- Gold prices remain steady despite weak Chinese data, Risk-Off Start to the week.

- Market uncertainty and geopolitical tensions are supporting gold’s safe-haven appeal.

- Key support and resistance levels to watch are identified.

Most Read: Markets Weekly Outlook – ECB to Deliver 25 bps Rate Cut? Bank Earnings in Focus

Gold prices held steady this morning as weak Chinese data renewed market concerns and led to a risk-off start to the week. The Chinese data is an interesting one where Gold is concerned, as the drop in exports could lead to fear that demand for Gold may fall from China while the risk-off mood benefits Gold thanks to its safe haven appeal.

Thus, following a n initial fall at market open, Gold bulls did push prices back toward the Friday highs above the $2660/oz handle. Following the reaction to last week’s US data, Gold bulls still appear to be dominant, this despite the prospect of less aggressive rate cuts from the Federal Reserve.

Market participants are now pricing in less than 50 bps of rate cuts from the Fed before the year is out. This begs the question, why are Gold prices still elevated?

I think a lot of this is down to the risk still prevalent in Global markets. The first being uncertainty around China and Global growth moving forward and the second obviously being the uncertainty around the geopolitical dynamics still at play. Markets are still holding out hope that the Chinese stimulus will be enough even though it is too early to tell.

These factors are keeping market participants on edge and thus the safe haven play remains supported.

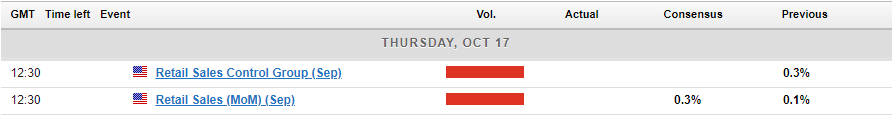

Economic Data and Week Ahead

Markets may experience a thin session liquidity wise today as the US celebrates Columbus day. This could lead to some erratic price action for the precious metal as the DXY is also likely to play a role.

Federal Reserve policymakers are scheduled to speak today and markets will be paying attention to policymakers Waller and Kashkari for further dovish sentiments which should keep Gold prices bid heading into tomorrow.

The lack of high impact data this week from the US could see Gold dominated by overall market sentiment, geopolitics and Federal Reserve policymakers comments.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

Technical Analysis Gold (XAU/USD)

From a technical analysis standpoint, Gold surprised with last weeks rally to break back above the psychological 2650 handle.

Looking at the four-hour chart (H4) chart below, the previous H4 candle closed as a shooting star hinting at further downside. My concern is that at present with such a bullish long and medium-term trend, any push to the downside may be limited. The only positive for bears is that the recent rally has failed to take out the precious metals all time highs around 2685, which was printed on September, 26.

Immediate support rests at the 2650 handle before the 100 day-AM and support level comes into focus around 2643-2640. A break of this level will open up a potential run toward the 2625 handle.

Conversely, a move higher from here will face resistance at 2670 before the all time highs at 2685 and the psychological 2700 handle comes into focus.

GOLD (XAU/USD) Four-Hour (H4) Chart, October 14, 2024

Source: TradingView (click to enlarge)

Support

Resistance

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.