More than half (62%) of financial advisors allocate between 6% and 25% of clients’ portfolios to alternative asset classes and more than 80% expect allocations to increase within the next year, according to a survey by alternatives investment platform CAIS and consultant Mercer.

The survey was conducted at the CAIS Alternative Investment Summit held in October. The 260 respondents included independent RIAs, broker/dealer affiliates, family offices and other advisor professionals. The numbers align with other industry surveys, including WMIQ’s study on alternative investment conducted earlier this year.

“If you look at current allocations, most are in the single digit ranges,” said Neil Blundell, CAIS head of investments. “Alternative assets are projected to grow, and hopefully allocations will be going from single digits to double digits and eventually that modern portfolio taking shape at 50/30/20.”

The research confirmed that interest in alts is spreading from traditional corners down to accredited and non-accredited investors.

“What’s going to be one of the drivers of that move is that you can see historically, investors have been qualified purchasers. But there is large chunk of advisors covering clients in the $1 million to $5 million range,” Blundell said. “You can see the demand. More asset managers are creating vehicles and wrappers for high-quality alternatives and we are putting those on our platform. That’s propelling some of the growth we are seeing.”

Alternative investments are being packaged into interval funds, business development companies, non-traded REITs and tender offer funds, structures that have lower minimum investments and no capital calls, making them more attainable for accredited investors.

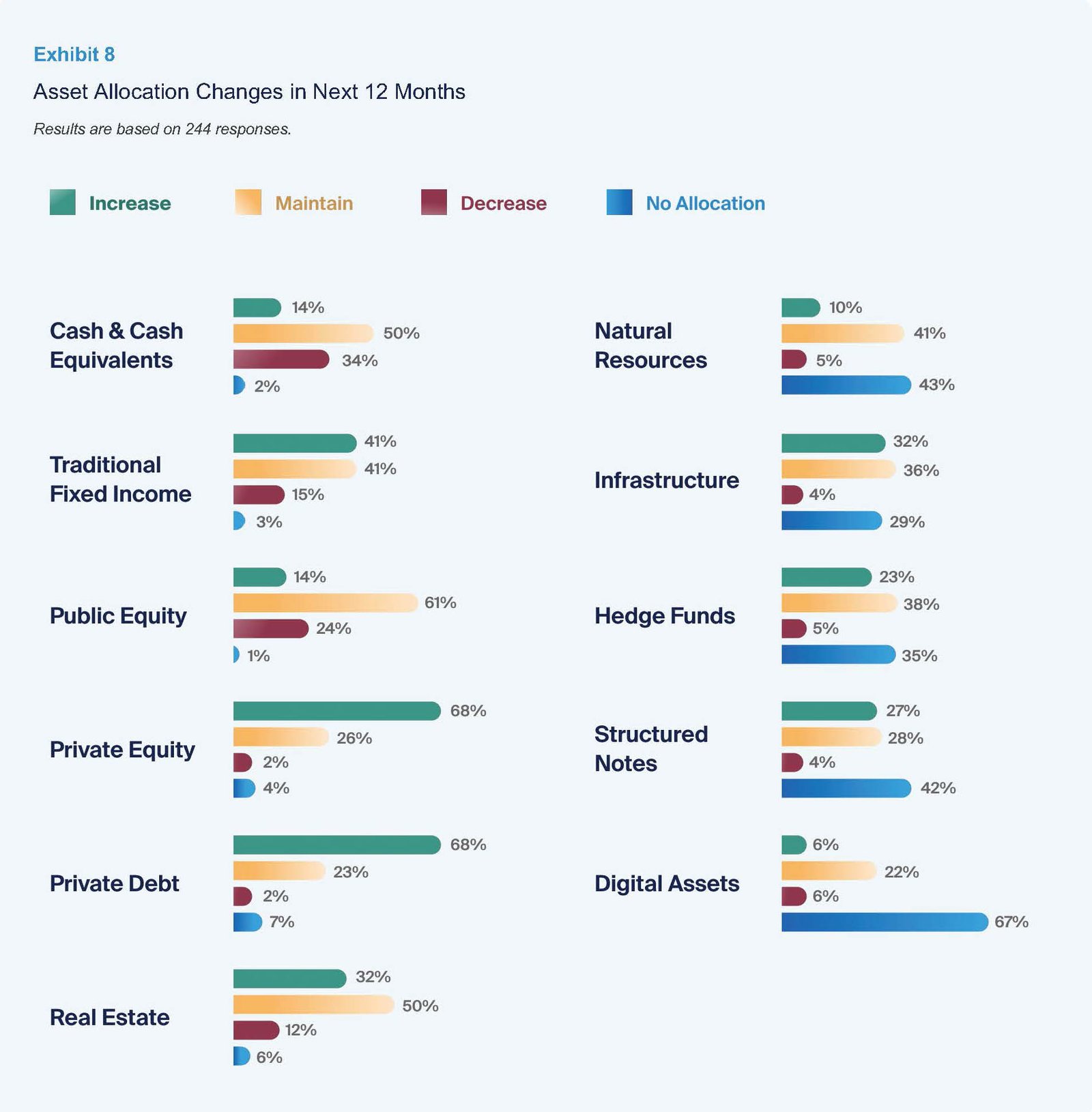

The survey found that advisors currently allocated to alternatives were heavily invested in real estate (96%), private equity (93%), and private debt (91%). Looking forward, respondents were bullish on both private equity and private debt. In, 68% of respondents said they planned to increase allocations to both of those segments in the next 12 months. That was compared with 41% for traditional fixed income and 14% for public equity.

The survey found that advisors currently allocated to alternatives were heavily invested in real estate (96%), private equity (93%), and private debt (91%). Looking forward, respondents were bullish on both private equity and private debt. In, 68% of respondents said they planned to increase allocations to both of those segments in the next 12 months. That was compared with 41% for traditional fixed income and 14% for public equity.

The study found advisors see different alternatives assets classes having divergent purposes in client portfolios. For example, 65% said that private equity enhances returns vs. 33% for hedge funds, 25% for private debt and 24% for real estate. Hedge funds were the top choice for diversifying risk (51%) of respondents. Private debt was the strongest for supplementing income (41%) and structured notes for preserving capital.

“As the wealth channel continues to embrace alternative investments, these findings underscore the independent advisor’s need for strategic partners that can help them streamline alts adoption,” Gregg Sommer, partner and US Financial Intermediaries Leader, Mercer, said in a statement. “Mercer provides independent due diligence and monitoring for funds available on the CAIS platform, with our reports and ratings made readily available to its users, to help advisors continue to differentiate their portfolios.”

In terms of their own business, 78% of respondents said alternative investments help clients meet goals and objectives and 59% said it helps them win new clients.

But barriers remain. In all 55% of respondents cited high levels of administration and paperwork as obstacles as well as lack of liquidity (47%) and concerns around due diligence and compliance (35%).