Retail Sentiment Analysis – Gold, US Oil, and DAX 40 Latest

Gold Retail Trader data: Mixed Signals Emerge

Recent retail trader data reveals a near-even split in market positioning, with 49.98% of traders holding long positions. The ratio of short to long traders stands at 1:1, indicating a balanced market sentiment.

Key points:

- Net-long traders increased by 9.35% daily but decreased by 10.08% weekly

- Net-short traders declined by 5.75% daily but surged by 14.93% weekly

Our analysis typically adopts a contrarian stance to crowd sentiment. The slight bearish tilt suggests potential upward momentum for gold prices. However, the mixed short-term and long-term trends create an ambiguous trading outlook.

Recommended by Nick Cawley

How to Trade Gold

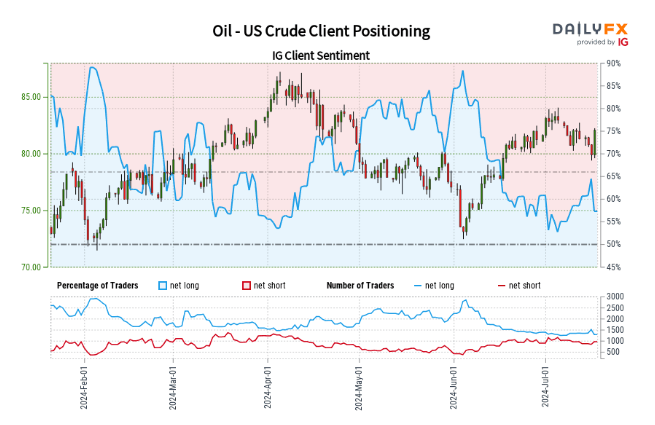

US Oil Retail Trader Data: Bullish Positioning Hints at Potential Reversal

Recent retail trader data reveals a significant bullish bias in US Crude Oil positioning, with 57.35% of traders holding long positions. The ratio of long to short traders stands at 1.34:1, indicating a clear preference for upside potential.

Key points:

- Net-long traders decreased by 15.31% daily and by 3.97% weekly

- Net-short traders increased by 11.19% daily and by 5.07% weekly

While our contrarian approach typically suggests bearish pressure when traders are net-long, recent shifts in positioning warrant closer attention. The decrease in long positions coupled with an increase in short positions may signal a potential upward reversal in Oil – US Crude prices.

| Change in | Longs | Shorts | OI |

| Daily | -18% | 17% | -6% |

| Weekly | -8% | 6% | -2% |

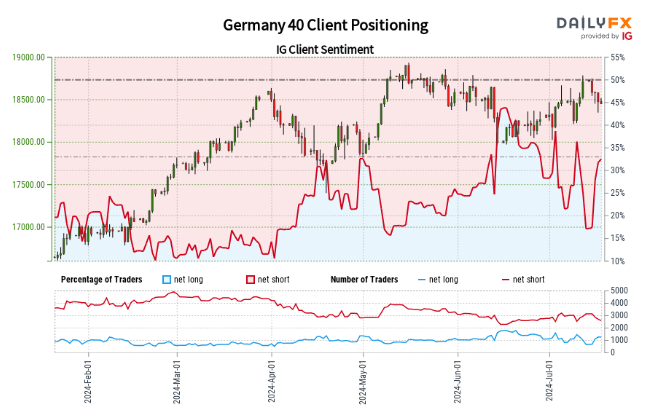

DAX 40 Retail Traders data: Bearish Positioning Hints at Potential Reversal

Recent retail trader data reveals a significant bearish bias in Germany 40 positioning, with only 32.81% of traders holding long positions. The ratio of short to long traders stands at 2.05:1, indicating a clear preference for downside potential.

Key points:

- Net-long traders increased by 4.90% daily but decreased 0.39% weekly

- Net-short traders decreased by 4.64% daily and 6.84% weekly

While our contrarian approach typically suggests bullish pressure when traders are net-short, recent shifts in positioning warrant closer attention. The decrease in short positions coupled with a slight increase in long positions may signal a potential downward reversal in Germany 40 prices.

Recommended by Nick Cawley

Traits of Successful Traders