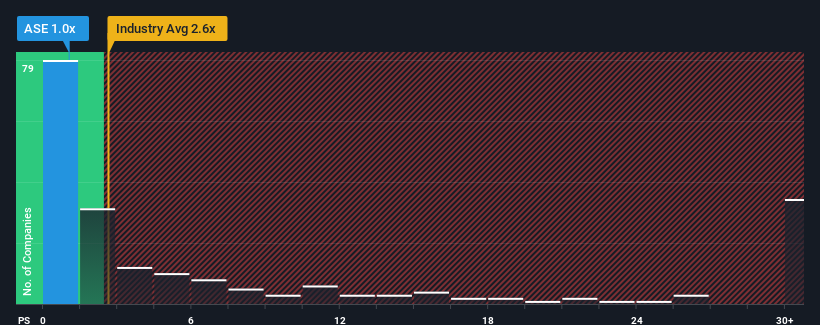

You may think that with a price-to-sales (or “P/S”) ratio of 1x Asante Gold Corporation (CSE:ASE) is a stock worth checking out, seeing as almost half of all the Metals and Mining companies in Canada have P/S ratios greater than 2.6x and even P/S higher than 15x aren’t out of the ordinary. Although, it’s not wise to just take the P/S at face value as there may be an explanation why it’s limited.

Check out our latest analysis for Asante Gold

What Does Asante Gold’s Recent Performance Look Like?

Asante Gold certainly has been doing a great job lately as it’s been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn’t eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

We don’t have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Asante Gold’s earnings, revenue and cash flow.

What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Asante Gold would need to produce sluggish growth that’s trailing the industry.

If we review the last year of revenue growth, we see the company’s revenues grew exponentially. Although, its longer-term performance hasn’t been anywhere near as strong with three-year revenue growth being relatively non-existent overall. Accordingly, shareholders probably wouldn’t have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the industry, which is expected to grow by 10% over the next year, materially higher than the company’s recent medium-term annualised growth rates.

With this information, we can see why Asante Gold is trading at a P/S lower than the industry. Apparently many shareholders weren’t comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Asante Gold’s P/S

It’s argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

In line with expectations, Asante Gold maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won’t provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we’ve discovered 2 warning signs for Asante Gold (1 is significant!) that you should be aware of.

It’s important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we’re helping make it simple.

Find out whether Asante Gold is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.