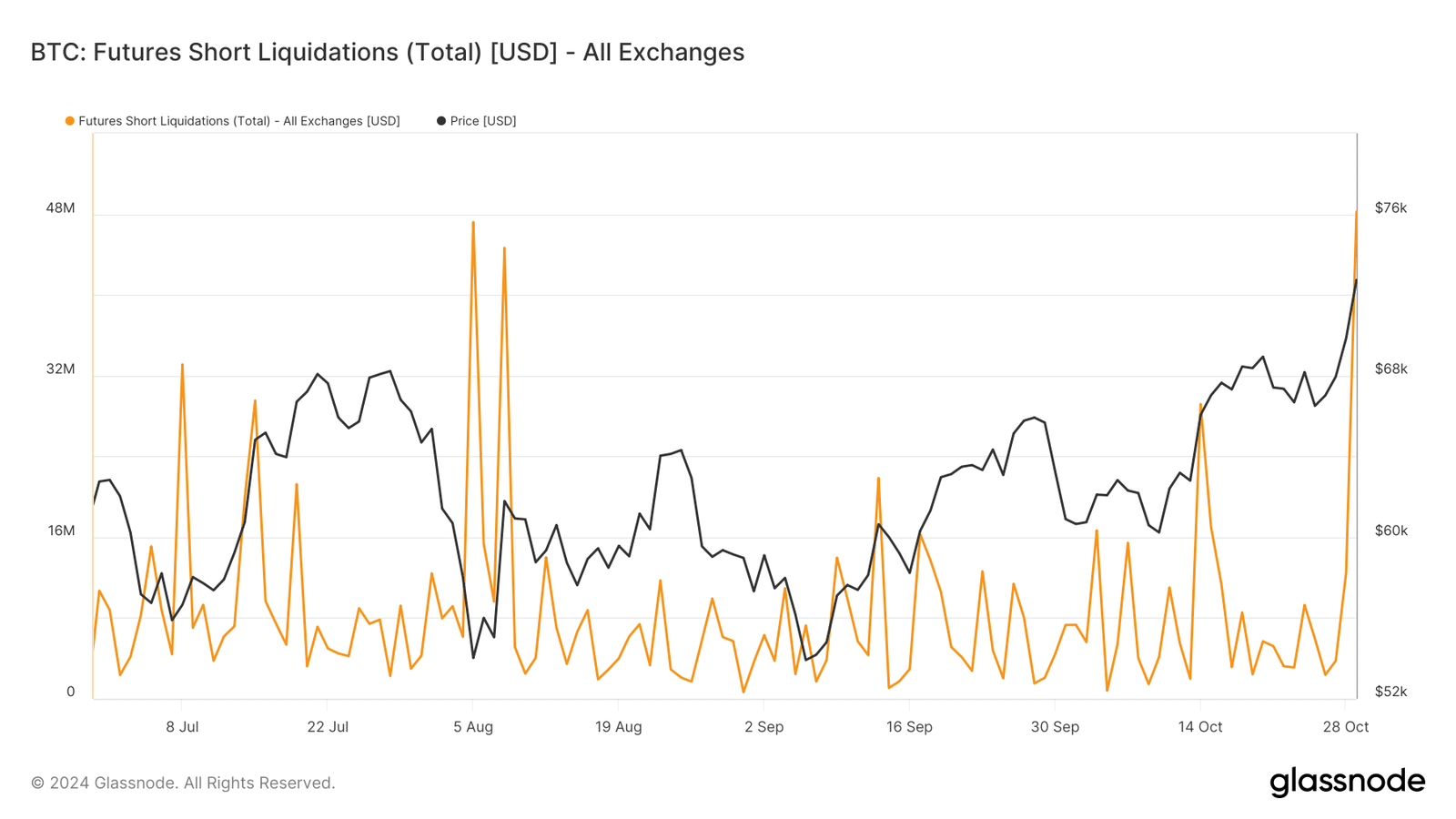

As Bitcoin’s price surged toward the $72,000 mark, a noticeable spike in short liquidations swept through the market. The rise in liquidations signals the intense volatility in recent days, as many short positions were caught off-guard by Bitcoin’s upward momentum.

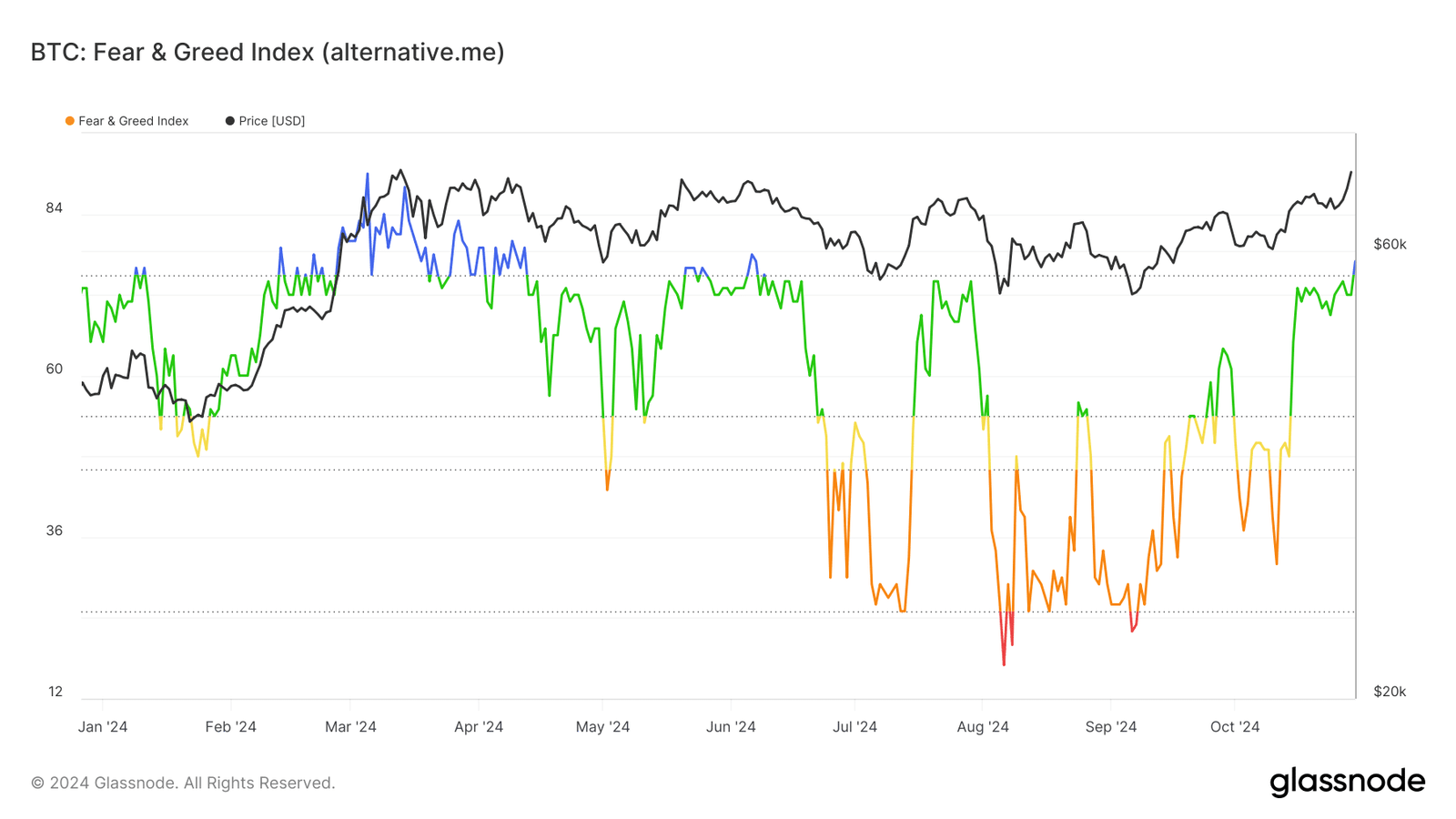

The convergence of Bitcoin’s price movements with the Fear and Greed Index reveals the underlying sentiment driving these fluctuations.

Short liquidations hit new highs amid Bitcoin rally

Bitcoin’s price rally over the past week has led to a significant uptick in futures short liquidations across major exchanges.

According to data from Glassnode, total short liquidations reached unprecedented levels, with over $48 million wiped out in a single day as BTC pushed beyond critical resistance levels.

This spike in liquidations illustrates the market’s reaction to the bullish momentum, as traders betting on a price decline were forced to exit their positions in rapid succession.

The liquidation volume highlights the sensitivity of leveraged short positions to Bitcoin’s price fluctuations. With the market now pushing the $72,000 threshold, short traders are retreating to avoid further liquidation losses.

The cascade effect of liquidations tends to fuel price momentum further, as forced buy-backs on short contracts drive Bitcoin’s price upward.

Rising Fear and Greed Index reflects shifting sentiment

Alongside the spike in liquidations, the Fear and Greed Index has shown a steady climb, reflecting the shift from a cautious market stance to a more optimistic outlook.

At the beginning of October, the index oscillated in the “fear” territory, suggesting market hesitation.

However, as Bitcoin’s price continued to break resistance levels, the index has transitioned into “greed,” reaching its highest reading since the mid-year.

The Fear and Greed Index has historically been a barometer for potential market corrections, as extreme greed often precedes short-term pullbacks.

However, the current level of optimism, driven by strong market fundamentals and institutional interest, might sustain the rally. But elevated greed could suggest an overheating phase, where corrections become likely if sentiment turns too exuberant.

What’s next for Bitcoin amid high volatility?

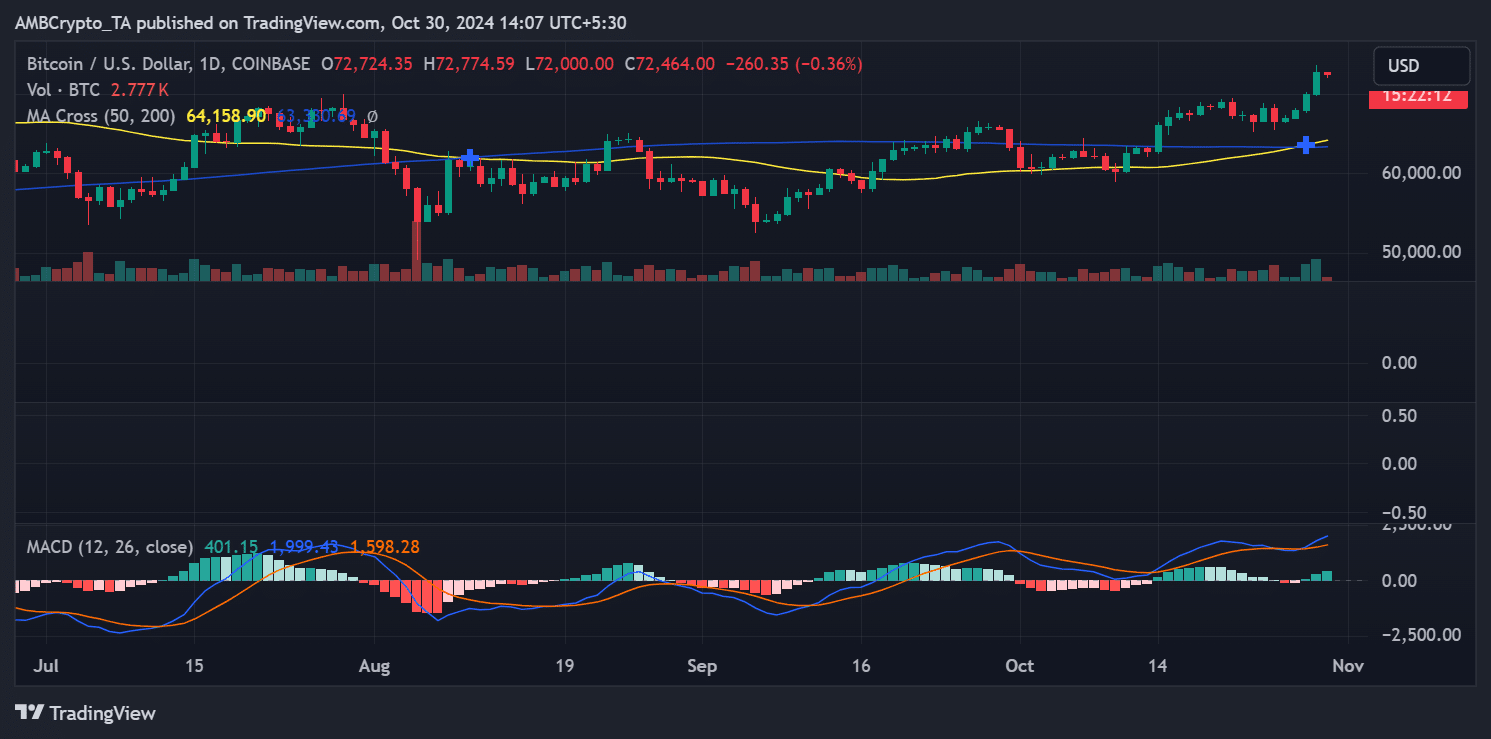

With Bitcoin edging closer to its all-time high, the market is poised for heightened volatility. The MACD indicator on the daily chart shows bullish momentum.

At the same time, the Fear and Greed Index implies that sentiment is strongly in favor of further upside.

Yet, as history shows, high greed levels can result in sharp reversals, especially if the price fails to establish a new high above resistance.

Read Bitcoin (BTC) Price Prediction 2024-25

Bitcoin’s trajectory will likely depend on sustained buying interest and potential profit-taking pressures. Short traders may adopt more cautious strategies, given the recent liquidations.

Overall, Bitcoin’s path appears bullish, yet traders should brace for possible corrections in this highly dynamic environment.