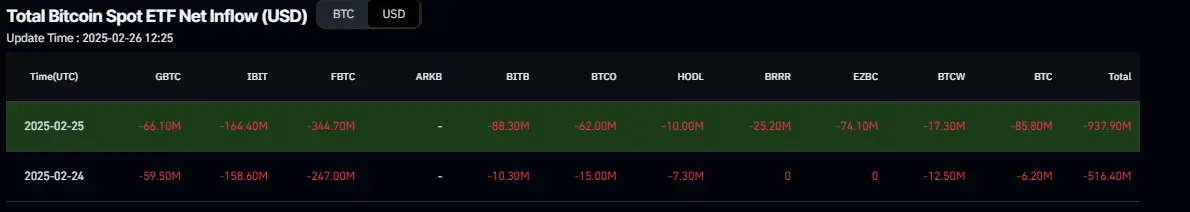

Bitcoin (BTC) price hovers around $88,800 on Wednesday after reaching a low of $86,050 the previous day. US Bitcoin spot Exchange Traded Funds (ETF) supported BTC’s price correction, recording the highest single-day outflow of $937.90 on Tuesday. A K33 report highlights how Micro Strategy’s latest purchase of BTC was not well-received by the market while it processed a resurgence in concerns over US President Donald Trump’s tariffs.

The SEC ends its investigation into Uniswap, boosting UNI token trading, as CEO Hayden Adams calls for new crypto regulations separate from traditional finance.

The SEC has officially dropped its investigation into Uniswap Labs, leading to a short-lived spike in the UNI token’s price. Despite ongoing bearish market conditions, this news marks a positive moment for the decentralized exchange, which recently launched its v4 upgrade and introduced the Unichain mainnet.

The crypto market fell below the support for the last three months on Tuesday, going into a brutal sell-off mode. Institutional investor sentiment didn’t help either, as US stock indices also saw a sell-off. Sentiment stabilised on Wednesday, and we see an attempt to form a bottom, pushing off from the $2.87T market cap and now up to $2.93T.