The launch of the first spot Bitcoin (BTC) exchange-traded funds (ETFs) in the U.S. has been billed as a historic event for digital assets as they bring a new level of legitimacy to the asset class, and many have compared their launch to the release of the first spot gold ETF in 2004, which made gold investing more accessible for individuals and institutions alike.

A topic that has been less discussed is the effect that the new spot BTC ETFs are having on the gold and precious metals markets, as the new “digital gold” has been dominating financial headlines and taking some of the attention and wealth usually reserved for the world’s oldest and most reliable store of wealth.

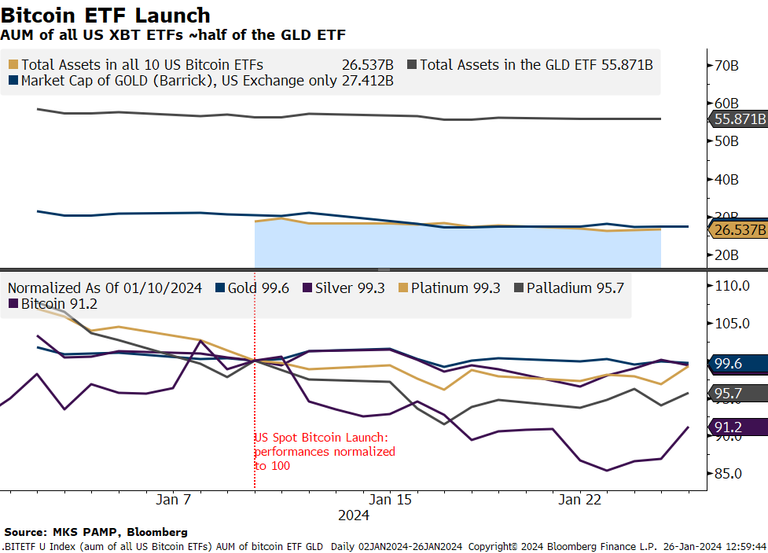

According to Nicky Shiels, head of metals strategy at MKS PAMP, “all 4 Precious Metals have traded flat (Gold, Silver) to lower (PGMs; Palladium -6% and Platinum -2%),” since the launch of the SEC approved spot BTC ETFs.

“Inflows into US Bitcoin ETFs in just 15 days surpassed $25bn alone, equivalent to the market cap of the largest Gold producer (Barrick),” she said. “AUM in Bitcoin ETFs now outrank holdings in US Silver ETFs and rank as the 2nd largest US commodity ETF after Gold.”

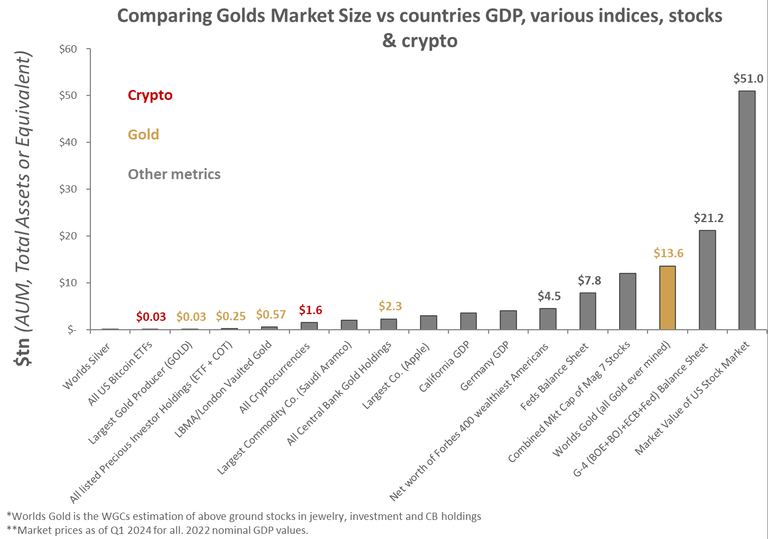

That said, Bitcoin has a long way to go to catch up with precious metals in terms of stored wealth, Shiels noted, as “known investor holdings in all Precious Metals (ETF + COT in all 4 PMs) stands at $250bn, 10x what is sitting in crypto products.”

And discussions about BTC overtaking gold as a store of wealth are premature, she added, as “The value of all the Gold ever mined is ~210K tonnes or $13.6tn worth (WGC estimates),” which is “almost double the size of the Feds Balance Sheet (which has shrunk to a still lofty $7.8tn) and still ~9x the size of the crypto AUM.”

“Overall, Gold [and] crypto remain alternative investments, and a fraction of the market value of the US stock market standing at $51tn, though Gold – accounting for investment and physical demand – has a relatively much larger, broader and established footprint and thus larger market depth [and] liquidity, vs Bitcoin,” Shiels said.

But gold shouldn’t rest on its laurels, she warned, saying the “takeaways from the GLD launch in 2004 is too extraordinary to ignore” as the launch of Gold ETFs “transformed the gold equity, physical and investment markets.”

The above chart shows the assets under management of the GLD ETF, all US-listed Bitcoin ETFs, and all gold ETFs as of Friday.

“In the month leading into the approval [and] launch of the Bitcoin ETFs (Dec 15 – Jan 15, 2023), Gold ETFs sold 1.3mn oz, Silver ETFs sold 9mn oz and Platinum 18K oz – collectively, that’s equivalent to almost $3bn of outflows (note that Silver & Platinum ETFs have since added back to holdings),” she said.

While this wasn’t “massive given historical outflow periods,” Shiels said it is notable because “this followed the convincing dovish Fed pivot at the Dec FOMC, so investors should’ve been re-leveraging, not deleveraging,” and the “spot Bitcoin ETFs launch drew in a combined $1.5bn of AUM (half of the monthlong AUM exit in Precious) in just 2days.”

“There’s an argument to be made for ETF investors to now ‘diversify’ ones US$-hedge exposure into some Bitcoin away from Gold (or Silver or Platinum), which could explain recent persistent ETF outflows,” she said. “In addition, momentum and price action becomes self-fulfilling – for example, $50K+ Bitcoin prices may attract more retail [and] FOMO inflows than $2100 Gold or $25/oz Silver.”

Shiels cited Bloomberg Intelligence estimates that US-listed spot Bitcoin ETFs could reach around $50 billion in assets within two years from $5 billion currently, and said, “Crypto ETF growth of that magnitude, due to adviser adoption, could be an ongoing threat to current Precious Metals ETF holdings, simply given the recent trends between these two asset classes.”

“Upcoming Quarterly 13F filings and ongoing monitoring of flows between Precious Metals [and] ETF will be insightful into this relationship,” she added.

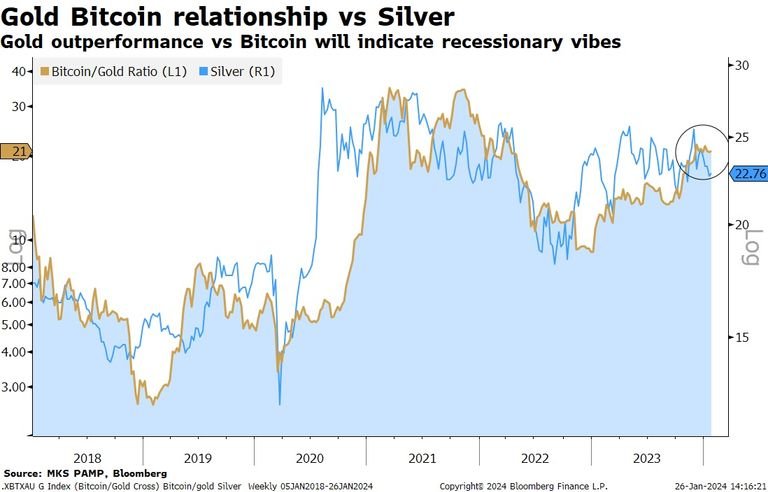

Diving deeper into the correlation between Bitcoin and Gold, Shiels noted that “Currently, one requires 21 oz of Gold to purchase 1 Bitcoin (>$42,000),” and “the post-COVID high-low range has been 10 oz of Gold:1 Bitcoin up to 35oz of Gold:1 Bitcoin.”

“It made sense that the digital version of Gold (Bitcoin) outperformed the old analog metal (Gold) in 2021 (it was the largest monetary & fiscal policy expansion in history!), underperformed in 2022 (‘crypto winter’ as Fed pushed back-to-back 75bp hiking cycle) and only mildly outperform Gold in 2023 (mild Fed hikes),” she said. “The Bitcoin/Gold ratio is a proxy for Fed liquidity conditions.”

Since Bitcoin, gold, and silver “remain on the same side of the anti-fiat, deglobalization, easing Fed policy argument,” Shiels said the main difference in which will see more inflows comes down to investor profiles.

“The Bitcoin/Gold correlation is weak at best given these varying investor profiles; physical Gold bugs just aren’t crypto bugs and vice versa, but arguably Silver investors/traders have a lot more in common with typical Bitcoin participants – both tend to be more retail (vs. institutional interest as in the Gold space), with an affinity for volatility, influenced by social media trends and both are better performing high beta proxies to easy monetary policy/ZIRP vs Gold,” she said.

“The relative outperformance of Bitcoin vs Gold is indicative of easier monetary policy/liquidity-on/risk-on influences and only when Gold decidedly outperforms Bitcoin, will that be indicative of harder landing/recessionary conditions,” she said. “In that sense, Silver should take some cues from the rallying Bitcoin/Gold ratio recently and provide some tactical bullish tailwinds.”

The fact that silver has failed to do so “is puzzling,” Shiels said, as “physical restocking from China & India plus net investor inflows against a super supportive macro backdrop (soft landing data, imminent Fed easing, expected US$ weakness).”

“In the long term, Bitcoin inflows are most at risk of cannibalizing retail and fast money Silver flows,” she warned.

From a macro perspective, Shiels said, “the crypto industry is ‘maturing’” and has advanced past the drama of 2022 “with more regulatory approval and a new legitimized product.” She said it is now a growing threat to “older havens like Gold in some regions and to a larger degree Silver retail participation.”

“It doesn’t erode the extremely strong cultural and generational affinity for physical Gold [and] Precious holdings,” she added.

“Bitcoin remains little match vs Gold in becoming institutionally investable imminently as it requires reliable integration within Traditional Finance infrastructure and that likely will take several years to build out,” Shiels concluded. “But there will be some overlap in certain participant pools as Bitcoin becomes more mainstream; the Precious industry should take a page out of the PGM book (re: EVs) and address potential – real, ongoing and farfetched – threats to the industry.”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.