(Kitco News) – Gold prices chopped around in a narrow $10 range between $2,016 and $2,025 this week, with only minor reactions to even the most significant data releases and corporate earnings reports.

The latest Kitco News Weekly Gold Survey showed institutional experts and retail traders maintaining their cautious stance, with no clear consensus about gold’s direction heading into what promises to be a very significant week for central banks and employment data.

Adrian Day, President of Adrian Day Asset Management, believes this week’s moderating inflation numbers will boost gold prices next week.

“Odds of a Fed rate hike in March have increased (in my opinion) given another low core PCE number this week,” Day said. “That will see gold higher.”

Darin Newsom, Senior Market Analyst at Barchart.com, sees gold caught between conflicting technical trends.

“This is a tricky one as the April contract posted a new low for the move during Thursday’s session before rallying to close higher for the day,” he said. “This indicates the contract could still try to move into a short-term uptrend, all while having to fight against the intermediate-term downtrend on the weekly chart. The opposite looks to be the case with the US dollar index.”

“I am bearish on gold for the coming week,” said Colin Cieszynski, chief market strategist at SIA Wealth Management. “My thinking is that the Fed may come in less dovish than the street has been hoping for, which could spark a rally in the US Dollar and put a headwind in front of Gold.”

Frank Cholly, Senior Market Strategist at RJO Futures, said investors should expect a prolonged period of sideways price action.

“I think the gold market is just marking time here above $2,000,” Cholly said. “It’s hard to see basing the bottom at this level, but basing a base… I think that the Fed is more likely to just hold rates higher for longer than to cut right away. I don’t think that that bodes well for gold necessarily, but I do think that technical levels are important, and maintaining levels above 2000 is somewhat positive.”

“We can follow those treasuries and see what the treasury market is telling us in terms of what the Fed’s going to do, but right now, I’m just going to focus on the dollar,” he said. “As long as gold stays above $2,000 I’m somewhat optimistic about price action. If we see gold move down towards $1,950, I think that buyers will come in and support that level.”

Looking ahead, Cholly sees the potential for gold price volatility around Powell’s press conference next week.

“The way I see it right now, there’s a possibility for a larger trading range, for some volatility to come back to that market,” he said. “I’m going to look at the charts, to where the market should find value or where it possibly runs into some good resistance. Obviously, $2,100 on the upside is going to be a bit of a hurdle to get over, and I think that $1,950 on the downside is going to prove to be a pretty supportive level. I can see the market chopping around in that larger range, and spending a good deal of time from $2,000 to $2,050.”

As to when the market can expect a clear signal on rate cuts from the Fed, Cholly said he doesn’t expect the Fed to do anything for some time. “I don’t see anything before June.”

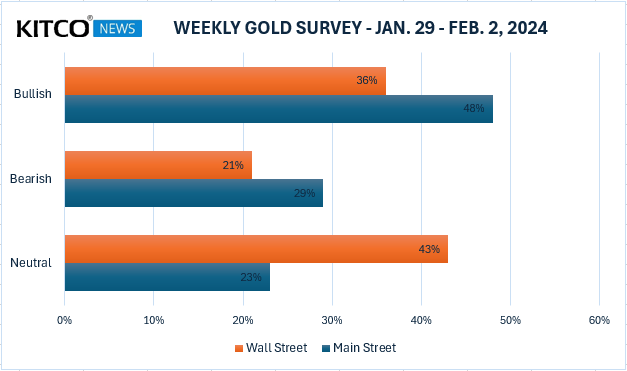

This week, 14 Wall Street analysts participated in the Kitco News Gold Survey, and they continued to show caution on gold’s near-term price potential. Five experts, or 36%, expected to see higher gold prices next week, while three analysts, representing 21%, predicted a drop in price. Six experts, representing 43%, expected gold prices to trade sideways during the coming week.

Meanwhile, 89 votes were cast in Kitco’s online polls, with retail traders showing a bit more bullishness but still indecisive overall. 43 retail investors, representing 48%, looked for gold to rise next week. Another 26, or 29%, expected it would be lower, while 20 respondents, or 23%, were neutral on the near-term prospects for the precious metal.

While the continuing conflict in the Middle East will garner some attention, the U.S. jobs report, the Federal Reserve’s rate decision and Fed Chair Jerome Powell’s press conference will be the major focal events for markets.

The Fed is expected to leave interest rates unchanged at Wednesday’s FOMC announcement, but Powell’s presser will be his opportunity to rein in the runaway rate cut expectations that he unleashed at the last press conference.

In addition to the U.S. Nonfarm Payrolls report for December on Friday morning, markets will also be watching U.S. consumer confidence and JOLTS job openings on Tuesday, ADP employment data on Wednesday, and the Bank of England’s monetary policy announcement, weekly jobless claims, and ISM Manufacturing data for December on Thursday.

Jameel Ahmad, Chief Analyst at GTC Global Trade Capital, said he expects to see gold prices fall from their recent elevated range.

“I see risks of a fall below $2,000, and the reason why is because of those drastically reversing expectations for interest rate cuts in the U.S., and the likelihood that we are going to see further U. S. dollar strength, considering the comeback it made since late 2023.”

“Continued demand for the dollar is likely going to really threaten gold to the downside more.”

Ahmad agreed that today’s gold price still reflects a degree of irrational optimism about the timing and the scale of rate cuts.

“When you consider that the U.S. dollar has had its best start to the year at one point since 2011, and the actual gold price itself, just looking at the candlesticks, we’ve only dropped so far, just over $50,” he said. “Considering that the Japanese Yen has weakened something like 800 pips, and some of the other pullbacks we’ve seen in assets, everybody’s on the wrong side of the Fed. Even 75 basis points right now, considering the U.S. economic data, even that seems optimistic.”

Another reason why Ahmad believes even the more conservative rate cut projections are optimistic is the ongoing conflict in the Red Sea. “That is an inflation pressure cooker that we all hope won’t come, but it’s another volatile situation, which gives even more impetus for central banks to leave interest rates high, no matter how unfortunate that is for the average person on the street,” he said.

“What might help gold is if we do have a very sudden geopolitical surge,” Ahmad said. “But again, if that actually strengthens the dollar because inflation projections go up and so forth, then gold might not benefit as much. We have a lot of very uncertain issues in the world that continue to persist.”

Ahmad believes Federal Reserve chair Jerome Powell’s press conference on Wednesday is a major risk factor for gold prices.

“The devil’s in the details when it comes to Powell, and investors can just hope that it won’t be a non-event such as Christine Lagarde and the ECB yesterday,” he said. “Clearly, there’s been a mismatch because of what the Fed prepared the market for, or at least what the market bought into, and the reality on the street in terms of economic data.”

“The only benefit from the U. S. economy doing so well and maintaining resilience is that we are heading for the soft landing, not the hard landing, which would have led to a great deal more of global financial market turmoil,” he added. “But if you look at world markets maintaining around record highs, despite this dialed back Fed narrative on rates, gold actually has not been that volatile considering the dollar move. At some point, something’s going to break the camel’s back.”

“Maybe we’re going to have to see a world market pullback based on interest rates not moving as fast as anybody thought they were, rather than a bigger move in gold,” Ahmad said. “That’s maybe what I would look out for, from the standpoint of an investor.”

Adam Button, head of currency strategy at Forexlive.com, expects gold prices to remain in their recent holding pattern. “The seasonal tailwinds have been a dud this year as the market re-evaluates the path of Fed policy,” he said. “The best bet for gold in the week ahead is a soft non-farm payrolls report.”

James Stanley, senior market strategist at Forex.com, is staying bullish for next week. “Sellers still haven’t been able to test below $2k and the falling wedge remains in-play,” he said. “USD bulls had ample opportunity to run a trend earlier this week when it tested above the 200DMA, but it couldn’t hold the move.”

“Going into FOMC next week I think the path of least resistance for gold is higher,” Stanley said.

Mark Leibovit, publisher of the VR Metals/Resource Letter, said he still sees considerable upside for gold this year, though he also sees the possibility for a near-term correction. “Remain bullish through 2024,” he said. “Risk to 1980 in Gold here. Target 2700.”

And Kitco Senior Analyst Jim Wyckoff expects gold prices to post gains next week. “Steady-higher as bulls have overall near-term technical advantage,” he said.

Gold wrapped up one of its least eventful weeks in recent memory, with spot gold down 0.12% on Friday and down 0.54% during the week, last trading at $2,018.59 per ounce.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.