brightstars

A “Hold” rating for Dundee Precious Metals

This analysis confirms the Hold rating on US-listed shares of Dundee Precious Metals Inc. (OTCPK:DPMLF), a gold and copper mining company in Toronto, Canada with gold and copper production located in Bulgaria.

In terms of H1-2024 revenue, Dundee Precious Metals Inc. (hereafter “Dundee”)’s business is ≈84% gold and ≈16% copper, leading to a high exposure to gold price market volatility and growth prospects.

How the Stock Performed Since the Last Hold Rating

Since the last Hold rating on November 21, 2023, Dundee shares have risen 19.55%, or 20.93% in total (including a quarterly dividend of $0.04/share), versus a change of 17.43% in the S&P 500. As expected, the company benefited from the robust results in the gold business, which were supported by the gold price rally amid rising expectations of interest rate cuts and strengthening demand for the yellow metal as a safe-haven investment against increased risks and uncertainties worldwide. The expectation of lower interest rates is good for gold, as the yellow metal does not pay any income. It then happens that gold is favored at the expense of US Treasuries, which instead provide an income based on a predetermined interest rate.

The price of gold is also rising for this reason: To protect the value of their assets against rising inflation, the Fed’s “Higher interest rates for Longer” policy that affects the economic cycle, and geopolitical conflicts, investors are flocking to the benefits of the yellow metal, as a safe haven asset.

Since the last analysis, the Gold Spot Price (XAUUSD:CUR) has risen 20.5% to trade currently at $2,386/oz, lifting shares in Dundee as the bullish commodity translates into higher profitability for the Canadian miner and rising profits are an important share price driver.

A Bullish Metal Drove Dundee’s Revenue, Margins, and Cash Flows

In the first half of 2024, the bullish sentiment in gold caused two peaks recorded around April 18 and May 20, helping Dundee business deliver impressive financial results:

After wrapping up a fifth straight weekly increase, gold futures on April 19 posted “the longest winning streak since January 2023“, driven by a combination of economic and geopolitical factors.

According to Ole Hansen of Saxo Bank, these were “geopolitical risks related to the Middle East and the war in Ukraine, strong retail demand in China, central bank demand, rising debt ratios in major economies and a potential resurgence in inflation,” as reported by Carl Surran, Seeking Alpha news editor.

In addition, David Meger of High Ridge Futures suggested a higher risk of a dramatic economic slowdown triggered by a restrictive interest rate policy by the Fed to curb inflation, thus reiterating the call for an upward trend in the price per ounce of gold as a safe-haven investment to protect investors’ portfolios:

gold would pull back if the situation in the Middle East actually de-escalates, but longer term, the higher uptrend in gold will continue as the Federal Reserve might not be cutting rates as soon as the market expects.”

Not only did the rush for precious metals not stop, but later, around May 21, there was even a kind of Olympics in the wild world of commodities, “with gold, silver and copper-based bronze all scoring a place on the podium”, reported by Yoel Minkoff, Seeking Alpha News Editor.

The Fed’s upcoming pivot on interest rates as well as rising safe-haven demand on geopolitical tensions were pointed by analysts to push gold prices above $2,450 per ounce, which was a record high at that time.

Dundee also mines copper, and the subsequent situation with the red metal’s fundamentals led to a rapid rise in prices per pound, which was also reflected in the share price through increased profitability of operations of the Canadian mining company. Commenting on copper prices reaching an all-time high on stock exchanges around the world, Yoel Minkoff said:

Fear of supply shortages and trade disputes has helped generate buzz around the industrial bellwether, which is also key for the green transition and rising electrification needs. Copper is used in EVs, wind turbines, power transmission and AI data centers, meaning there are actual supply and demand fundamentals to assess when evaluating the worth of the red metal.”

Driven by rising gold and copper prices combined with payable metals volumes that were consistent (116,000 oz. gold and 11.9 million lb. copper) with full-year 2024 guidance (210-245,000 oz. and 23-27 million lbs.) generated year-over-year improvements in the following H1-2024 financial metrics. Revenue increased 8% year-on-year to $280.6 million. This combined with low operating costs (as a benchmark, total All-In-Sustaining Costs decreased by one-per cent year-on-year to $793 per ounce of gold sold), resulted in the following progress: Approximately 8% year-over-year growth in Adjusted EBITDA (from continuing operations) of $147.6 million, 2% year-over-year growth in Adjusted Net Income (from continuing operations) per share of $0.58, and 5% year-over-year growth in Free Cash Flow (from continuing operations) of $142.5 million.

As a measure of profitability much welcomed by investors in capital-intensive industries such as metal mining and exploration companies, Dundee’s adj. EBITDA margin remained fairly stable at 52.6% for H1-2024: Metal price gains offset lower sales volumes impacted by planned lower grades and explorations at an asset engaged in an effort to extend it’s mine life.

Dundee’s 3-year Production and Cost Forecast

In addition to bullish metals, a competitive operating cost benefited Dundee’s business margins, and the favourable impact is likely to continue going forward: Dundee’s AISC/oz is guided at $790 to $930 per ounce of gold sold in the full year 2024, at $720 – $880 in FY 2025 and $760 to $900 in FY 2026. Dundee production is not expensive at all compared to North American miners. As a realistic and accessible comprehensive benchmark, these companies were affected by AISC of $1,522/oz in the final quarter of 2023. These operators certainly faced pressures from cost inflation and tight labor conditions on-site operating costs, but the fact is that the average AISC for North America was the highest of any region in the world and continued to rise since 2017.

In terms of future production, Dundee targets to mine 245,000-285,000 ounces of gold in the full year 2024, 230,000-270,000 ounces in the full year 2025 and 190,000-220,000 ounces in the full year 2026 before a gold mining project being developed in Serbia add to the company’s production portfolio (expected ≈ in 2027). Copper production will be 29-34 million pounds in 2024, about 31-36 million pounds in 2025 and 30-35 million pounds in 2026.

The Outlook for Gold and Copper Prices

Due to well-known macroeconomic and geopolitical factors, analysts predict the following prices for gold and copper in the coming periods:

Recently, analysts at Morgan Stanley (MS) forecast a price of $2,650 per ounce for the fourth quarter of the year, an increase of 11.1% from $2,386 per ounce at the time of writing.

According to UBS Group AG (UBS), the yellow metal still has room to move up:

The bank expects the gold price to reach $2,600/ounce by the end of the year and $2,700/ounce by mid-2025. For investors, an allocation to gold within a portfolio can be an attractive diversifier and a hedge, it added.”

Due to insufficient supply, while the world has an increasing need for copper for its electrification, AI projects, Data Centers, energy transition and the development of renewable energy sources, the price of copper has been under upward pressure. Trading Economics says that copper is up 2.66% since the beginning of 2024, and Trading Economics analysts expect the price to trade at $4.14/lb by the end of this quarter. Looking ahead, they estimate the red metal will trade at $4.35/lb in 12 months. At the time of writing, the price of copper is $3.9752/lb.

The copper price forecast for the next 12 months gives hope to Dundee shareholders as it represents an advance compared to Dundee’s average realized copper price per pound at $4.26/lb in H1-2024, up from $3.91/lb in H1-2023.

Dundee’s Producing Mines

Production in Bulgaria comes from 2 mines:

The Chelopech mine (60 km east of Sofia) is a 100% owned underground copper-gold mine and has a mine life until 2032.

The Ada Tepe mine (3 km south of Krumovgrad) is a 100% owned open pit gold mine and has a mine life of up to 2026. The life of the Ada Tepe mine can be significantly extended through ongoing exploration activities, supported by a solid financial position resulting from robust mining operations at both mines and rising gold prices.

Chelopech mined ≈62.3% of the total gold concentrate produced by Dundee in H1 2024 and 100% of the company’s copper production. Ada Tepe mined nearly 38% of the total gold concentrate produced by Dundee in H1 2024.

Total gold production was 130,371 ounces, down 10% on the previous year. Total copper production was 14.6 million ounces, down 3% from the previous year. These trends were due to lower metal grades from subsequent mining and Ada Tepe’s work to extend mine life. Therefore, the volume cuts for Dundee did not come out of the blue.

Dundee’s Portfolio of Development and Exploration Activities

The portfolio of mineral metals activities of Dundee includes the following projects:

- 100% owned feasibility study phase Timok Gold Project in the central-eastern region of the Republic of Serbia. This is a 0.8 million ounce proven and probable reserve discovered in 2008. A feasibility study was completed in February 2021, but activities are currently on hold as the company focuses on Čoka Rakita, which has the potential for a new high-grade discovery and is located only 3 km southeast of Timok.

- 100% owned pre-feasibility study (“PFS”) phase Čoka Rakita project in Serbia. Discovered in January 2023, the Čoka Rakita high-grade deposit hosts 1.8 million ounces of gold, as indicated by the Initial Inferred Mineral Resource estimate. Therefore, Čoka Rakita has engaged in aggressive drilling activities since then aiming at a feasibility study, but as evidenced by a preliminary economic assessment dated April 2024, Čoka Rakita seems already to have robust project economics. The presence of the necessary on-site infrastructure, including power and road access to the mine site, de-risks the investment. This is due to the proximity of the Čoka Rakita project to other operations of Dundee in Bulgaria. In addition, metallurgical test work continues to demonstrate the highest gold recoveries, hovering at 90% when the gold is extracted using conventional techniques such as gravity concentration and conventional flotation. In addition, the Čoka Rakita gold mine is expected to benefit from the income tax relief provided by Serbian law for large investments. The PEA assumes that this relief will equate to an effective income tax rate of 0% over the 10-year life of the Čoka Rakita mine. The Čoka Rakita mine wants to produce an average of 129,000 ounces of gold annually over 10 years, with a peak of 164,000 ounces in the first 5 years. In terms of average all-in-sustaining costs (this is estimated to be $715 per ounce of gold for the Čoka Rakita mine). The production will be a low-cost one, continuing the trend that has branded Dundee’s operations to date. The Čoka Rakita mine needs a total of $381 million to bring the site to metal production, which is not a burden as an expense compared to the sound financial condition of Dundee and its low-cost/high-margin business delivering well amid favourable gold prices in the markets. The payback period is 2.39 years according to the $1,700/oz base case scenario. PEA states that Čoka Rakita is a robust project with $891 million in free cash flow over the life of the mine or $89.1 million per year, which this analysis compares to the Chelopech mine’s free cash flow of $150 million on an annualized basis. For comparison, the Chelopech mine is chosen as it has a higher mine life of 8 years from now versus just a couple of years of Ada Tepe. $150 million is calculated as Dundee’s free cash flow of $142.5 million from total ongoing operations in H1 2024 multiplied by 2 (“annualized”), multiplied by the 84% gold share (as the company also mines copper at Chelopech) multiplied by the 62.3% Chelopech mine contribution to the total gold in Dundee. However, Čoka Rakita’s free cash flow is based on a gold price assumption of $1,700/oz, while the Chelopech mine sold ounces of gold at an average realized gold price per ounce of $2,254/oz (up 16.2% y/y): Čoka Rakita is on track to be as profitable as the Chelopech mine assuming current market price-based scenarios for the future gold mine in Serbia as well. Čoka Rakita’s net present value (or “NPV”) is $588 million if the gold price is $1.7000/oz, but rising to $888.2 million with a gold price of $2.040/oz (this is $1,700/oz + 20%) and likely significantly higher at current gold market prices. The payback period is also reduced from 2.39 years with a gold price of $1,700/oz to 1.94 years if the gold price is $2,040/oz. The internal rate of return (IRR) is 33% when the price of gold is $1,700. Financially, this is a robust project: in our analysis so far, we have come across gold mining projects labelled as “highly profitable” with IRR in the range of 20-35%. Dundee is therefore accelerating the project development plan, focusing on the benefits to local communities from an environmental and economic perspective. The PFS is expected to be completed in the first quarter of 2025, while construction is scheduled to start in mid-2026. Serbia’s mine-friendly environment and legislation, as stated on the company’s website, will be of great help in completing this project on time and replacing Ada Tepe if exploration does not prevent the asset in Bulgaria from reaching the lower stage of its life cycle. The environmental impact assessment (EIA) is expected to be submitted in the first quarter of 2026.

Serbia is very rich in metallic deposits, including those crucial to the green transition, as Rio Tinto Group (RIO) is also trying to establish lithium production for electric cars here. Earlier this year, Serbian President Aleksandar Vučić said in an interview at the World Economic Forum debate in Davos that Western capital was heavily invested in the region and that Asian economies such as China, Japan and South Korea were also increasing their influence.

- 100% owned permitting stage Loma Larga Gold Project in Azuay Province, Ecuador. It is located about 30-kilometres southwest of the city of Cuenca. Loma Larga is a high-quality underground development project. Leveraging its proven ability to develop large, high-margin metal projects, achieved with the construction of the world-class Chelopech mine in Bulgaria, Dundee does not want to miss the opportunity with Loma Larga. The company is looking to take advantage of the following circumstances: Albeit on a different continent, Loma Larga shares similar geology, mining methodology and process management to the Chelopech mine. The 2020 feasibility study indicates the potential to produce an annual average of approximately 200,000 ounces of gold in the first five years of operation. The asset can generate high economic returns in the future through the 12-year operation of an underground deposit, producing an estimated 170,000 ounces of gold per year.

- 100% owned exploration stage Tierras Coloradas Exploration Project in Loja Province, Ecuador. The Tierras Coloradas consists of four exploration licenses for a total of 6,955 hectares (approximately 70 km2) near the Peruvian border and hosts a low sulfidation epithermal vein system covering an area of approximately 3 by 3.5 kilometres. Current drilling activity confirms the existence of well-mineralized, high-grade vein systems that remain open at depth and along strike.

A Solid Financial Condition

Dundee will support metal mining in Bulgaria, gold mine development in Serbia and exploration activities in the Balkans and Ecuador with a solid financial position as evidenced by the following metrics.

Sustaining capital expenditures are planned to be $36-46 million in 2024, $34-43 million in 2025 and $28-35 million in 2026. The expectation of growth capital allocations is limited to the full year 2024 and is in the range of $16-20 million.

The company will also fund the quarterly dividend payment previously highlighted in this analysis and support the repurchase of up to 15,500,000 common shares, representing approx. 9.8% of the public float. The ordinary shares purchased from 18 March 2024 (program start date) to 17 March 2025 (program end date) will be cancelled.

As of June 30, 2024, Dundee’s balance sheet included cash and cash equivalents of $707.5 million and an undrawn credit facility of $150 million. The balance sheet is unencumbered with long-term debt. On top of this, investors must also consider the cash flows that will result from operations, which appear to be well-positioned thanks to promising commodity price prospects, and production developing in line with the company’s forecasts.

If you scroll down to the “Risk’ section of this page, you will find an Altman Z-Score of 6.43, indicating a zero percent chance that Dundee will face bankruptcy problems in the next few years.

The Stock Price: Rosy Outlook, but Technically Shares Are Not Low. Things Are Setting the Stage for a Pullback, but not Anytime Soon

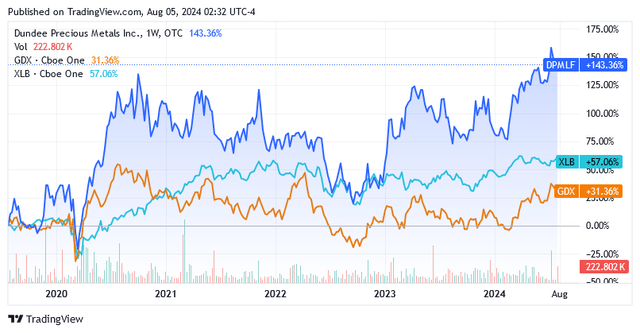

The upside catalysts highlighted in this article undoubtedly positioned Dundee shares very firmly to continue to outperform either gold mining and exploration stocks or the basic materials stocks: US-listed shares of Dundee or DPMLF on the US over-the-counter exchange are up 143.36% more than the VanEck Gold Miners ETF (GDX) +31.36% and The Materials Select Sector SPDR Fund ETF (XLB) +57.06% over the past 5 years as of this writing.

However, while this analysis gives credit for the rosy outlook, it also believes that the current share price is slightly elevated relative to recent trends. As the share prices may retreat to more compelling levels in line with the cyclicality of commodity prices, investors are suggested to stick with a Hold rating for the time being until a dip in the stock price emerges.

Shares were trading at $8.37 apiece at the time of this writing, giving it a market cap of $1.52 billion. Shares are trading almost entirely above the MA Ribbon, and much closer to the upper boundary than the lower boundary of the 52-week range of $5.78 to $9.02/share.

The 14-day Relative Strength Indicator of 47.80 shows neither overbought nor oversold levels, but this also means there is plenty of room for the shares to reach much lower prices than current ones.

This analysis assumes that there will be a decline in the share price, but not soon. The Fed is likely to cut interest rates at its September meeting. With gold prices in particular (at the expense of US Treasuries) and copper prices celebrating lower interest rates, rising hopes of lower rates should provide a tailwind for Dundee shares. Indeed, Fed rate traders now believe US central bank policymakers will cut rates by 50 basis points (85.5% likelihood as of this article), not just 25 basis points (14.5% likelihood as of this article) at the September meeting, as the labour market cooled dramatically last week, perhaps providing the long-awaited strong signal: US nonfarm payrolls were at their lowest level in three months and the US unemployment rate rose from previous 4.1% to 4.3%.

Consensus for a first-rate cut will therefore keep Dundee shares afloat through September. However, market participants also fear a significant slowdown in the economic cycle, as they believe the Fed is waiting too long to pivot the monetary policy and that higher interest rates have done too much damage to the economy.

The risk of a recession is increasing. This is shown by two indicators:

- According to the Sahm rule, which has successfully predicted the last nine recessions in the United States since 1970, a recession in the coming months is a real risk, even though the US recession in early July did not represent a baseline scenario for the analysts of this indicator.

- The inverted yield curve indicator (three-month Treasury yields are currently higher than 10-year Treasury yields: 5.183% versus 3.793%), developed by Duke University professor and Canadian economist Campbell Harvey, points to future headwinds for the U.S. economy. Since World War II, this index has reliably predicted a recession 8 out of 8 times.

As previously explained, the recession in the US increases the demand for gold as a safe-haven asset, and the price per ounce as well as Dundee’s shares will benefit, although the latter will initially face downward pressure. Since the shares of a gold mining company are indistinguishable from the rest of the US stock market at the initial stage of market fears of an economic downturn, the negative winds will also hit Dundee’s shares, based on a 24-month Beta market coefficient of 1.03x (scroll down this web page to the “Risk” section).

After the Fed meeting in September, Dundee shares may offer an opportunity to increase positions, but until then, investors should stick with the Hold rating.

The same considerations apply to shares of Dundee Precious Metals Inc. (TSX:DPM:CA), traded on the Toronto Stock Exchange, with a price of CA$11.68 apiece and a market capitalization of CA$2.10 billion, as of this article. The 52-week range was at CA$7.79 to CA$12.35/share, shares were trading high compared to MA Ribbon, and a 14-day RSI of 52.54 indicated room for downside.

The stock is characterized by the following daily trading volumes on both markets, which are not elevated volumes: Over the past 3 months, an average of 26,467 shares have traded on OTC Markets OTCPK (scroll down on this Seeking Alpha page to the “Trading Data” section), while on the TSX, an average of 475,851 shares changed hands (scroll down on this Seeking Alpha page to the “Trading Data” section).

Out of the total 181.33 million shares that make up the float, which is freely tradable on the stock exchanges’ open market, institutions own 66.17% of the float.

With the above shares volumes traded daily, a position that is too fat can be very difficult to bring to the desired volume if circumstances suddenly require it.

Conclusion

Dundee Precious Metals Inc. is a strong option to take advantage of the very promising outlook for gold and copper prices, particularly for the yellow metal, as the company is highly exposed to the ounce and, to a lesser extent, to the pound. The yellow metal will benefit from the Fed’s monetary policy switch and rising demand for safe-haven assets in a global scenario characterized by macroeconomic problems and geopolitical tensions. The alternative is to invest directly in physical metal, but this route is not the easiest and most pursuable, as this allocation requires capital that an individual investor does not usually have, as an institutional investor or a bank does.

Dundee has robust and low-cost production of gold (84% of total revenues) and copper in Bulgaria, and a portfolio of gold exploration and development projects in Serbia and Ecuador. The company is accelerating the development of a gold mine in Serbia as exploration has identified a promising large-scale, high-margin gold production that can replace a facility in Bulgaria that is nearing the end of its mine life in a few years but is attempting to extend through drilling.

The shares are trading at high levels compared to recent trends, but this analysis believes that they could pull back significantly, but not soon, as expectations of a rate cut in September will tend to create upward pressure. This analysis also believes that shares could see a drop in the market price after the September meeting as a short-term consequence of the pessimistic sentiment arising in the stock market due to fears of a U.S. economic downturn rather than a soft landing.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.