Gold has held a prominent place in the financial markets for centuries, respected both as a form of currency and a store of value. Its history as a monetary standard dates back to ancient civilisations, where it was used for trade and as a symbol of wealth and power.

Gold has retained its attraction as a safe-haven asset, particularly during times of economic uncertainty and inflation. Investors flock to gold during financial crises, geopolitical tensions, and periods of high inflation, viewing it as a reliable hedge against currency devaluation and market volatility.

ADVERTISEMENT

CONTINUE READING BELOW

This unbroken trust in gold is evident in its unique role in the global financial system as both a historical constant and a modern financial instrument.

Its status as a ‘safe-haven’ asset stems from its unique properties:

- Tangible: Unlike stocks or currencies, gold is a physical asset you can hold.

- Durability: It doesn’t rust or decay, retaining its value over centuries.

- Limited supply: Unlike fiat currencies, gold’s supply is relatively fixed, making it a scarce resource.

These characteristics have made gold a go-to investment during periods of economic turmoil:

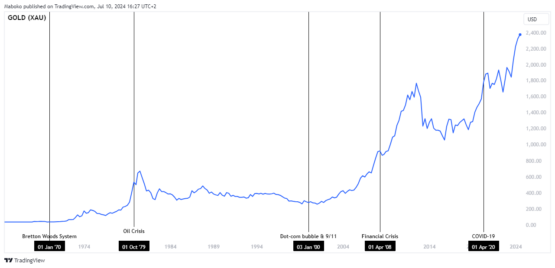

- 1970s: The collapse of the Bretton Woods system, which tied the US dollar to gold, led to high inflation and economic uncertainty. Investors flocked to gold, sending prices soaring.

- 1979 oil crisis: This global energy crisis further fueled inflation and economic woes, pushing gold prices even higher.

- Dot-com bubble burst and 9/11 (2000s): The burst of the tech bubble and the aftermath of the 9/11 attacks caused investors to seek safer assets, driving renewed interest in gold.

- 2008 financial crisis: Fear of bank failures and market meltdowns sent investors scrambling for gold, driving prices to record highs.

- Covid-19 pandemic (2020): The economic slowdown and aggressive monetary measures implemented in response to the pandemic saw another surge in gold prices.

Gold price events

These historical events highlight how gold can act as a hedge against inflation and economic instability. When traditional investments falter, gold often retains its value, offering investors a sense of security. However, it’s important to remember that gold prices can also be volatile, and past performance is not a guarantee of future results.

South Africa’s golden opportunity

This global surge in gold prices presents a significant opportunity for South Africa’s gold mining industry, one of the world’s largest. The country boasts a rich history of gold production, and its established mines are well-positioned to capitalise on the rising demand. However, deep-level mining operations require significant investment and ongoing efforts to improve efficiency and safety.

ADVERTISEMENT:

CONTINUE READING BELOW

The outlook for South African gold miners is cautiously optimistic. Gold prices recently hit a record high of $2 405.05, fueled by factors like geopolitical tensions and strong demand from key markets, particularly young consumers in China and the US. This surge can lead to increased profitability for South African miners, potentially attracting new investment and boosting the industry’s overall contribution to the South African economy.

Analysts predict a continued rise in the price of gold. While short-term fluctuations might occur, the long-term trend points towards a rising price for this valuable asset.

Join the gold rush

At Brokstock, we offer Gold CFDs at competitive market prices. Join the global market and safeguard your savings, hedge against inflation, and diversify your portfolio with us.

**This information does not constitute financial advice of any nature whatsoever. The decision to invest and the suitability of any investment choice is solely your responsibility. Authorised FSP No 51404.

References: