Today’s 1% drop in gold prices appears to be driven by profit-taking, as it comes amid a quiet day for data and follows a decent 2.5% rally last week. However, our gold forecast remains bullish, with the precious metal potentially heading towards its third consecutive month of gains.

Last week, gold shined before experiencing a slight retreat at the beginning of this week. Its resilience has been notable since the release of weaker-than-expected April non-farm payrolls data. The metal received additional support in the latter part of last week as the dollar weakened following the latest jobless claims data, which indicated a cooling US labour market. This reinforced the perception that the Federal Reserve may implement rate cuts by around September.

Therefore, gold’s recent gains can be attributed in part to a weaker dollar and increased likelihood of Fed rate cuts. This week, the US dollar faces a significant challenge with several key data releases on the horizon.

Key US inflation data could impact gold forecast

The release of this week’s crucial US data has the potential to significantly impact both the US dollar and, consequently, gold. On Tuesday, we will have the latest Producer Price Index (PPI) data, followed by the Consumer Price Index (CPI) on Wednesday. Additionally, Retail Sales figures and the Empire State Manufacturing Index are scheduled for release on the same day. Thursday will bring further economic indicators, including Housing Starts & Permits, the Philly Fed index, industrial production data, and weekly jobless claims.

For gold, attention is focused on any indications of a weakening economy and labour market weighing on inflationary pressures. The forthcoming inflation data will provide substantial insights into the duration of elevated interest rates.

Following a sharp rise in the University of Michigan’s Inflation Expectations survey to 3.5% from 3.2% last month, as revealed on Friday, the latest PPI and CPI data for April carry the potential to significantly amplify or alleviate inflation concerns, depending on the direction of any surprises. CPI has consistently outperformed expectations since the beginning of the year. The Federal Reserve and those bearish on the dollar will be hoping to see a more subdued reading this time, as failure to deliver could further delay expectations of a rate cut. It’s projected that CPI will ease to 3.4% year-on-year in April, down from 3.5% the previous month. On a month-over-month basis, a 0.4% increase is anticipated in headline CPI and a 0.3% rise in core CPI.

Gold likely to find buyers on the dips

Throughout this year, it has been evident that gold traders have been keen to seize any downward movements in the market. Given the robust trajectory of precious metals, it’s understandable why they’ve adopted this approach. The present weakness observed in the market could potentially present another opportunity for traders to buy on the dip.

The momentum behind gold this year can be attributed to substantial demand, driven by ongoing central bank acquisitions and an increasing interest in inflation hedging. Persistent instances of inflation surpassing expectations have eroded the purchasing power of global currencies, prompting a heightened interest in alternatives to fiat currencies. Gold has emerged as a prominent alternative in this regard.

China’s continued efforts to bolster its economic resurgence further support this trend, particularly considering its status as the world’s leading consumer of gold. Reports indicating the nation’s intention to issue ultra-long special bonds could serve to bolster commodities even more.

Gold forecast: technical levels and factors to watch

Source: TradingView.com

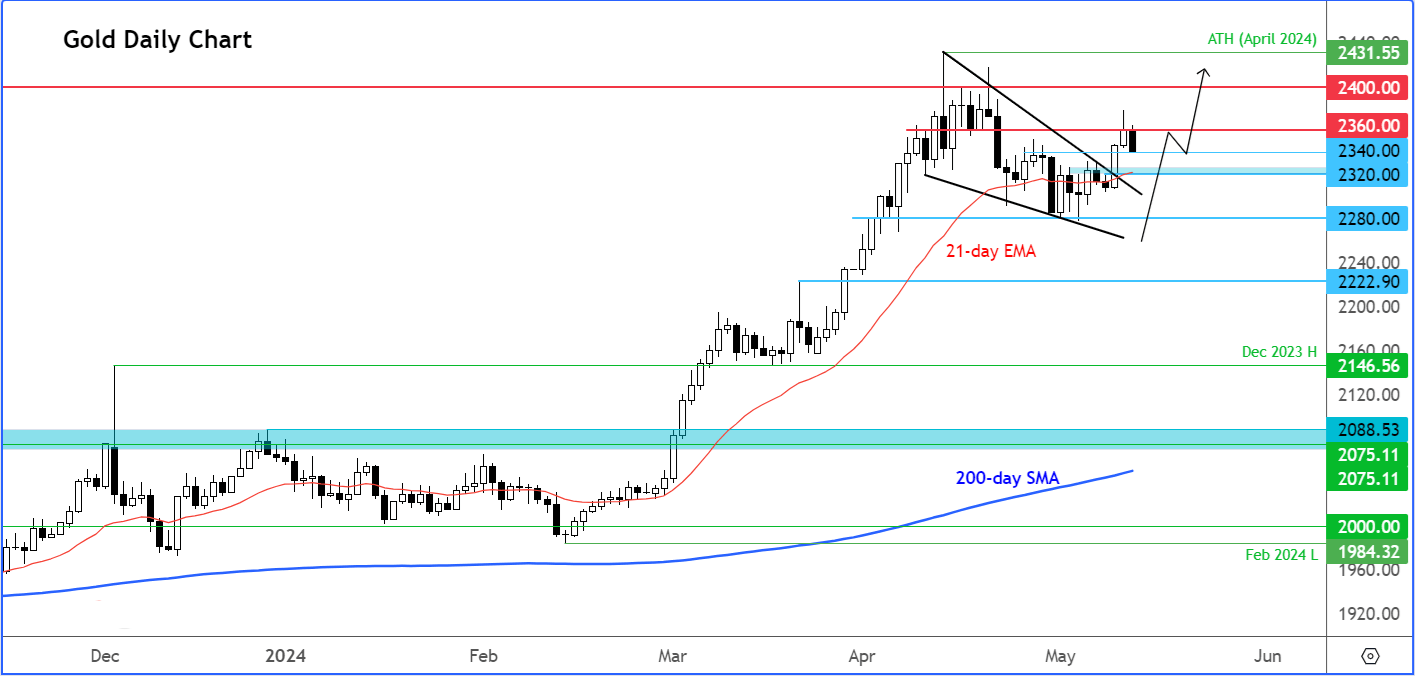

Despite today’s drop, the XAUUSD forecast remains bullish. The metal had been within the confines of a descending wedge pattern in recent weeks, following its earlier breakout to record highs. However, last week marked a departure from this pattern, suggesting that the metal may be poised for another ascent, particularly as the recent consolidation has allowed momentum indicators like the RSI to reset from their previously “overbought” levels, both in terms of time and price.

With the breakout above the resistance trend of the wedge pattern, the bulls now have a signal for a potential continuation of the uptrend. It wouldn’t be surprising to see gold gradually erode the next resistance zone around the $2360-80 area.

Targets for further bullish movement beyond $2460 include $2400, followed by the record high reached in April at $2431. However, the potential rally could extend well beyond that level once momentum picks up.

Despite my bullish stance, the possibility of a more significant correction below these levels cannot be ruled out, even though last week’s breakout from the descending wedge pattern would suggest otherwise. It’s prudent to remain prepared for all outcomes, particularly given the significant event risk ahead this week, namely the CPI data.

Therefore, it’s crucial to monitor key support levels closely. At the time of writing, the first level of support at $2340 was being eroded, putting the next short-term level at $2335 into focus. The key level to watch is at $2320, representing the point of origin for last week’s breakout from the wedge pattern’s bearish trend. A potential breach below $2320 would put the bulls in a spot of bother.

— Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore - Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade