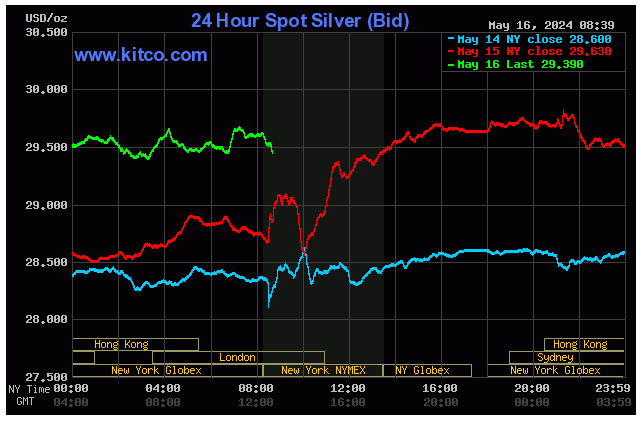

(Kitco News) – Gold prices are lower and silver modestly up near midday Thursday. Both precious metals are pausing after recent gains. Gold prices hit a four-week high overnight and silver a five-week high. June gold was last down $12.70 at $2,382.20. July silver was last up $0.051 at $29.78.

It was another busy day for U.S. economic data Thursday, with the data a mixed bag that contained no big surprises to significantly move the markets.

U.S. stock indexes are firmer near midday and hit new record highs after Wednesday’s slightly cooler-than-expected U.S. CPI report. The rally in the stock market (a competing asset class with the safe-haven metals) is a bearish daily element for gold and silver.

The key outside markets today see the U.S. dollar index firmer. Nymex crude oil prices are up and trading around $79.25 a barrel. The yield on the benchmark 10-year U.S. Treasury note is fetching around 4.4%.

Technically, June gold futures prices hit a four-week high early on today. The bulls have the solid overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at the record high of $2,448.80. Bears’ next near-term downside price objective is pushing futures prices below solid technical support at $2,300.00. First resistance is seen at today’s high of $2,402.70 and then at $2,415.00. First support is seen at Wednesday’s low of $2,357.10 and then at $2,350.00. Wyckoff’s Market Rating: 7.5.

July silver futures prices hit a five-week high early on today. The silver bulls have the solid overall near-term technical advantage. Silver bulls’ next upside price objective is closing prices above solid technical resistance at the contract high of $30.19. The next downside price objective for the bears is closing prices below solid support at this week’s low of $28.185. First resistance is seen at $30.00 and then at $30.19. Next support is seen at today’s low of $29.555 and then at $29.00. Wyckoff’s Market Rating: 8.0.

July N.Y. copper closed down 590 points at 486.55 cents today. Prices closed nearer the session low and saw profit taking after hitting a record high of 512.80 cents on Wednesday. The copper bulls have the solid overall near-term technical advantage. Prices are in a three-month-old uptrend on the daily bar chart. Copper bulls’ next upside price objective is pushing and closing prices above solid technical resistance at this week’s high of 512.80 cents. The next downside price objective for the bears is closing prices below solid technical support at 460.00 cents. First resistance is seen at 500.00 cents and then at 512.80 cents. First support is seen at Wednesday’s low of 481.40 cents and then at 475.00 cents. Wyckoff’s Market Rating: 8.0.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.