For investors seeking refuge in tangible assets, the question of which coins to choose becomes paramount. Investors may be familiar with the time-tested gold, silver, and platinum. But there are other precious metal coins that made the list too like palladium, and more.

Apart from which metal it’s made of, the type of coin can really impact its value, too. Other types of coins include numismatic, bullion, and limited editions. These are important to distinguish between to understand the true value of your coin investments. By knowing the nuances of each coin type, investors will have a stronger command over which coin best suits their precious metal portfolio.

Different kinds of coins are found all over the world!

Precious Metal Coins

1. Gold Coins

Investors flock to gold for its timeless allure as a safe-haven asset. Its enduring value and historical significance make it a reliable hedge against economic uncertainties, inflation, and currency fluctuations. Gold’s stability, coupled with its potential for long-term capital preservation, provides a solid foundation in diversified investment portfolios.

Specifically, gold is often viewed as a safe-haven asset. This is particularly true during times of geopolitical instability. Investors may turn to gold as a store of value when other traditional investments, like stocks or currencies, appear riskier. Importantly, physical gold, such as gold coins, is a tangible asset that you can hold. Some investors prefer the tangibility of owning physical gold as opposed to other forms of investment like stocks or bonds.

American Gold Eagles are very popular gold coins for investors.

Gold coins have been used throughout the ages. This is partly because gold is found on every continent and is universally seen as valuable by many different cultures. It is also partly because gold has unique physical properties. These physical and chemical properties include:

These qualities have made gold the ideal material for use as money.

2. Silver Coins

Unlike gold, silver has significant industrial applications. Silver is especially useful in electronics, solar panels, and medical technology. This industrial demand can contribute to a steady and growing need for silver.

Moreover, silver is generally more affordable than gold. It’s more accessible to a broader range of investors. This affordability allows for easier entry into the precious metals market. However, silver prices can be more volatile than gold prices, which can make some investors uncomfortable. But this volatility may present opportunities for investors to capitalize on price fluctuations.

The American Silver Eagle coin has been minted every year since 1986.

Like gold, silver has been used as a store of value throughout history. Investors often turn to precious metals during times of economic uncertainty. Silver has, at times, followed gold’s lead in serving as a safe-haven asset. Similar to gold, silver is often considered a hedge against inflation. As the value of currency decreases due to inflation, the value of precious metals may remain relatively stable or increase.

Silver coins are the most popular form of precious metal for investors due to its much lower price point than gold coins. Tens of millions of silver coins are minted and distributed all over globe each year.

In the past, most governments also issued legal-tender coins made of silver. That remained true throughout modern history, yet this ended in the second half of the 20th century. Many coin collectors and investors still stack these so-called “junk silver coins.”

3. Platinum Coins

Like silver, platinum has significant industrial applications. First among them is in the automotive industry for catalytic converters. As the demand for automobiles and other industrial uses increases, the demand for platinum also rises.

Platinum is a relatively rare metal, and mining and production can be challenging. Limited supply relative to demand can contribute to the metal’s value. Platinum prices have historically shown a correlation with both gold and silver. At times, it has traded at a premium to gold.

Many investors choose the American Platinum Eagle coin.

Adding platinum coins in a diversified investment portfolio can provide additional diversification benefits. Precious metals like platinum often have different price movements than traditional financial assets, offering a hedge against volatility.

The popular American Platinum Eagle coin has been in production since 1997. You will find other platinum coin offerings from several of the major government mints around the world.

4. Palladium Coins

Palladium is widely used in the automotive industry, particularly in catalytic converters. With the global emphasis on environmental regulations and the increasing demand for cleaner vehicles, the demand for palladium in catalytic converters is likely to remain strong.

Another aspect of palladium’s appeal is its rarity as a metal. The vast majority of its supply comes from Russia and South Africa. So any disruptions in the supply chain can impact the availability of palladium, potentially affecting its price.

Investors recognize its scarcity, essential industrial applications, and the potential for sustained growth. This makes palladium an appealing addition to portfolios seeking exposure to both precious metals and industrial demand.

The American Palladium Eagle coin. The design uses the classic “Mercury” motif that appeared on the U.S. dime from 1916 to 1945.

Popular palladium coin options are Palladium Maple Leaf coins from Canada and Russian palladium coins featuring a ballerina. The U.S. Mint introduced its first palladium coins in 2017.

5. Copper Coins

Copper coins are not typically considered traditional investment vehicles. At least not in the same way as gold, silver, or platinum. Copper is primarily valued for its industrial applications rather than its role as a store of value. Copper is widely used in various industries, including construction, electronics, and telecommunications.

Pennies are the best-known copper coins. Many denominations are made from copper-nickel alloys, as well.

Economic growth and increased infrastructure development can drive demand for copper. While not always considered as precious metals, some investors view copper as a potential hedge against inflation due to its use in various sectors of the economy.

Most American coins, and many more around the world, are made from a metal alloy that is mainly copper.

6. Rhodium Coins

Rhodium is one of the rarest elements that comes from the earth. The limited supply, coupled with high demand, can contribute to its price volatility. While this volatility presents opportunities for investors, it also comes with increased risk. That’s a factor investors want to hedge since there are multiple wars going on globally.

Unlike gold or silver, rhodium coins are not as widely available. The market for rhodium is specialized, and transactions may involve higher costs. That’s why investing in rhodium might be more challenging for individual investors compared to more commonly traded precious metals. Investors who are interested in investing in rhodium might need to explore rhodium coins or bars.

The first legal-tender coin made of rhodium was issued by the Pacific island Tuvalu in 2018. The design showed the fabled South Sea dragon. There are also some precious metal coins that are plated in a thin layer of rhodium.

This Maple Leaf coin is plated in rhodium and produced by the Royal Canadian Mint.

Other Types of Coins

1. Bullion Coins

Investing in bullion coins, typically made of precious metals like gold and silver, is the most common form of precious metals. Their intrinsic value is tied to the metal content. This makes them a reliable hedge against inflation and economic uncertainties.

Bullion coins provide investors with a tangible asset that protects against market fluctuations. They also offer a direct and tangible exposure to the precious metals market.

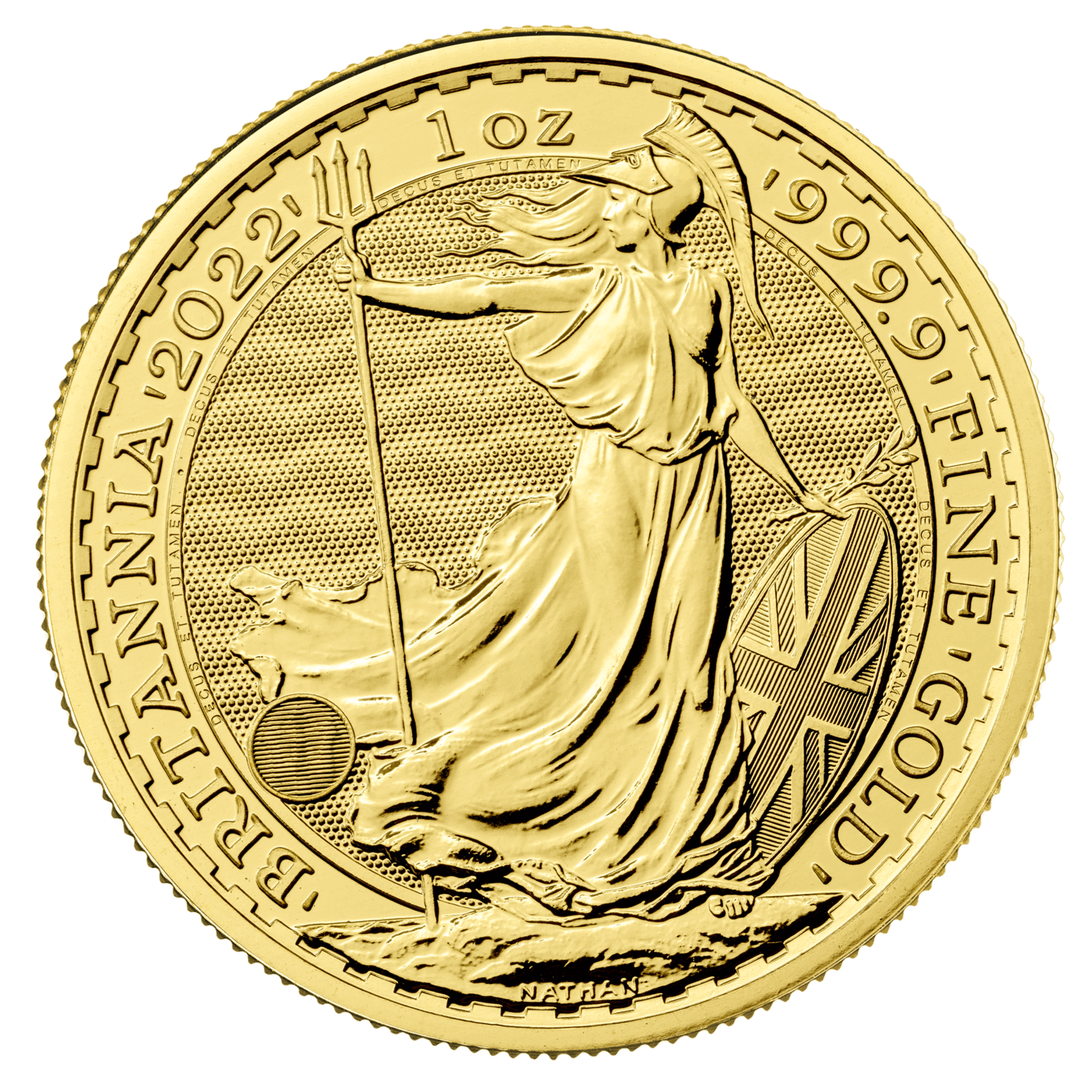

The Gold Britannia coin from Britain’s Royal Mint is a good example of a modern bullion coin.

2. Numismatic Coins

Numismatic coins are known for their historical and collector value. As such, they attract investors seeking a mix of rarity and historical significance.

Numismatics offer appreciation based on historical context, rarity, and collector demand. These coins appeal to enthusiasts who appreciate the aesthetic and historical aspects of coins. They are a nuanced investment avenue beyond the traditional focus on metal content.

Successfully navigating the numismatic coin market does require learning more about coin collecting.

One of the most widely-collected numismatic coins is the Morgan silver dollar.

3. Semi-Numismatic Coins

Semi-numismatic coins strike a balance between the intrinsic value of precious metals and the collectible appeal of numismatic coins.

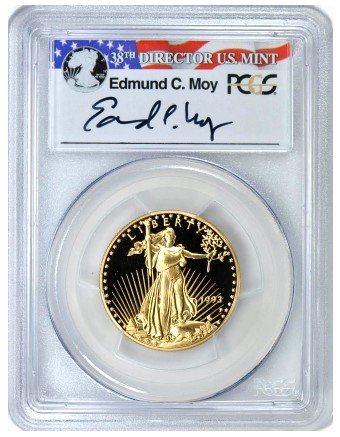

An example of a semi-numismatic coin would be a modern bullion coin that has been graded for the exceptionally high quality of its condition. This high level of preservation is called “mint state” in numismatic circles.

Investors interested in semi-numismatic coins like their dual potential. They can experience both metal value appreciation and a numismatic premium over time.

This category allows for diversification within the precious metals market. It combines the stability of bullion with the potential for additional returns driven by collector demand.

This Gold Eagle coin graded by PCGS is representative of the “semi-numismatic” category.

4. Circulating Coins

Investing in circulating coins involves acquiring legal tender coins for their face value or metal content. While their numismatic value may be limited, the potential for appreciation lies in their historical or cultural significance.

For some investors, collecting circulating coins provides a tangible connection to history. It’s a way to diversify a collection with coins that have circulated through daily life.

Circulating coins are the ones you can find in your pocket change.

5. Uncirculated Coins

Uncirculated coins are often minted with precision and care. They appeal to investors seeking coins in pristine condition. These coins, untouched by circulation, retain their original luster. They are often considered more valuable than their circulated counterparts.

Investors appreciate the potential for higher resale value. They may also like the aesthetic appeal of the coins’ mint-state condition.

6. Limited Edition Coins

Limited edition coins offer exclusivity and scarcity, appealing to collectors and investors alike. There are only a finite number of these coins in existence. They often come with unique designs, special minting techniques, or commemorate significant events.

These coins add a dimension of exclusivity and uniqueness to a diversified portfolio. Investors are drawn to the potential for increased value over time. That’s due to their rarity and the collector demand for unique, limited-edition pieces.

Written by Paulina Likos

Learn more about coin collecting and the best coins to buy from the experts at Gainesville Coins:

Rare Coins Worth Money: A Comprehensive Guide

Coin Glossary: Most Important Coin Collecting Definitions

1942 Nickel No Mintmark: Values & Strange History Explained

Most Asked Questions About US Mint Coins: Buyer’s Guide

Collector Resources for Understanding the Hobby of Collecting Coins