mbbirdy/E+ via Getty Images

Brookfield Asset Management Ltd. (NYSE:BAM), (TSX:BAM:CA) has achieved a negative return of -4.93% in 2024, including two earnings results where, in the last one, earnings came in line, and revenues were missed. BAM is an asset manager who has achieved in TTM Q1 24 $4.4 billion in fee revenue, $2.2 billion in fee-related earnings, and has a dividend yield of 3.69%. In this analysis, I will explain why I would sell these shares if I were to be holding them. For that, I will briefly describe their business overview, financial performance, valuations, and risks I see in this investment in the future.

Brookfield Asset Management – Business Overview

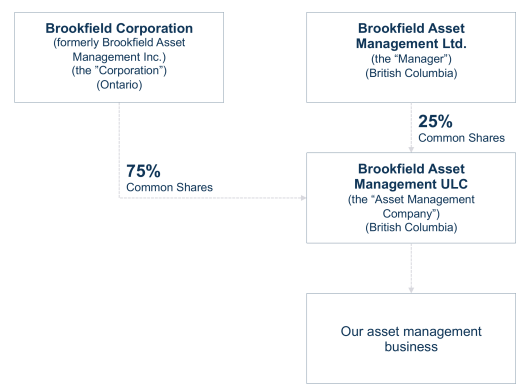

BAM 40-F

Brookfield Asset Management Ltd. is a holding company created to form a spin-off of Brookfield Asset Management ULC from Brookfield Corporation (BN) (formerly Brookfield Asset Management Inc.) in 2022. From there, Brookfield Corporation retained 75% of Brookfield Asset Management ULC shares, and Brookfield Asset Management Ltd. took the rest of the interest.

Brookfield Asset Management accumulated a total AUM of $929 billion in Q1, of which less than half comes from fee-bearing capital. This ratio is inferior to other alternatives, such as KKR & Co. Inc. (KKR) and Ares Management Corporation (ARES), which have a sounder composition of fee-bearing AUM to total AUM of around 80% and 62%, respectively.

AUM that does not generate fees could derive from funds that charge fees from invested capital rather than from committed capital or the company’s proprietary investments. If the former is predominantly the case, fee-bearing AUM is well positioned to increase significantly once uncalled capital is called. However, uncalled capital that is currently not paying fees sat at $50 billion in Q1, which is just approximately 11% of the gap.

Following this, BAM operates within five different verticals, which are;

- Credit & Other.

- Real Estate.

- Infrastructure.

- Renewable Power & Transition.

- Private Equity.

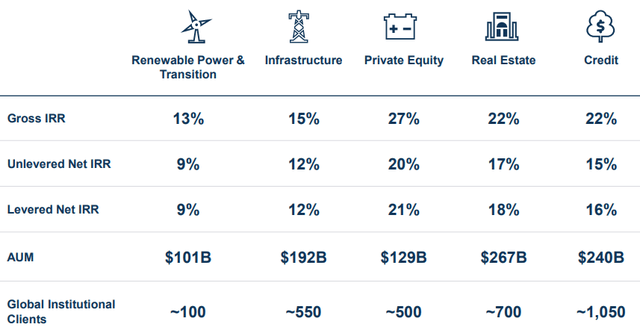

INVESTOR PRESENTATION – MAY 2024

Out of those, the company gives primary attention to discussing its Renewable Power & Transition revenue source in its presentations by presenting it always first. However, it is the business line with the lowest AUM, number of institutional clients, performance, and fee-bearing AUM growth.

On the other hand, Real Estate accumulates the most AUM, but in terms of fee-bearing AUM, Credit takes the lead with $181 billion, which is also driven by Oaktree, as BAM owns approximately 73% of the shares.

Now, when looking at fee-bearing capital growth from the historical financials presented by the company since Q2 22, FBAUM coming from Infrastructure funds has grown the most, followed by Credit funds, and again, Renewables funds exhibit the lowest growth.

| Fee-Bearing Capital ($B) | Q2-22 | Q1-24 | Change |

| Total Renewable Power and Transition Funds | 50 | 51 | 2% |

| Total Infrastructure Funds | 72.4 | 93 | 28% |

| Total Private Equity Funds | 39 | 40 | 3% |

| Total Real Estate Funds | 83 | 93.7 | 13% |

| Total Credit Funds | 147.8 | 181.2 | 23% |

| Total Fee-Bearing Capital | 392.2 | 459 | 17% |

BAM Supplemental Information Q1 24

Finally, from their product distribution, 86% of their fee-bearing AUM is in the form of long-term capital, which brings cash flow stability to management fees. Of that capital, 54% is in long-term private funds, 16% is in permanent capital vehicles, and 16% is in perpetual strategies. Last, the remaining 14% is in liquid strategies.

Financial Performance

| TTM 24 | TTM 23 | Change | |

| Total Fee Revenues | 4413.9 | 4163.2 | 6.0% |

| Fee-Related Earnings (per share) | 1.37 | 1.32 | 3.8% |

| Distributable Earnings (per share) | 1.36 | 1.33 | 2.3% |

| Stock Price (26/06) | $37.98 | $31.47 | 20.7% |

| P/FRE | 27.7x | 23.8x | 16.3% |

| P/DE | 27.9x | 23.7x | 18.0% |

Supplemental Information Q1 24 | Seeking Alpha

From the financial performance within major KPIs of an alternative asset manager, revenues, and earnings closely followed the fee-bearing AUM growth of 6.3% from a year ago. Total TTM fee revenue stood at $4.342 billion, which represented a 6.0% increase from the same figure of the year before. Nonetheless, fee-related earnings per share advanced at lower rates of 3.8%, and distributable earnings per share at 2.3%.

Now when gathering key multiples, the financial performances end up in a price-to-fee related earnings of 27.7x, which represents a 16.3% multiple expansion from a year ago. Similarly, price-to-distributable earnings extended 18.0% and sat at 27.9x.

BAM Price Action

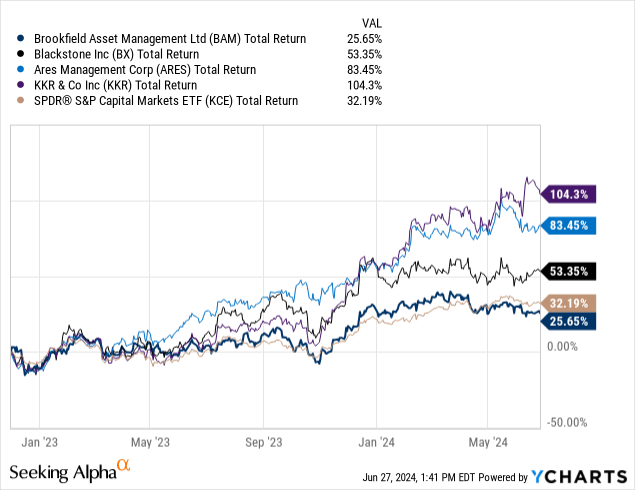

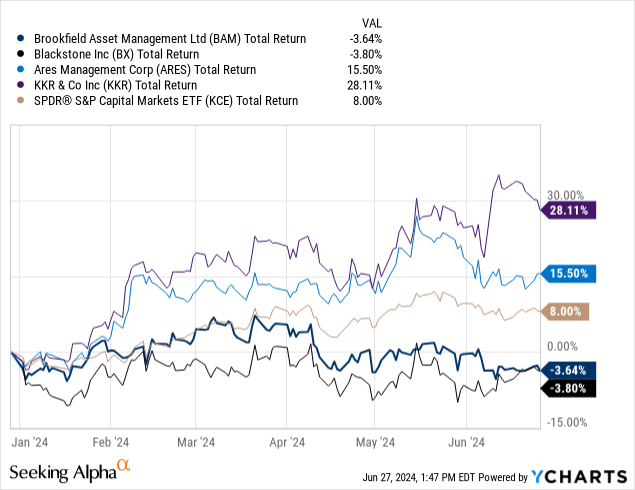

Since the spin-off, BAM not only underperformed peers such as KKR, Ares, or Blackstone Inc. (BX), but it has also done it against its natural benchmark, measured by the SPDR® S&P Capital Markets ETF (KCE) by -6.54% on a total return basis. Also, from a YTD perspective, the situation continues to be of an underperformer even with general markets rising, as seen in the chart below.

BAM Valuation

Companies’ Financials | Seeking Alpha

Looking at the valuation, BAM has cheaper price-to-fee related earnings than Blackstone and KKR but slightly higher than ARES. Nonetheless, their growth over the past year is considerably inferior to fast-growing asset managers such as Ares and KKR, which grew FRE at 16% and 19% from last year, respectively. While BAM grew at a modest 3.8%, that could be summed up with the slow fee revenue growth of 6.0% in TTM Q1 24.

Seeking Alpha

Now, when analyzing the following Seeking Alpha’s Quant Ratings and Wall Street analysts, both fall under inferior categories of the peer group. For example, the SA Quant rating suggests a sell of the stock, and Wall Street analysts suggest a hold at an average target price of $41.71, which is 10.8% higher than the current price.

Outlook

Even though alternative credit is expected to rise in AUM through the upcoming years across the industry as a whole, what’s true is that the competitive landscape is getting tighter and tighter. Yet, these funds are far less regulated than traditional banks and are a fast and reliable way for companies to fund their capital structures via non-conventional sources of financing. In Q1 earnings, analyst Geoffrey Kwan from RBC Capital asked CFO Peer Marshall about their position in alternative credit, and she replied with the following comments,

If you take a step back, we have a long record and have proven that we can deploy through various market cycles, earning attractive returns for our credit businesses. And we can do this for a few reasons. One, we have a strong asset knowledge across all the sectors we invest in. We can provide more than just capital, making us a partner of choice, and we can provide all parts of the capital structure from debt to equity and in between, leading to more proprietary deal flow. And finally, I would say we can provide certainty of capital with quick execution on large ticket sizes, limiting the competition.

Overall, Credit is one of the business lines that is growing the fastest, to the point that in the last quarter, BAM acquired an additional 5% interest in Oaktree. At the same time, CFO Mrs. Marshall described their pleasing ability to provide financing within the capital structure spectrum, as gained through their asset type diversification, that other focused alternative asset managers such as Blue Owl Capital Inc. (OWL) do not have as they are predominantly in private credit.

Risks to the Renewable Energy Business Line

Although their renewable energy business line only constitutes 10% of the AUM, I have concerns about further inflows at the same rate as in the past decade. For example, the Global Clean Energy ETF has experienced major decreases and outflows, and the expected electricity needed to meet AI capabilities will require higher natural gas consumption, based on experts. Even though trillion-dollar enterprises such as Amazon.com, Inc. (AMZN), Alphabet Inc. (GOOG), (GOOGL), and Microsoft Corporation (MSFT) have settled renewable energy deals, my non-expert take is that this won’t be enough. At the same time, Trump discussed this AI electricity issue on the All-In podcast by commenting on the following,

They need electricity at levels that nobody’s ever experienced before to be successful, to be a leader in AI. The amount of electricity that is like double what we have right now and even triple what we have right now. It’s incredible how much they need to be the leader. And we’re going to have to be able to do that, and a windmill turning with its blade, knocking out the birds and everything else, is not going to be able to make us competitive.

Currently, based on betting houses, former President Donald J. Trump has a higher chance of winning the election. If to that you add the European Union results that shifted towards the right, I personally do not see accelerated fiscal stimulus for renewable energy production as it probably was before, reducing expected inflows to green funds.

This is the sixth alternative asset manager that I have analyzed here on Seeking Alpha, and from all, BAM is the one that’s more tilted toward climate investments, or at least that’s the marketing image I get from reading presentations, which is subjective. Because of the global political risks mentioned above, I’d rather avoid these types of asset managers and stick to “traditional” alternative asset managers that do not deviate from categorizing their investments by asset or sub-asset type only. Even though the renewable business line only constitutes 10% of the AUM.

Takeaway

To conclude, this is a highly established asset manager with a strong product offering diversified within different asset and sub-asset types of alternative investments. Yet, my thoughts are that alternatives are growing, and the fee revenue and fee-related earnings (which don’t include volatile carried interest) are lagging some other names that are growing significantly faster in these respects. On top of that, I see risks in their potential to attract further inflows to their Renewable Power & Transition business line due to global political shifts and lackluster performances in public markets in names such as SolarEdge Technologies, Inc. (SEDG), Enphase Energy, Inc. (ENPH), and Vestas Wind Systems A/S (OTCPK:VWDRY), partially offset by the yearly performance of First Solar, Inc. (FSLR).

If I had shares of BAM and wanted an alternative investment opportunity, I would sell those and initiate positions in names such as Blue Owl and Apollo Global Management, Inc. (APO). Not because I think BAM would provide negative returns, but because I think the competition is better positioned to outperform due to their higher growth rates in AUM, and also because they are even more tilted towards private credit which am bullish on.

Nonetheless, my bearish thesis could be wrong, and BAM could end up outperforming its peers. This could come from many sources, but the major one is from a pick-up in its revenue and fee-related earnings growth, which could primarily come from higher valuations in its infrastructure, credit, and real estate business lines that together sum approximately 80% of the current fee-bearing capital. Last, although after the debate Trump increased its chances of winning the election, nothing is certain and the possibility of a swap in a democratic candidate is still open.