Gold prices reached record highs on Tuesday as investors continue to flock to the precious metal ahead of the Federal Reserve’s expected rate cut in September.

Spot gold surged above $2,525 per ounce on Tuesday while gold futures (GC=F) for December delivery climbed above $2,560 per ounce.

Gold purchases by central banks, which hit a record in the first quarter of 2024, have driven up prices this year while geopolitical tensions have kept investors focused on the precious metal as a safe haven asset.

Gold futures are up more than 23% year to date, making it one of the best-performing metals of the year.

“We see gold prices rising to USD 2,600/oz by the end of 2024 amid firm demand from central banks and a likely rise in activity from exchange-traded funds,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management.

The next catalyst for gold is expected to come on Friday, when Fed Chair Jerome Powell speaks at the Jackson Hole Economic Symposium. Investors will be looking for clues that cement a rate decrease by the Federal Reserve next month.

As of Tuesday, traders were pricing in a 71.5% chance the Fed will reduce rates by 0.25% on Sept. 18; odds for a 0.50% cut stood at closer to 28%, according to the CME FedWatch tool.

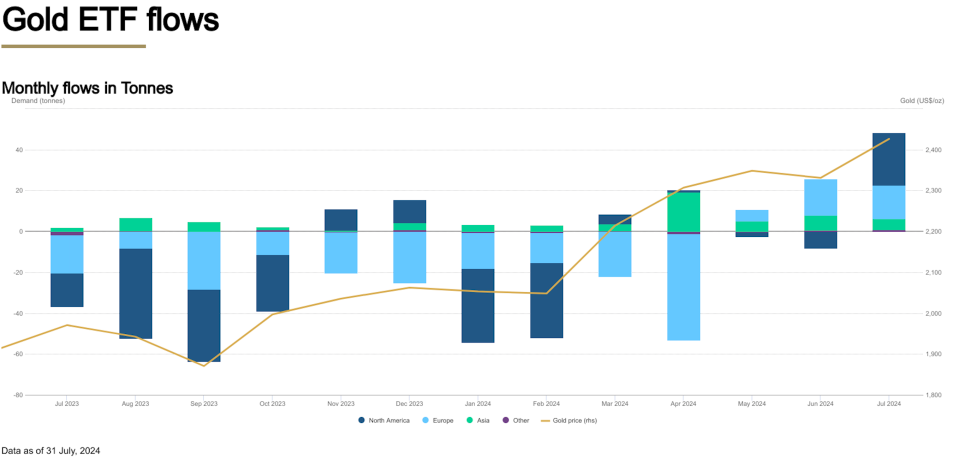

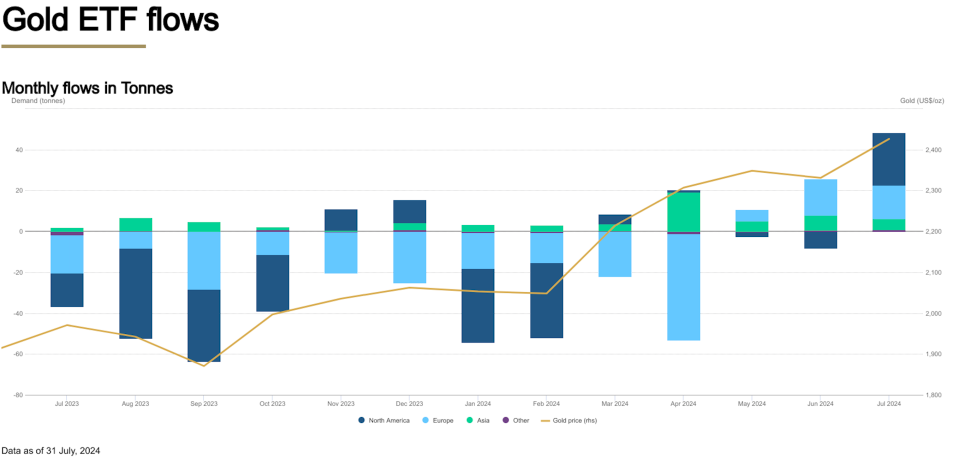

Global physically backed gold ETFs have now seen inflows three months in a row as Western investors piled into gold, with North American activity outpacing Europe and Asia in July.

“It’s mainly the anticipation of the rate cuts that are likely on the way,” Joseph Cavatoni, senior market strategist at World Gold Council, told Yahoo Finance on Tuesday.

“You’re seeing momentum, which is a tactical driver in the gold market … you’re seeing a large position of net longs in that space.”

“Gold is no longer competing against bond [or] CDs if you factor in the inflation rate, and look at the real return — gold will far outpace the growth on yields on a CD,” Alex Ebkarian, co-founder and CEO of Allegiance Gold, told Yahoo Finance.

Still, from now until the end of the year, Ebkarian expects profit-taking pullbacks to potentially weigh on additional price gains.

“It’s healthy for us to have some sort of a retraction,” said Ebkarian.

“This is the seventh time that gold has put an all-time high record since the beginning of April, and any time that occurs, we get profit takers.”

Ines Ferre is a senior business reporter for Yahoo Finance. Follow her on X at @ines_ferre.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance