As the tech rally stalls after its monumental surge and investors reassess their portfolios in light of shifting market dynamics, financial stocks are emerging as attractive alternatives.

With ‘Strong Buy’ ratings from analysts and solid upside potential ahead, Apollo Global Management (NYSE:), and KKR & Co. (NYSE:) offer attractive prospects for long-term growth as concerns over inflation resurface and investors rotate out of the tech sector.

Using the power of InvestingPro, available now for less than $9 a month, let’s delve into what makes these two stocks stand out and why analysts are bullish on their prospects.

1. Apollo Global Management

- 2024 Year-To-Date: +18.1%

- Market Cap: $62.5 Billion

- Fair Value Upside: +39.1%

Apollo Global Management is a leading global alternative investment manager with a diverse portfolio of investments across private equity, credit, and real estate.

Shares of the New York-based private equity firm have been on a major uptrend since the start of the year, gaining about 18% so far in 2024.

Source: Investing.com

As global markets continue to evolve, Apollo’s proven track record of successful investments and a disciplined approach to capital allocation positions it well for continued outperformance in the months ahead.

As per InvestingPro data, analysts have assigned Apollo Global Management a ‘Strong Buy’ rating, citing several factors that could drive the stock higher. These include the company’s strong investment performance, robust fundraising activities, and a favorable outlook for its various investment strategies.

In addition, Apollo’s focus on operational improvement and value creation within its proactive portfolio management approach bodes well for future earnings and sales growth.

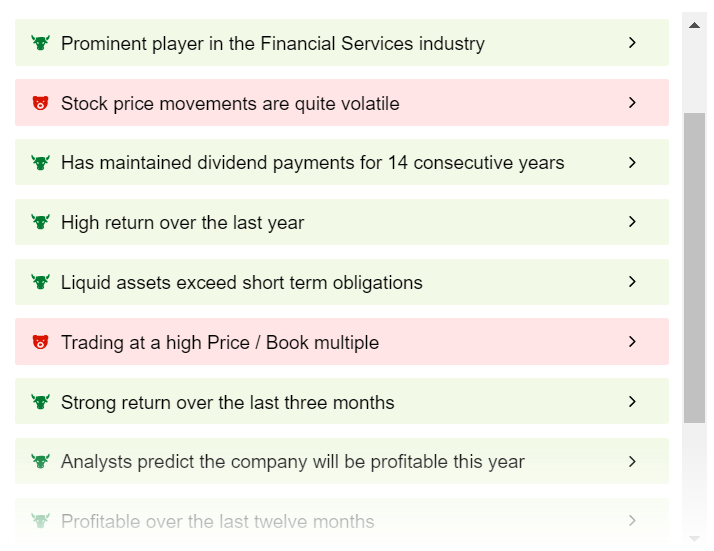

ProTips Headwinds: As ProTips points out, Apollo is in solid financial health condition, thanks to its pristine balance sheet and a robust profitability outlook.

Source: InvestingPro

Additionally, it should be noted that the company has maintained its dividend payout for 14 years running, demonstrating the strength of its underlying business.

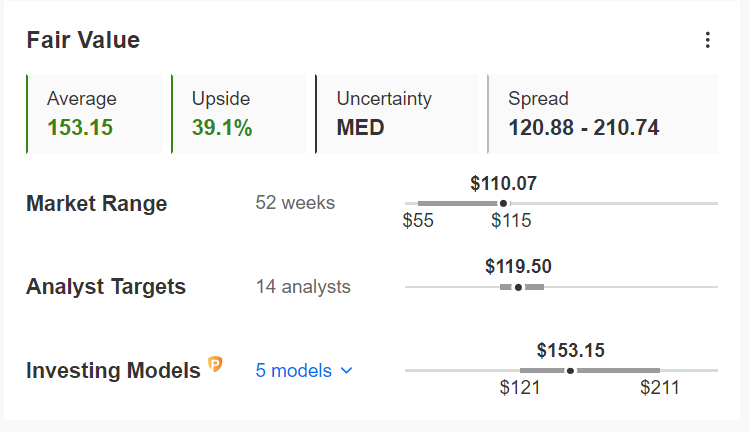

‘Fair Value’ Price Target: According to InvestingPro, APO stock is extremely undervalued and could increase 39.1% from Thursday’s closing price of $110.07.

Source: InvestingPro

That would bring shares closer to their ‘Fair Value’ price of $153.15.

2. KKR & Co.

- 2024 Year-To-Date: +16.9%

- Market Cap: $85.7 Billion

- Fair Value Upside: +9.6%

KKR is a leading global investment firm that manages multiple alternative asset classes, including private equity, infrastructure, and real estate.

The New York-based investment management company has seen its stock jump roughly 17% since the start of 2024.

Source: Investing.com

Investors looking for strong buy opportunities may find KKR a worthy addition to their portfolios. Like Apollo, KKR has garnered a ‘Strong Buy’ recommendation from analysts, who see significant upside potential for the stock.

Key drivers of this bullish sentiment include KKR’s strong investment performance as well as a favorable macroeconomic environment for alternative investments.

Additionally, KKR’s focus on deploying capital into high-growth sectors and its ability to unlock value through operational improvements position the company for continued success.

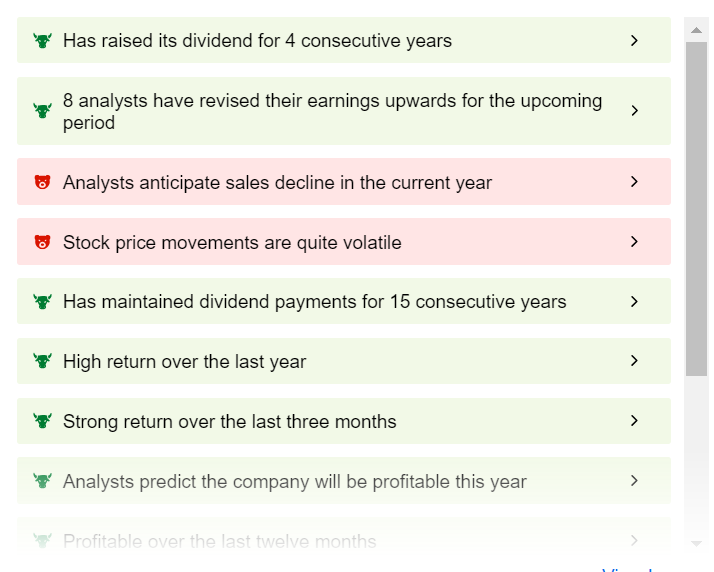

ProTips Headwinds: As seen below, InvestingPro paints a mostly positive picture of KKR’s financial health, highlighting its upbeat earnings prospects, rising net income, and overall strong profitability outlook.

Source: InvestingPro

ProTips also mentions that KKR has maintained its annual dividend payout for 15 consecutive years – and it has raised it in the last four years – thanks to increasing free cash flow levels.

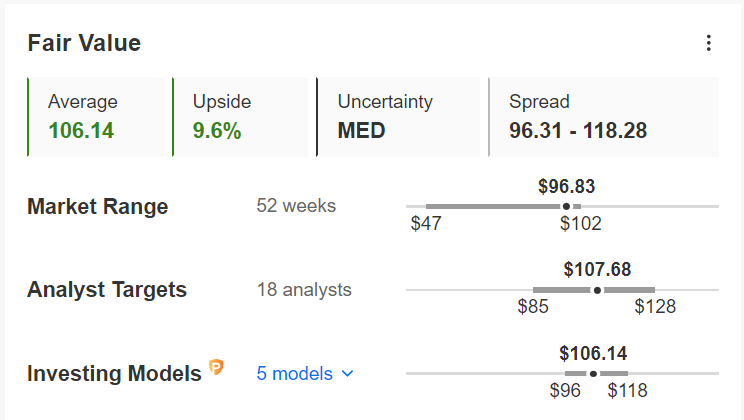

‘Fair Value’ Price Target: According to InvestingPro, KKR’s ‘Fair Value’ price target implies approximately 10% upside potential ahead.

Source: InvestingPro

Such a move would take shares to $106.14 from last night’s closing price of $96.83.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Subscribe Today!

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.