To print this article, all you need is to be registered or login on Mondaq.com.

1 Legislative and regulatory framework

1.1 In broad terms, which legislative and regulatory provisions

govern alternative investment funds in your jurisdiction?

The establishment and functioning of alternative investment

funds (AIFs) in India are regulated by the Securities and Exchange

Board of India (SEBI) through the comprehensive framework provided

in the SEBI (Alternative Investment Funds) Regulations, 2012

(‘AIF Regulations’), as amended from time to time. Along

with these regulations, SEBI issues guidelines and circulars that

help to shape the regulatory landscape for AIFs.

AIFs must also adhere to various regulatory frameworks,

including:

- the SEBI (Intermediaries) Regulations, 2008;

- the Prevention of Money Laundering Act, 2002;

- the SEBI (Foreign Portfolio Investor) Regulations, 2019 (if

AIFs are receiving the foreign investments from foreign portfolio

investors); - the Foreign Exchange Management Act, 1999 and applicable rules

and regulations thereunder such as: -

- the Foreign Exchange Management (Non-debt Instruments) Rules,

2019; - the Foreign Exchange Management (Mode of Payment and Reporting

of Non-Debt Instruments) Regulations, 2019; - the Foreign Exchange Management (Overseas Investment) Rules,

2022; and - the Foreign Exchange Management (Overseas Investment)

Regulations, 2022; and

- the Foreign Exchange Management (Non-debt Instruments) Rules,

- the Income Tax Act, 1961 and the applicable rules

thereunder.

An AIF excludes funds governed by:

- the SEBI (Mutual Funds) Regulations, 1996;

- the SEBI (Collective Investment Schemes) Regulations, 1999;

or - any other regulations under the purview of the SEBI for the

regulation of fund management activities.

Additionally, the AIF Regulations provide specific exemptions

from registration for entities such as:

- family trusts established for the benefit of

‘relatives’ as defined in the Companies Act, 1956; - employee welfare trusts or gratuity trusts established for the

welfare of employees; and - ‘holding companies’ as defined in Section 4 of the

Companies Act, 1956.

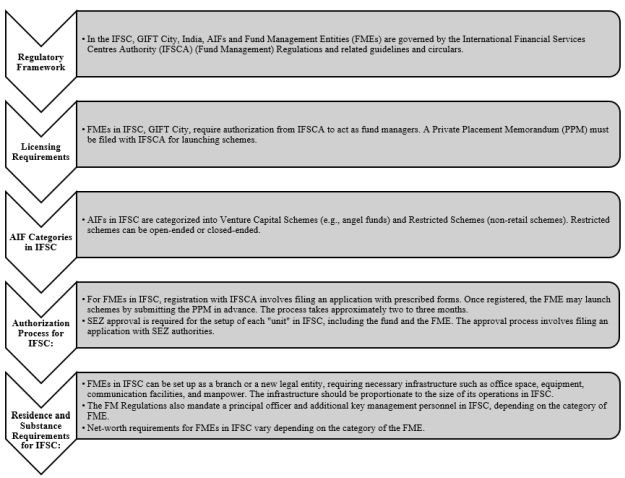

In the International Financial Services Centre (IFSC), situated

in Gujarat International Finance Tec (GIFT) City, funds and the

entities responsible for their management – termed ‘fund

management entities’ (FMEs) – operate under the

regulatory jurisdiction of the International Financial Services

Centres Authority (IFSCA). The regulatory framework governing these

entities is defined by the IFSCA (Fund Management) Regulations,

2022 (‘FM Regulations’), which are complemented by

additional guidelines and circulars issued by the IFSCA.

1.2 Do any special regimes or provisions apply to specific

types of alternative investment funds?

Category I AIFs:

- Investment focus: Start-ups, early-stage ventures, social

ventures, small and medium-sized enterprises (SMEs), infrastructure

and other sectors deemed socially or economically desirable by

government or regulators. - Includes: Venture capital funds (VCFs), SME funds, social

impact funds, infrastructure funds, special situation funds and

others as specified. - Clarification: Funds perceived to have positive spillover

effects on the economy, eligible for incentives or concessions. The

trusts or companies formed under this category are construed as

‘venture capital companies’ or ‘VCFs’ as specified

under the Income Tax Act.

Category II AIFs:

- Investment scope: Excludes Categories I and III.

- Financial operations: Do not undertake leverage or borrowing

beyond day-to-day operational requirements and as permitted by the

AIF Regulations. - Includes: Private equity funds, debt funds without specific

government or regulatory incentives.

Category III AIFs:

- Investment strategy: Employ diverse or complex trading

strategies; may use leverage, including through derivatives (listed

or unlisted). - Includes: Hedge funds, funds aimed at short-term returns and

other open-ended funds without specific government or regulatory

incentives.

Specified AIFs under Regulation 19 of the AIF

Regulations:

- Angel funds:

-

- A sub-category of VCFs under Category I AIFs. They are allowed

to make investments in start-ups. - Investors include:

-

- individuals with:

-

- net tangible assets of at least INR 20 million, excluding the

value of the principal residence and early-stage investment

experience; - serial entrepreneur experience; or

- at least 10 years’ senior management experience;

- net tangible assets of at least INR 20 million, excluding the

- bodies corporate with a net worth of at least INR 100 million;

and - AIFs or VCFs registered under regulations.

- A sub-category of VCFs under Category I AIFs. They are allowed

- Special situation funds (SSF):

-

- Category 1 AIFs specialising in special situation assets

aligned with their investment objectives, and eligible to act as a

resolution applicant under the Insolvency and Bankruptcy Code,

2016. - An applicant can seek registration as an SSF, adhering to

Chapter II of the SEBI Regulations. - Each SSF scheme must specify its corpus, as determined by

SEBI. - Exclusive acceptance of investments from other AIFs is

prohibited, except those classified as SSFs.

- Category 1 AIFs specialising in special situation assets

- Corporate debt market development funds:

-

- Formed as a trust with a registered deed under the Registration

Act, 1908. - Seek registration as an AIF under Chapter II of the AIF

Regulations. - Closed-ended funds with a 15-year tenure, extendable with

SEBI’s approval. - Units offered to asset management companies and specified

debt-oriented schemes of mutual funds. - Investments in line with the SEBI (Mutual Funds) Regulations,

1996. - Manager or sponsor maintains a continuing interest of at least

INR 50 million. - Borrowing limit of up to 10 times the corpus, subject to

SEBI’s conditions.

- Formed as a trust with a registered deed under the Registration

Large-value funds (LVFs)/accredited funds: An

LVF for accredited investors refers to an AIF or a scheme within an

AIF. In this context:

- every investor – excluding the manager, sponsor and

employees or directors of the AIF, as well as employees or

directors of the manager – must qualify as an accredited

investor; and - each accredited investor must make a minimum investment of INR

700 million.

AIF categories in the IFSC in GIFT City:

- Authorised FMEs:

-

- Target accredited investors or those investing above a

specified threshold via private placement. - Invest in start-ups or early-stage ventures through the Venture

Capital Scheme. - Family investment funds investing in permitted asset classes

should register as authorised FMEs.

- Target accredited investors or those investing above a

- Registered FMEs (non-retail):

-

- Gather funds from accredited investors or those exceeding a

specified threshold through private placement. - Invest in securities, financial products and permitted asset

classes through restricted schemes. - Permitted to offer portfolio management services and act as

investment managers for the private placement of investment trusts

(real estate investment trusts (REITs) and infrastructure

investment trusts (InvITs)). - Have the flexibility to engage in activities allowed for

authorised FMEs.

- Gather funds from accredited investors or those exceeding a

- Registered FMEs (retail):

-

- Collect funds from all investors or a specific section under

one or more schemes. - Invest in securities, financial products and permitted asset

classes through retail or restricted schemes. - Can act as an investment manager for the public offer of

investment trusts (REITs and InvITs). - Have the authority to launch exchange-traded funds.

- Empowered to undertake activities allowed for authorised FMEs

and registered FMEs (non-retail).

- Collect funds from all investors or a specific section under

1.3 Do the legislative and regulatory provisions governing

alternative investment funds have extra-territorial reach?

The AIF Regulations encompass provisions that extend their reach

beyond India’s borders. In case of breaches involving both the

AIF Regulations and the Foreign Exchange Management Act (FEMA)

Regulations, SEBI and the Reserve Bank of India (RBI) have

regulatory powers. Notably, these powers are not limited to actions

against the AIF alone but extend to the AIF’s manager, sponsor

and its respective promoters.

In accordance with Regulation 15(1)(a) of the AIF Regulations,

AIFs are permitted to invest in securities of companies

incorporated outside India, subject to the following conditions or

guidelines set forth by the RBI and SEBI:

- SEBI Circular SEBI/HO/IMD/DF1/CIR/P/2018/103/2018 of 3 July

2018 and SEBI Circular CIR/IMD/DF/7/2015 of 1 October 2015 set out

the legal framework under which overseas investment by AIFs and

VCFs takes place. This framework encompasses the allocation of

investment limits on a ‘first come, first served’ basis,

contingent upon availability within the block limit. The 2015

circular specifies that not more than 25% of an AIF’s

investible funds can be invested overseas. Further, provisions

within the framework govern: -

- the conditions for investment;

- the approval procedure;

- the timeline for investment;

- disclosure requirements; and

- regulatory compliance.

- Overseas investments by AIFs and VCFs

are subject to the Foreign Exchange Management (Transfer or Issue

of Any Foreign Security) Regulations, 2004, including amendments

and related directions as issued by the RBI from time to time. Such

AIFs and VCFs must also comply with any other FEMA regulations and

RBI guidelines, as amended from time to time, with respect to any

structure which involves the overseas direct investment route. AIFs

and VCFs must report on the utilisation of overseas limits within

five working days through the SEBI intermediary portal. Failure to

utilise the allotted overseas limit within the stipulated six-month

period will necessitate reporting to SEBI within two working days

post-expiry. In the event of a decision to surrender the allocated

overseas limit, reporting to SEBI is required within two working

days of the date of such determination. These disclosure

requirements are aimed at facilitating the monitoring of

utilisation of overseas investment limits allotted by SEBI. - As outlined in SEBI Circular SEBI/HO/AFD-1/PoD/CIR/P/2022/108

of 17 August 2022, the requirement to have an Indian connection has

been removed for AIFs and VCFs making overseas investments. AIFs

and VCFs are only permitted to invest in investee companies

overseas which are incorporated in jurisdictions in which the

securities market regulator is either: -

- a signatory under Appendix A of the International Organization

of Securities Commission’s (IOSCO) Multilateral Memorandum of

Understanding (MoU), such as Luxembourg and the Netherlands;

or - a signatory to a bilateral MoU with SEBI, such as the United

States, Mauritius and Singapore.

- a signatory under Appendix A of the International Organization

Further, to address the impact of the Prevention of Money

Laundering Act, 2002 and the FEMA Regulations on AIFs, and in

alignment with the Financial Action Task Force’s (FATF)

anti-money laundering guidelines, SEBI issued a Master Circular on

Anti-Money Laundering (AML) and Countering the Financing of

Terrorism (CFT) on 15 October 2019, along with subsequent circulars

to ensure adherence to the specified guidelines.

In the event of non-compliance with the AIF Regulations or any

SEBI directions, Section 15EA of the SEBI Act, 1992 provides for

the imposition of penalties of at least INR 100,000, which may

extend to INR 100,000 for each day that the failure persists, with

a maximum penalty of INR 10 million or three times the gains

derived from the failure, whichever is higher. Furthermore, the

SEBI circular of 1 October 2015 prescribes reporting standards for

FDI in AIFs. Failure to adhere to the prescribed reporting norms

for AIFs will entail severe consequences, including a prohibition

on the non-compliant entity from receiving any additional foreign

investment, including indirect foreign investment. Furthermore,

such non-compliance will be considered a contravention of the FEMA,

thereby subjecting the entity to potential penalties and/or the

confiscation of any currency, security or other assets associated

with the contravention.

1.4 Are any bilateral, multilateral or supranational

instruments in effect in your jurisdiction of relevance to

alternative investment funds?

SEBI sought to foster international collaboration by signing a

bilateral MoU on 28 July 2014 with securities market regulators

from 27 member states of the European Union/European Economic Area

(EEA). This MoU is centred on consultation, cooperation and the

exchange of information pertinent to the supervision of AIF

managers. Notably, India has also extended its collaborative

efforts by signing a separate bilateral MoU with Gibraltar on 2

February 2018.

SEBI has bolstered global regulatory partnerships through

multiple MoUs with international counterparts, including IOSCO

multilateral and bilateral MoUs. These collaborations facilitate

cross-border cooperation and information exchange for regulatory

and enforcement purposes. A comprehensive list of SEBI’s MoUs

with securities regulators worldwide can be found at www.sebi.gov.in/department/office-of-international-affairs-36/oia-bilateral.html

This collaborative approach is aligned with global regulatory

efforts, particularly within the framework of IOSCO. Regulatory

bodies worldwide work collectively to enforce laws and regulations

within their jurisdictions, fostering a cohesive regulatory

environment. India, which is a signatory to various bilateral tax

and investment protection treaties, prioritises the resolution of

double taxation issues related to income. This commitment is

especially crucial for cross-border fund structures and

investments, emphasising India’s dedication to facilitating

seamless and compliant cross-border financial activities.

1.5 Which bodies are responsible for regulating alternative

investment funds in your jurisdiction? What powers do they

have?

SEBI is the primary regulator of India’s securities market,

with a mission to:

- protect investors’ interests; and

- oversee the development of the market.

SEBI has extensive powers under the SEBI Act and the AIF

Regulations, including the ability to:

- conduct inspections, searches and seizures;

- impose penalties; and

- bar individuals from accessing capital markets.

SEBI also offers non-binding guidance on the interpretation of

the AIF Regulations. In accordance with the SEBI Circular of 21

July 2016 and Rule 9(l)(1) of the Prevention of Money Laundering

(Maintenance of Records) Amendment Rules, 2015, SEBI-registered

intermediaries must conduct the initial know-your-customer (KYC)

process for their clients. This includes in-person verification and

the prompt uploading of investor/client data to both the Central

KYC Records Registry and the KYC Registration Agency system within

10 days of establishing an account-based relationship with an

investor/client.

The RBI, as the central bank, operates under the RBI Act 1934,

as amended from time to time and regulates foreign exchange through

the FEMA Regulations. The RBI’s jurisdiction covers:

- foreign exchange inflows;

- downstream investments;

- sectoral caps;

- pricing norms; and

- anti-money laundering.

The RBI compels regulated entities to report suspicious

transactions to the Financial Intelligence Unit – India

(FIU-India).

Additionally, FIU-India, operating under the Department of

Revenue within the Ministry of Finance, functions as the central

national agency tasked with receiving, processing, analysing and

disseminating information pertaining to suspicious financial

transactions.

Further, the income tax authorities oversee the taxation of both

funds and their investors, ensuring compliance through filing

requirements and audits. Under the tax rules, the income tax

authorities are empowered to recover tax either from the trustee or

from the beneficiaries (ie, investors) directly. The trustee has

the option to settle the entire tax liability at the AIF level.

Additionally, the trustee, acting as a representative assessee, has

the authority to recover from investors any taxes paid on their

behalf.

In the IFSC located in GIFT City, funds and FMEs are governed by

the FM Regulations and the guidelines and circulars issued by the

IFSCA. The primary objectives of the IFSCA are to:

- enhance the ease of conducting business within the IFSC;

and - establish a regulatory framework of global standards.

Beyond overseeing the types of transactions conducted within the

IFSC, the IFSCA is tasked with regulating the operations of

entities engaged in business transactions within the IFSC.

These authorities are proactive regulators that engage with

industry organisations and stakeholders to enhance the regulation

of AIFs. They issue guidance, FAQs and master circulars for

clarity, and often release consultation papers and draft guidelines

to seek feedback before major regulatory changes.

1.6 To what extent do the regulators cooperate with their

counterparts in other jurisdictions?

SEBI has cemented its commitment to international regulatory

cooperation through the signing of diverse agreements. These

include the IOSCO multilateral MoUs, supplemented by the IOSCO

enhanced multilateral MoUs, along with bilateral MoUs. These

agreements collectively aim to elevate cross-border cooperation and

foster seamless information exchange for regulatory and enforcement

purposes.

In addition to these global initiatives, SEBI has fostered

international collaboration by signing a bilateral MoU on 28 July

2014 with securities market regulators from 27 member states of the

European Union/EEA. This MoU is centred on consultation,

cooperation and the exchange of information pertinent to the

supervision of AIF managers. Notably, India has also extended its

collaborative efforts by signing a separate bilateral MoU with

Gibraltar on 2 February 2018.

India has also entered into bilateral tax information exchange

agreements with 21 jurisdictions and is a party to the Multilateral

Convention of Mutual Administrative Assistance in Tax Matters. As

such, it can exchange information with such jurisdictions, subject

to the receipt of valid requests.

Crucially, India’s membership of the FATF underscores its

active role in global efforts to combat money laundering and

terrorist financing. The RBI, in collaboration with the FATF,

engages in collaborative endeavours with fellow member nations.

These include:

- executing essential measures;

- conducting assessments; and

- advocating for the universal acceptance and implementation of

relevant measures on a global scale.

2 Form and structure

2.1 What types of alternative investment funds are typically

found in your jurisdiction?

The various types of alternative investment funds (AIFs)

commonly encountered in India are described in question 1.2.

2.2 How are these alternative investment funds typically

structured?

In accordance with the SEBI (Alternative Investment Funds)

Regulations, 2012 (‘AIF Regulations’), the Securities and

Exchange Board of India (SEBI) allows the establishment of an AIF

in the form of:

- a trust;

- a limited liability partnership (LLP);

- a company; or

- a body corporate.

However, trusts are the prevailing choice for AIF structures due

to specific legal, regulatory, tax and commercial

considerations.

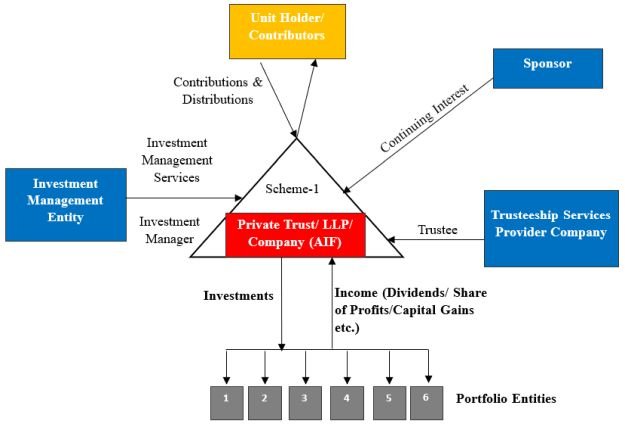

Structure:

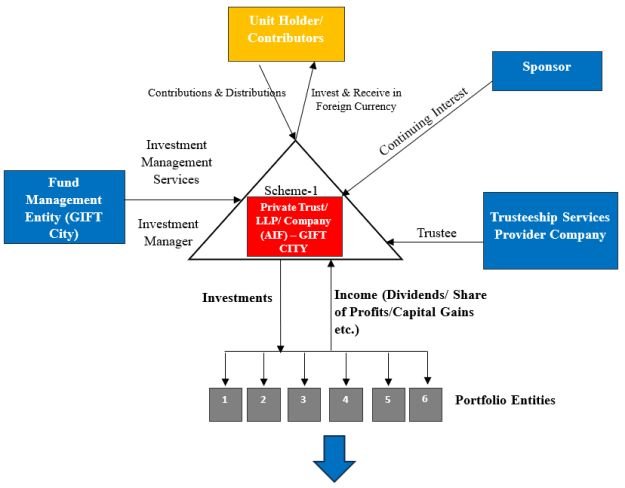

Structure in the International Financial Services Centre

(IFSC) Gujarat International Finance Tec City:

Inbound investments (AIFs in IFSC)

- Offshore shares, debt, derivatives, mutual funds etc

- Securities listed on IFSC exchange

- Companies in IFSC

- Indian shares, debt, derivatives, mutual funds etc

- Indian listed and unlisted companies

- Units of AIFs, REITs, InvITs

Outbound investments (AIFs in the IFSC):

- Offshore shares, debt, derivatives, mutual funds etc

- Foreign Securities listed on IFSC exchange

- Companies in IFSC

Under Indian law, a trust does not possess a distinct legal

identity and relies on the legal personality of the trustee.

Consequently, the trustee has the legal ownership of the trust

property, while investors are the beneficial interest holders in

the trust. Investment management agreements are formal legal

documents that grant investment managers the authority by trustees

to oversee and manage capital on behalf of investors.

In contrast, LLPs and companies possess separate legal

identities, with investors participating as partners or

shareholders in LLPs and companies registered as AIFs, although

such arrangements are relatively uncommon.

Certain vehicle types – such as family trusts, employee

stock ownership plan trusts, employee welfare trusts, gratuity

trusts and securitisation trusts – are excluded from the

definition of an AIF.

2.3 What are the advantages and disadvantages of these

different types of structures?

Company:

| Advantages | Disadvantages |

| It possesses a distinct legal identity and

perpetual continuity. |

Establishing a company entails meticulous

planning, paperwork and navigating through various stages before formal registration. |

| The liability of shareholders is limited to their

invested capital. |

Essential components such as the capital

structure, constitution, and accounts must be made public through the submission of the necessary documents to the registrar of companies. |

| It features the separation of ownership and

management, with the authority vested in the board of directors. |

It is subject to more stringent compliance and

reporting requirements, leading to increased operational costs. It must also adhere to rigorous accounting and auditing standards. |

| It is a legal entity that may sue and be sued in

its own name. |

The dissolution process can also be more

time-consuming compared to that for trusts. |

LLP:

| Advantages | Disadvantages |

| It has a separate legal identity and a perpetual

existence. |

Designated partners bear unlimited liability to

ensure partnership compliance with applicable laws; and personal assets of partners may be attached in case of fraudulent actions against LLP creditors |

| Partners enjoy limited liability, which is tied to

their capital contributions. |

Some financial institutions may be restricted from

investing in an LLP, limiting capital-raising opportunities. |

| It is subject to fewer compliance requirements

than a company. |

LLPs with foreign partners may face exchange

control limitations on investments in investee companies. |

| There is no limit on the number of partners,

subject to a 1,000-investor restriction imposed by the AIF Regulations; and there is no requirement for a trustee in AIF management. |

The establishment and dissolution processes can be

lengthier than those for trusts. |

Trust:

| Advantages | Disadvantages |

| It is relatively easy to establish and wind up,

providing flexibility in pursuing commercial objectives. |

A notable disadvantage is the potential imposition

of tax at the maximum marginal rate if the trust is structured as a discretionary trust or if the beneficial interests of investors remain uncertain, as seen in hedge funds, particularly for Category III AIFs. |

| It is subject to fewer statutory disclosure

requirements compared to companies or LLPs. |

|

| Regulatory compliance under the Trusts Act is

minimal, resulting in management cost savings. |

|

| Launching multiple schemes under a single trust

structure offers a flexibility that may not be as feasible for LLPs and companies. |

|

Each legal structure has its own advantages and disadvantages,

making the choice of structure dependent on specific business needs

and objectives.

2.4 What are the most widely used alternative investment funds

structures used in your jurisdiction?

The trust stands out as the pre-eminent AIF structure, driven by

its alignment with specific legal, regulatory, tax and commercial

considerations.

Of the different categories of AIFs, Category II is favoured due

to its flexibility in structuring investment strategies and its

sector-agnostic nature. This category accommodates the formation of

private equity funds and real estate funds. In India, the Category

II AIF is extensively adopted, given its versatility, enabling

managers to articulate comprehensive investment policies and

objectives for the AIF.

2.5 Is there a preferred alternative fund structure for

particular investment strategies (ie, hedge fund/private

credit/private equity)?

Hedge funds: Hedge funds serve as investment

vehicles that draw in private investors and strategically employ a

diverse array of trading and investment strategies across domestic

and international markets. They actively oversee their portfolios,

utilising both long and short positions in traditional securities,

alongside holdings in listed and unlisted derivatives.

Category III AIFs exhibit versatility by investing across a

spectrum that includes:

- securities of both listed and unlisted investee companies;

- derivatives;

- complex or structured products; and

- other AIF units.

They can be either open-ended or closed-ended funds, with the

latter adhering to a minimum tenure of three years. They are

preferred investment strategies for hedge funds and private

investment in public equity (PIPE) funds. They employ a wide array

of trading strategies and leverage, encompassing investments in

both listed and unlisted derivatives. Notably, the government

provides no specific incentives or concessions for investments in

these funds. Category III AIF funds, focusing on public equities,

exhibit lower liquidity risk. Conversely, those engaged in real

estate and private equity ventures carry a higher level of

risk.

Private credit and private equity: ‘Private

credit’ refers to a form of debt financing extended by non-bank

lenders or funds that is not publicly issued or traded in open

markets. The private credit market has garnered substantial

attention from both high-net-worth individuals and institutional

investors due to its distinct characteristics and appeal.

Private equity funds serve as investment vehicles created to

aggregate capital from institutional investors and high-net-worth

individuals. These funds leverage the pooled capital to acquire

equity stakes in private companies, strategically aimed at

generating significant returns on investment.

Category II funds are specifically designed for private equity,

private credit and distressed assets funds. An AIF falling under

this category can exclusively invest in securities,

encompassing:

- non-convertible debentures;

- convertible cumulative debentures;

- optionally convertible debentures; or

- other variations of debt securities.

AIFs, including Category II funds, are constrained to investing

solely in shares and securities, as outlined in Section 2(h) of the

Securities Contracts (Regulations) Act, 1956. An important

restriction for AIFs is the prohibition against providing loans.

However, this restriction does not apply to special situation funds

(SSFs). It is imperative that SSFs adhere to the due diligence

requirements mandated by the Reserve Bank of India for their

investors.

Specifically, a debt fund registered under Category II primarily

focuses on investing in debt or debt securities of both listed and

unlisted investee companies in accordance with its stated

objectives.

2.6 Are alternative investment funds required to have a local

administrator appointed?

In India, the establishment of an investment fund necessitates

mandatory registration as an AIF, unless the fund qualifies for a

specific exemption. SEBI mandates that an AIF must be managed by a

fund manager that is established in India. This regulatory

requirement ensures that AIFs operating in the Indian market are

overseen by managers which are locally based and accountable to the

Indian regulatory authorities.

According to the AIF Regulations, a manager appointed by an AIF

to oversee its investments can be an individual or an entity based

in India. Managers are commonly structured as companies or LLPs.

Investments made by an AIF are categorised as investments by

residents under exchange control norms, contingent upon both the

manager and the sponsor of the AIF being residents owned (with more

than 50% ownership) and controlled. Where either the manager or the

sponsor does not meet the criteria of being resident-owned or

controlled, investments made by the AIF are designated as

‘downstream investments’ or ‘indirect foreign

investments’ by the AIF. In such instances, compliance with the

Foreign Exchange Management Act becomes mandatory.

In the IFSC, fund management entities have the flexibility to

take on various forms, including:

- companies, trusts, LLPs or branches thereof; or

- any other form specified by the IFSC Authority.

2.7 Are alternative investment funds required to appoint a

local custodian to hold assets? If yes, what legal protections are

in place to protect the alternative investment fund’s

assets?

In India, AIFs must appoint a custodian for the safekeeping of

their assets, as per the regulatory framework established by SEBI.

The custodian plays a crucial role in ensuring the security and

protection of the AIF’s assets.

The sponsor or manager of the AIF must engage a custodian

registered with SEBI for the safekeeping of securities if the

corpus of the AIF exceeds INR 5 billion. A Category III AIF must

appoint a custodian, irrespective of its corpus size. Additionally,

in the case of Category III funds dealing with commodity

derivatives involving physical settlement, the appointed custodian

is responsible for safeguarding the received securities and

goods.

Furthermore, for Category I and Category II AIFs engaged in

credit default swaps, the sponsor or manager must:

- appoint a custodian registered with SEBI; and

- adhere to specific terms and conditions stipulated by

SEBI.

Further, in recently published consultation paper, SEBI mandated

all AIFs, regardless of corpus, to appoint a custodian.

2.8 Is it possible for an alternative investment fund to

redomicile to your jurisdiction? If yes, what considerations are

required and what are the steps involved?

Regulation 2(1)(q) of the AIF Regulations specifies that a

‘manager’ is an individual or entity appointed by the AIF

to oversee its investments. As per SEBI’s practical

requirements, the investment manager is expected to be an

individual or entity located in India. In situations where foreign

managers seek to establish funds domiciled in India, the investment

manager may take the form of a subsidiary or a distinct entity set

up within India.

Currently, there are no provisions allowing the re-domiciliation

of funds into India. An AIF must be established within India,

taking the form of a trust, a company or an LLP.

3 Authorisation

3.1 Must alternative investment funds be authorised or licensed

in your jurisdiction?

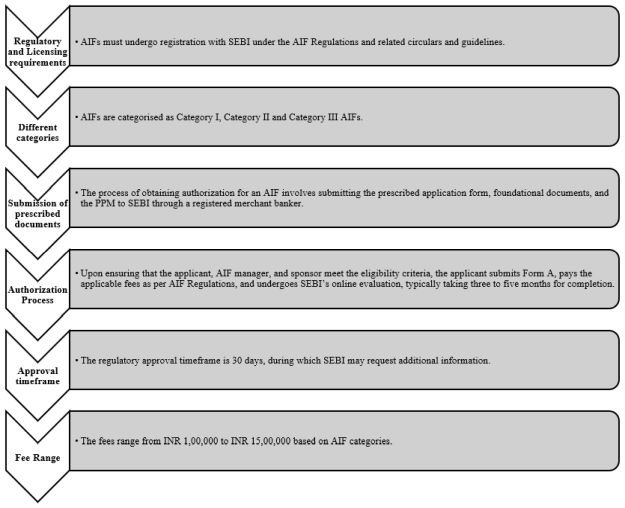

Alternative investment funds (AIFs) must register with the

Securities and Exchange Board of India (SEBI) under the SEBI

(Alternative Investment Funds) Regulations, 2012 (‘AIF

Regulations’), necessitating the submission of a private

placement memorandum (PPM) to SEBI.

Within the International Financial Services Centre (IFSC),

situated in Gujarat International Finance Tec (GIFT) City, India,

funds and entities acting as fund management entities operate under

the regulatory framework established by the International Financial

Services Centres Authority (IFSCA) and must be registered with

IFSCA.

Please see question 3.3 and question 1.1 for more

information.

3.2 If so, what criteria must be satisfied to obtain

authorisation? Do any restrictions apply in this regard?

In deciding whether to grant a certificate and authorisation,

SEBI assesses eligibility based on the following conditions:

- The applicant’s constitutional documents (memorandum of

association for a company, trust deed for a trust or partnership

deed for a limited liability partnership (LLP)) must authorise it

to operate as an AIF. - The applicant must be restricted by its constitutional

documents from making a public invitation for securities

subscriptions. - In the case of a trust, the trust instrument must be in the

form of a deed and must have been duly registered under the

Registration Act, 1908. - If the applicant is an LLP, it must be properly incorporated

and the partnership deed must have been duly filed with the

registrar of companies under the Limited Liability Partnership Act,

2008. - If the applicant is a body corporate, it must be established

under central or state laws and must be permitted to engage in AIF

activities. - The applicant, sponsor and manager must be considered fit and

proper persons based on the criteria specified in Schedule II of

the SEBI (Intermediaries) Regulations, 2008. - The key investment team of the manager must have at least one

key member of personnel with a relevant certification and another

with professional qualifications in finance, accountancy, business

management, commerce, economics, capital market or banking, as

specified by SEBI. - The manager or sponsor must have the necessary infrastructure

and manpower for effective operations. - The applicant must clearly outline the investment objective,

targeted investors, proposed corpus, investment style or strategy

and proposed tenure of the fund or scheme at the time of

registration. - Verification must be conducted to ensure that neither the

applicant nor any entity established by the sponsor or manager has

previously been refused registration by SEBI.

3.3 What is the process for obtaining authorisation of

alternative investment funds and how long does this usually

take?

SEBI has established a prescribed application form for AIF

registration, which must be accompanied by the AIF’s

foundational documents and the PPM. This submission is facilitated

through a SEBI registered merchant banker. Key parties to the AIF,

such as the manager and sponsor, must provide certain declarations

and undertakings, along with a disciplinary history.

Upon ensuring that the applicant, the AIF manager and the

sponsor meet the eligibility criteria, the next step involves the

submission of an application for the issuance of a certificate

under the designated categories outlined in the AIF Regulations.

This application is facilitated through the completion of Form A,

as delineated in the First Schedule of the AIF Regulations.

Concurrently, the applicant must remit the non-refundable

application and registration fees, the details of which are

stipulated in the Second Schedule of the AIF Regulations.

A registered merchant banker, appointed by the manager, conducts

a thorough vetting of the placement memorandum and declarations. If

deemed adequate, a due diligence certificate is issued by the

merchant banker, stating that the disclosures are sufficient for

submission to SEBI, along with the relevant documents. The merchant

banker is also responsible for incorporating SEBI’s comments

into the placement memorandum. An exemption is granted to

large-value funds for accredited investors, subject to specific

conditions.

The entire application process is conducted online. According to

the AIF Regulations, SEBI is mandated to approve or reject the

application within 30 days. SEBI may request additional information

or documents during this period. Usually, the establishment and

registration process typically takes three to five months,

encompassing the time required for SEBI’s evaluation of the

application. This includes the timeframe for submission of the fund

documentation and AIF application (pre-formation formalities),

which usually takes around a month.

Amount to be paid as fees (as per Second Schedule of AIF

Regulations):

| Application fee | INR 100,000 |

| Registration fee for Category I AIFs other than

angel funds |

INR 500,000 |

| Registration fee for Category II AIFs other than

angel funds |

INR 1 million |

| Registration fee for Category III AIFs other than

angel funds |

INR 1.5 million |

| Scheme fee for AIFs other than angel funds | INR 100,000 |

| Re-registration fee | INR 100,000 |

| Registration fee for angel funds | INR 200,000 |

| Registration fee for corporate debt market

development funds (specified AIF as provided under Regulation 19 of these regulations) |

INR 500,000 |

Process flow for setting up an AIF in India as per the

AIF Regulations:

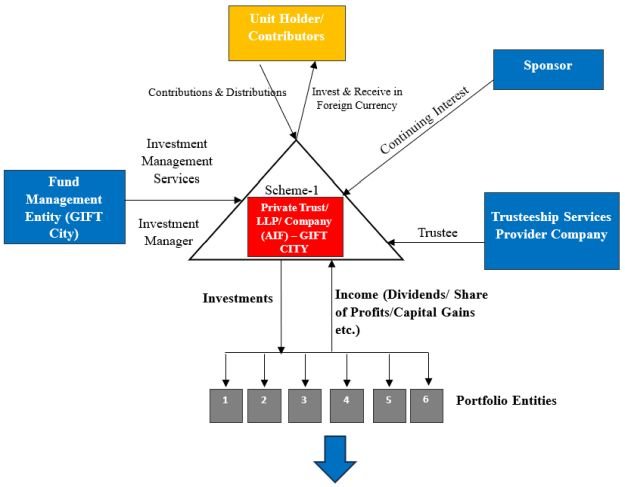

The establishment and registration process with the IFSCA

typically takes two to three months, encompassing the time required

for SEBI to evaluate the application.

Process flow for setting up an AIF in GIFT

City:

4 Management and advisory relationships

4.1 How are alternative investment fund managers and advisers

typically structured in your jurisdiction?

According to the Securities and Exchange Board of India (SEBI)

(Alternative Investment Funds) Regulations, 2012 (‘AIF

Regulations’), a manager appointed by the AIF to oversee its

investments may take the form of either a person or an entity

situated in India. Ordinarily, these managers are established as

companies or limited liability partnerships (LLPs).

The manager of a SEBI-registered AIF must be established in

India. During the certification process, SEBI will evaluate the

professional qualifications and experience of the manager’s key

investment team, who will serve as employees, partners or directors

of the investment manager. The SEBI application necessitates the

investment manager to showcase the essential infrastructure

required for effectively managing AIFs.

Within the International Financial Services Centre (IFSC), fund

management entities (FMEs) have the flexibility to adopt various

structures, such as a company, an LLP or a branch thereof.

Alternatively, they can choose any other form as specified by the

International Financial Services Centres Authority (IFSCA).

In the case of AIFs within the IFSC, FMEs can also be

established as a branch of an entity already registered or

regulated by a financial sector regulator in India or a counterpart

in a foreign jurisdiction that engages in similar activities. This

setup, whether a branch or a new legal entity, must possess

adequate infrastructure – including office space, equipment,

communication facilities and manpower – commensurate with the

scale of its operations in the IFSC. Additionally, if an FME opts

to establish a branch in the IFSC, the branch operations must be

segregated from those of the registered entity outside the IFSC.

The IFSCA (Fund Management) Regulations, 2022 (‘FM

Regulations’) also require the FME to have a principal officer

and additional key management personnel in the IFSC, depending on

the category of FME.

4.2 What are the advantages and disadvantages of these

different types of structures?

For a thorough exploration of the pros and cons related to

various structural choices, please see question 2.3. Additionally,

question 8.2 offers valuable insights into the tax considerations

relevant to AIF managers and investment advisers.

4.3 Must alternative investment fund managers be authorised or

licensed in your jurisdiction?

Investment managers of AIFs need not register separately with

SEBI in order to manage the AIF. Regulation is directed at the fund

rather than the manager, and the manager is automatically

registered when the fund completes its registration process.

However, anyone offering investment advice for remuneration to

clients or other entities must be registered with SEBI as an

investment adviser under the SEBI (Investment Adviser) Regulations,

2013.

Additionally, in the case of an FME in the IFSC, located in

Gujarat International Finance Tec (GIFT) City, authorisation from

the IFSCA is required to engage in such activities.

4.4 If so, what criteria must be satisfied to obtain

authorisation? Do any restrictions apply in this regard?

Requirements in India:

- The AIF manager must be based in India, with key investment

team members being employees, partners or directors of the

manager. - SEBI will assess the professional qualifications and experience

of the investment team during the registration process. - At least one key team member must have a professional

qualification in finance, accountancy, business management,

commerce, economics, capital markets or banking from a university

or institution recognised by the central government, a state

government or a foreign university. Alternatively, a charter from

the CFA Institute or any other qualification specified by SEBI will

be accepted. - At least one key team member must hold certifications as

specified by the SEBI periodically. - The manager or sponsor must have the necessary infrastructure

and manpower to effectively discharge its activities.

Requirements in GIFT City:

- Infrastructure:

-

- FMEs in the IFSC can be established as a branch or a new

entity. - An FME’s infrastructure – including office space,

equipment, communication facilities and manpower – must be

proportionate to its operations. The office should be dedicated,

secured and accessible only by authorised person(s) of the

FME. - For a branch set-up, there must be effective ringfencing of

operations from the registered entity outside the IFSC.

- FMEs in the IFSC can be established as a branch or a new

- Key personnel requirements:

-

- The FM Regulations mandate a principal officer and additional

key management personnel in the IFSC, depending on the category of

FME.

- The FM Regulations mandate a principal officer and additional

- Net worth requirements:

-

- Authorised FMEs: $75,000.

- Registered FMEs (non-retail): $500,000.

- Registered FME (retail): $1 million.

- Applicant and key individual requirements:

-

- The applicant, principal officer, directors/partners/designated

partners, key managerial personnel and controlling shareholders

must be fit and proper individuals at all times. A person is deemed

‘fit and proper’ if they have a record of fairness and

integrity, including financial integrity, good reputation,

character and honesty. - Disqualifications would include:

-

- convictions for moral turpitude, economic offences or

securities law violations; - pending recovery proceedings or winding-up orders;

- insolvency, unreleased discharge or unsoundness of mind;

- orders restraining financial product dealings within the last

three years; - any adverse regulatory orders within the last three years;

- financial unsoundness, wilful defaulter status or fugitive

economic offender declaration; and - any other disqualification specified by the authority.

- convictions for moral turpitude, economic offences or

- The applicant, principal officer, directors/partners/designated

4.5 What is the process for obtaining authorisation and how

long does this usually take?

AIF managers: As detailed in question 4.3,

there is no requirement for a manager to seek a separate

registration or licence for managing AIFs other than approvals as

mentioned in the SEBI (Investment Adviser) Regulations, 2013.

FMEs in GIFT City:

- The IFSC in GIFT City operates as a special economic zone

(SEZ), necessitating approval from SEZ authorities for each

‘unit’, including funds and FMEs. - To register as an FME, an application must be submitted to the

IFSCA in the prescribed format. - Upon receiving registration, the FME can proceed to launch its

scheme by submitting the private placement memorandum (PPM) to the

IFSCA in advance. - The setup and registration process with the IFSCA typically

takes around two to three months.

4.6 What other requirements or restrictions apply to

alternative investment fund managers and advisers in your

jurisdiction?

The following additional requirements/restrictions/obligations

apply to AIF managers:

- The AIF, key management personnel, trustee, trustee company,

directors of the trustee company, designated partners or directors

of the AIF, managers and their key management personnel must adhere

to the specified Code of Conduct outlined in the Fourth Schedule of

the SEBI (Alternative Investment Funds) Regulations, 2012 (‘AIF

Regulations’). - The manager and either the trustee, the trustee company, the

board of directors or the designated partners of the AIF are

collectively responsible for ensuring compliance with the Code of

Conduct specified in the Fourth Schedule of the AIF

Regulations. - The manager is accountable for every decision of the AIF,

ensuring compliance with: -

- regulations;

- the terms of the placement memorandum;

- agreements with investors;

- the fund documents; and

- the applicable laws.

- The manager is responsible for ensuring that AIF decisions

comply with established policies and procedures, as well as other

internal policies, subject to conditions specified by SEBI. - The manager may form an investment committee (by any name) to

approve AIF decisions, subject to conditions specified by

SEBI. - If the corpus of the AIF exceeds INR 5 billion, the sponsor or

manager must appoint a custodian registered with the SEBI for

safeguarding securities. - The manager is prohibited from providing advisory services to

any investor other than the clients of a co-investment portfolio

manager, as specified in the SEBI (Portfolio Managers) Regulations,

2020, for investments in securities of investee companies where the

AIF managed by it makes investments. - The manager, trustee, trustee company, board of directors or

designated partners must ensure the segregation and ring-fencing of

assets and liabilities of each scheme of an AIF. This extends to

segregating and ring-fencing bank accounts and securities accounts

for each scheme. - The manager must appoint a compliance officer responsible for

monitoring compliance with the provisions of the act, rules,

regulations, notifications, circulars, guidelines, instructions and

any other directives issued by the SEBI.

4.7 Can an alternative investment fund manager impose

restrictions on the issue, redemption or transfer of interests in

the funds under management?

An AIF manager has the authority to impose limitations on the

issuance, redemption or transfer of interests concerning the AIFs

under its management.

Investors/contributors are not permitted to solicit or

transfer/pledge any of their units, capital commitment, interests,

rights or obligation with regard to the AIF without the prior

written consent of the investment manager, which may be denied by

the investment manager. The transfer is subject to the following

requirements:

- The proposed transferee/pledgee is an eligible person;

- The proposed transfer/pledge will be subject to the execution

of necessary documentation by the transferee/pledgee and the

transferor/pledgor, as may be stipulated/prescribed/required by the

investment manager; and - The proposed transfer/pledge will not contravene any applicable

law or policy of the government or otherwise is not prejudicial to

the interests of the trust/fund. In the event of the transfer of

units by a contributor, the new contributor will execute a deed of

adherence acknowledging that it will be bound by the terms and

conditions of the trust documents, in accordance with the form

specified in the contribution agreement.

Conditions for redemption:

- Closed-ended AIFs: Closed-ended AIFs have the authority to

limit transfers or redemptions of investor interests at the

discretion of their investment managers. Closed-ended AIFs are not

allowed to provide priority exit rights to investors. - Open-ended funds: For open-ended funds, the circumstances under

which a manager can restrict redemptions are subject to detailed

disclosures in the PPM or as required by law. The suspension of

redemptions is permissible only under exceptional circumstances,

serving the best interests of the AIF investors. During the

suspension period, new subscriptions cannot be accepted by the

manager. Any suspension of redemptions for open-ended schemes must

be promptly reported to SEBI.

Post the redemption of units and payment of consideration, the

contributor will cease to be entitled to any rights in respect

thereof and accordingly its name will be removed from the list of

contributors with respect to such units. Units that are not

redeemed by the AIF will be redeemed as per the applicable laws

after the term comes to an end.

4.8 Are there any requirements regarding the ownership of

alternative investment fund managers? If so, please provide

details.

The investment manager of an AIF is acknowledged as a regulated

entity according to the AIF Regulations. By virtue of this

recognition, an AIF manager is eligible to receive up to 100%

foreign investment through the automatic route, circumventing the

need for government approval, unless the manager has engaged in

other unregulated financial services activities.

The AIF Regulations do not prescribe a maximum limit for

investments by the fund manager or sponsor. However, through its

informal guidance, SEBI has emphasised that the quantum of

investment by the fund manager or sponsor should align with the

continuing interest obligations applicable to the AIF, ensuring

coherence and compliance with regulatory requirements.

Category I and II AIFs: The manager of a

SEBI-registered AIF must be established in India. The manager or

sponsor of the AIF must maintain a continuing interest in the AIF,

constituting a minimum of 2.5% of the corpus or INR 50 million,

whichever is lower. This interest must take the form of a direct

investment in the AIF and should not be facilitated through the

waiver of management fees.

Category III AIFs: For Category III AIFs, the

stipulated continuing interest is higher, set at a minimum of 5% of

the corpus or INR 100 million, whichever is lower.

Moreover, the manager or sponsor must transparently disclose its

investment in the AIFs to investors. This disclosure ensures

clarity and openness regarding the financial involvement of the

manager or sponsor in the AIF, fostering trust and transparency

within the investment framework.

Angel funds: The manager or sponsor must

maintain a consistent stake in the angel fund of at least 2.5% of

the corpus or INR 5 million, whichever is lower. Importantly, this

continuing interest must not be achieved through the waiver of

management fees.

Corporate debt market development funds: The

manager or sponsor must maintain a continuing interest in the fund

amounting to no less than INR 50 million. This commitment must be

in the form of a direct investment in the fund and should not be

fulfilled through the waiver of management fees.

Change in control: SEBI typically asks AIF

managers during the application stage to provide information on the

shareholding or partnership interest of the manager entity.

Regulation 20(13) of the AIF Regulations stipulates that any change

in control of the manager or sponsor requires notification with and

approval by SEBI. SEBI may impose fees and set other conditions,

with which the AIF must comply. SEBI has issued the following

circulars providing guidance on the process and fee payment

requirements of change in control:

- SEBI Circular SEBI/HO/AFD-1/PoD/P/CIR/2022/155 of 17 November

2022 provides as follows in relation to the fee for a change in

control of manager/sponsor or a change in manager/sponsor of an

AIF: -

- A fee, equivalent to the AIF’s registration fee, is applied

for changes in control or management. - The fee must be paid by the manager or sponsor within 15 days

and cannot be passed on to investors. - If both the manager and sponsor change simultaneously, only a

single registration fee is charged. - No fee is charged in specific scenarios, such as where the

manager is taking control by replacing the sponsor or where

sponsors are exiting in AIFs with multiple sponsors. - Prior approval given by SEBI is valid for six months from the

approval date.

- A fee, equivalent to the AIF’s registration fee, is applied

- According to SEBI Circular CIR/IMD/DF/14/2014 of 19 June 2014,

read with SEBI Circular CIR/IMD/DF/16/2014 of 18 July 2014, the

following process must be followed by AIFs in case of a change in

control: -

- Existing unit holders that do not wish to continue after the

change should be given an exit option. They must be given at least

one month to express their dissent. - For open-ended schemes, two exit options are available:

-

- buying out units from dissenting investors at market price;

or - redeeming units by selling underlying assets.

- buying out units from dissenting investors at market price;

- For closed-ended schemes, the exit option involves buying out

units from dissenting investors. Prior to this, the units’

valuation is determined by two independent valuers and the exit is

at a value not less than the average of the two valuations. The

entire process, from the last date of the offer for dissent, should

be completed within three months.

- Existing unit holders that do not wish to continue after the

- SEBI Circular SEBI/HO/IMD-1/ DF9/CIR/2022/032 of 23 March 2022

has streamlined the process for approving changes in the control of

the sponsor and/or manager of an AIF involving a scheme of

arrangement under the Companies Act, 2013. The key points are

follows: -

- Applications for the change in control must be submitted to

SEBI before filing with the National Company Law Tribunal

(NCLT). - Upon ensuring compliance with the regulatory requirements, SEBI

will grant in-principle approval. - The in-principle approval is valid for three months from the

date of issuance. During this period, the applicant must apply to

the NCLT. - Within 15 days of the NCLT order, the applicant must

submit: -

- an application for final approval;

- a copy of the NCLT order approving the scheme;

- a copy of the approved scheme;

- a statement explaining any modifications and reasons; and

- details of compliance with SEBI’s in-principle approval

conditions.

- Applications for the change in control must be submitted to

4.9 Can alternative investment fund managers delegate to

third-party investment managers or investment advisers? If yes,

please provide details of any specific requirements.

The manager has the option to establish an investment committee,

subject to conditions set by the SEBI. Members of the investment

committee must ensure that their decisions align with specified

policies. However, this provision does not apply to an AIF where

each investor, excluding certain individuals affiliated with the

fund:

- has committed to investing at least INR 700 million; and

- has provided a waiver regarding compliance with this

regulation, as specified by SEBI.

Further, managers are bound by the SEBI Guidelines

CIR/MIRSD/24/2011 on Outsourcing of Activities of 15 December 2011.

SEBI’s outsourcing principles emphasise adherence to regulatory

guidelines, such as the following:

- The manager must conduct thorough due diligence when selecting

and monitoring third-party services. - A comprehensive policy must be in place to guide outsourcing

activities. - A risk management programme must be established.

- Outsourcing must not compromise obligations to customers and

regulators. - All outsourcing relationships must be governed by written

contracts outlining rights, responsibilities and expectations. - Additionally, steps must be taken to ensure the protection of

confidential information from unauthorised disclosure.

The outsourcing of core business activities and compliance

functions is prohibited.

4.10 Can alternative investment fund manager provide investment

management services to clients other than alternative investment

funds? If yes, do any additional requirements apply?

Managers can extend their investment management services beyond

AIFs. However, in doing so, they must:

- provide the relevant services;

- meet licensing requirements; and

- serve an appropriate clientele.

Importantly, these extended services must not conflict with the

regulations governing AIFs. Top of Form

They can engage in the following activities:

- They can provide portfolio management services to designated

mandate accounts by obtaining registration under the SEBI

(Portfolio Managers) Regulations, 1993. - They can also cater to retail funds in accordance with the SEBI

(Mutual Funds) Regulations, 1996. - Where resident Indian clients are advised, the manager must

secure registration under the SEBI (Investment Adviser)

Regulations, 2013.

The manager is restricted from offering advisory services to any

investor except the clients of the co-investment portfolio manager,

as outlined in the SEBI (Portfolio Managers) Regulations, 2020.

This restriction specifically applies to investments in securities

of investee companies where the AIF managed by the manager is

making an investment.

To comply with SEBI regulations, managers must meet some

requirements, which are outlined in questions 4.4 and 4.6.

5 Marketing

5.1 Is the marketing of alternative investment funds subject to

authorisation in your jurisdiction?

The Securities and Exchange Board of India (SEBI) (Alternative

Investment Funds) Regulations, 2012 (‘AIF Regulations’) and

the International Financial Services Centres Authority (IFSCA)

(Fund Management) Regulations, 2022 (‘FM Regulations’)

stipulate that AIFs can raise funds through private placement,

facilitated by the issuance of a private placement memorandum

(PPM). These regulations provide detailed guidelines on the

specific information required to be disclosed within the PPM. Given

the confidential nature of PPMs, they cannot be marketed directly.

Instead, only a concise summary document is shared and discussed.

Distributors exclusively engage with clients, while the fund pitch

and detailed explanations are conducted by the fund management

team, ensuring adherence to confidentiality and regulatory

protocols.

SEBI Circular SEBI/HO/AFD/PoD/CIR/2023/054 of 10 April 2023

grants AIF managers the authorisation to engage potential investors

through SEBI-registered intermediaries such as independent advisers

and portfolio managers. In this circular, SEBI clarified that

investors onboarded in the AIF through registered intermediaries

would participate via a ‘direct plan’ and should not be

subject to any placement fee by the AIF, as these investors are

already being charged by the registered intermediaries.

Conversely, managers also have the option to approach potential

investors through distributors, constituting an ‘indirect

plan’. For Category I and II AIFs, up to one-third of the total

distribution fee/placement fee may be paid to distributors upfront,

with the remaining fee disbursed on an equal trilateral basis over

the fund’s tenure. In the case of Category III AIFs, any

distribution fee/placement fee is to be charged to investors solely

on an equal trilateral basis. Notably, no upfront distribution

fee/placement fee should be directly or indirectly charged by

Category III AIFs to their investors.

Marketing AIFs through a PPM necessitates registration and

approval from the local regulator, SEBI. In the context of a fund

in the International Financial Services Centre (IFSC) at Gujarat

International Finance Tec City, the fund management entity (FME)

must proactively submit the PPM to the IFSCA for advance review.

Notably, for venture capital schemes in the IFSC, the filing of

scheme documents follows a streamlined process, known as the

‘green channel’, allowing schemes to be immediately opened

for subscription by investors upon filing with the IFSCA.

5.2 If so, what criteria must be satisfied to obtain

authorisation? Do any restrictions apply in this regard?

The PPM serves as the pivotal legal marketing document for an

AIF, encompassing comprehensive material information. Regulation 11

of the SEBI (Alternative Investment Funds) Regulations, 2012

(‘AIF Regulations’) stipulates that the PPM must encompass

essential details, including information about:

- the AIF;

- its manager;

- the key investment team;

- the sponsor;

- the fund’s investment objective, strategy and process;

- the target investors;

- the corpus;

- associated fees and expenses;

- the fund’s leverage approach; and

- restrictions on redemptions, transfers and withdrawals.

The PPM should also address:

- potential conflicts of interest;

- risk factors; and

- the disciplinary history of involved parties.

In cases where the AIF discloses a manager’s track record, a

benchmarking report is required. SEBI has prescribed a standardised

PPM format for most AIFs, exempting angel funds and those with each

investor committing a minimum capital contribution of INR 700

million.

For IFSC funds, the PPM must outline:

- the investment objective;

- the target investors;

- the proposed corpus;

- the investment style;

- the methodology;

- tenure;

- fees;

- risk management practices;

- leverage calculation; and

- key management personnel.

It should also include relevant information about the FME and

the scheme.

5.3 What is the process for obtaining authorisation and how

long does this usually take?

See question 5.1 for additional context on this query.

Typically, the documentation process for marketing and the AIF

application takes two to three weeks. Conversely, the vetting and

approval of the application, along with associated documentation by

SEBI, typically takes around two months.

5.4 To whom can alternative investment funds be marketed?

AIFs are designed for private placement and can be marketed

exclusively to a select group of sophisticated and private

investors, encompassing:

- funds of funds;

- government institutions;

- corporations;

- public sector undertakings;

- private banks;

- insurance companies;

- eligible pension funds;

- global development financial institutions;

- multilateral organisations; and

- high-net-worth individuals.

Indian entities such as banks, insurance companies and pension

funds are subject to sectoral regulators’ specific investment

restrictions in AIF units. Therefore, their investments must adhere

to these sectoral regulations in addition to compliance with the

AIF Regulations.

AIFs have the flexibility to attract investments from retail

investors, including high-net-worth individuals, with minimum

ticket sizes specified by the AIF Regulations or the FM

Regulations. For SEBI-registered AIFs, the standard minimum ticket

size is INR 10 million, although angel funds and special situation

funds have reduced requirements of INR 2.5 million and INR 100

million respectively. Exceptions to the minimum ticket size are

granted for:

- accredited investors;

- deemed accredited investors; and

- employees, directors and partners of the investment

manager.

SEBI has introduced the notion of an ‘accredited

investor’ in India. This accreditation is primarily determined

by:

- net-worth criteria; and

- endorsement from an accreditation agency.

Accredited investors are expected to be well informed and well

advised on investment matters. Consequently, regulatory relaxations

have been instituted to facilitate the involvement of accredited

investors and the pooling of such investors in large-value

funds.

For IFSC funds, the minimum ticket size is $150,000, with

similar exemptions for:

- accredited investors;

- deemed accredited investors; and

- employees, directors and partners of the investment

manager.

5.5 What are the content criteria that marketing materials for

alternative investment funds must satisfy?

Marketing materials for AIFs must adhere to the specified

requirements outlined in the AIF Regulations. The PPM must

encompass comprehensive information about both the AIF and the AIF

manager, with further details provided in question 5.2.

5.6 What other requirements or restrictions apply to marketing

materials for alternative investment funds?

The AIF Regulations strictly limit the marketing of AIFs to

private placement through the issuance of a PPM. Public advertising

for investment by the manager is not permitted.

AIFs are marketed through private placement, involving the

issuance of a PPM to individuals or entities both within and

outside India. However, no AIF can have more than 1,000

investors.

If an AIF is established as a company, it must adhere to the

private placement procedures outlined in the Companies Act,

2013.

To understand the direct and indirect plan of SEBI, please see

question 3.1.

5.7 Can alternative fund managers from other jurisdictions

market alternative investment funds in your jurisdiction without

authorisation?

An AIF is restricted from making a public offer or extending

invitations to the general public for the subscription of its

units. Instead, it is exclusively authorised to raise funds through

private placement, targeting sophisticated investors.

For resident Indians, offshore investments are subject to

adherence with:

- the conditions outlined in the Foreign Exchange Management

(Non-debt Instruments) Rules, 2019; and - the Liberalised Remittance Scheme of the Reserve Bank of

India.

The marketing offshore funds in India must be approached with

caution; and if the offer meets the criteria for a public offering

under Indian law, registration of the offering document is

obligatory.

5.8 Is the appointment of local marketing entities required in

your jurisdiction?

Individuals offering ‘investment advice’ to resident

Indians must obtain registration in accordance with the SEBI

(Investment Adviser) Regulations, 2013. Thus, local marketing

entities may be appointed subject to a condition that they are

regulated by SEBI. Offering marketing through unregulated entities

is not permitted. Therefore, the promotion of offshore funds to

Indian residents should be structured with legal counsel.

5.9 Is it possible to market alternative investment funds to

retail investors in your jurisdiction? If so, are there specific

requirements?

Please see question 5.4.

6 Investment process

6.1 Do any investment or borrowing restrictions apply to the

portfolios of alternative investment funds?

Alternative investment funds (AIFs) are limited to investing

solely in shares and securities as defined under Section 2(h) of

the Securities Contracts (Regulations) Act, 1956. AIFs are not

permitted to extend loans. However, this prohibition does not apply

to special situation funds (SSFs), which are allowed to obtain

‘stressed loans’ according to Clause 58 of the Master

Direction – Reserve Bank of India (Transfer of Loan

Exposures) Directions, 2021 (upon their inclusion in the Annex of

the Master Direction). These SSFs must adhere to the due diligence

requirements for their investors mandated by the Reserve Bank of

India.

In the International Financial Services Centre (IFSC),

closed-ended schemes of restricted (non-retail) funds and family

investment funds may venture into physical assets such as real

estate, bullion, art and other physical assets specified by the

IFSC Authority (IFSCA). Nevertheless, investments by an IFSC fund

in India are subject to the conditions applicable to foreign

investments in India. Depending on the nature of the investment and

the investment strategy, this could affect the nature of

instruments/securities in which investments may be made and

regulatory approvals may be required for certain investments.

The conditions applicable to Category I and II AIFs are as

follows:

- There is a maximum investment of 25% of investable funds in one

portfolio company. As per the SEBI (Alternative Investment Funds)

Regulations, 2012 (‘AIF Regulations’), ‘investable

funds’ are defined as “the corpus of the scheme of

Alternative Investment Fund net of expenditure for administration

and management of the fund estimated for the tenure of the

fund”. - Large-value funds (LVFs) in Categories I and

II can invest up to 50% of their investable funds in one portfolio

company. - Category I AIFs may have additional restrictions based on

sub-category – for example, infrastructure funds must invest

at least 75% in infrastructure projects.

The conditions applicable to Category III AIFs are as

follows:

- A maximum of 10% of their investable funds may be invested in

one portfolio company. However, in case of listed equity, the 10%

limit applies to either the investable funds or the net asset value

(NAV) of the scheme. - LVFs in Category III can invest up to 20% of their investable

funds in one portfolio company. However, in case of listed equity,

the 20% limit applies similarly to either the investable funds or

the NAV.

The conditions applicable to FMEs in the IFSC are as

follows:

- FMEs are restricted from investing more than 10% of the

scheme’s corpus. In the case of restricted, open-ended schemes,

the upper limit for investments in the securities of unlisted

companies is 25% of the scheme’s corpus. - Any substantial deviation from the fund strategy may be

implemented, contingent upon obtaining consent from at least

two-thirds of the investors by value.

Borrowings: Category I and II AIFs are

restricted from borrowing funds directly or indirectly, and from

engaging in any form of leverage, except to fulfil temporary

funding needs for a maximum of 30 days, on up to four occasions per

year, and not exceeding 10% of the investable funds.

In contrast, Category III AIFs have the flexibility to employ

leverage or borrowings, contingent upon investor consent and

subject to a maximum limit defined by the Securities and Exchange

Board of India (SEBI), which currently stands at twice the NAV.

Adequate disclosures are essential for both investors and SEBI.

SEBI Order QJA/KS/AFD-1/AFD-1-SEC/27020/2023-24 of 31 May 2023

pertains to Category I AIFs – specifically infrastructure

funds – and provides that the pledging the securities of

portfolio entities to raise capital at the portfolio entity level

goes against the AIF Regulations.

Under the IFSCA (Fund Management) Regulations, 2022, there are

no borrowing or leverage limitations, as long as the private

placement memorandum includes appropriate disclosures. Furthermore,

the respective FME must establish a robust risk management

framework aligned with the scheme’s complexity and risk

profile.

6.2 Are there any specific legal or regulatory requirements

regarding investments in particular assets?

The AIF Regulations mandate specific portfolio composition

requirements for different categories and sub-categories of

AIFs.

For Category I AIFs, the requirements are as follows:

- Venture capital funds must invest at least two-thirds of their

investible funds in unlisted equity shares or equity-linked

instruments of venture capital undertakings or companies listed or

proposed to be listed on small and medium-sized enterprise (SME)

exchanges. Additionally, up to one-third of their investible funds

can be invested in initial public offerings of venture capital

undertakings, debt instruments, preferential allotment of equity,

or equity-linked instruments of financially weak companies and

special purpose vehicles created for investment purposes. - SME funds must allocate a minimum of 75% of their investible

funds to unlisted securities, partnership interests of venture

capital undertakings, or investee companies that are SMEs or listed

on SME exchanges. - Social venture funds should invest a minimum of 75% of their

investible funds in unlisted securities or partnership interests of

social ventures. - Infrastructure funds must invest at least 75% of their

investible funds in unlisted securities, partnership interests of

venture capital undertakings, investee companies or special purpose

vehicles involved in infrastructure projects.

Category II AIFs must commit at least 50% of their investible

funds to unlisted investee companies.

Category III AIFs have no specific portfolio allocation

restrictions, except for the general diversification requirement,

enabling them to:

- invest in:

-

- listed or unlisted investee companies;

- derivatives; and

- complex products; and

- engage in commodity derivatives with physical settlement.