It should also generate strong free cash flow at current gold prices – and return much of that free cash flow to investors while making minor but sensible acquisitions. Also, Barrick shares offer optionality. If today’s unusual economic and fiscal conditions drive up the price of gold, Barrick’s shares will rise with it.

Given their attractive valuation, the shares don’t need this second (optionality) point to work. It just offers extra upside. Barrick’s balance sheet has nearly zero debt net of cash. Major risks include the possibility of a decline in gold prices, production problems at its mines, a major acquisition, and/or an expropriation of one or more of its mines.

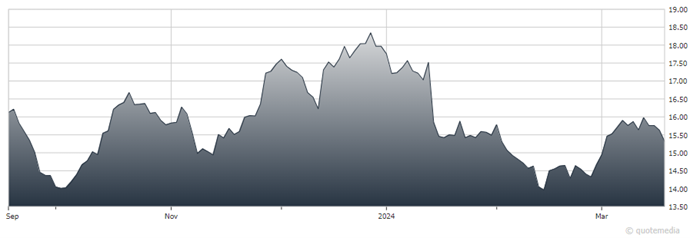

Barrick Gold Corp. (NYSE:)

is holding its $2,000+ pricing despite what is increasingly becoming a higher-for-longer US interest rate environment. Gold’s new, higher range may be driven by enduring domestic and international government fiscal deficits as well as from enduring inflation. Reasonably reliable official data also indicates that central banks, particularly China’s, are stepping up their gold purchases.

Additionally, there may be a correlation trade among hedge funds that links gold and . Bitcoin is surging as demand has been remarkably strong for newly approved Bitcoin ETFs. Most previous institutional holdouts, including BlackRock (NYSE:), have become supporters of Bitcoin. The correlation trade would carry gold upward with Bitcoin prices.

Our view on gold prices is based on what we believe is a structural upshift in inflation. These changes include war, government spending, crime, oil prices, and past-the-peak fading of the benefits of global free trade, in addition to a tight labor market. There is a reasonably good chance that inflation will remain above a 3% pace indefinitely. This would imply permanent 4%-6% interest rates.

Barrick shares have roughly 72% upside to our $27 price target. The shares remain depressed despite gold prices trading near $2,200, indicating that investors have no confidence in gold prices and little confidence in the company’s ability to generate higher cash flow.

Recommended Action: Buy GOLD.