The family office of a well-known Indian real estate developer aims to actively engage in both public and private markets as it focuses on broadening its scope and portfolio.

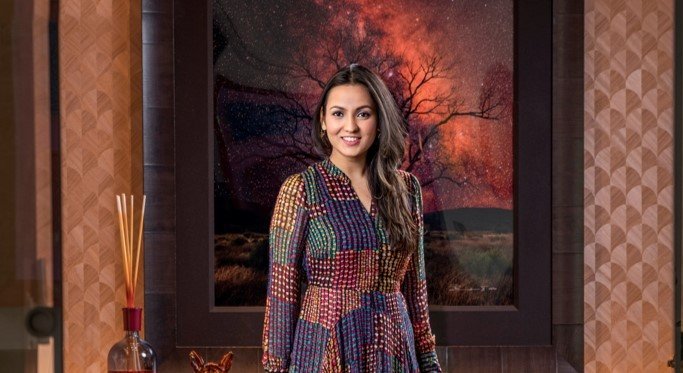

“A notable part of our portfolio consists of listed equities. We are convinced that equity markets, characterised by their natural fluctuations, have enormous growth prospects in the long run, particularly in an expanding economy such as India,” said Adrija Agarwal, founder of Sattva Ventures.

“Beyond listed equities, we zealously seek out alternative asset classes as well,” she told AsianInvestor.

These include direct investments in companies, offering strategic and financial support to investee companies.

“This firsthand participation means that we take part not only in offering financial support; we, together with these enterprises, explore the ways to achieve value improvement at key levels,” Agarwal said.

Agarwal represents the second generation of the Sattva Group, which is headquartered in Bangalore, India.

The Sattva Group’s primary business interests are in real estate, with minor interests in education and e-commerce.

“By diversifying across these asset classes, we aim to balance the potential high returns of equities with the strategic growth opportunities presented by direct investments,” said Agarwal.

Some of Sattva Ventures’ private market investments include healthcare company Ayu Health; electric-vehicle based logistics company Fyn; and food technology platform Ghost Kitchens.

PUBLIC PLUS PRIVATE

Within public equities, the family office invests mainly in mid-cap and small-cap stocks, guided by conviction that economic growth is fostered by a wide range of businesses helping the large-cap universe.

The stocks picks are based on strong management, substantial growth potential and high return ratios. While it has a sector-agnostic approach, the family office is inclined towards financials, healthcare, industrials and infrastructure.

Other prominent Indian family offices have also told AsianInvestor about the increasing importance of public equities in family office portfolios.

It’s a sentiment that Agarwal shares: “We expect significant growth in this area, reflecting the overall economic health and stability.”

Beyond public equities, the family office believes there will be a growing role for private equity and debt markets, especially in infrastructure and manufacturing.

“These industries are essential for the economic progress of the country and they offer the double advantage of providing steady returns and the opportunity for huge capital appreciation,” said Agarwal.

ALTS APPEAL

India’s alternative investments market is growing rapidly, helped by strong regulatory support and increasing investor awareness.

“Through a magnificent compound average growth rate (CAGR) which amounts to 26%, alternative investments such as private equity, venture capital and hedge funds are beating traditional investment vehicles,” said Agarwal.

“This dynamic growth can be directly attributed to the new trend in which investors are looking for new opportunities with higher returns but more diversified portfolios.

“Our family office, for instance, is strongly passionate about alternative investments, as we recognise their potential to deliver substantial value,” she added.

Alternative investment funds (AIFs), over the past decade, have witnessed substantial growth in commitments, funds raised and investments made in India.

Total investments by the AIF industry totalled around $47 billion, according to local regulatory data at the end of March.

Sattva Ventures occasionally hands over mandates or separately managed accounts to external fund managers.

“We highly emphasise establishing and sustaining long-term associations with our fund managers,” she said.

Some of Sattva Ventures’ investment partners include Fireside Ventures, Waterbridge, Nueva Capital, Trifecta Capital and Quona Capital.

In addition, the family office values gold and silver for its historical role in portfolio diversification as well as efficacy in handling market volatility.

“Such commodities can be considered as the eternal security guards that protect the portfolio during financial uncertainties,” said Agarwal.

With growing market uncertainty in the form of global geopolitics and crucial elections in various markets, family offices across Asia Pacific have piled into gold as a safe haven over the past 12 months.

¬ Haymarket Media Limited. All rights reserved.