Alternative Investment Fund (AIF) as a market has matured significantly by offering many alternative investment opportunities to investors, according to SEBI.

The factors which have fuelled growth of AIF market segment is India‘s thriving start-up ecosystem, supportive regulatory framework, a steadily growing pool of domestic investors, and unique investment opportunities with potentially higher returns.

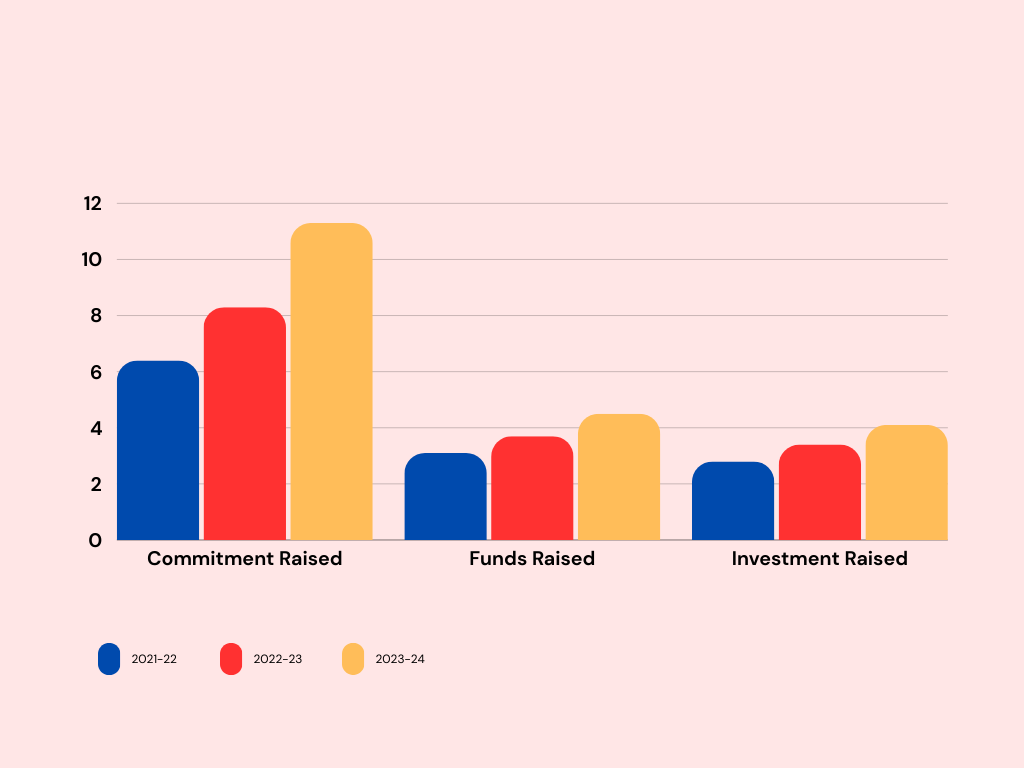

The Annual Report for 2023-24, published by market regulators finds that the commitments raised by AIFs have seen three-fold increase, reaching ₹ 11.3 lakh crore at the end of 2023-24 from ₹ 3.7 lakh crore at the end of 2019-20.

There has been an increment in amount of funds raised and investments made have grown substantially, reaching ₹ 4.5 and ₹ 4.1 lakh crore, respectively.

The report highlights that Category II AIFs have emerged as significant players in the AIF space, contributing to 80 per cent of the commitments raised, 71 per cent of the funds raised, and 68 per cent of the investments made by the end of 2023-24.

There has also been an active registration of 195 new AIFs during the year, bringing the total number of registered AIFs to 1,283 by the end of 2023-24.