With less than two weeks remaining before the U.S. presidential election, there’s a growing sense of uncertainty in the air. Investors are wondering how to position their money, bracing for the possibility of significant volatility and market shifts.

While some hedge funds are making bold moves on so-called “Trump trades,” we at U.S. Global Investors see things differently.

In fact, I share billionaire hedge fund manager Paul Tudor Jones’ recent outlook on gold and Bitcoin (which validates what I have been writing about for many years). Like him, we currently favor alternative assets as the smart play going forward.

It’s not that we’re betting against stocks or the economy, which we believe will do well over time no matter who wins the White House next month. Nevertheless, the writing is clearly on the wall: Ballooning U.S. debt and geopolitical tensions all point to the need for a strong hedge.

The Ballooning U.S. Debt Problem

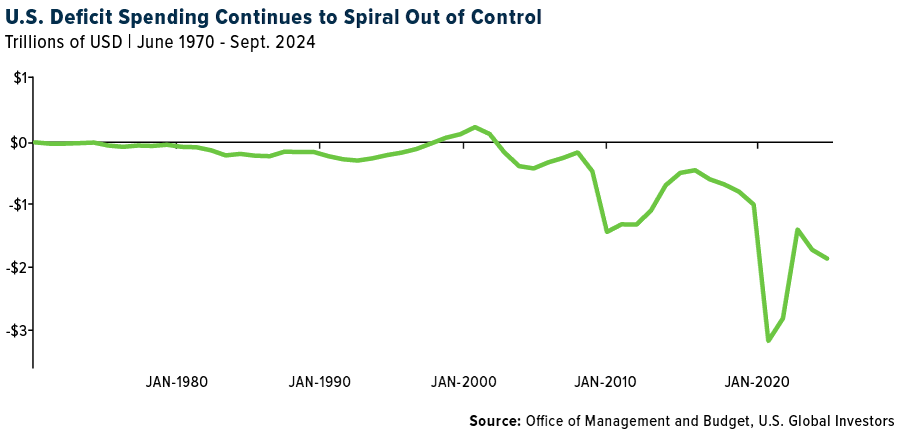

You won’t be surprised to read that the U.S. debt situation has spiraled out of control. Just 25 years ago, the national debt was a little under 60% of GDP. Today, that rate has doubled to 120%.

According to Paul Tudor Jones, founder and CEO of Tudor Investment Corp., this puts the U.S. in a precarious position—one that’s unsustainable in the long run unless serious action is taken to rein in government spending.

We all know that politicians have a knack for promising more spending (in the Democrats’ case) or tax cuts (in the Republicans’ case) to keep voters happy. It’s easy to see why Jones is concerned that either approach will only exacerbate the debt problem. As he pointed out, the U.S. is “going to be broke really quick unless we get serious about dealing with our spending issues.”

That’s not just a dramatic soundbite—it’s a reality check. The federal deficit for 2024 soared above $1.8 trillion, up 8% from the previous year. Meanwhile, the debt burden, which is rapidly nearing $36 trillion, shows no signs of easing.

All Roads Lead to Inflation

When the government keeps printing money to finance its spending, the inevitable result is inflation. And in times of inflation, the purchasing power of traditional assets like bonds erodes. That’s why Jones favors assets that perform well in inflationary environments such as gold, silver, commodities and Bitcoin. I agree wholeheartedly with this assessment.

Think about it: Why would you want to own fixed-income assets when interest rates are being adjusted and are likely to be lower than the inflation rate? Long-dated bonds are particularly vulnerable. U.S. banks, remember, are still dealing with billions of dollars in unrealized losses on their fixed-income positions. According to Florida Atlantic University’s bank screener, Bank of America’s unrealized losses on held-to-maturity investments in the first quarter were a staggering $110 billion, more than any other U.S. institution by far.

The Fed will likely try to “inflate” its way out of this mess, meaning it will keep nominal interest rates lower than inflation to support economic growth. For investors, this means that preserving wealth will require smart positioning in alternative assets.

Jones is already betting against the bond market— “I am clearly not going to own any fixed-income,” he told CNBC this week—and I believe many investors would be wise to take a similar approach.

The Case for Gold and Silver

Let’s start with gold and silver. Both have been go-to haven assets for centuries, and for good reason. When geopolitical tensions have risen, when inflation has reared its ugly head and/or when there’s been uncertainty in the markets, investors have flocked to gold and silver.

This year is no exception. We’ve seen gold shatter records multiple times in 2024, with prices rising more than 32% year-to-date, the metal’s best annual growth since 1979.

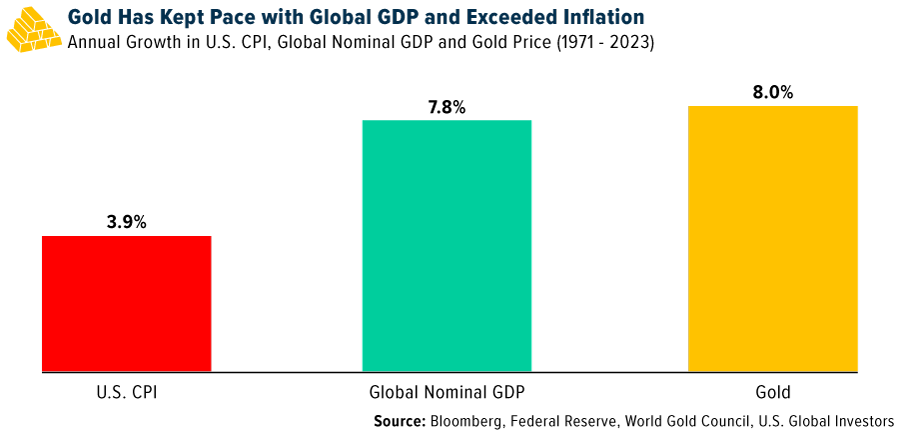

According to data from the World Gold Council, gold has consistently outperformed both inflation and the growth rate of the world economy. From 1971 to 2023, gold’s compound annual growth rate (CAGR) was 8%, compared to 4% for the U.S. consumer price index (CPI) and 7.8% for global GDP growth.

Silver, often dubbed the “poor man’s gold,” is another asset that deserves attention. With its industrial applications, especially in the green energy sector, silver has strong potential for future growth. According to one projection, the clean energy transition could dramatically increase the demand for silver in photovoltaic (PV) technology, potentially consuming between 85% and a jaw-dropping 98% of current global silver reserves by 2050.

Bitcoin: The Digital Gold

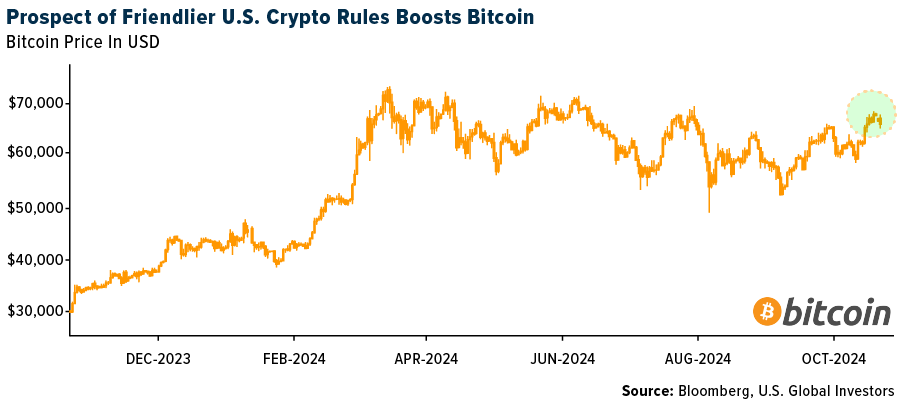

Now, let’s talk about Bitcoin. The world’s largest digital asset has quickly become a preferred store of value for many investors, especially those looking to hedge against fiat currency depreciation. Nearly half of all traditional hedge funds currently maintain exposure to cryptos, including Bitcoin.

Institutions are also backing Bitcoin with the same enthusiasm. Just look at BlackRock’s Bitcoin ETF, IBIT. It’s one of the fastest-growing ETFs in financial history, with assets under management now over $26 billion. That’s no small feat.

Bitcoin’s decentralized nature, capped supply and growing institutional acceptance make it an attractive asset in times of uncertainty. Like gold, it’s a hedge against inflation, but it also offers the potential for significant upside as more investors and institutions recognize its value.

Don’t Get Distracted by the Election Noise

Now, I know many of you are wondering: “What about the election? What if Trump wins? What if Harris wins?”

Here’s a news flash for you: Over the long run, it may not matter as much as you think. Larry Fink, CEO of BlackRock, made a great point recently when he said that he’s “tired of hearing this is the biggest election in your lifetime. The reality is over time, it doesn’t matter.”

While hedge funds are taking positions in “Trump trades” like private prisons and fossil fuels, we believe that trying to time the market based on election outcomes is a risky game. Yes, the election will cause short-term volatility, but if you’re in the right assets—like gold, silver and Bitcoin—I believe you’ll be well-positioned to weather the storm.

Index Summary

- The major market indices finished mostly down this week. The Dow Jones Industrial Average lost 2.68%. The S&P 500 Stock Index fell 0.98%, while the Nasdaq Composite gained 0.16%. The Russell 2000 small capitalization index fell 2.94% this week.

- The Hang Seng Composite lost 8.21% this week; while Taiwan was down 0.59% and the KOSPI fell 0.41%.

- The 10-year Treasury bond yield gained 15 basis points to 4.24%.

Airlines and Shipping

Strengths

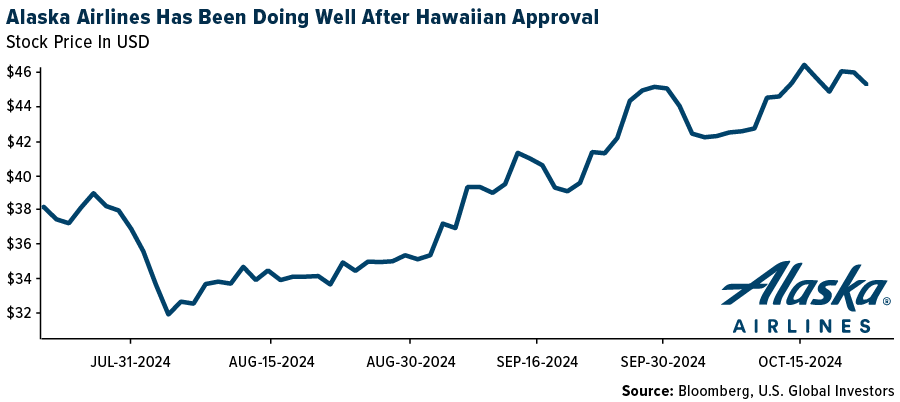

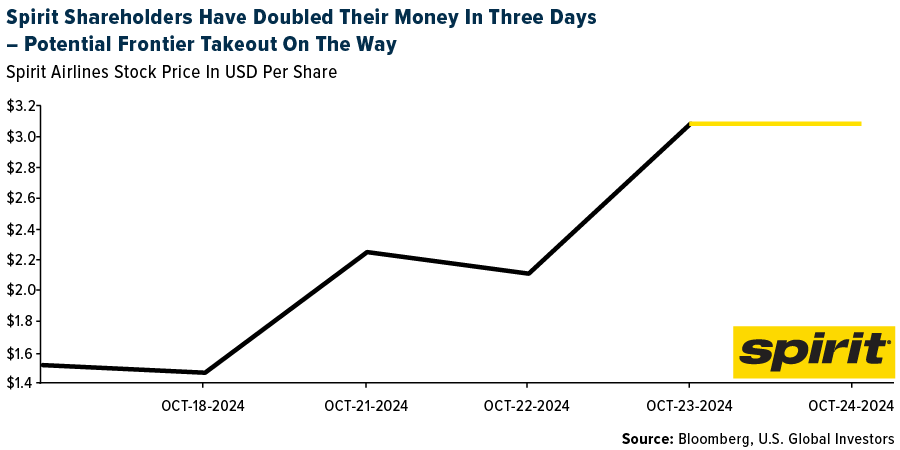

- The best performing airline stock for the week was Spirit, up 89.9%. Alaska Air expects its third quarter 2024 combined results to be on the better end of its previously guided earnings per share (EPS) range, inclusive of 13 days of Hawaiian’s results. The carrier expects to report the industry’s best adjusted pre-tax margin performance for the quarter, with positive revenue and cost performance in the quarter. Revenue trends experienced throughout the third quarter are continuing into the fourth quarter, with strong advanced booking performance for both the Alaska and Hawaiian networks.

- According to Shippingwatch, the major container port of Los Angeles had its busiest quarter to date. A total of 954,706 containers passed through the West Coast port in September, according to an update from the Port of Los Angeles. This represents a 27% increase compared to the same month last year, making the period from July through September the busiest ever for the port, with a total of 2.58 million TEU.

- Volaris reported solid third quarter results, reports JPMorgan, above Bloomberg consensus from top to bottom line. EBITDAR was at $315 million and EBITDA at $274 million, both including the compensation from Pratt & Whitney. The positive surprise was led by a combination of 2% higher than anticipated yield and 5% lower than anticipated fuel costs.

Weaknesses

- The worst performing airline stock for the week was Norwegian Air Shuttle, down 17.4%. According to RBC, the Boeing vote against the agreement was 64%. The latest offer would have increased wages by 35% over four years and included a $7,000 ratification bonus as well as a $5,000 contribution into a retirement plan. The latest offer did not include a re-instatement of the company’s pension plan. The initial contract offer was rejected by 96% of the union members, so it appears that Boeing is getting closer.

- According to Morgan Stanley, freight rates are continuing their downward correction following the premature peak season and front-loading of volumes, leaving shipping lines facing an underwhelming winter. The Drewry World Container Index (WCI) continued its drastic downward trajectory, established in July, reaching $3,216 per container.

- Airbus deliveries continue to trend at a slow pace, reports Bank of America, with 35 aircraft delivered month-to-date versus 71 last year. First flights indicate better underlying production but there remains a lot to do in the last 10 weeks of the year. The bank continues to expect Airbus to come in below the 770-delivery guidance with the firm estimating 760 in fiscal year 2024.

Opportunities

- According to TD, United Airlines has an immense lead in international travel due to management’s prudent decision not to retire widebodies during the pandemic. Cirium data shows that United currently has 220 widebodies in service. This compares to 168 at Delta and 126 at American.

- Goldman has reported that the number of container ships waiting to dock and unload goods along the West Coast remained at two, but East Coast backlogs declined significantly from 27 to 10, likely reflecting improving port throughput post the recent East/Gulf coast port strikes.

- Frontier Airlines is in the early stages of a renewed bid for Spirit Airlines, reports the Wall St. Journal. The combination would create a national ULCC better able to compete for price conscious traffic and should be easy to approve by the DOJ and DOT.

Threats

- According to TD, Frontier/Spirit certainly changes the calculus for the industry. A national high utilization ultra-low-cost carrier takes away the dynamic of two carriers chasing the same cost-conscious traffic. The combined entity will likely be in a stronger position to compete in the Southeast and Caribbean which is negative for American, Southwest, and JetBlue.

- The past two winters have been particularly mild, reports Stifel, and the possibility of energy shortages never materialized. With relatively heathy current storage levels and after two years of not needing the extra gas, there is very little in the way of floating storage now. The number of ships used has peaked around two dozen in late October to mid-November, but now storage is only about half a dozen vessels.

- Frontier Airlines lowered its January system capacity by 940 basis points (bps), according to Bank of America. The cuts follow similar reductions in recent weeks. This week, Latin American cuts (-15.6%) were greater than domestic cuts (-8.0%). First quarter 2025 system capacity is tracking toward +11.3% from flat to down in the fourth quarter of 2024, but they expect more meaningful cuts to the first quarter over the coming weeks.

Luxury Goods and International Markets

Strength

- Tesla reported better-than-anticipated results, earning $0.72 per share compared to the expected $0.63. The company generated $25.2 billion in revenue, reflecting a 7% increase from the same period last year. Additionally, it announced plans to launch a more affordable electric vehicle in the first half of next year.

- Hermès reported a rise in sales for the third quarter, achieving quarterly sales of $3.9 billion, representing 11% growth. Sales in Japan were particularly strong, increasing by about 23%. However, the Asia-Pacific region (excluding Japan) experienced weaker performance, largely due to subdued demand in China.

- Tesla was the top-performing stock in the S&P Global Luxury sector, gaining 21.4% in the past five days. Shares surged after the company reported stronger-than-expected quarterly results.

Weaknesses

- Loreal posted disappointing sales last quarter, as the beauty company saw much wekeaer demand in China. “In mainland China, the beauty market, which was already negative in the second quarter, contuned to detoriorate impacted ny low consumer confidence,” Loreal said.

- The Eurozone Services PMI, which measure the activity level of purchasing managers in the services sector, eased to 51.2 in October of 2024 from 51.4 in the previous month. New orders decreased for the second consecutive month, and at the fastest pace since January.

- Capri Holdings was the worst-performing stock in the S&P Global Luxury index, losing 49%. Shares declined after a jugde blocked the purcahse of the company by Tapestry.

Opportunities

- Tesla reported higher profits due to lower costs and increased sales. They noted that the Cybertruck became profitable within a year of its launch. The company’s battery and solar operations grew by 52% year-over-year, while services and other revenue increased by 29% compared to Q3 2023. CEO Elon Musk said on the earnings call that his “best guess” is that “vehicle growth” will reach 20% to 30% next year, due to “lower cost vehicles” and the “advent of autonomy.”

- Estée Lauder has partnered with Amazon to launch its products on the Amazon Premium Beauty store, introducing a Virtual Foundation Tool for customers. This move could enhance Estee Lauder’s market reach and potentially influence its stock performance.

- The Chinese government’s plan to nearly double spending on housing projects to $562 billion could stimulate economic activity and consumer confidence. This may lead to a rebound in luxury spending, benefiting companies within the ETF that are heavily reliant on Chinese markets.

Threats

- Barclays has lowered its sales and earnings per share estimates for LVMH for this year and next. The broker noted that a recent miss in the Fashion & Leather Goods division indicates weaker-than-expected demand from Chinese customers, suggesting that recovery may take longer than anticipated.

- Brokers continue to downgrade luxury brands, particularly those heavily reliant on Chinese customers. Citibank downgraded Kering to neutral, removing a buy rating it had maintained for over a decade. As a result, Kering shares fell by as much as 1.8% on Monday and are on track for their worst year since the Global Financial Crisis, down approximately 40%.

- Pre-owned home sales in the U.S. for the first nine months of the year were lower than in the same period last year. Elevated real estate prices and high mortgage rates may be keeping potential buyers on the sidelines. While mortgage rates declined around the time of the Federal Reserve’s initial rate cut, they have recently risen back above the 6% level.

Energy and Natural Resources

Strengths

- The best performing commodity for the week was natural gas, rising 12.84% after what might be a bottom in the market, which has fallen for nearly three weeks. India’s largest solar-panel producer’s $514 million initial public offering (IPO) was fully subscribed in the first few hours of opening, benefiting from the world-beating rally in the nation’s renewable energy stocks this year, according to Bloomberg.

- Investors are upbeat on nuclear power following news that Amazon signed several agreements to support funding and development of the X-energy Xe-100 SMR, and an agreement with U.S. utility Dominion to explore SMR deployment in Virginia. This adds to increasing momentum behind growth in nuclear energy and potential for new nuclear builds in the U.S., which RBC views as positive long-term drivers for the sector.

- Zinc is rapidly moving deeper into a market structure that suggests supply of the metal used to galvanize steel is tightening. The cash price is at a $24.09 premium to three-month contracts on the London Metal Exchange, a pattern known as backwardation where near-term prices are higher than those further out, according to Bloomberg.

Weaknesses

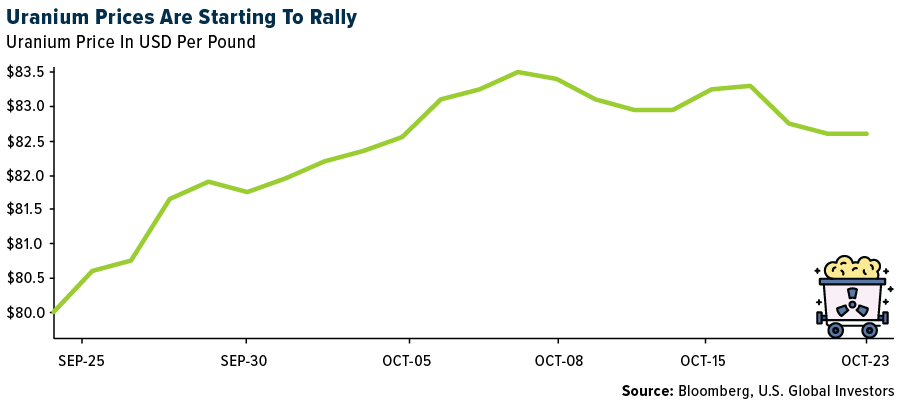

- The worst performing commodity for the week was uranium, as proxied by the Sprott Physical Uranium Trust, dropping 5.06% with the surge in momentum over the past several weeks tapering off from the price. UBS’s weekly refining margins tracker points to a further decline in UBS European composite refining margin. The average refining margin for the week was down $0.23 per barrel to $4.61 per barrel.

- Global steel production has declined by 5%, primarily due to a 6% year-over-year drop in China. Production outside of China fell by a smaller margin, down 3%, with Russia and Iran contributing to the decrease. This was partially balanced by steady growth in countries like Brazil, Turkey, Mexico and Ukraine, according to Morgan Stanley.

- Iron ore fell as traders weighed prospects for rising supplies against China’s efforts to put a floor under the economic slowdown in the top importer. Futures dipped briefly below $100 a ton in Singapore, according to Bloomberg.

Opportunities

- Saudi Aramco is bullish on China’s oil consumption after the government introduced a raft of stimulus measures aimed at reviving Asia’s biggest economy, CEO Amin H. Nasser said. Demand for jet fuel is a bright spot for the nation, said Nasser, who was speaking at the Singapore International Energy Week conference on Monday, according to Bloomberg.

- Lundin Mining heirs Adam and Jack Lundin are betting big on Argentina’s copper potential as they lead the company into the country’s volatile landscape. This ambitious move aligns with the family’s legacy of taking risks in underexplored regions, but also highlights the challenges of operating in politically unstable and economically uncertain areas. With Argentina’s government backing resource extraction, the Lundins hope to capitalize on the global demand for copper essential for clean energy, though success hinges on navigating the country’s unpredictable future, reports mining.com.

- According to Bloomberg, Mitsubishi Power Ltd. sees the world ordering 50% more gas turbines annually through 2026, compared with the past three years, driven in part by data center growth. Globally, there will be 60 gigawatts worth of equipment orders every year from 2024 through 2026, up from an average annual capacity of 40 gigawatts sold between 2021 and 2023, said Takao Tsukui, executive vice president of international sales at Mitsubishi Power, the world’s top supplier of gas turbines.

Threats

- Almost nine years after a devastating dam collapse at a Brazilian iron ore mine, BHP Group Ltd. is set to defend allegations at a London trial that it is “cynically and doggedly” trying to avoid its liability to pay billions in compensation to the communities hit hardest. The collapse of Fundão Dam at an iron ore joint venture between Vale SA and BHP is at the heart of one of the largest UK class actions of its kind starting Monday, according to Bloomberg.

- Morgan Stanley says that oil demand is down from a peak of 1.5 million barrels per day (mb/d) earlier this year, but this has continued to fall, even in the last two weeks. The average forecast now stands at just 870,000 b/d. Growth in refined product demand is now estimated at just 455,000b/d. Notably, the average forecast now sees China’s oil demand growth at close to zero this year.

- The key raw material needed to make aluminum is tearing toward a record high as buyers race to secure supplies, following an export disruption in top-miner Guinea that has rippled through to China. Prices for alumina have surged by more than 20% so far this month and are now within striking distance of the record of $707.75 set in 2018, according to pricing agency Fastmarkets Ltd.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was Safe (SAFE), rising 62.99%.

- Options traders are increasing bets that Bitcoin will reach a record high of $80,000 by the end of November no matter who wins the U.S. presidential election. The IV for Bitcoin options coming due around the November 5 election day is elevated, writes Bloomberg, with the wagers skewed toward call options that give the buyer the right to buy the cryptocurrency at new highs.

- Billionaire hedge fund manager Paul Tudor Jones said he is long gold and Bitcoin in an interview with CNBC this week. He expects that the path forward will be inflationary regardless of who lands in the White House – though he has started positioning for a Trump victory, according to an article published by Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Aerodrome Finance (AERO), down 22.23%.

- Portofino Technologies, a Switzerland-based crypto market making firm that was given the nod earlier this year form the FCA to serve institutional crypto clients in the UK, has seen an exodus of staff in recent months, following the sacking of the firm’s co-founder and its head of finance, writes Bloomberg.

- India is considering banning cryptocurrencies such as Bitcoin and Ethereum in favor of its own central bank digital currency, according to Bloomberg, with key regulatory institutions advocating for the move. This comes as the government is preparing a discussion paper on the future of crypto regulation in the country.

Opportunities

- Bitcoin came close to $70,000 on Monday after a spurt of inflows into ETFs for the largest digital asset as well as optimism about the outlook for the U.S. regulation supported sentiment. Bitcoin rose 1% before paring some of gains to trade at $68,252, writes Bloomberg.

- Nimbus Capital is investing $10 million in Alvara Protocol to revolutionize asset management in Defi. Alvara is a transformative platform aimed at democratizing asset management within the DeFi space. Built on the newly developed ERC-7621 token standard, Alvara introduces an innovative tokenized basket factory that streamlines and simplifies basket management, making it more accessible for all users, writes Bloomberg.

- Crypto hedge fund managers JellyC and Trovio Asset Management have merged as part of an effort to attract allocations from institutions such as pension funds. Australia-based JellyC will be the majority shareholder of the combined operation, company executives said in interviews.

Threats

- Ethereum co-founder Vitalik Buterin continued his recent series of blog posts addressing Ethereum’s future in a new post which outlines possible approaches the blockchain’s community can take to mitigate proof-of-stake centralization risks as part of the planned “Scourge” upgrade, The Block reports.

- Last week’s roundup of crypto promoters and traders, following an elaborate string operation by federal prosecutors, served as a reminder that fake trades used to inflate prices continue to be a lingering issue in the digital asset world, Bloomberg reports. The wash trading strategy used to boost the FBI-created token NexFundAI remains a common practice on decentralized-finance exchanges and can be encountered on certain centralized exchanges as well.

- Valeria “Bitmama” Fedyakina, a Russian influencer, faces 10 years in prison for $22 million crypto fraud. Law enforcement previously suspected her of treason but recently charged her with economic crimes alone, writes Bloomberg. Fedyakina allegedly defrauded at least four Russian businessmen with a phony cross-border payment scheme.

Defense and Cybersecurity

Strengths

- MTU Aero Engines’ military business drove a 14% rise in revenue and an increase in adjusted net profit to €541 million in the first nine months of the year.

- RTX announced that its Raytheon unit secured $676 million in U.S. Army contracts to continue producing the TOW missile system, with production set for Tucson, Arizona.

- The best performing stock this week was LOAR Holdings, rising 7.76%, following Honeywell’s earnings report on October 24, with Loar historically showing an average one-day move of 39% compared to Honeywell’s 2.5%, according to Bloomberg’s supply chain analysis.

Weaknesses

- Chinese President Xi Jinping urged the military to intensify war preparedness and ensure strong combat capabilities during a visit to the People’s Liberation Army Rocket Force, following large-scale drills around Taiwan.

- Turkey launched airstrikes on Kurdish militant targets in Iraq and Syria in response to a deadly attack on a state-owned defense firm in Ankara, killing five people, with officials attributing the assault to the Kurdistan Workers’ Party (PKK) and the The People’s Defense Units (YPG).

- Textron Inc. was the worst-performing stock this week, dropping 8.55% after reporting third-quarter earnings and revenue below analyst expectations. The company’s aviation segment was affected by a labor strike, and its earnings per share (EPS) forecast for 2024 was subsequently downgraded.

Opportunities

- Palantir announced a strategic partnership with L3Harris to advance U.S. defense technology by integrating artificial intelligence (AI) with L3Harris’ cutting-edge hardware. The collaboration aims to improve situational awareness, target identification and communication through joint efforts in U.S. Army programs and enterprise-wide digital transformation initiatives.

- Saab expects its 2023 sales to reach the upper end of its 15-20% growth guidance, driven by increased defense spending and significant orders, including a $600 million contract and a $123 million order from Lithuania. In the third quarter, Saab’s order bookings rose 41% to $2 billion, net profit increased to 966 million kronor, and sales grew 18% to 13.55 billion kronor.

- Hensoldt and Raytheon have partnered to enhance electro-optical and infrared systems for NATO forces, establishing a maintenance facility in Germany by early 2025, with plans to expand their collaboration to both airborne and land-based defense programs.

Threats

- Taiwan Semiconductor Manufacturing suspended shipments to a client after discovering a Huawei product contained a chip supplied by the company, prompting an investigation and notification of U.S. and Taiwan governments.

- The FBI has launched an investigation into the leak of classified U.S. intelligence documents, which detail Israel’s potential plans for a retaliatory strike against Iran, after the material was posted to the Telegram messaging app, reportedly from a Tehran-based channel.

- ASML CEO Christophe Fouquet anticipates growing pressure from the U.S. to further limit semiconductor technology sales to China, highlighting geopolitical tensions and questioning the best approach for the Netherlands and Europe amid these restrictions.

Gold Market

This week gold futures closed the week at $2,754.90, up $24.90 per ounce, or 0.91%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by x.97%. The S&P/TSX Venture Index came in off 0.28%. The U.S. Trade-Weighted Dollar rose 0.83%.

Strengths

- The best performing precious metal for the week was palladium, up 10.10%. Palladium surged after the U.S. asked G7 allies to consider sanctions on Russian exports of the metal. The Biden administration floated potential restrictions during a meeting of G-7 finance officials in Washington this week as it mulls fresh ways to squeeze President Vladimir Putin’s war efforts, according to Bloomberg.

- Wheaton Precious Metals’ unit has entered a definitive pact with Montage Gold in respect to its Kone Gold Project, according to a statement. They will pay Montage total upfront cash of $625 million in four equal installments during construction. This project is expected to have a 16-year mine life based on reserves, with first production anticipated in early 2027, according to Bloomberg.

- Gold extended its rally to a fresh record high, amid tensions in the Middle East and as traders looked toward the U.S. presidential election. Bullion rose higher — having breached the $2,700- an-ounce threshold — with analysts attributing gains to haven demand amid uncertainty around, according to Bloomberg.

Weaknesses

- Gold was the weakest-performing precious metal this week, though it still managed a slight gain of 0.91%. RBC reports that Newmont’s third-quarter results fell below expectations, with EBITDA -16% under consensus. Key factors included significantly higher third-quarter costs and a revised full-year cost increase of 9% over previous guidance. Generalist investors, who had bought Newmont shares following a strong second-quarter report, sold off the stock, leading to a 16% decline over the week.

- RBC reports that Calibre Mining announced third-quarter 2024 gold sales of 46,100 ounces, falling short of both consensus estimates of 74,000 ounces and RBC’s own estimate of 76,500 ounces. Due to these lower-than-expected results, Calibre reduced its annual production guidance from 275,000–300,000 ounces to 230,000–240,000 ounces and raised its cost guidance. Production delays were attributed to adjustments needed for newly opened underground workings.

- BMO reports that Petra Diamonds released its first-quarter fiscal 2025 operating results, along with sales outcomes from its combined Tenders 1 and 2, held after the quarter ended. Diamond production fell short of BMO’s estimates due to operational adjustments at the Finsch mine. First-quarter revenue was affected by Petra’s decision to postpone Tender 1 in response to weaker market demand.

Opportunities

- RBC reports that Bellevue Gold posted a first-quarter cash flow beat of A$40 million above consensus, driven by lower costs, while production and growth capital expenditures aligned with expectations. Bellevue achieved strong cash flow and unit costs of A$1,892 per ounce (against a fiscal 2025 guidance of A$1,750–1,850 per ounce), despite processing more lower-grade tons than anticipated in the first quarter. RBC expects grades to improve throughout fiscal 2025, along with a steady increase in mine tonnage.

- According to Scotia, silver is currently trading near $34 per ounce, up 42% year-to-date, having broken above the prior resistance in the mid $32-per-ounce level, though still below the all-time highs near $50 per oz reached on two prior occasions in 1980 and 2011. The Silver Institute has also noted that the physical silver market recorded a deficit in each of the last two years, with another deficit forecast for 2024. Furthermore, they continue to see silver supply growth challenged in jurisdictions such as Mexico in particular.

- Shares in Chow Tai Fook, one of China’s biggest gold retailers, rose as much as 10% as Morgan Stanley noted the retailer’s sales were showing signs of recovery. Gold’s momentum in China had slowed such that domestic prices were trading at a discount to international prices. If this is a real change in sentiment for gold as proxied by jewelry-buying, this could be a renewed catalyst to take prices higher.

Threats

- A ruby smuggling syndicate circulated a disinformation campaign that the Gemfields ruby mine was opening its mine to anyone that wanted to mine. Thus, about 300 people on Sunday invaded a pit at Gemfields Group Ltd.’s ruby mine in Mozambique, which accounts for about half the world’s supply of the stones, CEO Sean Gilbertson said. Two people were shot and injured by police, he said. A crowd of about 500 people later gathered at a village near the Montepuez ruby mine in northeastern Mozambique intending to enter the mine.

- Newmont’s recent earnings call revealed operational challenges, with a downward revision in production due to underperformance at key mines, leading to a 16% share drop for the week. This, alongside Barrick’s disputes with the Malian government over profit sharing, highlights the increasing geopolitical and operational risks in the gold industry. These pressures threaten the ability of major miners to meet growth targets, suggesting a need for potential M&A as reserves dwindle.

- Morgan Stanley indicates mining companies have cut production and cancelled rough sales, such as Petra Diamonds and De Beers, to reduce historically high inventories. Prices also remain under pressure, with implied September rough prices decreasing 27% month-over-month and 32% year-over-year.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2024):

Alaska Airlines

Amazon.com Inc

Barrick Gold Corp.

Bellevue Gold Ltd.

Boeing

BHP Group Ltd

Airbus

American Airlines

Calibre Mining Corp.

United Airlines

Delta Air Lines

Estee Lauder Companies Inc.

Frontier Airlines

Southwest

JetBlue

Kering SA

Lundin Gold Inc

L’Oréal SA

LVMH Moët Hennessy Louis Vuitton

Estee Lauder

Loreal

Montage Gold Corp.

Newmont Corp.

Hermes International SA

Wheaton Precious Metals Corp

Tesla Inc.

Textron Inc.

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.

The Drewry World Container Index (WCI) measures the bi-weekly ocean freight rate movements of 40-foot containers in seven major maritime lanes.