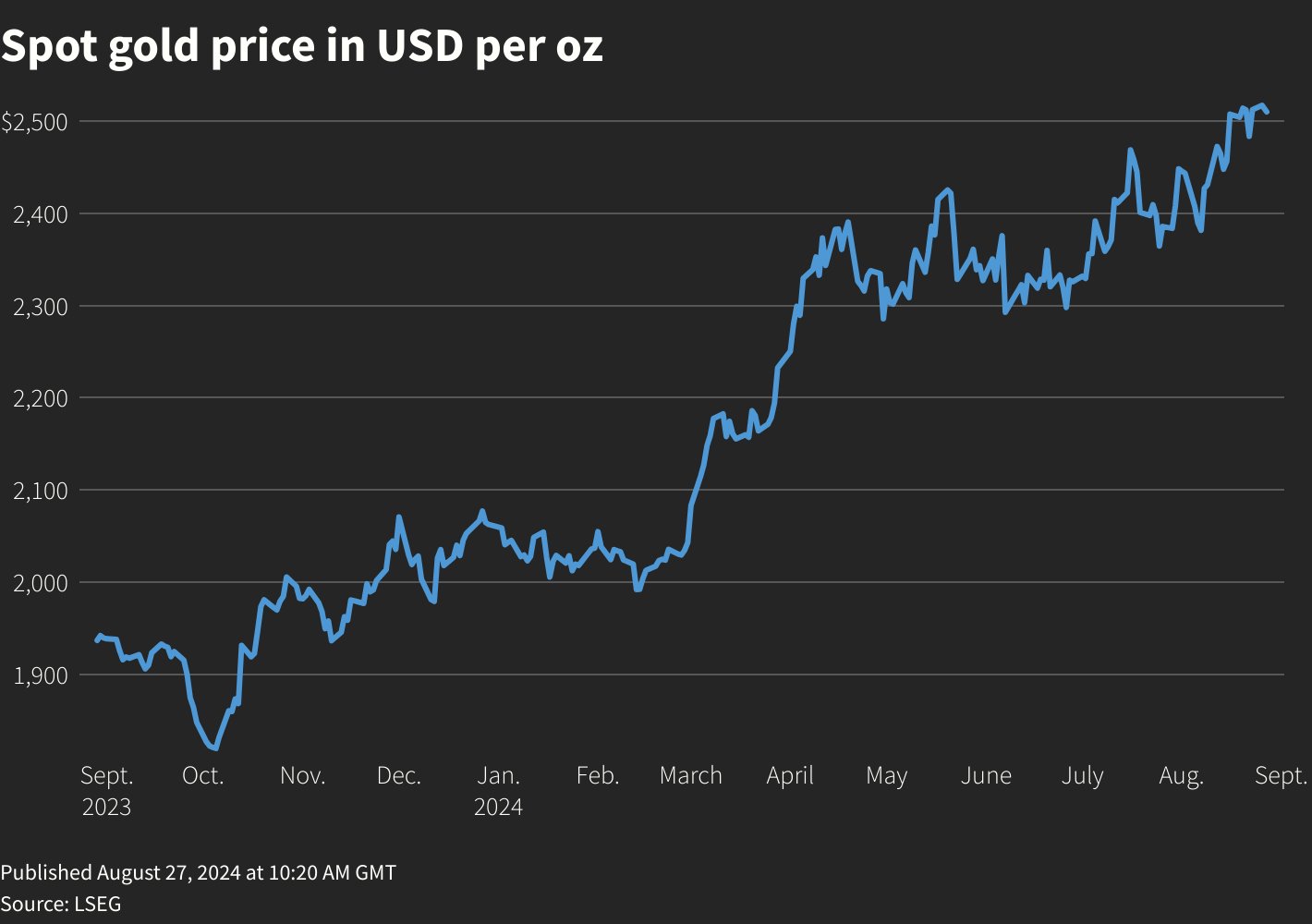

Aug 27 (Reuters) – Gold prices eased on Tuesday, consolidating near record highs reached last week, as investors sought clarity on the magnitude of an imminent interest rate cut from the Federal Reserve ahead of an inflation report due this week.

Spot gold fell 0.3% to $2,510.02 per ounce, as of 1118 GMT. U.S. gold futures fell 0.4% to $2,545.40.

“Gold has by now priced in a September start to the U.S. rate-cutting cycle, so prices may struggle in the short term to reach much higher levels, unless U.S. economic data weakness supports a 50 bps cut instead of the expected 25 bps,” Ole Hansen, head of commodity strategy at Saxo Bank, said.

Hansen sees consolidation during the coming months, with a limited risk of a deeper pullback towards $2,400.

The Fed’s most favoured inflation gauge, U.S. PCE inflation data, is due on Friday.

“Gold could even break past $2700 by year-end if the Fed can deliver 100 basis points in rate cuts before Christmas, as per the market’s current expectations,” Han Tan, chief market analyst at Exinity Group said.

“The month of December has also seen the highest average monthly gain for gold over the past 5 years. If such seasonality kicks in once more, that could help ring in the festive cheer for bullion bulls.”

Among other metals, spot silver rose 0.1% to $29.93 per ounce, platinum was little changed at $962.25 and palladium gained 1.3% to $971.00.

Sign up here.

Reporting by Sherin Elizabeth Varghese in Bengaluru; Editing by Mrigank Dhaniwala

Our Standards: The Thomson Reuters Trust Principles.