Aug 26 (Reuters) – Gold prices firmed on Monday, nearing its recent record high, amid solid bets of a September interest-rate cut following dovish signals from Federal Reserve Chair Jerome Powell and safe-haven demand due to geopolitical risks in the Middle East.

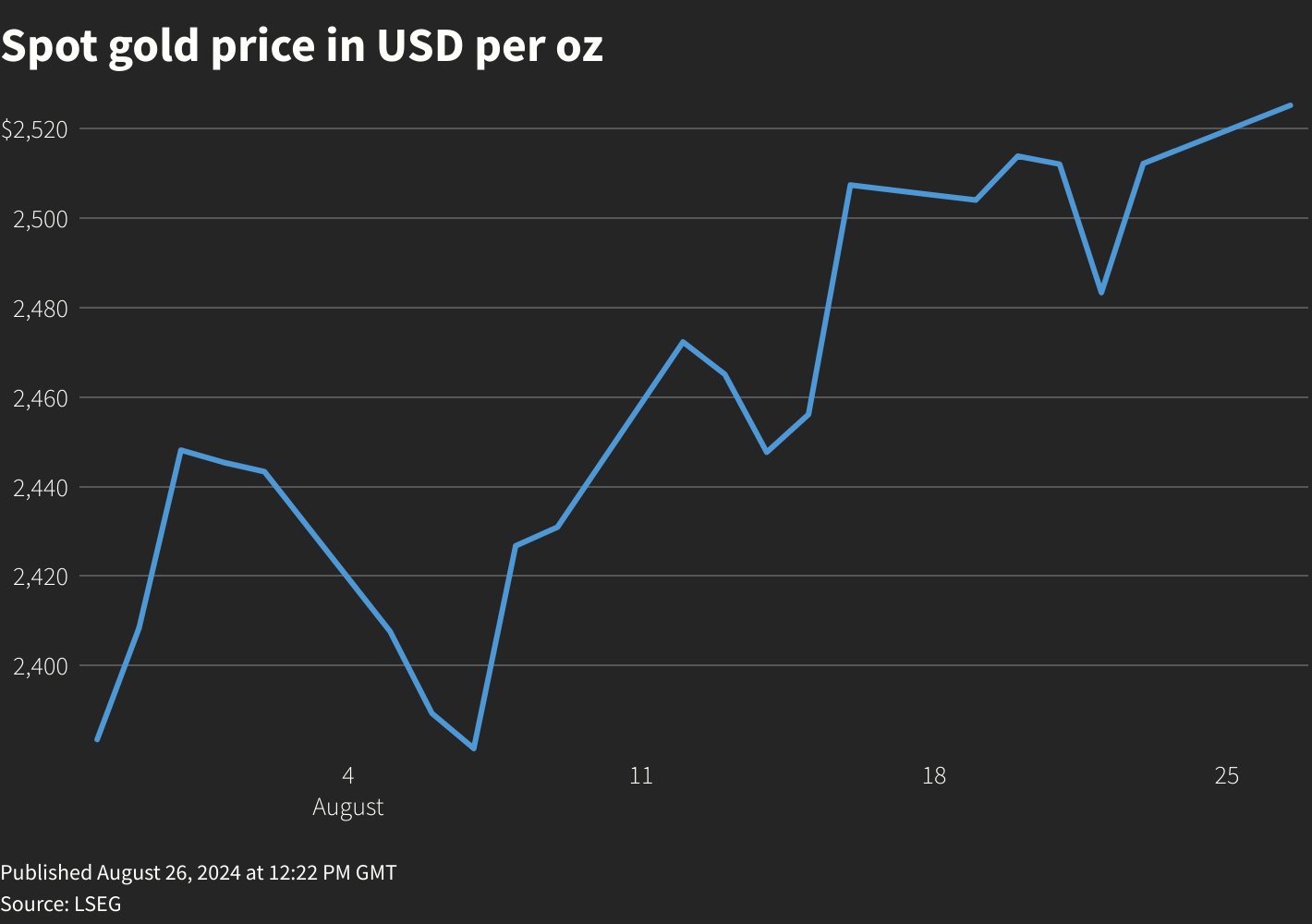

Spot gold rose 0.3% to $2,518.47 per ounce at 01:45 p.m. ET (1742 GMT), just shy of the record high of $2,531.60 hit last week. U.S. gold futures settled 0.3% higher at $2,555.20.

The dovish signals from Powell’s speech on Friday and safe-haven interest and geopolitical risks in the Middle East are precipitating the bid in gold this morning, said Peter A. Grant, Vice President and Senior Metals Strategist at Zaner Metals.

“I’ve got a short term kind of Fibonacci objective (for gold prices) at $2,539.77 and then my secondary is at $2,597.15,” Grant added.

Bullion, traditionally seen as a hedge against geopolitical risks, tends to thrive in a low-interest-rate environment.

“There might be some indication that China is going to come back in, but even if they don’t, demand from central banks has been pretty robust regardless of price this year and that’s going to continue,” Grant said.

Spot silver rose 0.6% to $29.98, hitting a more than a month high.

Platinum gained 0.1% to $963.80, while palladium held steady at $963.00.

Sign up here.

Reporting by Anushree Mukherjee in Bengaluru; Editing by Krishna Chandra Eluri

Our Standards: The Thomson Reuters Trust Principles.