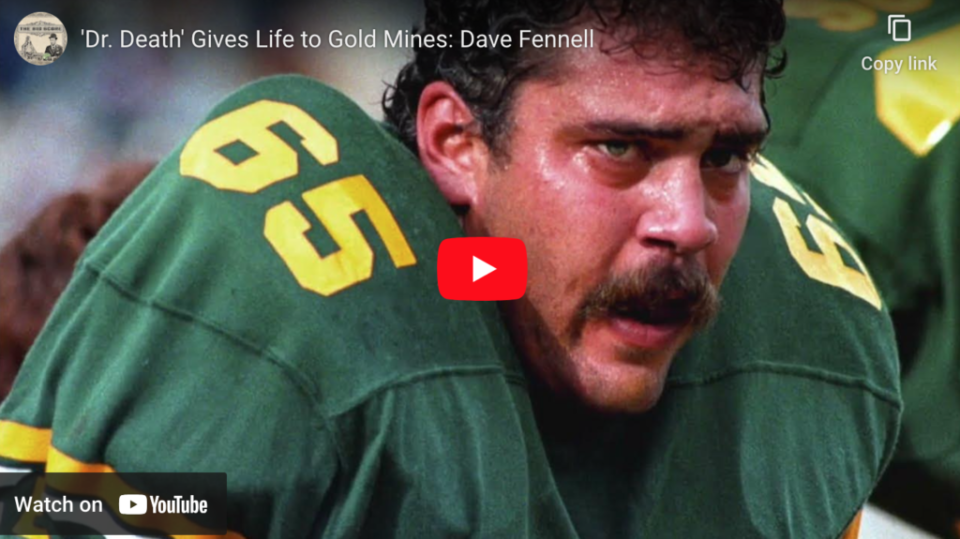

“If you’re going to survive as a defensive lineman. The people who are opposite you, have to be afraid of you,” Fennell remembers.

“I was capable of playing very violently.”

He played 10 seasons for the Edmonton Eskimos (renamed Elks in ‘21), appearing in 8 Grey Cups (Canada’s Super Bowl). The Eskimos won 6, including 5 in a row 1978-1982.

Fennell, who turned 71 on Feb 4, is chain-smoking Marlboros on a Zoom call with me on Feb 5. He’s reflecting on a career that spans beyond the gridiron to golden ventures. His resume includes co-founding Golden Star (US $467M sale in ‘22) and Miramar ($1.5B sale in ‘08). Fennell was a tenured director of Sabina ($1.1B sale in ‘23) and Torex ($1.2B market cap). His Reunion Gold ($485M market cap) has rapidly discovered a major gold deposit after setbacks.

Weary of the spotlight from his football career, Fennell has kept quiet about his journey – until now.

Fennell’s sons picked up his drive too. David Jr. played Michigan State football then turned engineer. John raced luge at the Sochi Winter Olympics, now he’s a corporate analyst.

–

Raised in a middle-class Edmonton, Alberta family, Fennell was the second of four children. “I was taught very early on, you’re not allowed to quit when you start something. It was not acceptable.”

He completed a 4-year undergrad degree at U of North Dakota in 3 years. Fennell could have gone to the NFL, but chose to stay in Edmonton, joining the Eskimos on the condition he’d also go to law school.

It’s hard to imagine a pro athlete smoking, studying law, and winning six championships today. But Dave Fennell did it all. He planned to play pro for 10 seasons, and wondered, “What do you do when the cheering stops?”

Joining a law firm next, the bosses leveraged his “Dr. Death” fame for networking. Fennell recalls, “They loved taking me to the Petroleum Club on Mondays.”

His law practice worked with many small miners. After three years and a Guyana field trip, Fennell decided to get into gold mining himself.

At 32, Fennell founded Golden Star Resources (GSR). He partnered with Roger Morton, a U of Alberta geology professor, to explore Guyana. GSR spent $20K staking the forgotten Omai gold deposit. “It was open ground.”

Anaconda Copper explored Omai extensively in the late 1940s but stopped when the Korean War began.

Secrets of the Anaconda Library

A private detective helped Fennell find Anaconda’s geological data. They learned of a cavernous library in Montana, holding 100 years of records. A librarian just laid off, liked Fennell and sold him the Guyana files for $30K.

GSR hired SNC Lavalin, with their top supercomputer, to process this historical information. It showed a big potential mine.

Placer Dome partnered on Omai in ‘87, before walking away. Fennell didn’t give up. He invited Louis Gignac’s Cambior to visit Omai during a 3 day rainstorm. Cambior ended up funding construction for a 70% stake. It produced 3.7 million gold ounces from 92-05.

Renowned mining investor Rick Rule says Fennell is easy to underestimate. “The physicality obscures a great intellect and a guy that’s actually very kind. He’s the classic entrepreneur. When he sees an opportunity, he can’t not grasp it.”

Next, GSR pursued Cambior to partner in Suriname. “If I had a mine each time someone told me a story about a property, I’d be a very rich man,” Gignac says. GSR’s Rosebel discovery was in region reeling after Suriname’s civil war. “David, why don’t you settle down, get married, do something easier than this,” Gignac advised him.

Fennell persisted, inviting Gignac to tour Rosebel. It poured rain again on that trip, which Gignac saw as a good omen after Omai’s success. Cambior eventually built the mine. Rosebel became one of South America’s largest, yielding over 6 million ounces. Today, it’s operated by Zijin. GSR stock jumped 600% in the early ’90s thanks to these wins.

Gignac and Fennell discuss Omai and Rosebel in this Canadian Mining Hall of Fame video (begins at 2:24):

Investor Mike Halvorson says GSR’s work in the Guianas and Suriname put the area on the map for mining.

“Back in those days, from a political point of view, it was considered high-risk to go into the Guianas,” Gignac remembers. “It took a lot of guts for [Fennell] to get involved, and a lot of guts to follow him there. We eventually mined about twice the [initial] reserves at Omai. By doing Omai, it was that much easier to do Rosebel. We were comfortable with the region and its people. There’s a lot of advantages in these countries. It’s simpler. Decision makers are easier to know and be in contact with.”

Halvorson remembers Fennell throwing a ‘chirping’ analyst into a pool on one Suriname stay. The guy skipped on the water like a stone. Fennell and Halvorson connected in Edmonton in the 1980s through their love of migratory bird hunting.

“Anything that walks, flies or swims, Dave has killed,” says mining engineer Bruce McLeod, who hunts and fishes with Fennell. A massive Anaconda snake skin once adorned the crown mouldings in Fennell’s Montreal offices.

At 41, Fennell lucked out as the sole bidder for Sigrist House, once King Edward VIII’s Bahamian villa. Fennell lived there 28 years before downsizing.

In the late 90’s, Fennell clashed with GSR’s board and was pushed out. Later, GSR refocused on Africa and was sold to a Chinese company.

To avoid GSR conflicts, Fennell eyed new gold regions. BHP’s Hugo Dummett offered him all their gold assets for $80 million. But with few flush bidders, BHP sold the portfolio in pieces.

Ivanhoe got to Mongolia and discovered Oyu Tolgoi. Randgold took West Africa, and Harmony got East Africa.

“If you’d have kept that package together, it’d be the second largest copper company [today]. And you’d be arguing with Newmont about who was the biggest gold company,” Fennell says.

He bought the Canadian assets for US $20.4 million. It had Hope Bay, a 4 million ounce gold discovery in the high Arctic.

Fennell dealt through Cambiex Exploration (CBX), where he’d been appointed Chair and CEO in January ‘99, when CBX was a 15 cent stock with a $3.5 million market cap.

CBX split the tab with Miramar, a modest gold miner sitting on cash. Miramar swallowed CBX in 2002, appointing Fennell Executive Vice Chairman. Miramar invested about $100 million in Hope Bay and led it through permitting. In 2008, Newmont bought Miramar for $1.5 billion.

Every $1 invested in CBX’s equity funding when Fennell took over in early ‘99 was worth $19.50 when Newmont acquired Miramar 9 years later. CBX shareholders made even more money through a spinout company, Ariane Gold, acquired by Cambior in ‘03.

Rob McLeod, a geologist at Hope Bay, admired Fennell’s strong presence, humour, and optimism. Fennell built bonds with Inuit partners through fishing and Crib games, easing the permitting process.

Fennell would need that optimism for his next venture.

–

In 2004, Fennell listed Nevada explorer New Sleeper. A name change to Reunion Gold (RGD) came in 2006, after recruiting former GSR colleagues and returning to the Giuanas.

The stock ran from 30 cents to over $2 in early ‘07 on the back of a Suriname gold find. It didn’t pan out. RGD crashed to 3.5 cents during the ‘08 financial crisis.

“When you take your shareholder’s money and you say you’re going to do this, and if it’s not successful, my job is to fix that and I’m not going to roll all the stock back. I’m not going to wipe shareholders out,” Fennell says, explaining RGD’s current 1.23 billion shares.

Reunion roared back above $2 again after a Guyana manganese discovery. Then, metal prices crashed, cutting RGD to one penny by 2016.

“You’re going to fail a hundred percent guaranteed in both exploration and football,” Fennell says. “The real question is, what are you going to do after you fail?”

A US $10 million sale of the manganese project provided a lifeline.

In 2019, Barrick partnered with Reunion on exploration, committing $4.2 million.

Reunion was a 7-cent stock in 2020 when they found gold at Guyana’s Oko project.

But, Barrick quickly abandoned the alliance and skipped a $3 million commitment. They even sued Reunion after Oko’s success. In 2023, Barrick and RGD settled, owing nothing to each other.

Oko moved from a prospect to a major gold deposit rapidly. An initial 2023 resource estimate showed 4.3 million ounces (indicated plus inferred).

Fennell believes Oko could be the best gold mine in South America. He sees a 300–400,000 ounce per year, low-cost mine, with a 12 year initial mine life.

“It’s going to be much bigger and longer,” Fennell says, optimistically. “Whether we’re going to live longer is a whole different question.”

Reunion aims to publish a PEA study on Oko before Summer. Fennell also looks forward to a feasibility study and final permits in Q1 2025, with construction to start soon after.

“From a discovery to a tier one mine in [potentially] six years, it doesn’t get any better,” Fennell says.

He’s in Georgetown this week, talking with the Guyanese government about Oko’s future. Reunion’s looking at options: build, sell, merge, or partner up. Fennell wants RGD to avoid execution risk and debt.

G Mining Services, led by Fennell’s old friend Gignac, is advising on Oko. They’ve successfully built many mines, like Fruta del Norte in Ecuador (Lundin Gold – $3.7B market cap). Gignac’s G Mining Ventures, doing well and on track in Brazil, could be a key player in Oko’s future.

“There will be a mine [at Oko]. There’s absolutely no question,” says Gignac. “The size, grade, and gold content. That’s going to be the next one to put on his record.”

There’s a slight problem with Venezuela’s claim over Guyana’s Essequibo region, where Oko is. Fennell isn’t worried. He says the US will protect it because of Exxon and Chevron’s huge oil investments there.

Gignac says Fennell hasn’t changed since they first met in the late 80s. “Always glass half-full, always enthusiastic. A track record as good as anybody at finding deals, doing exploration, and developing orebodies.”

Fennell is honest and a consummate salesman according to Rule. “I don’t think in 35 years he ever lied to me, but he would polish the living shit out of the rearview mirror.”

Some colourful highlights of my 2-hour Zoom with Mr. Fennell were published on Youtube. It’s raw and full of wisdom about gold exploration and football.

“David is one of the most low-key and commercially successful entrepreneurs in [mining],” Bruce McLeod wrote on X. “He has played a huge part in mentoring others too. Without David, I wouldn’t be where I am today.”

Fennell says, “We always overcome challenges. I never give up.”

Reunion Gold (RGD-TSXV) is worth $485 million at press time, last at 39.5 cents.

Fennell owns 61 million RGD shares. He has warrants and options to purchase 12.6 million more.

B. McLeod, Rule & Halvorson all own the stock.

All figures CAD unless otherwise indicated.