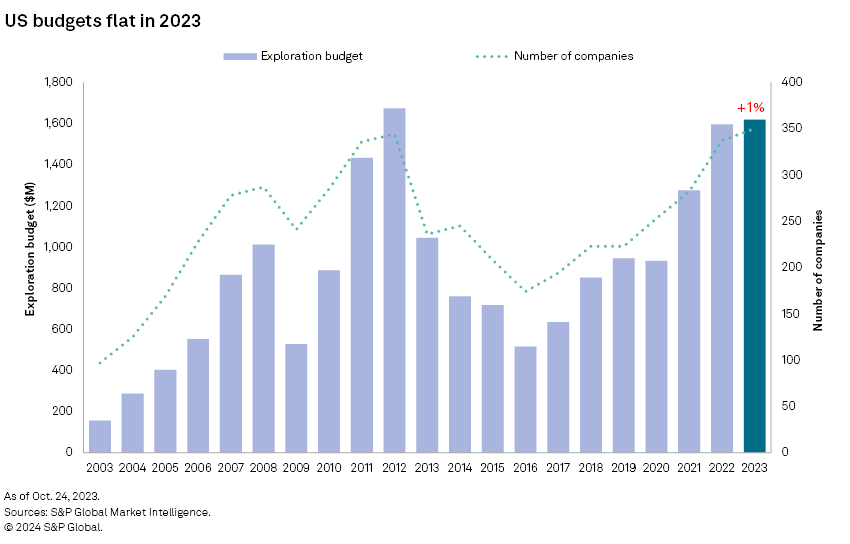

US exploration budgets were flat in 2023, up 1% to $1.62 billion, outperforming global non-ferrous exploration, which fell 3% during the monetary tightening of central banks to combat inflation, along with the continued geopolitical uncertainties. Despite lower growth in 2023, US budgets have increased since 2017 and are only $50 million shy of the all-time high of $1.67 billion recorded in 2012. While gold and silver exploration declined in 2023, other commodities deemed critical, such as copper, lithium, nickel and rare earth elements, helped to offset. The number of companies exploring in the US jumped 4% to 350 — the highest in our record.

Exploration in the US grew faster than the global average for almost a decade, fueled by major and junior companies’ increased interests, initially for gold and, more recently, other metals deemed critical, such as copper and lithium. The slowdown in global exploration in 2023 due to various macroeconomic and geopolitical headwinds affected the US, although not as much as the rest of the world due to several ongoing large-scale exploration projects. These projects are expected to continue with further growth as the government looks at ways to solve the bottleneck in permitting.

Provided that the ongoing trend in decarbonization and electrification remains strong, we can still expect the US to remain resilient and even outperform as long as shocks from different corners remain at bay.

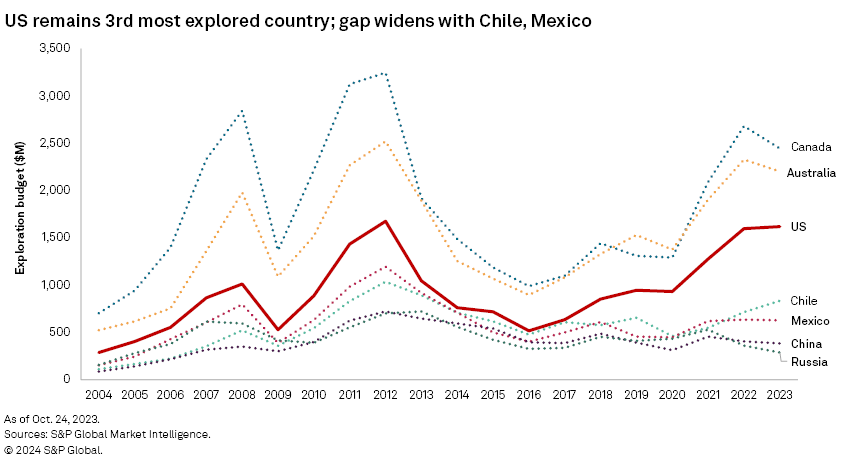

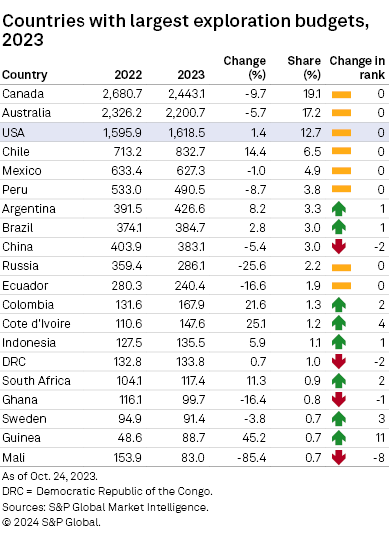

The US remains the third most explored country in 2023, distantly following Canada and Australia. During 2017–23, the US share of global exploration climbed to 13% from 8% in 2017. Canada and Australia recorded comparable growth in the same period, although their budgets fell in 2023, down 9% and 5%, respectively. The US also managed to outpace the growth of major Latin American countries, such as Chile and Mexico, alongside China and Russia.

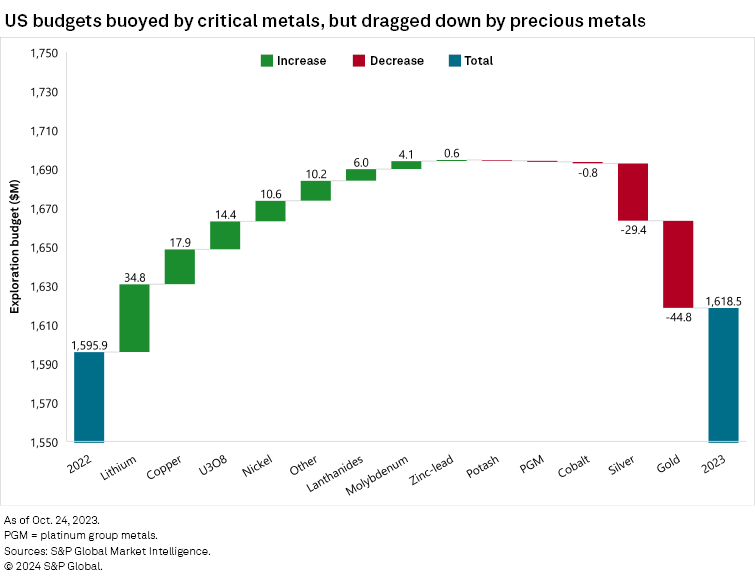

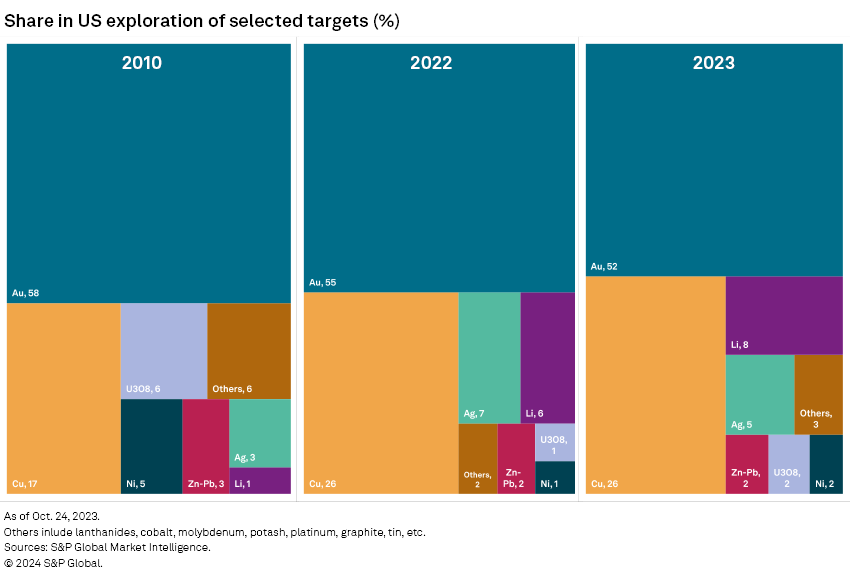

Exploration in the US in 2023 was buoyed by higher allocation for critical metals led by lithium, copper, nickel, rare earth elements and even uranium. Lithium fueled the bulk of the increase, up 37% to $128 million, after nearly doubling in 2022. Allocations for lithium have grown elevenfold since 2010 and are now the third-most explored metal in the US. Lithium exploration accounted for 1% of US exploration in 2010 and jumped to an 8% share in 2023. Lithium is widely used as the cathode for various chemistries of lithium-ion batteries that have ballooned in demand in the past half-decade as demand for electric vehicles accelerates.

Copper also boosted US exploration, up 4% in 2023. Copper is crucial in electrification and decarbonization, making it the most used conductor in wires and electric motors. Since 2020, copper exploration in the US has been up 67%. In terms of the US exploration share, copper exploration accounted for 26% in 2023, up from 17% in 2010.

While copper and battery metals boosted US exploration, precious metals, led by gold and silver, dragged the country’s budgets down 5% and 28%, respectively. Gold exploration accounted for 52% of US non-ferrous exploration in 2023, down from 55% in 2022. Reduced junior allocation for gold, down 19%, weighed down gold exploration despite an 11% increase by major explorers. Historically, gold accounted for a larger share, with 58% in 2010 and almost 80% in the late 1990s.

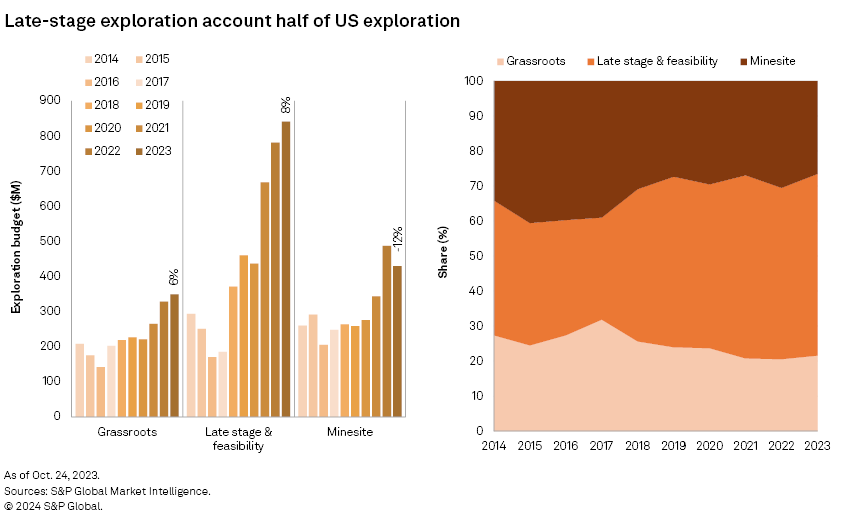

Late-stage work continues to ramp up

Late-stage and feasibility work has significantly increased over the seven years, accounting for a 52% share of US exploration in 2023, up from 29% in 2017. Allocations for late-stage exploration increased 8% in 2023, slightly higher than the increase in grassroots exploration, up 6%, while minesite exploration is down 12%. Juniors have buoyed the increased late-stage allocations, up 17%, while the majors’ spending dipped 11%. Late-stage works in the Cactus copper project by Arizona Sonoran Copper Co. Inc. and Santa Cruz Santa Cruz copper-gold project by Ivanhoe Electric Inc. have the largest late-stage budgets in the US.

The rise in late-stage has pushed grassroots’ and minesite’s share of the 2023 US total to 22% and 27%, respectively, from 32% and 39% in 2017. In 2023, minesite spending fell 12%, dragged down by lower gold, silver and copper allocations. Grassroots spending increased 6%, buoyed by higher spending for lithium exploration despite a dip in gold and silver exploration.

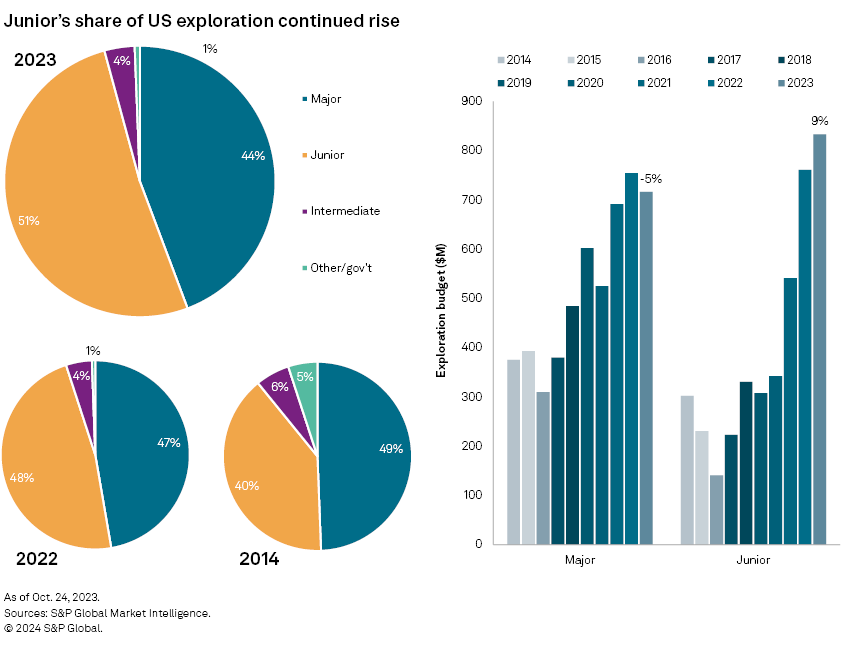

Juniors continue to flock to US

Junior budgets nearly tripled in the last 10 years, to $834 million in 2023, from $302 million in 2014. Juniors’ allocation lifted the US budgets in 2023, up 9%, while majors’ and intermediates’ spending fell 5% and 18%, respectively. Juniors’ share of exploration has also grown from 40% in 2014, overtaking the majors in 2022 and reaching more than half of US exploration in 2023. Juniors are focused on gold, copper and lithium exploration in the same period.

While juniors’ presence grew in the last 10 years, majors’ share declined from 49% in 2014 to 44% in 2023. Majors’ share of budgets in the US was higher in the late 1990s and early 2000s, peaking at 69%, but slowly lost its share as juniors’ budgets grew faster over the years. Majors’ allocation in the US dipped 5%, bucking their global trend of a 1% increase in their share of exploration spending, largely focused in Canada and Latin America.

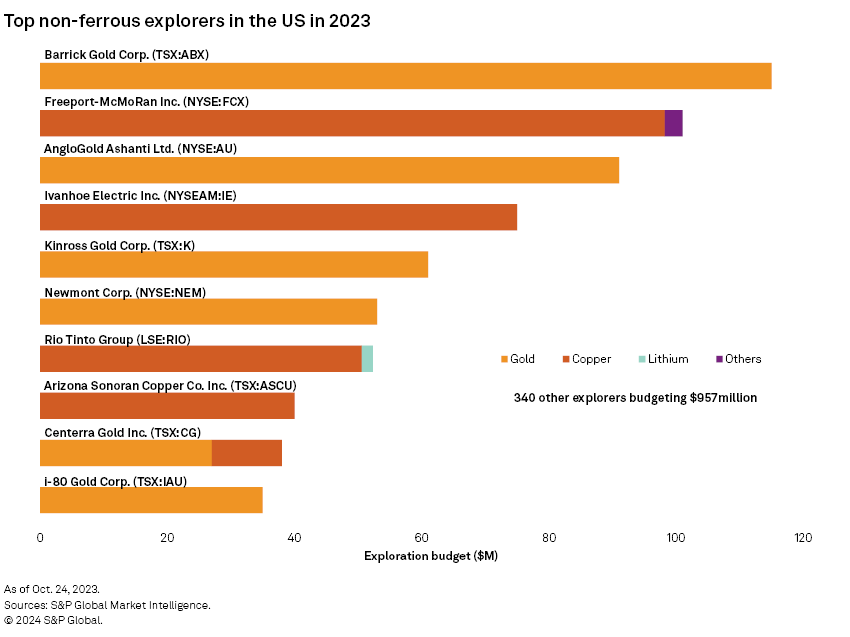

Top major explorers in the US include Toronto Stock Exchange-listed Barrick Gold Corp., NYSE-listed Freeport-McMoRan Inc. and AngloGold Ashanti PLC. Majors in the US are focused on gold and copper exploration.

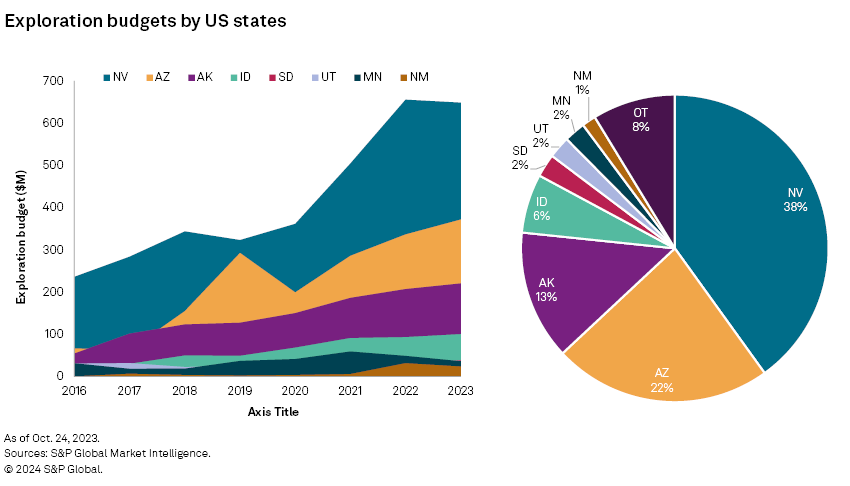

4 states continue to dominate US exploration

Only four states account for more than four-fifths of non-ferrous exploration in the US. Nevada, Arizona, Alaska and Idaho comprise 83% of allocations in the US in 2023, up from an 81% share in 2022 and 72% in 2016. Nevada led with $648 million, albeit down 1% year over year. Two-fifths of exploration dollars are allocated to Nevada, although this has fallen from 46% in 2016 as Arizona’s allocation grew faster. Many projects have gained budgets in Arizona, such as the previously mentioned Cactus and Santa Cruz projects. Arizona has received 11% higher allocations in 2023, accounting for 22% of the US budgets.

Various factors bring uncertainty to US exploration in 2024

Looking at our financing data for junior and intermediate companies in 2023, funds raised in 2023 marked another year of decline, with a 4% year-over-year decrease, albeit slower compared to 2022, which fell 79%. Sales of global passenger plug-in EVs have also been decelerating and may shift some interest away from these commodities as prices continue to languish. On the other hand, gold prices are expected to remain elevated in the medium term, which can offset the softening demand in the interest of critical metals. The federal and state governments are also looking at ways to reduce delays in mine permitting that, if improved, could attract more investments in the industry.

While we expect the US to outperform global exploration due to the momentum there of various projects, a slowdown in exploration remains on the table, depending on various shocks including but not limited to supply-demand dynamics, global geopolitics and internal politics in the US, as 2024 marks a presidential election year.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.