Production was initially targeted for early last year, but the company has missed a few deadlines, including the most recent one for December.

Despite having the project 99.3% completed, Gold Fields said that required rework on critical safety aspects, staff availability for the primary contractor, and late configuration changes have caused the latest set back.

As a result, production estimates for this year have been revised down. Gold Fields now expects to churn out around 220,000-250,000 ounces of gold equivalent compared to the 400,000-430,000 ounces announced in September. The mine is expected to produce 600,000 ounces of gold both next year and in 2026.

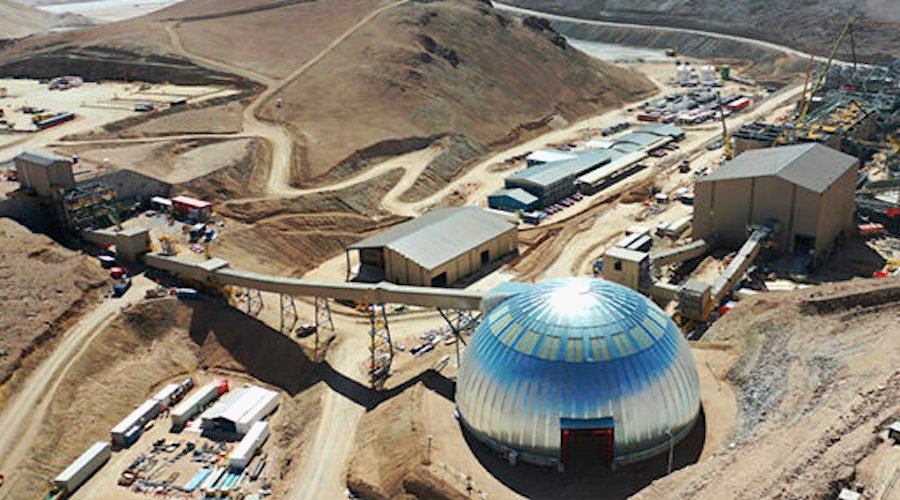

Salares Norte, located in Chile’s northern Atacama region at between 3,900 and 4,700 meters above sea level, is expected to generate an average of 2.8 million ounces per year of dore metal (gold – silver). This translates into 350,000 annual ounces of gold equivalent.

The mine is strategic for Gold Fields, as it will serve as a base to consolidate the company’s presence in South America.

Chile’s gold production peaked in 2000 at 54.1 tonnes, data from the country’s copper commission, Cochilco, shows. The nation, the no.1 copper producer and second-largest lithium producer after Australia, has dropped in the ranking of the world’s gold producing nations to the 23rd position as of December 2023, according to data from the World Gold Council.