The launch of the first spot Bitcoin (BTC) exchange-traded funds (ETFs) in the U.S., which have seen significant inflows and trading volumes in their first month of trading, has prompted many investors to reevaluate their stance on gold as the yellow metal has largely traded sideways around $2,040 while BTC and the broader crypto market rally higher.

In a commentary for the CME, analysts at Inspirante Trading Solutions said, “In the post-Bretton Woods era, perceptions of gold have undergone significant transformation. Increasingly, individuals question gold’s relevance in a modern financial portfolio, with some dismissing it as a ‘barbaric relic’ of a bygone era.”

The analysts added, “This skepticism reflects broader changes in monetary policy, economic theory, and investment strategy,” but noted that “such views overlook gold’s enduring attributes and its historical resilience as a store of value.”

“Gold continues to play a crucial role in diversifying investment portfolios, hedging against inflation, and serving as a safe haven in times of economic uncertainty,” the report said. “It remains a critical asset for investors seeking to preserve wealth over the long term, embodying a form of ‘true’ money that transcends the limitations of contemporary fiat currencies.”

For that reason, the trading firm highlighted the importance of understanding the factors that influence gold’s price to better understand its evolving role in financial markets.

“While it’s a common perception that the U.S. dollar significantly affects gold prices – given that gold, like many commodities, is denominated in USD – this relationship exhibits variability over time,” they said. “A nuanced examination reveals that the correlation between gold prices and the U.S. dollar (often tracked using the U.S. Dollar Index, DXY, as a proxy) is not consistently strong across all periods.”

“For instance, from early 2022 to the beginning of 2024, the correlation between gold and the DXY has been marked with periods of synchronicity and divergence, suggesting other drivers at play in determining gold prices,” the report said.

They pointed to the real yield on U.S. 10-year Treasury notes, calculated as the nominal yield minus inflation expectations, as one such factor affecting gold price.

“Real yields offer a more accurate measure of the investment’s return, adjusting for the effects of inflation. Historically, there has been a noticeable inverse correlation between real yields and gold prices,” the FinTech firm said. “The rationale behind this relationship is straightforward: as real yields increase, the opportunity cost of holding non-yielding assets like gold becomes higher, typically leading to lower gold prices, and vice versa. However, this correlation is not perfect, and periods of divergence have been observed, indicating the influence of other market dynamics and sentiments.”

Demand is another “pivotal factor influencing gold prices,” they said, which includes both investor sentiment and central bank policies.

“Traditionally, gold has been a staple in investment portfolios and a key component of national reserves,” the report said. “The appeal of gold to investors can fluctuate based on generational trends, economic outlooks, and the emergence of alternative investment vehicles.”

Inspirante noted that “recent years have seen a shift among newer generations of investors towards digital assets like Bitcoin, which offer a narrative of scarcity and value preservation similar to gold. This shift has influenced gold demand and, consequently, its price.”

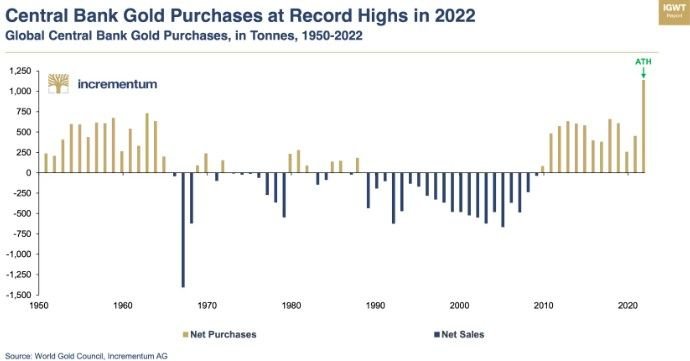

Positive influences include increased gold buying by central banks, especially the RICS+ countries (Brazil, Russia, India, China, South Africa, and their allies), which “have been aggressively boosting their gold holdings.”

“This trend underscores a strategic move towards diversification and a hedge against currency and economic uncertainties, highlighting gold’s enduring appeal as a reserve asset,” the analysts said.

In this evolving landscape, Inspirante said it’s crucial to look beyond conventional views of gold as merely another commodity denominated in fiat currencies to get a better understanding of its significance.

“By adopting a lens where gold serves as the primary unit of account and the truest store of value, we uncover profound insights into its enduring worth,” they said. “This shift in perspective reveals that fiat currencies, which lack backing from scarce resources like gold or oil, are inherently vulnerable to the erosive effects of central bank policies and governmental monetary expansion, commonly referred to as ‘money printing.’ Over time, these policies diminish the purchasing power of fiat currencies, whereas gold consistently preserves wealth.”

The trading and research firm looked at the performance of gold against the Dow Jones to highlight the yellow metal’s ability to hold its value.

“By examining the ratio of the Dow Jones Industrial Average to gold, we observe the number of ounces of gold required to buy a unit of the stock market over several decades,” they said. “Remarkably, despite the stock index increasing more than 360 times in value, this ratio remains around its historical average. This consistency underscores gold’s capacity to maintain purchasing power, illustrating its stability amidst the volatility of equity markets.”

Gold versus the Nasdaq and the Russell 2000 produced similar results, they noted, and the report also proved that gold has held its value relative to real estate over the past 50 years.

“The ratio of the average U.S. home price to gold provides insights relevant to everyday citizens,” they said. “Despite a more than tenfold increase in home prices since the 1970s, the amount of gold required to purchase an ‘average home’ remains within historical norms, which is between 150 and 400 in terms of the ratio. This example vividly demonstrates gold’s effectiveness in preserving purchasing power in the face of real estate market inflation.”

Gold has also held up against oil, “a commodity of paramount importance to the global economy.”

“The number of ounces of gold needed to purchase a barrel of oil has remained remarkably consistent over decades, between 0.04 and 0.10 in terms of the ratio, despite geopolitical upheavals and unexpected global events,” the analysts said. “This stability affirms gold’s role as a reliable measure of value across different economic sectors.”

The report also compared the performance of gold to India’s Nifty 50 index, the value of Japan’s Nikkei 225 Index, valued in gold vs. JPY, and Turkey’s BIST 100 Index, valued in gold vs. TRY. All examples showed that gold has maintained its purchasing power while local currencies depreciated significantly.

“The journey through gold’s storied past and our reassessment of its value proposition fortify our conviction in gold’s enduring relevance,” Inspirante said. “This conviction aligns us with the long-term bullish camp, advocating for gold’s inclusion in investment portfolios for both value preservation and potential appreciation.”

The report said that gold not only serves as an inflation hedge, “but as a prudent investment in an era marked by monetary disorder – a condition all too prevalent in today’s global economy.”

While they remain optimistic in the long-term for gold, the analyst warned that “The gold market, like all financial markets, is subject to fluctuations.”

“Gold’s price action over the past decade suggests the formation of a multi-year Cup-and-Handle pattern, a bullish continuation signal, with the metal now poised at the critical juncture of a breakout from this formation’s neckline,” the report said. “Currently trading near its all-time high above $2,000 per ounce, gold faces a significant resistance at the $2,100 level – a threshold that has thrice rejected its advances since 2020, each followed by a correction exceeding 10%.”

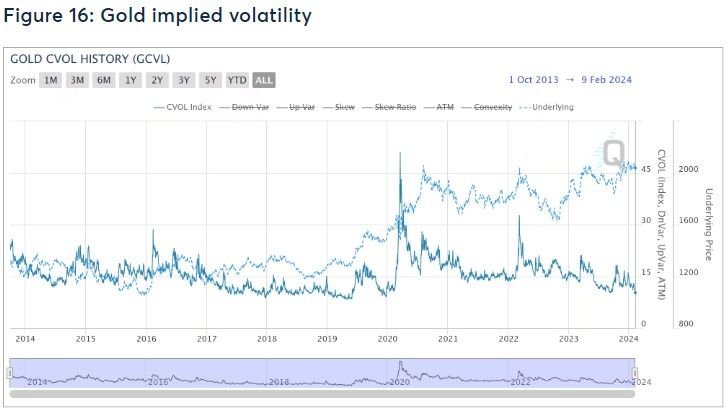

While periods of heightened implied volatility in gold have coincided with significant market events – such as the pandemic response in mid-2020 and the Russia-Ukraine conflict in 2022 – Inspirante said, “The current market environment presents a contrast. As gold surpasses the $2,000 level, the absence of a corresponding increase in volatility suggests a market that is either confident in the metal’s valuation or perhaps somewhat complacent about the broader macroeconomic backdrop.”

“This relatively calm ascent, not driven by a single, disruptive event, further bolsters our confidence in gold’s potential for sustained growth,” they said. “Moreover, the current low-volatility environment opens up opportunities for employing options strategies, allowing us to navigate the market’s complexities with greater finesse.”

That said, they warned that in the short term, “gold is converging towards the apex of a symmetrical triangle, signaling a potential inflection point.”

“Diminishing upward momentum and the risk of breaching the triangle’s support hint at the possibility of a dip below the $2,000 mark,” they said. “We remain cautious in the short term.”

The report cited the divergence between gold prices and real yields as the biggest factor affecting gold’s performance.

“Recent increases in real yields, driven by higher nominal yields and tempered inflation expectations, present a headwind to gold’s ascent,” they said. “The market anticipation of Federal Reserve rate cuts and a consequent decline in bond yields – if unmet in the near term – could challenge gold’s ability to break through its current resistance.”

“This scenario may precipitate a short-term correction, underscoring the need for vigilance in the coming months,” they warned. “While short-term caution is warranted due to potential reversals and the challenges posed by real yield dynamics, the long-term perspective remains overwhelmingly positive.”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.