Oct 15 (Reuters) – Gold edged higher on Tuesday lifted by retreating Treasury yields, while investors cautiously awaited more data that could offer fresh clues on the Federal Reserve’s monetary easing cycle.

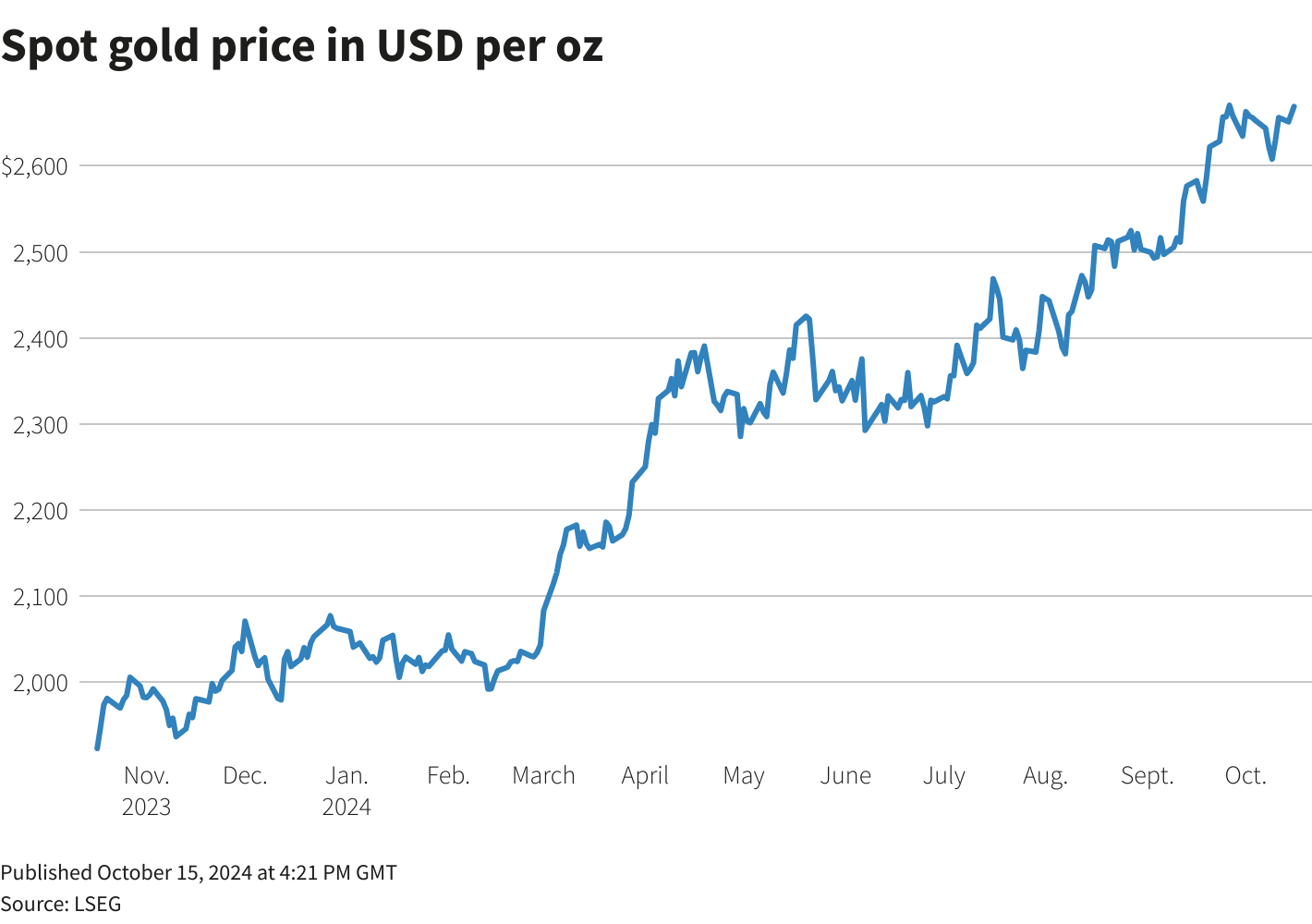

Spot gold rose 0.5% to $2,663.83 per ounce at 2:00 p.m. ET (1800 GMT). U.S. gold futures settled 0.5% higher at $2,678.9.

“We’re seeing a little pullback in yields as bond prices rally here. That’s offering a little stability, a little support to the gold market,” said David Meger, director of metals trading at High Ridge Futures.

“There is expectation that gold would be going through a bit of a pause or a bit of a consolidation. We’re leaning now more towards a sideways to higher uptrend as we do think that yields are going to retrace a bit. We’re going to see a little bit of a pullback in the dollar.”

Currently, traders see about a 90% chance of a 25-basis-point cut in November, according to the CME FedWatch tool.

Markets’ attention will be on upcoming U.S. retail sales, industrial production data, and weekly jobless claims due later this week.

Gold, which yields no interest on its own, also gains in times of political and economic uncertainties.

“We see slight downside risks for the gold price and expect the gold price to be $2,600 at the end of the year.”

Spot silver rose 1% to $31.49 per ounce and platinum fell 0.5% to $988.45. Palladium was down 1.6% to $1,012.98.

Sign up here.

Reporting by Anushree Mukherjee in Bengaluru, Editing by Franklin Paul, Vijay Kishore and Shailesh Kuber

Our Standards: The Thomson Reuters Trust Principles.