In an era where traditional investment landscapes are becoming increasingly volatile, a distinctive shift in wealth management strategies has emerged, marking a profound transformation in how the affluent secure their legacies. Amidst this evolving financial panorama, family offices—private entities dedicated to preserving and augmenting the wealth of the ultra-rich—have quietly yet significantly altered their investment portfolios. A recent survey by KKR reveals a compelling trend: a surge in allocations to alternative assets, distinguishing these exclusive entities from their institutional counterparts.

The Rising Tide of Alternative Investments

While the broader market witnesses a cautious pullback from hedge funds and private equity, family offices are boldly increasing their stakes in these alternative assets. According to the latest data, in 2023, family offices had a staggering 52% of their portfolios dedicated to alternative investments, a notable jump from 42% just a year prior. This strategic pivot reflects not only the unique investment horizon of family offices, which spans multiple generations, but also their adeptness at leveraging the current market dynamics. As banks and traditional lenders retract their funding to companies, family offices are stepping in, ready to capitalize on the opportunities this retreat presents.

Strategic Choices in Uncertain Times

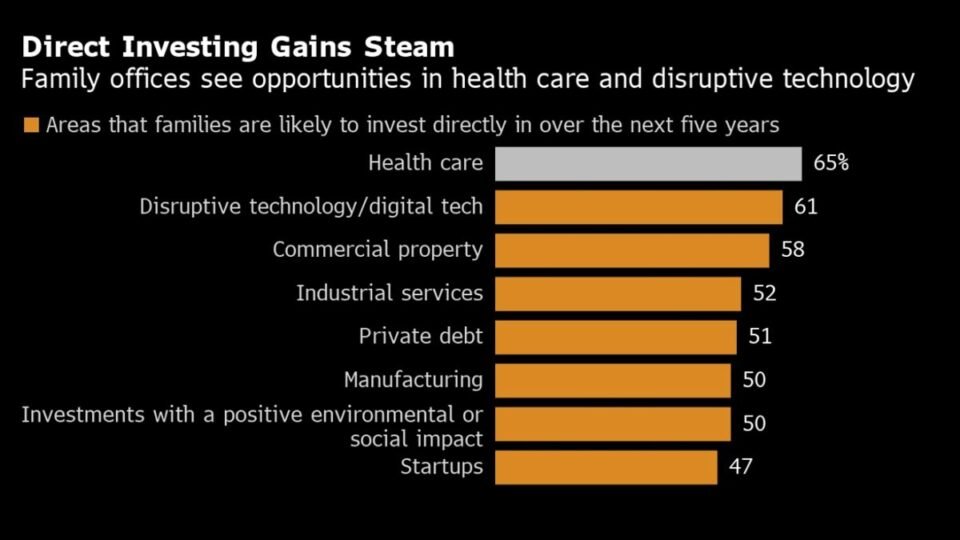

Amidst global financial uncertainty, family offices are not merely diversifying but are strategically moving capital from more liquid assets like cash and stocks into alternatives. Their favourites include private credit, infrastructure, private equity, and commodities. This shift is not a hasty reaction but a calculated move to align investments with long-term growth objectives. Moreover, the real estate sector, especially data centers, logistics, and warehouses, is drawing significant interest from family offices, driven by the digital economy’s insatiable demand for infrastructure. Another unexpected yet strategic pivot is towards the oil and gas sector, where family offices are identifying opportunities amidst forced selling by other investors.

Enhancing Operations and Risk Management

On the operational front, the North American Family Office Report 2022 by Campden Wealth highlights an interesting trend: a 33% increase in staff numbers among family offices over the past year. This expansion underscores the growing complexity and breadth of services these entities provide, encompassing strategy, legacy, investment management, operational efficiency, technology, compliance, and governance. To navigate this intricate landscape, PwC’s Family Office Diagnostic assessment emerges as a crucial tool, offering family offices a roadmap for enhancing operations and managing risks effectively. This comprehensive approach ensures not just the growth but the sustainability of the wealth and legacies they are entrusted with.

In conclusion, the strategic shift towards alternative investments among family offices underscores a broader narrative of adaptation and resilience in the face of global financial uncertainties. By leveraging their unique position and long-term outlook, these entities are not just weathering the storm but are positioning themselves to thrive, ensuring the preservation and growth of wealth for generations to come. As the investment landscape continues to evolve, the role of family offices as pioneers of innovative wealth management strategies becomes increasingly significant, marking a new chapter in the annals of financial history.