The traditional view is that gold is a safe-haven asset. Safe-haven assets are important because investors want the value of their portfolio protected during times of stock market distress. Is the traditional view correct?

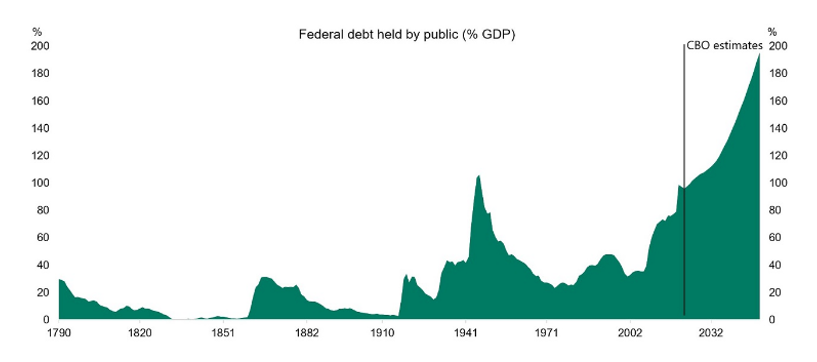

The Congressional Budget Office recently warned that its projections showed that the U.S. federal government debt is on a path from 97% of GDP last year to 116% by 2034—higher even than in World War II. Under current policies, it will eventually reach 200%.

The actual outlook is likely even worse because, from tax revenue to defense spending and interest rates, the CBO forecasts released earlier this year are underpinned by rosy assumptions (Trump’s 2017 tax cuts expire in 2025 and the CBO follows the legislation in its forecasts). Plug in the market’s current view on interest rates, and the debt-to-GDP ratio rises to 123% in 2034. Then assume—as most in Washington do—that ex-President Donald Trump’s tax cuts mainly stay in place, and the burden gets even higher.

Election Risks

Unfortunately, regardless of which side of the political spectrum you are on there are risks from the proposed policies of both candidates. With a Trump victory, there may be an increase in tariffs (which risks retaliation) including the potential imposition of 60% tariff on Chinese goods (up from 20%-25% currently); the repeal of the corporate AMT and buyback tax combined, a large increase in defense spending and full extension of TCJA tax cuts leading to even wider budget deficit. There is also the risk of militarized mass deportations negatively impacting labor force growth and wage inflation. Perhaps the greatest risk is that Trump has expressed the desire to influence Federal Reserve policy. Were this to happen—even the threat of it happening—it could create significant downside risks. The U.S. has long benefited from the dollar’s role as the world’s reserve currency. We have also benefited from our strong rule of law, having the deepest and most liquid capital markets and the freedom of capital. Any efforts to control the Fed could undermine the dollar and lead to an increase in the risk premium associated with U.S. debt instruments, raising the cost of our debt and negatively impacting our ability to fund the massive deficits we have accumulated.

With a Biden victory, there are the risks of multitrillion-dollar tax increases (half corporate, half high net worth) to support a multitrillion safety net expansion, widening the deficit as tax collections undershoot estimates while spending exceeds them.

The problem is that under either a Trump or a Biden presidency it is likely that the U.S. will continue to have a huge spending problem, with expenses running way above revenues. Eventually, lenders may no longer be willing to finance the deficits. If spending is not cut, the alternative solution would be to raise taxes to European levels. However, the result would be European-type low growth rates, which would have negative consequences for equities.

Given these risks, it’s no surprise that investor interest in gold has increased. Three main reasons dominate the heightened interest.

- Gold provides a hedge against currency risk;

- Gold acts as a haven of safety in bad times; and

- Gold is an excellent hedge against inflation.

Are these points valid? As always, we look to the empirical research evidence to provide answers.

In their June 2012 study, The Golden Dilemma, Claude Erb and Campbell Harvey examined those issues. In terms of being a currency hedge, they found that the change in the real price of gold was largely independent of the change in currency values—gold is not a good hedge against currency risk.

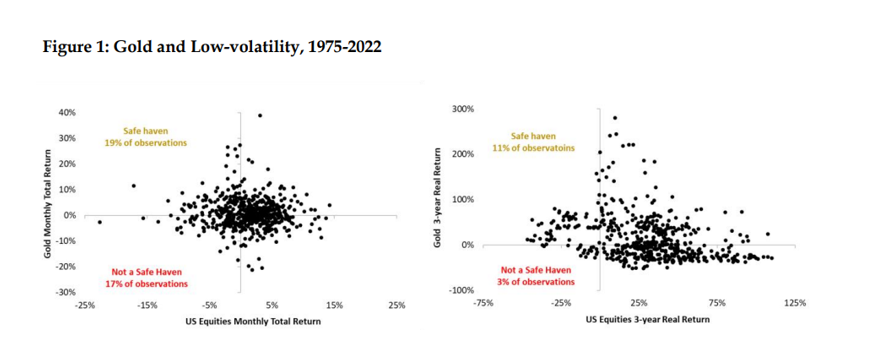

As for gold serving as a safe haven, meaning it is stable during bear markets in stocks, Erb and Harvey found gold isn’t quite the safe haven some might think. Seventeen percent of monthly stock returns fell into the category where gold dropped while stocks posted negative returns. If gold acts as a true safe haven, we would expect very few, if any, such observations. Still, 83% of the time on the right side isn’t a bad record. With that said, even the safe-haven hypothesis was tarnished, as gold prices declined over 30% during the worst of the financial crisis. When the hedge was needed most, it failed. In 2022 when stocks and bonds produced double-digit losses, even though gold outperformed stocks and bonds, it failed to provide a true hedge, as it fell slightly, closing at $1,824 in 2022 after closing at $1,829 in 2021.

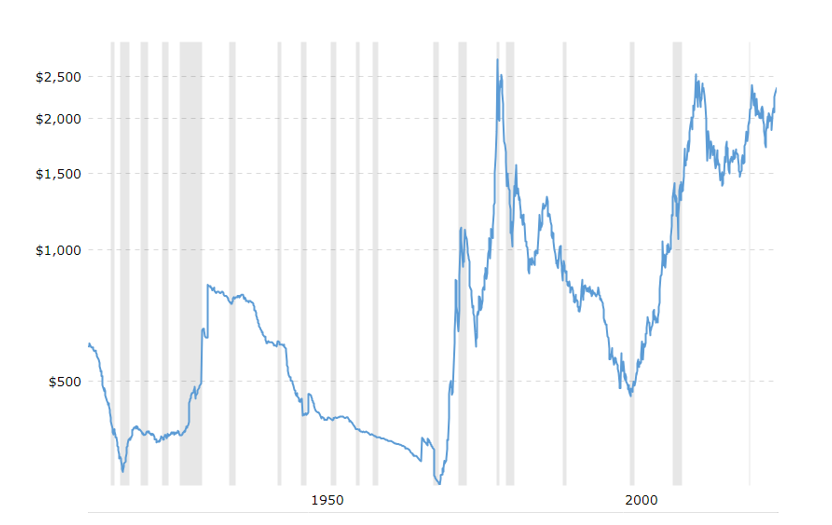

In terms of gold’s value as an inflation hedge, the following example should help provide an answer. On Jan. 21, 1980, the price of gold reached a then-record high of $850. On March 19, 2002, gold was trading at $293, well below its price 20 years earlier. The inflation rate for the period from 1980 through 2001 was 3.9%. Thus, gold’s loss in real purchasing power was about 85%. How is gold an inflation hedge when it lost 85% in real terms over 22 years?

Here’s an example with an even more extended period. As seen in the chart below, with gold now trading at around $2,363, it has lost more than 10% of its real value (inflation-adjusted) from its peak of about $2,644 in February 1980. That’s more than 43 years with a significant loss in real value if you were unlucky enough to have bought at the peak.

Their analysis led Erb and Harvey to conclude that although there is little relation between the nominal price of gold and inflation when measured over even 10‐year periods, the evidence suggests that gold does hold its value over the very long run. For example, in their 2019 update, The Golden Constant, they presented historical evidence that the wage of a Roman centurion (in gold) was approximately the same as the pay a U.S. Army captain earned today. They also showed that the price of bread (again in gold) thousands of years ago was about the same as we would pay today at an upscale bakery.

As additional evidence that gold is not a good hedge against inflation, Goldman Sachs’ 2013 Outlook found that during the post-World War II era, in 60% of episodes when inflation surprised to the upside, gold underperformed inflation. That said, gold has been a good inflation hedge over the very long run (such as a century). Unfortunately, that’s a much longer horizon than that of most investors.

In their April 2023 study, The Golden Rule of Investing, Pim van Vliet and Harald Lohre examined the strategic role of gold in investment portfolios, focusing on its marginal downside risk-reduction benefits relative to bonds and equities. They also considered longer horizons and accounted for inflation. They extended Erb and Harvey’s analysis to include 10 more years, covering the period from 1975 (when gold became truly tradable) through 2022. Here is a summary of their key findings:

Equities and gold jointly declined in 17% of the months. Conversely, equities were down, and gold was up in 19% of the months, roughly resonating with a 50/50 chance for gold to show negative returns in any given negative equity month—gold is not a perfect haven when evaluated at a one-month horizon.

At the three-year horizon, gold would have served as a haven in about three-quarters of down markets for equities—again, not a perfect safe haven. In addition, the somewhat limited protection came at a clear cost because gold was down half of the times when equities were up.

Van Vliet and Lohre next examined the effectiveness of gold in lowering downside risk over the period 1975-2022. They found:

The real returns for equities (CRSP total market), bonds (10-year Treasuries) and gold were 8.0%, 3.3% and 1.5%, respectively.

The risk of gold was high on a stand-alone basis—its downside volatility was 11.3% compared to 7.9% for equities and 5.3% for bonds. The Sortino ratio, which measures the return per unit of downside volatility, was 1.01 for equities, 0.62 for bonds, and only 0.13 for gold.

Judging by the loss probability over a one-year horizon, gold was riskier (49.7% chance of loss) than both equities (24.9% chance of loss) and bonds (34.6% chance of loss). Notably, bonds had a greater probability of loss than equities, though lower than that of gold. Further, on the basis of expected loss over a one-year horizon, gold was riskier (-6.1%) than both equities (-3.1%) and bonds (-2.5%). Finally, judging by the minimum return over a one-year horizon, gold was riskier (-46.1%) than both equities (-42.2%) and bonds (-25.3%).

When van Vliet and Lohre examined adding an increasing allocation of gold to a traditional stock and bond portfolio (with annual rebalancing), they found very little evidence of any real net benefits. For example, while adding a small allocation to gold (5%-10%) slightly reduced downside volatility (from 3.9% to 3.7%), slightly improved the Sortino ratio (from 1.56 to 1.61), reduced the probability of loss (from 26.6% to 22.4%) and the expected loss (from 1.6% to 1.3%), it also reduced the real return from 6.1% to 5.9%. They also found that increasing the gold allocation to above 10% generally led to even lower real returns and increased downside risk as well.

Their findings led van Vliet and Lohre to conclude: “Our empirical study corroborates that a portfolio’s loss probability, its expected loss and downside volatility can be brought down with modest allocations (5%-10%) to gold. However, hedging downside risk via gold investing comes at the cost of lower return.”

Latest Research

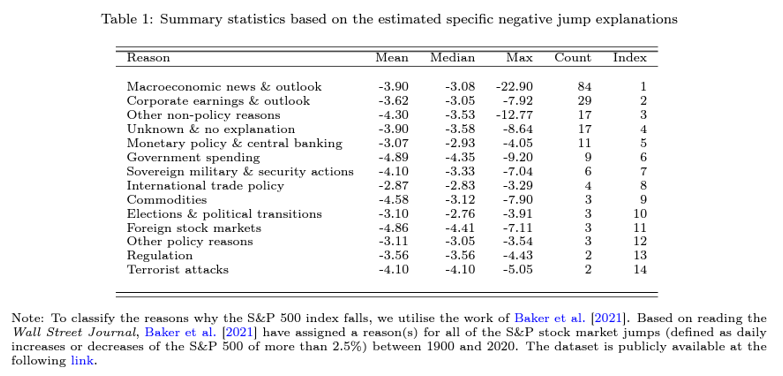

Examining the long-held view of gold as a universal safe haven during stock market downturns, the findings of Michael Ryan, Shaen Corbet and Les Oxley, authors of the study Is Gold Always a Safe Haven Asset?, published in the June 2024 issue of Finance Research Letters, are consistent with the prior research. They analyzed the performance of gold when there were negative jumps in the S&P 500 over the period from March 1979-December 2020.

To classify the reasons why the S&P 500 index falls, they used the work of Scott Baker, Nicholas Bloom, Steven Davis and Marco Sammon, authors of the 2021 study What Triggers Stock Market Jumps? Based on reading The Wall Street Journal, the authors assigned a reason(s) for all of the S&P 500 stock market jumps (defined as daily increases or decreases of the S&P 500 of more than 2.5%) between 1900 and 2020. In their dataset, the reason associated with a jump was assigned a value equal to unity. In contrast, all other underlying reasons were assigned zero. If there were two simultaneous reasons for the jump, the primary reason received a weight of 0.75 and the secondary category received a reason of 0.25. The table below the various underlying reasons used by the authors.

Their findings led them to conclude: “Gold’s strong safe haven status is not unconditional, but conditional on the specific catalysts driving stock market downturns. We find that gold’s role is a strong safe haven during market contractions triggered by macroeconomic news and developments, terrorism or trade policy. At the same time, its protective efficacy diminishes, or is absent altogether, under different conditions, such as stock market falls due to movements in commodity prices and election results.”

With that said, the three cases where gold acted as a strong hedge made up 90 of the 193 incidences. Acting as a strong hedge in 47% of the negative jumps helps explain why gold has been viewed as a safe-haven asset.

Investor Takeaways

Investors are often attracted to gold because they believe it provides hedging benefits and acts as a haven of safety in bad times. The evidence suggests that investors should be wary. First, while gold might protect against inflation in the very long run, 10 or 20 years is not the very long run. And there is no evidence that gold acts as a hedge against currency risk. As to being a safe haven, Erb and Harvey noted in their study: “In the shorter run, gold is a volatile investment which is capable and likely to overshoot or undershoot any notion of fair value.” Evidence of gold’s short-term volatility is that over the 17-year period 2006-2022, the annual standard deviation of the iShares Gold Trust ETF (IAU), at 17.2%, was higher than the 15.6% annual standard deviation of Vanguard’s 500 Index Investor Fund (VFINX). In addition, it experienced a maximum drawdown of almost 43%—safe havens don’t experience losses of that magnitude.

With that said, there have been periods when gold did act as a safe haven, just not reliably. As such, it cannot be considered portfolio insurance (a hedge) because insurance is always there when needed. Investors seeking to diversify their portfolios away from the risks of traditional stocks and bonds should also consider other assets that have low correlations to stocks and bonds but have higher expected (though not guaranteed) real returns, such as reinsurance funds (such as SRRIX, SHRIX and XILSX), private, senior secured, sponsored (by leading private equity firms) floating rate credit funds (CCLFX), and AQR’s style and risk premium funds (QSPRX and QRPRX).

Larry Swedroe is the author or co-author of 18 books on investing, including his latest, Enrich Your Future: The Keys to Successful Investing.