(Kitco News) – Gold prices chugged along for much of the week, trading between $2,300 and $2,360 through Wednesday, shaking off hotter-than-expected CPI and lulling market participants into a false sense of stability. Then, late Thursday, the rollercoaster began to ratchet back up, with spot gold hitting a new all-time high above $2,400 per ounce as multiple outlets reported that Iranian attacks on Israeli targets were imminent.

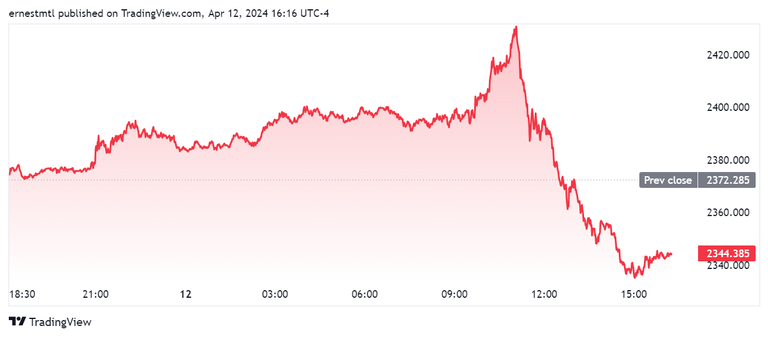

The momentum carried into Friday trading with one of the sharpest moves in the cycle to date as spot gold shot up from $2,393 at the U.S. market open to a new high of $2,431.59 by 11 am EDT, before giving all of it back later in the session.

The latest Kitco News Weekly Gold Survey showed Wall Street and Main Street marching in virtual lockstep on gold’s prospects, as geopolitical risks are expected to continue pushing prices into uncharted territory.

Darin Newsom, Senior Market Analyst at Barchart.com, said there’s no point in overthinking things in the current environment. “Is gold overbought? Yes,” he said. “Has the US dollar index extended its long-term uptrend? Yes. Am I willing to bet on gold turning down based on these two factors? No. For now, I’m going to follow my Market Rule #1: Don’t get crossways with the trend.”

Newsom said that regardless of outside influences, the trend for gold remains up. “The key is buyers continue to see value despite both cash and futures moving to new highs,” he said. “Until that side of the market changes its mind, I don’t want to be the one stepping in front of this runaway train.”

“This week has finished strong,” said Colin Cieszynski, Chief Market Strategist at SIA Wealth Management. “I am bullish on gold for next week.”

Frank McGhee, head precious metals dealer at Alliance Financial, said he’s been among the doubters during gold’s recent rally, but he’s a believer now because the market is finally taking note of geopolitical events.

“I’ve been wrong on this for most of this move up,” McGhee said. “The best component that I can see now is that the market is finally paying attention to geopolitical, and as the threat of an Iranian attack on Israel looms, the market has finally just decided to take notice.”

He said that for years, including through much of the Russia-Ukraine conflict, traders and investors ignored geopolitics. “I think the difference here is that you’ve got very strong hands underlying [gold] from central bank buying,” McGhee said. “And this is just a runaway.”

“We’re in a really weird economic circumstance where you can, as illogical as it sounds, see gold and the dollar move in the same direction,” he said. “Back in the 70s when we had the price spikes, the dollar just got creamed, and that’s what supported the gold rally. Now we’ve gone back to being a net exporter of oil, and so for every dollar up in the crude, now it’s impacting the strength of the dollar.”

“Everything that you used to know about how the markets work is thrown into the garbage.”

He said that the dollar and gold are both acting as safe havens at the same time as fear spreads across the globe. “You see it very rarely,” McGhee said. “And when you see it, it’s always a very powerful move to the upside.”

McGhee said technical levels also go out the window in these situations. “This is just surfing the wave,” he said. “Put your trailers in, and as the market continues to rally, let your trailers expand. In other words, don’t be too tight because you will get some really volatile shakeout moves that you just want to try and ignore.”

“The question will be, how much of a corrective reaction we get if there is no Iranian-Israeli dust-up over the weekend, or how much saber-rattling can continue to be there,” he added. “Sunday night’s going to be interesting.”

This week, 12 Wall Street analysts participated in the Kitco News Gold Survey, and whether despite gold’s outsized gains or because of them, an even greater proportion than last week were bullish. Nine experts, or 83%, expected to see gold prices climb even higher next week, while the remaining two analysts, representing 17%, predicted a price decline. None expected prices to remain where they are currently.

Meanwhile, 168 votes were cast in Kitco’s online poll, with 82% of Main Street investors anticipating further gains or sideways trading. 111 retail traders, representing 66%, looked for gold to rise next week. Another 30, or 18%, predicted it would be lower, while 27 respondents, or 16%, thought the precious metal would trend sideways.

The flow of economic data slows next week, but markets will still see the release of March Retail Sales and the Empire State Manufacturing Index for April on Monday, Preliminary Housing Starts and Building Permits for March on Tuesday, then March Existing Home Sales and the April Philly Fed survey on Thursday.

James Stanley, senior market strategist at Forex.com, expects the yellow metal to continue to post gains next week.

“There’s been heavy demand for gold and I don’t see any signs of that changing right now,” Stanley said. “From a macro front, I think what we’re seeing is the expectation for the Fed to remain dovish even in light of what showed in CPI this week. I do not expect that to change, and that can keep the door open for even higher gold prices.”

John Weyer, Director of the Commercial Hedge Division at Walsh Trading, believes the threat of escalation between Iran and Israel is pushing traders into the gold market and the dollar ahead of the weekend.

“This is clearly led by the sanctions being thrown on, and geopolitical actions,” Weyer said. “We’re seeing a flight to quality in the metals. When you see gold up over $50, that’s more than technicals and fundamentals at play.”

Weyer agreed that many traders are getting into long positions, while others are adjusting their existing plays.

“You get short covering,” he said. “You might be reversing positions, short covering, and then going long as well. We’ve had headlines over the past year, couple years coming from Ukraine, and then a flare-up in the Mideast. But this one, with the sanctions and a Russian tanker stuck out in the Gulf, it’s got some teeth to it.”

He said that traders scrambling to cover their assets need to take upside and downside volatility into account. “If I’m carrying anything, I’m going to put on some protection either way on this,” he said, “because if something changes quickly, it’ll give it back just as fast.”

Weyer also remarked on the unusual phenomenon of gold rallying even as the dollar strengthened against other currencies.

“When you see that happen, it is a flat-out flight-to-quality, safe-haven play,” he said. “In times of uncertainty everyone returns to gold, and the dollar’s proved to be stable for decades if not longer. You can say whatever you want about the U.S. government, but it has yet to fail, and you can see in the other currencies getting pounded, with the dollar up, some of that is probably leaving those currencies and going to the dollar.”

Weyer said that if nothing dramatic happens over the weekend, he could see gold retrace, but not by much.

“I think you could see us give some of it back, but we’re probably going to still remain at higher prices,” he said. “I think if it doesn’t flare up, it might take away the juice, so to speak, to keep rallying at this pace.”

“You might see us trade at these levels [above $2,400] for a while,” Weyer concluded.

Mark Leibovit, publisher of the VR Metals/Resource Letter, said he’s enjoying gold’s long-awaited takeoff, and he believes it could have another $300 left to gain in the current cycle.

“I put out a report that I thought we were headed to about $2,700, that was a near-term target, about two months ago,” he said. “It’s getting a little extended, you could see a peak here in the May, June period at the latest. Let’s see how far we go.”

Leibovit said that he’s been waiting for this move for some time and he’s not ready to sell just yet. “The swing target theory is that we got up to $1,980 or so back in 2011 Then we dropped down to $1,000, so that’s about an 800, 900-point swing. Then you add that number back to the top, that gets you to the $2,700 – $2,800 that I’m talking about. So that’s where I think we’re headed.”

Leibovit said after the precious metal’s recent outperformance, he’s trying to give gold the benefit of the doubt. “Certainly, you can have little corrections along the way, but I’m encouraged that the shares are finally catching up,” he said. “And as far as the news factor, we could speculate about debt in the U.S., BRICS nations creating their own currency backed by gold, all this other stuff which has a lot to do with it, China and Russia accumulating gold, difficulty with physical supplies, a lot of variables out there.”

“It’s not just Israel-Hamas, it’s a combination of a lot of events, a lot of pent-up enthusiasm over the years, and a technical breakout,” he said. “So that’s where we’re at.”

“You don’t want to get out too early and not enjoy the ride that we’ve been waiting for.”

Friday alone has been a wild ride for gold, with the daily chart resembling a rollercoaster not for the faint of heart. Spot gold last traded at $2,344.38 per ounce at the time of writing, down 1.18% on the day but up 0.60% on the week.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.